A major bull market is coming for uranium. This was the subject of a recent Stockhouse feature article. However, Stockhouse is far from alone in seeing the potential of the extremely powerful supply/demand parameters in this sector.

A major bull market is coming for uranium. This was the subject of a recent Stockhouse feature article. However, Stockhouse is far from alone in seeing the potential of the extremely powerful supply/demand parameters in this sector.

Rick Rule is a household name to retail investors. The President and CEO of Sprott US Holdings, Rule has been outspoken in calling for a massive surge in the price of U3O8. In a recent interview along with Doug Casey, Rule sees the current cost to produce a pound of yellowcake at between US$55 to $60 per pound. The most recent spot price quote for U3O8 was US$29.00. This unsustainable price imbalance is why we’ve seen uranium producers shutting down producing mines.

Rick Rule sees the price of uranium at least doubling over the near term. Investment bank, Cantor Fitzgerald is on the record calling for a long-term price of US$80 per pound for U3O8. So where is Rule committing his institutional dollars to position Sprott US Holdings for this coming opportunity?

Rick Rule sees the price of uranium at least doubling over the near term. Investment bank, Cantor Fitzgerald is on the record calling for a long-term price of US$80 per pound for U3O8. So where is Rule committing his institutional dollars to position Sprott US Holdings for this coming opportunity?

One of the strongest positions is its strategic investment in Fission 3.0 Corp. (TSX: V.FUU, OTCQB: FISOF, Forum). When FUU reached out to the market for an $8.0 million private placement in October, Sprott soaked up the entire allotment. And this isn’t “fast money”, simply looking for a quick payoff.

…Being willing to invest $1 in the company presupposes that you’ll be willing to invest another dollar when they run out again. …I’m going to put up $1 now and I may have to put in $2 later.

- Rick Rule, President and CEO of Sprott U.S. Holdings Inc, in 2018 interview with Marin Katusa

A strong partner. Even with the extremely bullish supply/demand parameters for uranium, that will be very reassuring to mining investors given the generally weak conditions in the mining industry at present.

Then there is leadership.

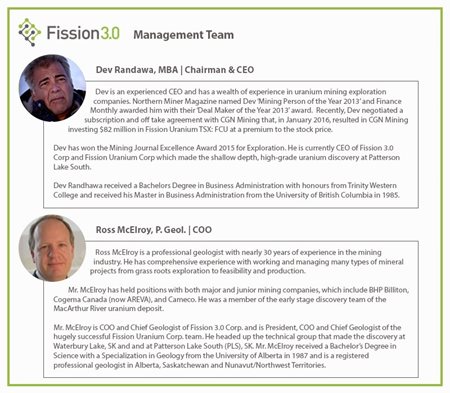

Fission 3.0 CEO, Dev Randhawa earned the title of “Deal Maker of the Year 2013” from Finance Monthly. Northern Miner named him “Mining Person of the Year” in the same year. Randhawa received those awards as CEO of Fission Uranium Corp, where he remains as chief executive.

Fission Uranium Corp. (TSX: FCU, OTCQB: FCUUF, Forum) is the original parent company that spun-out Fission 3.0. In fact, FCU itself was also a spin-out – from Strathmore Minerals Corp., which Dev Randhawa founded in 1996. As the third entity to spring out of this original business model, this is how Fission 3.0 derives its name.

The question investors may be asking is why has Randhawa chosen to take on these additional responsibilities in leading Fission 3.0? Part of the answer is the CEO’s strong, general convictions concerning the potential of the uranium market. Randhawa isn’t shy about sharing his own views on the potential of this coming Bull.

“We are coming into a period where the global nuclear power utilities need to buy uranium. The utilities buy on seven to 10 year cycles and those contracts are starting to expire over the next few years. The outlook for uranium mining hasn’t been this strong in almost a decade.”

But why not simply focus on Fission Uranium?

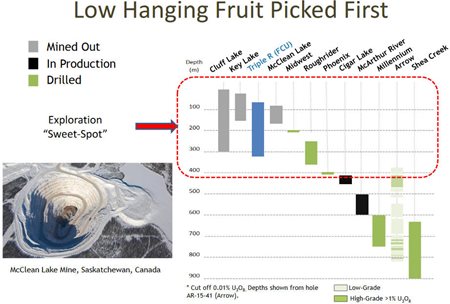

(click to enlarge)

FCU’s near-surface Patterson Lake South Project has plenty of upside potential for an ambitious mining executive, via its “Triple R” deposit. Cash costs are estimated at a very low US$14.02 per pound over the life of mine, from a September 2015 PEA.

Randhawa has played an important role in developing Patterson Lake South (PLS), leading to another award. He and the Fission Uranium technical team won the Mining Journal of Excellence Award 2015 For Exploration – on the strength of their Triple R discovery.

