The widest dislocation between physical gold and gold stocks in decades is gifting investors with generational opportunities for multi-bagger returns.

Investors have pummelled gold stocks down to some of the lowest valuations on the market today, despite the yellow metal almost doubling over the past five years to about US$2,300 per ounce. This is driven by:

- High interest rates increasing debt and consumer costs.

- The long-term nature of mineral exploration and development, where issuers tend to be non-yielding, entailing a currently high opportunity cost versus collecting 3-5 per cent per year from cash or bonds.

- The increased volatility and limited liquidity of gold stocks, especially junior miners, which tend to rely on debt and share issuances to fund their exploration campaigns. This completely disregards how they offer greater operating leverage to the gold price than their large-capitalization counterparts, with a demonstrated history of outsized returns in bull markets.

One of the most compelling junior mining stocks for exposure to this thesis is Northstar Gold (CSE:NSG), whose 100-per-cent-owned Miller Copper-Gold Property, only 18 kilometres from the mining mecca of Kirkland Lake, Ontario, boasts more than a decade of value-accretive exploration, which the market has responded to with an irrational 87.5 per cent drop in share price since 2020.

The Miller Copper-Gold Property

Northstar began exploring the 1,100-ha Miller Property between 2012-2015 through ground magnetics, 3D induced polarization (IP) surveying and 5,846 metres (27 holes) of diamond drilling, which led it to taking a 932-tonne bulk sample in 2016 from the historic No. 1 Vein that averaged 5.1 grams per tonne (g/t) of gold. This prospective result was followed up by:

- 28 drill holes covering 5,023 m and property-wide 3D IP, gravity and magnetic surveys in 2020, including an intercept of 19.4 g/t gold over 4.4 m, supporting a large and robust intrusion-centred alkalic gold system on the Miller Property.

- 22 drill holes over 4,485 m in 2021, yielding near-surface intercepts of 6.6 g/t gold over 117 m, 4 g/t gold over 50.6 m, 1.4 g/t gold over 118.5 m and 1.2 g/t gold over 107.3 m, in addition to prospective surface stripping, mapping and sampling programs, allowing Northstar to double the size of the near-surface bulk tonnage Allied Gold Zone to 350 m x 200 m, which contains shallow-dipping sheeted quartz-gold-telluride vein structures, as well as peripheral steeply dipping copper-gold structures returning intercepts up to 9.41 g/t gold and 1.03 per cent copper over 3 m.

In April 2022, Northstar commissioned SRK Consulting for tonnage and gold grade estimates for Miller’s Allied and Vein 1 zones. The exploration target study delineates an upper gold range over 500,000 ounces averaging 2.04 g/t gold, with room for significant expansion through additional drilling.

In April 2023, Northstar published a high-resolution UAV airborne magnetic survey at Miller, identifying 12 magnetic anomalies, including the more than 1-km-deep SM-01 anomaly partially underplating the Allied Gold Zone. SM-01’s high magnetic susceptibility signature suggests that it could be a source for gold-copper sulphide mineralization discovered in 2021, and that the Allied Zone could be connected to a multi-phase gold-copper mafic intrusion-related system similar to Agnico Eagle’s robust Upper Beaver exploration project only 18 km north of Miller.

Northstar is in the market for a senior partner to pursue lateral and depth expansion diamond drilling at Allied and should have no problem securing one given the zone’s established track record of positive results.

Cam Copper Mine and the Boston Creek Copper Belt

Just three months later, in July 2023, the junior mining stock complemented its gold exposure with 19 high-grade copper samples averaging 14 per cent at the Cam Copper Mine, which is only 2.4 km southwest of Allied, hosts four lenses (Zones 1-4) of massive copper sulphides, and is centred on a high-grade Besshi-type copper system at the northwest end of a 0.9-km-long belt of volcanogenic massive sulphide (VMS) horizons. Cam is de-risked by residing on the South Boston Creek Copper Belt – a +2.5 km belt of Besshi VMS copper deposits and horizons – and by development and high-grade production dating back to the 1920s, further enhancing the Miller Property’s prospectivity.

