To a large extent, investing is a numbers game. Find a company where the numbers add up very prospectively, and stock-pickers have likely identified a winning investment. This rationale applies equally to cannabis companies. With The Hydropothecary Corporation (TSX: V.THCX, Forum), its numbers should be very interesting for investors.

To a large extent, investing is a numbers game. Find a company where the numbers add up very prospectively, and stock-pickers have likely identified a winning investment. This rationale applies equally to cannabis companies. With The Hydropothecary Corporation (TSX: V.THCX, Forum), its numbers should be very interesting for investors.

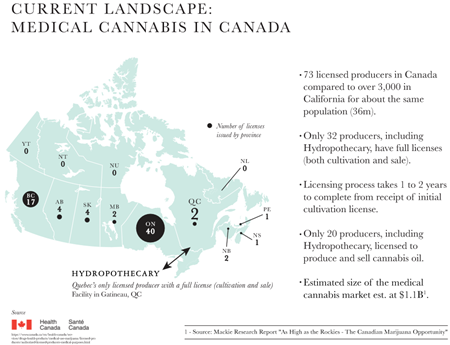

Let’s start with demographics. As of the 2014 census; Ontario has a population of 13.6 million people. Ontario currently has 40 (ACMPR) licensed cannabis producers.

Quebec has a population of 8.2 million people. Quebec currently has only two licensed producers, with one of these licensees being a production only LP, which just received its license in recent days. The other Quebec license-holder is THCX, one of Canada’s most-established and best-financed publicly listed cannabis companies.

(click to enlarge)

Why is a company’s base of operations important with respect to the cannabis industry? To start with, consumer preferences.

Consumers generally prefer dealing with locally based businesses – their neighbours. Such sentiments are magnified within Quebec. While Canada continues to be enriched by its bilingual heritage, the Quebecois people still retain their strong, cultural identity.

Quebec residents prefer to deal with Quebec businesses. THCX is proudly Quebecois, and that translates into a competitive advantage.

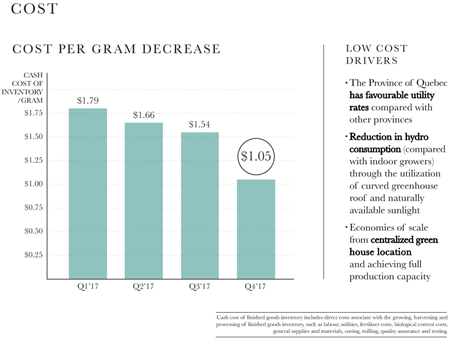

What about cost? This leads to the other important reason for Hydropothecary to base its operations in Quebec: one of the lowest hydroelectricity rates for any agricultural production in Canada. With our colder climate, energy costs are particularly significant for Canadian cannabis cultivation.

The much lower energy costs for the Company’s cannabis cultivation operations is one of the primary reasons that THCX is already an industry leader in terms of low cash costs for cannabis production. How low?

The chart below shows the cash costs of finished goods inventory of Hydropothecary, and the steady progress in lowering those costs. Already, THCX is one of Canada’s lowest cost cannabis producers.

(click to enlarge)

In a conference call with Stockhouse Editorial, THCX’s CEO, Sebastien St. Louis detailed how Hydropothecary is pushing to become Canada’s lowest-cost producer.

The cannabis industry is moving into the next phase of its evolution - out of the barrier to licencing phase and into the capital deployment phase. The capital deployment phase will be marked by large well-financed licensed producers rapidly expanding their production capacity to meet the demand for recreational cannabis. Company’s competing in the capital deployment phase will face strong cost pressures and will see their margins shrink in the face of competition from large-scale producers. We see this coming, and this is why cost efficiency has been a priority for THCX, and why our Quebec advantage positions us for success in the recreational cannabis market.

