It has been a solid start to the year for Montreal, Québec-based Osisko Gold Royalties Ltd(TSX:T.OR, NYSE:OR, Forum). The precious metals royalty and streaming Company released its consolidated financial results for Q1 2018, with robust numbers on its balance sheet.

It has been a solid start to the year for Montreal, Québec-based Osisko Gold Royalties Ltd(TSX:T.OR, NYSE:OR, Forum). The precious metals royalty and streaming Company released its consolidated financial results for Q1 2018, with robust numbers on its balance sheet.

For the quarter ending March 31, 2018, Osisko reported a 94% increase in cash flows from operating activities over Q1 2017 at $23.3 million. As of April 30, 2018, Osisko Gold held $205 million in cash and cash equivalents and $382 million in equity investments. This marks Osisko’s 15th consecutive quarter of returning capital to its shareholders.

The Company is also operating on a high gross margin. Speaking to investors on an earnings conference call in early May 2018, Company’s CFO and VP of Finance, Elif Lévesque, stated that Osisko also recorded cash operating margins of 91% from royalty and stream interests. She noted that this continues to be the highest cash margin in the metals and mining sector, generating $29.5 million in addition to a cash operating margin of $2.4 million from off-take interests.

“For the year we’re probably looking at average cash margins of 87% from royalties and streams. In addition to the cash operating margin from the royalties and streams we also generated a 2.6% cash margin from the off-take interests during Q1 2018. We look at those agreements separately. They do add a little bit on top of what we receive from our royalties and streams.”

CFO Lévesque added that Osisko Gold has reduced its debt by $32 million in April. During Q1 2018, Osisko also repurchased 1,607,099 shares at a total cost of $20.3 million, or at an average price of $12.65.

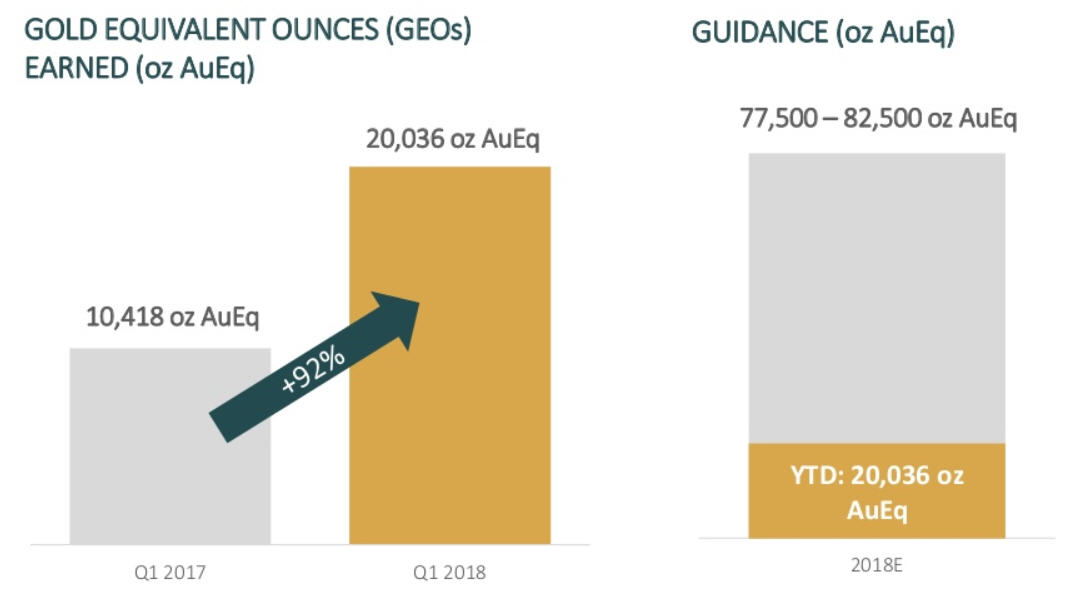

The other big piece of news from Q1 for the Company is that it had 20,000 gold equivalent ounces (GEOs), which is on-track for its annual guidance of 77,500 to 82,500 ounces of GEOs.

In March 2018, Osisko Gold also signed a term sheet with Victoria Gold Corp. to acquire a 5% net smelter return royalty for $98 million on its Dublin Gulch property, which hosts the Eagle Gold project located in Yukon. The Company has invested a total of $148 million into Eagle Gold, which is permitted, fully financed and in construction. Osisko expects to receive an average of 10,000 GEOs annually from the project once it is in production, which is expected by 2020.

Chair & CEO of Osisko Gold Royalties, Sean Roosen elaborated on the Company’s investment strategies, noting that Osisko Gold is moving through 2018 looking for valuable transactions, ready to execute on any investment that meets the Company’s criteria.

“Our value creation approach to investing in both near-term and long-term opportunities keeps us focused on finding the right opportunities for Osisko and its shareholders. Osisko is in an excellent position to continue to invest in the opportunities that present themselves in the current market environment. We have nearly a billion dollars of available financial capacity to deploy into new investments and are actively reviewing new opportunities.”

Osisko Gold Royalties distributed $7.8 million through a dividend payment to its shareholders in Q1 2018, bringing the total up to $62.9 million since it began in 2014.

osiskogr.com

FULL DISCLOSURE: Osisko Gold Royalties Ltd is a paid client of Stockhouse Publishing.