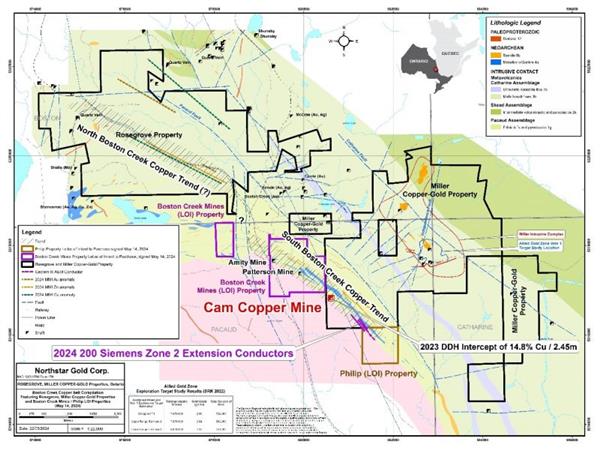

During this period, Northstar was also targeting the possible northwestern extension of the Boston Creek Copper Trend on its neighboring 1,150 ha Rosegrove Property. On March 12, 2024, Northstar announced coincidental LiDAR, magnetic and Mobile Metal Ion (MMI) gold anomalies, and a 3 km northwest-trending band of copper-zinc anomalies that possibly represents the northwest extension of the +2.5 km South Boston Creek Copper Trend (see figure below).

The above Cam Copper and Rosegrove results suggest Northstar has a sizeable copper play in the making, worthy of a ramped up and aggressive follow-up exploration effort.

Northstar’s consolidated historic Boston Creek Copper Belt illustrating Rosegrove Property Cu-Zn MMI trends, Miller Copper-Gold Property 2024 potential VMS horizon EM conductors and recently signed adjoining Boston Creek Mines and Philip Property letters of intent. (Source: Northstar Gold.)

Northstar’s consolidated historic Boston Creek Copper Belt illustrating Rosegrove Property Cu-Zn MMI trends, Miller Copper-Gold Property 2024 potential VMS horizon EM conductors and recently signed adjoining Boston Creek Mines and Philip Property letters of intent. (Source: Northstar Gold.)

Prior to receiving the Rosegrove MMI results, Cam’s initial drilling program followed in fall 2023, with four drill holes intersecting lenses of copper-rich VMSs across zones 1-3 as high as 21.7 per cent copper and 16.47 g/t silver, highlighted by 14.8 per cent copper over 2.5 m (CC03-23), and results supporting the potential for a robust, multi-horizon, high-grade copper VMS system with ample expansion potential.

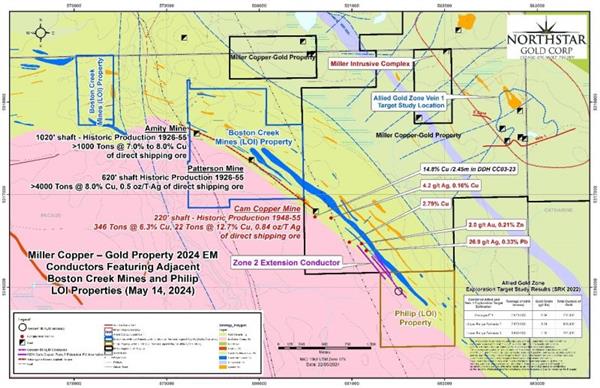

Northstar’s most recent value-add at Cam is a surface electromagnetic (EM) survey over a 900-m southeast strike length extension completed in May. The EM survey defined a strong near-surface conductor measuring 200 Siemens, a minimum 350 m in strike length and 150 m in depth, in addition to numerous parallel conductors over a strike length of at least 500 m, which, in combination with early 2024 grab samples, substantiate a strongly mineralized VMS envelope and the potential extension of Cam’s Zone 2.

In addition to the EM survey work, Northstar also completed a 3D inversion of previously collected magnetic data across the Cam area, successfully outlining the Zone 2 VMS horizon and several larger anomalies extending for 900 m along strike to the southeast, including one anomaly only 115 m to the southeast of CC03-23 with continuity established through modelled induced polarization.

Management believes that larger magnetic anomalies on the Zone 2 VMS horizon near the Zone 2 extension and EM conductors could contain robust accumulations of massive sulphides. Similar EM technology and surveys have led to numerous VMS discoveries across Canada, including Hudbay Minerals’ Lalor discovery at its Snow Lake property in Manitoba, which will yield up to 200,000 ounces of gold and 12,000 tonnes of copper in estimated 2024 production.