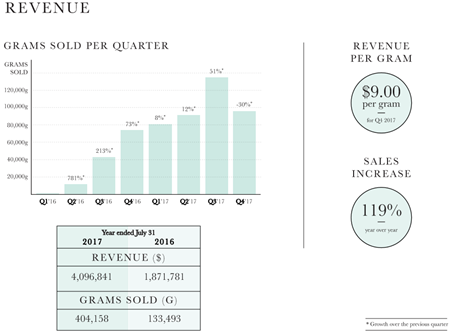

Meanwhile, the Company has four brand lines of cannabis products. Robust sales of these products are at an average price of $9.00/gram. That translates into very strong margins on cannabis sales. The numbers also show strong revenue growth.

(click to enlarge)

These margins are also a function of product quality, and THCX’s focus on product innovation. One small example of this commitment to quality is that Hydropothecary is the only cannabis company in Canada to ship all of its dried flower products in glass jars rather than plastic bottles.

Another example is product testing – and consumer safety. THCX relies on independent, third-party testing of all of the Company’s cannabis production. . Furthering their focus on quality, Hydropothecary was also the first licensed producer in Canada to obtain a kosher certification for some of its products.

The Company offers a broad selection of proprietary cannabis blends among its four product lines. Time of Day includes “Good Morning”, “Midday”, “After Dinner” and “Bedtime”. These products cover a relatively wide spectrum of cannabidiol and delta-9-tetrahydrocannabinol levels, as well as sativa, hybrid and indica plants. Each product is carefully selected to treat symptoms universally reported by patients at each of the four times-of-day.

H2 is THCX’s “classic” line of dried cannabis products. This product line is focused on the mid-market, with 11 products now offered at $10 and under. By leveraging its premium brand, the company hopes to set itself apart from competitors while remaining competitive on price.

Where Hydropothecary’s product innovation shines is with respect to their two, most recent brand lines: Decarb and Elixir No.1. Each of these product lines provide delivery systems for cannabis that are not only healthier and easier to use, but offer more discrete consumption options for consumers. THCX was the first licenced producer to have a cannabis resin sales license that allowed it to sell extract to other licenced producers.

Traditionally, cannabis has been inhaled via combustion. This is still the fastest and most-efficient method for delivering cannabinoids to the bloodstream. However, smoking cannabis causes some degree of respiratory irritation. For cannabis-users with existing respiratory health issues, this is an undesirable side effect.

Decarb was the first of Hydropothecary’s ready to consume smoke-free product lines and a first in Canada. Decarb is fine-milled cannabis, which can be put into easily digestible capsules. The fine-milling improves the body’s absorption of cannabinoids. While not as fast-acting as inhaled cannabis, oral consumption provides an extended duration of effect. With roughly the same consistency as flour, Decarb can be readily incorporated into cooking/baking, sprinkled onto food, into drinks or directly consumed.

Elixir No.1 is both THCX’s newest and most-innovative cannabis product offering. Advertised as a misting spray that is “easy to use, discrete, and convenient” Elixir No. 1 is the first sublingual spray authorized for consumption under Canada’s medical cannabis regime.

Why a sublingual spray? “Sublingual” simply implies under the tongue. While not quite as rapid-acting as via smoking, the sublingual spray can produce a therapeutic effect for up to 2 – 3 hours.

In addition to being a healthier cannabis consumption option, Elixir No.1 offers other advantages. Its pleasing peppermint taste will appeal to users who find conventional cannabis consumption overly pungent. In addition, the child proof spray bottle is designed to deliver low amounts of cannabinoids with each mist.. This facilitates using the minimal amount required to obtain the desired medicinal effect.

Of course, medicinal cannabis is only half of the cannabis story. The other, newer element to this story is recreational consumption. Already becoming a reality in the U.S. (on a state-by-state basis), most Canadians know that Canada’s federal government has fully committed to legalization of recreational use at the national level.

Just as THCX has carefully positioned itself in a premier cannabis jurisdiction, the Company has also been fully engaged in positioning itself for recreational-use cannabis in Canada. How?

A 2016 report from Deloitte estimates that recreational use of Canada will become an $8.7 billion market by itself. A more recent industry report from PI Financial lays out the parameters.