Patterson Lake North

As CEO of Fission Uranium, Randhawa had an intimate familiarity with the assets that were spun out into Fission 3.0. While many of these properties have prospective potential, at the top of the list for both FUU and its shareholders is Patterson Lake North (PLN).

While PLN isn’t nearly as advanced as PLS, Patterson Lake North does not take a back seat to Patterson Lake South in the eyes of Dev Randhawa – when wearing his hat as FUU’s CEO. Here Randhawa defers to the technical veteran who has led exploration for both FCU and FUU: Ross McElroy. For Fission 3.0., McElroy’s title is Chief Geologist and Chief Operating Officer.

A professional geologist with over 30 years experience, Ross McElroy knows geology and he is especially familiar with the geology of the Athabasca Basin. McElroy played a prominent role in Cameco’s McArthur River discovery. That’s a track record that investors can bank .

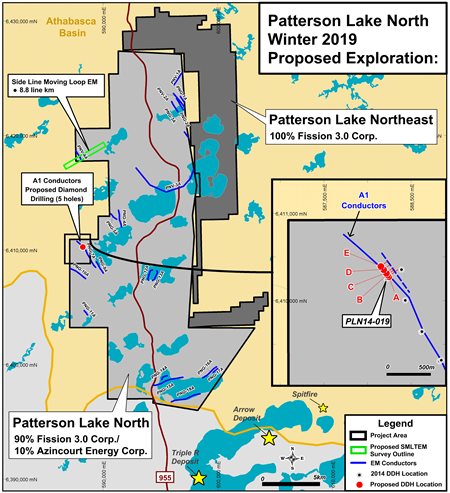

(click to enlarge)

It is McElroy who explained to Stockhouse Editorial why the Fission 3.0 team is so bullish on this 27,408-hectare land package, which was originally acquired via staking in 2004.

“Patterson Lake North (PLN) is the most advanced of our projects. It is located in the highly prospective SW Athabaca Basin region, where the latest current major uranium discoveries of Triple R and Arrow deposits have been discovered.

Drilling on PLN has already identified a basement EM conductor of interest, with hydrothermal alteration and, structural basement off-setting faults and anomalous pathfinder geochemistry and elevated radioactivity….all signs that are often associated with uranium mineralization. Future drilling will target this corridor with the aim to discover high-grade uranium.”

Another Patterson Lake South? The Triple R deposit (according to the most recent resource estimate from 2018) is an Indicated resource of 87.8 million pounds @ 1.82% U3O8, along with an Inferred resource of 52.9 million pounds @ 1.80% U3O8. Abundant potential exists to add to this resource through expanding the Triple R Deposit and/or drilling out additional mineralized zones.

(click to enlarge)

While mining investors may be enthused over the prospective potential of Patterson Lake North, the biggest longer term investment driver for this project generator could be its “property bank”.

The Property Bank

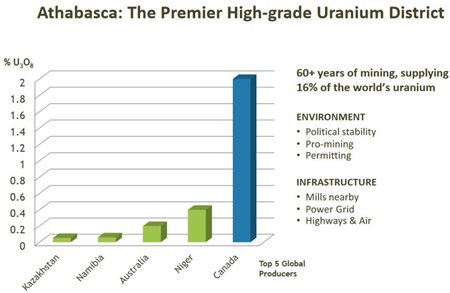

As noted, Fission 3.0 holds a large portfolio of prospective uranium properties, more than 20 in total. All but one are situated in the Athabasca Basin. Here is where the details get interesting.

(click to enlarge)

The Athabasca Basin already hosts a number of major, high-grade uranium deposits. However, the vast majority of this development has taken place in the eastern half of this Basin. McElroy believes that the blue-sky potential of the west Athabasca Basin is equally prospective and therefore has staked a number of FUU’s projects in this prospective area as well.

PLN is actually part of a package of four properties that are situated in the vicinity of Patterson Lake South, totaling 83,763 hectares: Patterson Lake North (PLN), Patterson Lake Northeast (PLNE), Clearwater West and Wales Lake.

The Big Picture here is that a major bull market is primed for uranium. As with any bull market, this will lead to a feeding frenzy in the mining industry as mining companies scramble for the best projects. When that spike in activity occurs, Fission 3.0 will be waiting – with its Athabasca uranium project “bank”.

As noted, FUU has received strong financial support from the institutional market. What this commitment translates into is that FUU’s exploration initiatives are fully funded for the next two rounds of drilling. This will be music to the ears of experienced mining investors because of a basic equation of mining exploration.

Fully funded = advancing operations while minimizing dilution.

The first phase is a Winter/Summer 2019 program: 8 holes and a total of 3,250 meters. Investors wanting further information on this upcoming drill program should watch for an upcoming Stockhouse feature on this PLN drill program along with greater overall background on the Project.

Why Fission 3.0? It’s actually fairly simple. The right time. The right Project. The right leadership.

www.fission3corp.com

FULL DISCLOSURE: Fission 3.0 Corp. is a paid client of Stockhouse Publishing.