(Image via Doré Copper Mining | Cedar Bay site)

(Image via Doré Copper Mining | Cedar Bay site)

The mining markets are open for business, and it’s the perfect time to drill.

Not only has the easing of COVID-19 restrictions opened up the playing field for exploration companies, but the mining market itself has strengthened. Gold prices

consistently staying above US $1,700/oz is a sign for any junior and exploration-based company that now is the time to act, especially in strong districts like Quebec which have reopened for business.

For companies with noted exploration advantages like

Doré Copper Mining Corp. (

TSX-V:DCMC,

OTC:DRCMF,

Forum), the greenlight couldn’t have come at a better time. The near-term and near-development exploration company is

well-known by Stockhouse investors for its high-grade gold and copper assets in Quebec, with excellent land packages and existing infrastructure on hand.

Before the pandemic began, the Company has

begun an extensive drilling program following up on high-grade gold and copper mineralization at many of its properties in the Chibougamau mining camp of Quebec. After completing drilling at the Corner Bay property and revealing some of the highest-grade intercepts to date, Doré was forced to

suspend the campaign in March on account of COVID-19.

Now Doré, French for “golden” and the name of the gold-silver alloy produced at precious metal mines, is back in action. On May 14, the Company announced it had

resumed drilling at the Cedar Bay property, and recently it detailed the ongoing and further drilling plans for the rest of the current program. The key is capitalizing on historical and already estimated resources in a strong market, especially at Cedar Bay.

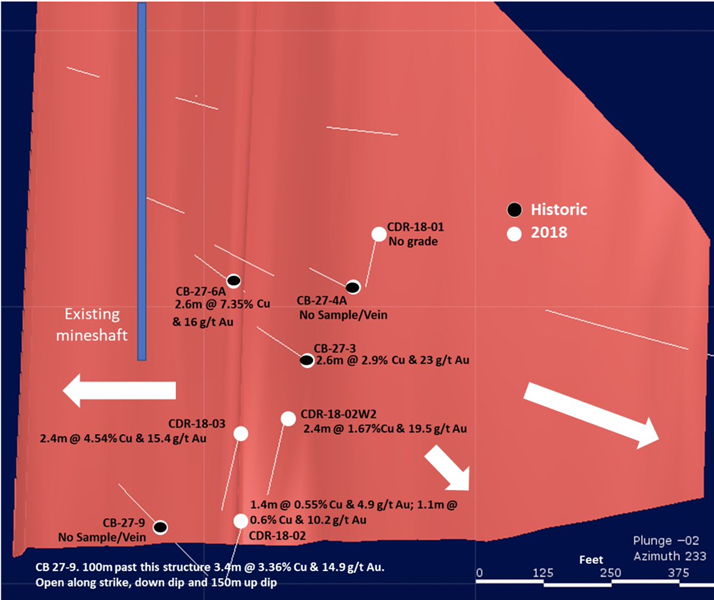

Structures on the property were already found to have high-grade gold. Located perpendicular to and from the displacement along the Lac Doré fault, Cedar Bay’s extensional shear veins had been mined in the past, with 3.8 million tonnes mines at grades of 3.1 g/t Au and 1.63% Cu from 1958 to 1990. However, the property was only mined on parts of its 10-20 zone and to the 2,200-foot level, and further high-grade gold areas have since been identified by Doré Copper. A 43-101 resource estimate from 2019 listed 360,000 tonnes Au in Cedar Bay, at significant grades of 8.7 g/t Au and 1.9% Cu.

(Image via Doré Copper Mining)

(Image via Doré Copper Mining)

The current drilling program further taps into those resources, with the deposit being drilled from the northeast and holes passing through at least three veins in the 10-20 zone as well as the main vein that was historically mined. Previous programs at the 10-20 zone returned high-grade intercepts including 3.3m at 3.4 g/t Au, 2.4m at 19.5 g/t Au, and 2.1m at 15.4 g/t Au, with additional significant copper findings in each. The ongoing program, however, drills past the existing orebody that has yet to be mined.

And following the program at Cedar Bay, Doré already has its next plans lined up. The drilling program will continue at the Company’s optioned Joe Mann mine, following up on holes drilled in 2008 that included intercepts of 3.02m at 30.3 g/t Au and 1.8m at 26.66 g/t Au, before returning to Corner Bay to build on the drilling completed earlier in 2020. Considering the intercepts at Joe Mann were drilled

after the local mine had closed and in deeper locations, it’s clear that Doré is able to find minerals and value where others may have overlooked them.

Again, the time to act on prosperous gold properties is now, and Doré Copper Mining has impressive properties in spades. Having a portfolio of both historical and untapped resources is one thing, but assembling it in a known mining district with infrastructure on-hand is an advantage that many similar plays can only dream of. It’s what makes the Company a “near-term and near-development” exploration play, and with the hunt for gold back on, Doré’s position is as good as ever.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.