When a junior mining company acquires a property with mega-project potential, this often creates a quandary for investors. On the one hand, as development progresses investors can estimate for themselves the value of the metal discovered – as ore in the ground.

On the other hand, it is simply beyond the financial capacity of most junior mining companies to advance such a project all the way to production. Even in relatively benign settings, the cap-ex to put a major mining project into commercial production generally now starts at around a billion dollars.

This raises the issue: what is the exit strategy for such companies? Finding a large-cap mining company with the financial resources to fund such a project, and the desire to take on a mega-project can be akin to finding the pot-of-gold at the end of a rainbow.

Midnight Sun Mining Corporation (

TSX: V.MMA,

OTCQB: MDNGF,

Forum) (“MMA”) is

not one of these junior mining companies. In a recent conference call with Stockhouse Editorial, President and CEO Brett Richards outlined the Company’s case as to how and why management believes this could be the next major African copper project to be developed – in arguably the world’s most prospective copper belt.

When it comes to an exit strategy for this project, investors don’t need to scratch their heads. There is a

natural exit strategy here. This will quickly become apparent to readers, but first some background.

The Company’s focus is on copper. More specifically, MMA is targeting the exploration of (potentially) world-class copper deposits in what is the planet’s largest hunting ground for copper: the Zambia-Congo Copperbelt. While Chile is the world’s single largest copper-producing nation, the copper-rich geology spread across these two central African nations is our largest source for copper.

.jpg?width=450&height=224) (click to enlarge)

(click to enlarge)

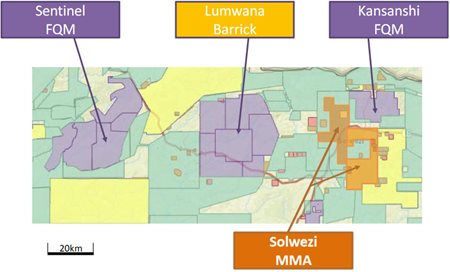

This is the best general destination for copper exploration, but management wasn’t satisfied in merely developing

any copper property in Copper Country. Midnight Sun has acquired two extremely promising licenses, just

15 kilometers away from First Quantum Minerals’ Kansanshi Mine.

Investors will note that this is a deep management team, with decades of senior mining experience. More pertinently, this is a “team” in the literal sense. Senior management of MMA have already worked together previously, successfully, with Roxgold’s major Yaramoko gold deposit (Burkina Faso) being the most notable example.

(click to enlarge)

(click to enlarge)

Kansanshi is not only Africa’s largest copper mine, it is the largest sediment-hosted mining complex in the entire continent. There is a current (combined) resource of approximately 1 billion tonnes of ore, grading at close to 1% Cu. The deposit also offers substantial gold credits. First Quantum operates a 1.2 million tonne/year smelter in this mining complex, with this production facility currently having

considerable surplus capacity.

The old cliché in mining is that the best place to explore for a

new mine is right next to a prolific existing mine. Midnight Sun is demonstrating the wisdom of this adage with its Solwezi Group of licenses, situated in Zambia.

This is a key operational detail. Knowledgeable investors understand that the Democratic Republic of Congo (DRC) is a premier destination for world-class metals deposits, specifically with respect to base metals. However, that nation is plagued with internal strife and political corruption.

Zambia shares similar geology with the DRC. What it does not share is the instability. Zambia is a stable nation, with a democratically-elected government that offers foreign corporations a reliable jurisdiction from which to base mining operations.

MMA is in the right nation for copper exploration, and positioned in the ideal location within Zambia: next to Kansanshi. While Midnight Sun has already been active with its own exploration efforts, there is also considerable historical exploration that has been conducted on the two Solwezi licenses.

Title to these licenses is currently held by Zambia High Light Mining Investment Limited (“ZHLMIL”). MMA has already earned-in a 60% interest under the terms of the deal. Midnight Sun has an exclusive option to increase this to an 80% interest, and is the operator of the project. Combined, the two Solwezi licenses comprise a huge land package that totals 506 square kilometers (license 21509-HQ-LEL and 12124-HQ-LEL). Within the license boundaries, several highly prospective copper zones have already been identified:

- Mitu

- 22 Zone

- Dumbwa

- Kifubwe

- Khaziba

.jpg)

Total exploration on the two licenses includes:

- Geochemical surveying (5,928 soil samples)

- Geophysical surveying (43.7 line kilometers NSAMT)

- Air core drilling (24,215 meters in 501 holes)

- RC drilling (1,276 meters in 15 holes)

- Diamond drilling (7,326 meters over 50 holes)

Attentive investors will note that while there has been a very large number of drillholes in these properties, the total amount of meters that have been drilled is relatively modest. This reflects the reality that mineralization here is

near surface.

This allows for efficient development of the two licenses. Targets can be first tested with (lower cost) near-surface air core drilling. Then where robust mineralization is encountered, a diamond drill can be brought in to provide deeper core samples.

The largest share of exploration work to date has taken place at the Mitu zone. While this geology boasts the potential for bulk tonnage mineralization, the Company has also shown that the project hosts strong grades.

