(Image via RBC Capital Markets.)

(Image via RBC Capital Markets.)

Canada’s economy will undergo a drastic transformation over the next decade and look quite different by 2030.

This comes via a new report from RBC Capital Markets, which stated that climate change and an aging population will be two main factors influencing the economy, but what will this new economic landscape look like and how can investors prepare to get in on emerging markets before they become dominant over other established sectors?

Titled “Navigating the 2020’s” (read the full report here), the forecast calls for economic and technological trends from the 2010s will collide with the growing forces of climate change and demographic disruption:

“A country whose economic identity has long been bound to natural resource extraction will accelerate its transformation into a services economy.”

The services sector has had a reputation for being rather “low-pay”, but for more than a decade, the fastest-growing — (the scientific, professional and technical services industries) — have historically paid above average wages.

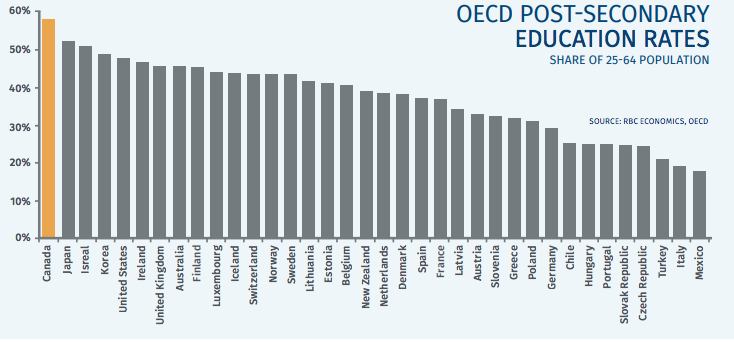

Founded in 1961 to stimulate economic progress and world trade, the Organisation for Economic Co-operation and Development (OECD) is an intergovernmental economic organisation that, according to the RBC report (click below to enlarge), is led by Canada in post-secondary education into this workforce among its 36 member countries.

(Chart via RBC Capital Markets.)

While the resource economy is expected to remain strong, the services sector will support Canada’s growth. The RBC report cited 2019 as a year where “The services sector demonstrated its resilience”. As the production of goods continues to see more and more automation, services output accounts for around 70% of Canada’s GDP, which is 20% higher than in the 1960’s.

“Services’ share of the overall economy will keep growing."

The sector includes the following components:

• Healthcare

• Transportation

• Tourism

• Economic

• Banking

• Government

• Construction

• Retail

According toCanadianVisa.org, retail is the most popular. Some major names include Best Buy Co. Inc. (NYSE: BBY), Walmart (NYSE: WMT) and Canadian Tire Corporation Ltd. (TSX: CTC).

A solid majority of new jobs created over the last five years were in the service sector, led by social services and healthcare as the main drivers. This plays back into the RBC report of how Canada’s aging population will draw more demand from healthcare services.

Healthcare stocks often make for solid long term investments, as these companies tend to operate with a deep and extended view of the future in mind.

Healthcare stocks worth a further look:

• ProMIS Neurosciences, Inc. (TSX: PMN)

• CVR Medical Corp. (TSX-V: CVM)

• WELL Health Technologies Corp. (TSX-V: WELL)

Healthcare stocks with a cannabis focus:

• Empower Clinics (CSE: CBDT)

• Nextleaf Solutions Ltd. (CSE: OILS)

• Alternate Health Corp. (CSE:AHG)

Healthcare stocks offer an intriguing proposition for investors. The aging population market is niche, yet growing and there is long-term focus shared among many of these companies. It is possible that those engaged in the medical cannabis market, could become crucial players in Canada’s economy over the next decade as their clientele base expands. Are there any healthcare-related stocks you are watching right now? Let us know in the comments below!

To learn about some of the most-talked about Healthcare stocks on Stockhouse, check out the Healthcare Bullboards.

For more of the latest info on Healthcare stocks, check out the Healthcare Trending Newshub on Stockhouse.

FULL DISCLOSURE: Empower Clinics Inc., Nextleaf Solutions Ltd., Alternate Health Corp. are paid clients of Stockhouse Publishing.