But Northstar’s exploration and Boston Creek Copper Belt consolidation strategy wasn’t complete yet. Seeing the magnitude and distribution of high-grade copper assays and geophysical anomalies south of Cam Copper Mine, Northstar just completed inking letters of intent (LOI) with the owners of the historic Boston Creek Mines Property and the Philip Property. These properties are contiguous with the Miller Copper Gold Property and occupy northwest and southeast extensions, respectively, of the Boston Creek Copper Trend. Northstar’s LOI agreements effectively consolidate the South Boston Creek Copper Trend, providing the company an exploration buffer zone and a 6-month exclusivity period to conduct due diligence studies and negotiate possible acquisition terms.

Potential VMS horizon EM conductors central to Miller Copper Gold Property, Boston Creek Mines Property LOI and Philip Property LOI.

Potential VMS horizon EM conductors central to Miller Copper Gold Property, Boston Creek Mines Property LOI and Philip Property LOI.

The past 6 months have been a busy time for Northstar. The company is now poised and positioning to follow up 2023 copper sampling, drilling and 2024 EM survey results at Cam this summer through prospecting, geological mapping, sampling and a phase II diamond drill program (slide 21).

A project portfolio that sweetens Miller’s value proposition

Northstar owns three additional exploration projects in Northern Ontario that merit serious consideration from potential partners. They are:

- The 1,150-ha Rosegrove Property, only 0.5 km from the Miller Property, where the company recently identified numerous gold and critical mineral targets. The Rosegrove claims overlay the same volcanic rock known to host significant gold-telluride mineralization at Miller.

- The 4,650-ha Bryce Gold Property, which is host to multiple deposits, including gold-copper (Sunday Creek Porphyry), gold-rich copper-led-zinc VMSs (Pike Lake Zone) and lode gold systems, features several untested large IP targets and conductors, and boasts intercepts as high as 0.86 g/t gold over 80 m.

- The Temagami-Milestone property, a critical minerals play prospective for copper, nickel and cobalt, which features multiple anomalies, surface samples up to 1.52 per cent copper, 0.61 per cent nickel and 0.134 per cent cobalt, as well as similar geology and mineralization as Teck Resources’ (TSX:TECK.A) former high-grade Temagami Copper Mine 20 km southwest along strike. The Temagami Mine produced about 900,000 tonnes at an average grade of 6 per cent copper from 1955 to 1972.

Backed by a leadership team steeped in decades of relevant experience across mineral exploration, project development and mining finance, Northstar offers exposure to four exploration properties with demonstrated potential, whose results have progressively enhanced shareholder value, even as shares have lost almost 90 per cent of their value. This dynamic positions patient investors to capitalize as the junior gold and copper stock releases new results from Cam, chooses strategic partners to advance its remaining properties, and continues sweetening its value proposition in anticipation of gold stocks catching up with the price of their target commodity.

A monumental bargain for a limited time

Northstar’s extensive history of high-grade gold and its land package’s vast expansion potential, including evidence for the presence of critical minerals like copper, zinc, cobalt and nickel, makes its stock, currently being left for dead by the broader market, a rare free lunch for junior mining investors who can cut through the macroeconomic noise and recognize the green flags for strong conviction.

While the stock is flat year-over-year, it will likely not remain so for long, as the company continues to unlock value at Miller on the road to material and economical resource extraction. Its most recent transactions, LOIs on the neighboring Boston Creek Mines and Philip properties, promise to expand Miller along the Boston Creek Copper Trend with a land package that includes historic intercepts up to 13 per cent copper over 1 m and two past-producing, direct-shipment mines combining for more than 5,000 tonnes of copper production.

As Northstar irons out acquisition terms for the Boston Creek and Philip properties over a 6-month lock-up period, interested investors are best advised to use this window for due diligence of their own, knowing full-well that an upside surprise in the price of gold, or central bank dovishness with interest rates, could supercharge sentiment and give the junior gold stock market its much-deserved time in the sun.

Join the discussion: Find out what everybody’s saying about this junior gold and copper stock on the Northstar Gold Corp. Bullboard, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Northstar Gold Corp., please see full disclaimer here.

(Top photo of high-grade copper at the Cam Copper Mine during 2023 exploration: Northstar Gold.)