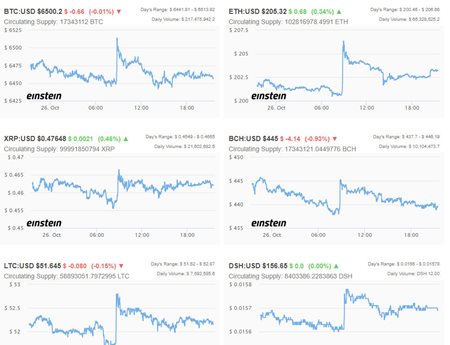

At press time, Bitcoin (BTC) is trading at exactly US$6,500, still stuck in its unprecedented trading range between US$6,200 and US$6,800 on Einstein Exchange. In the past month, BTC has broken out of the range only once, when it sharply moved up to nearly US$7,000 in mid-October. After making this sharp upwards move, it was quickly thrown back down to approximately US$6,600, gradually declining ever since.

As cryptocurrency markets continue to trade sideways and as volume decreases, many traders are beginning to lose patience and interest in the markets.

Despite this unusual trading activity in generally volatile markets, one analyst believe that it's actually a good sign for the future success of the markets.

CLICK BELOW FOR LIVE CRYPTOCURRENCY PRICE INDEXES:

Rob Sluymer of Fundstrat Global Advisors talked earlier today in Marketwtch about the declining volatility and dwindling trading volume, explaining that although investors shouldn’t get too excited about a pending bull market just yet, there is reason to be hopeful.

“While it is still premature to conclude a major upside trend reversal is broadly under way, each week we have highlighted an incremental ‘Silver Lining’ developing within the crypto universe,” Sluymer noted.

Sluymer, who is Managing Director and Technical Strategist at Fundstrat, went on to explain that low volume, decreased volatility, and the bullish divergences that have occurred in the price charts of many large cryptocurrencies, could eventually lead to the next bull market.

“We continue to view the decline in volatility, lower volumes and positive divergences between many alts and larger caps, notably [Ethereum and Bitcoin] as encouraging technical developments,” he said.

Despite being cautiously optimistic, Sluymer has previously expressed, and continuously maintains, that in order for a new bull market reboot, it’s critical that Bitcoin decisively breaks its September highs of approximately US$7,400.

And soon.