Based on our projections, we believe the Canadian licensed producers will need to cultivate an aggregate of 610,000 kg of cannabis to fulfill the demand for domestic and export demand in 2019. Last year’s total estimated production of 31,000 kg [2016] represents just 5% of this total.

In 2016; Canadian cannabis producers harvested just 5% of the quantity of cannabis necessary to meet expected 2019 demand. Meeting this expected twenty-fold increase in demand means one thing: dramatically ramping up cultivation capacity. Once again, Hydropothecary’s numbers look very strong.

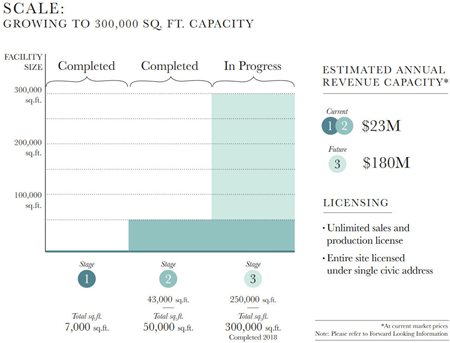

Currently, the Company’s Gatineau, Quebec facility encompasses 50,000 square feet. The facility is located on a huge 65 acre property. The entire property is covered by a single ACMPR cultivation license. While adding new buildings will require amendments to this license, THCX could potentially host millions of square feet of cannabis cultivation. THCX is already pushing ahead on a major expansion of this facility.

(click to enlarge)

On October 12, 2017; THCX announced that it was breaking ground on its 250,000 square foot expansion, which will take the total size of the Company’s production facility up to a very robust 300,000 square feet. Construction has been scheduled for completion by July 1, 2018 – the day that legalization of cannabis for recreational use in Canada is due to come into effect.

How does this translate into actual cannabis production? With Hydropothecary’s existing facility, it has an annual cultivation capacity of 3,600 kg of dried cannabis. At 300,000 sq. ft., this translates into cultivation capacity approaching 25,000 kg.

What investors want to know is the revenue potential for this level of production. At the Company’s existing, average selling price ($9.00/gram), 25,000 kg of cannabis production equals $225 million of revenue potential.

Management strongly believes that Hydropothecary has been flying under the radar of cannabis investors to date, in comparison to some of its peers. Do the numbers back this up? Aphria Inc is an industry leader that bills itself as one of Canada’s lowest cost producers. It is estimating that its own cash costs can be lowered to $1.11 by Q4 of this year. THCX has already achieved greater efficiency.

When investors compare Hydropothecary to its peers, these are some of the factors that stand out:

- One of Canada’s lowest cost cannabis producers

- Strategically positioned in Quebec

- A broad, innovative product line

- Robust margins

- Aggressive expansion, fully funded

- A value-packed market cap of (as of this writing) $220 million

Attentive investors will note a greater than 50% increase in the Company’s market cap since the end of July. Apparently, investor “radar” has begun to take notice of THCX.

As already mentioned, Hydropothecary is also one of Canada’s best-funded cannabis producers, and its major expansion is fully funded. After raising the necessary capital for that expansion, management went out and raised significantly more cash for the Company.

On October 30, 2017; THCX announced a $50 million convertible debenture offering. Within a few hours, it was announced the offering was increasing to $60 million. Management is expecting the total figure to approach $69 million. Has the market punished Hydropothecary for this new raise? Actually, its share price has gone up since then.

Investing in THCX means not merely buying into one of Canada’s best-performing cannabis stocks in recent months, it also means investing in Canadian jobs. Hydropothecary is a significant employer in the Gatineau area – one of the largest in the region.

CEO St. Louis offers these final thoughts for investors:

When you factor in THCX’s competitive advantage, our current expansion, our robust financing and, our focus on product innovation, THCX is positioned for success in the next stage of the cannabis business. As we continue to bring innovative products to market, we are confidant in our ability to become a leading cannabis brand, here in Canada and on the global stage.

Investing is a numbers game. The strong management team at THCX has built a Company that boasts very impressive numbers. And the market is starting to figure this out.

FULL DISCLOSURE: The Hydropothecary Corporation is a paid client of Stockhouse Publishing.