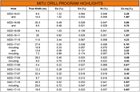

(click to enlarge)

(click to enlarge)

Drillhole highlights at Mitu (true widths) include:

- 11.6 meters of 3.44% Cu (4.23% Cu equivalent)

- 8.0 meters of 1.22% Cu and 14.0 meters of 1.02% Cu

- 9.4 meters of 1.03% Cu

Here is where the geology differs from nearby Kansanshi. While First Quantum’s mega-mine hosts copper with gold by-products, mineralization at Mitu (and most of the Solwezi licenses) is comprised of copper, with significant

cobalt and nickel credits.

Cobalt mineralization has consistently been encountered in drilling at Mitu (detailed drill results in Appendix below). At current cobalt prices, management calculates that in any potential mining operation that cobalt credits could easily comprise 1/3

rd of total revenues – more if the price of cobalt continues to rise.

This will generate considerable interest among mining investors for two important reasons. First, such robust by-product credits can dramatically improve margins, and the overall economics of the project. More specifically, as all experienced mining investors know, cobalt is currently the hottest metals sector, in terms of surging prices and extremely bullish supply/demand fundamentals.

While mineralization is somewhat different from Kansanshi, the overall geological footprint is highly similar. The Company has identified “ore shale” type mineralization. Previous drilling has demonstrated that this contains copper grades equivalent to Kansanshi, however with much higher levels of cobalt.

Mitu was the starting point for copper exploration on these licenses. However, ultimately it may not end up as the most prospective zone in MMA’s Solwezi Project. Considerable exploration has also taken place at 22 Zone, with some extremely robust copper intercepts – high-grade copper.

Highlights at 22 Zone (true widths) include:

- 21.0 meters of 3.26% Cu

- 11.3 meters of 5.71% Cu

- 6.4 meters of 5.08% Cu

- 4.5 meters of 6.27% Cu

These are the sorts of high-grade copper numbers that investors seldom see, especially in geology with clear bulk-tonnage potential. In their conference call with Stockhouse Editorial, management emphasized that given the large scale of this land package, these separate zones of mineralization would not be pods of some single, large mining operation.

Rather, these mineralized zones at Solwezi each could potentially evolve into

separate large-scale mines. Yet another region of the land package where the Company is excited over the potential are the Dumbwa zones: North and Central.

Midnight Sun has consistently encountered significant mineralization in its initial drilling campaign at Dumbwa. More detailed drilling results at Dumbwa are also available in the Appendix below.

Over the near term, the Company is planning on further exploration drilling, spread over Mitu, 22 Zone, and Dumbwa. Management estimates a total drill campaign for 2018 in the range of 10,000 – 15,000 meters, broken down as follows.

Longer term? This leads back toward the subject of a “natural exit strategy”. As already noted, much of the exploration work on the Solwezi licenses took place prior to MMA becoming the project operator. Who was the previous operator here?

First Quantum Minerals.

Whether due to administrative oversight or a strategic decision (made at that time), First Quantum allowed these licenses to lapse. How badly would this large-cap mining company like to re-acquire these licenses?

In his discussion with Stockhouse Editorial, CEO Richards became somewhat coy. Yes, he acknowledged, the Company has already had informal talks with several other mining companies who have expressed interest in these licenses – including at least some of MMA’s Zambian neighbours. The CEO also cautioned investors that considerable work still needed to be done before any discussions would reach a formal stage.

We need to first prove up the size and quality of the resource(s) to the market, so as it can add value to the MMA shareholders. We are currently building management and financial capacity to achieve this in 2018 and through 2019. From there, we are obviously well-positioned to explore what strategic options would be available for ultimate development of the licenses, and will do just that to deliver as much value to the MMA shareholders as possible.

Will First Quantum be one of the companies standing in line when MMA is ready to talk deal?? Readers can draw their own conclusions here. However, it is important to note that First Quantum is not the only major mining company “in the neighbourhood”.

(click to enlarge)

To the West, First Quantum operates a second, major copper mine: Sentinel. Sandwiched in between Sentinel and Midnight Sun’s holdings is Barrick Gold’s Lumwana Mine, another very large scale copper-gold mine – and another large-cap miner with the financial resources to take such a project into commercial production.

(click to enlarge)

(click to enlarge)

Even closer to Midnight Sun is mining mega-corporation, Rio Tinto. Indeed, part of Rio Tinto’s holdings in the region are

inside one of the Solwezi licenses.

CEO Richards volunteered that the “synergies” with First Quantum’s Zambian copper operations would likely be stronger. However, given the robust economics of neighbouring mines and indications of similar mineralization at Solwezi, by no means is MMA limited to talks with only one (potential) dance partner.

Most junior mining companies sitting on mega-project potential find they are living in “a buyer’s world”:

proving the economic potential of a project is much easier than finding an eager (large-cap) buyer to develop the project.

Midnight Sun is sitting in a much stronger position with its robust copper-cobalt licenses. Not only is it virtually surrounded by two copper-hungry giants, it boasts mineralization rich in cobalt – in a mining sector currently in the midst of a cobalt feeding frenzy.

For mining investors who like a nice layer of icing on their cake, there is a lot to get excited about with Midnight Sun Mining Corporation.

midnightsunmining.com

Appendix: Midnight Sun drilling results

(click to enlarge images above)

(click to enlarge images above)

FULL DISCLOSURE: Midnight Sun Mining Corporation is a paid client of Stockhouse Publishing.