(Image via Last Mile Holdings)

(Image via Last Mile Holdings)

Transportation is seeing a macro-economic shift in real-time, and companies that were well-positioned are the beneficiaries.

The key to succeeding in a world with the COVID-19 pandemic has been to recognize the changing environment and make the correct adaptation. At first, transit systems and shared vehicles were regarded by consumers with distrust, but over time only ridesharing has significantly recovered.

Partly it’s a matter of logistics. While mass-use transit systems are harder to manage, ridesharing still allows for single-use or small groups, and companies have stepped up with proper sanitation protocols. The other reason, however, is a noted shift in ridesharing as a primary mode of transportation. Data shows leisure and regular use picking up, and factoring in the increased use of service industries like food delivery that rely on ridesharing vehicles, the new reality for ridesharing is fast approaching.

And while some companies reacted to the changing world correctly and in time, others didn’t. In the micro-mobility space of e-bikes, e-scooters, and pedal bikes, the largest companies in the world like

Lime had blitzed the biggest urban markets to get ahead. It’s why you saw a scooter or three on every corner in some of North America’s largest cities. But that blitzscaling method meant the company couldn’t handle the COVID-19 pandemic properly.

Despite ridesharing being an essential services in most parts of the world, Lime found itself forced to pull its fleet of electric scooters from 99% of its markets around the world. The logistics of properly sanitizing and managing massive fleets safely and correctly was too much to handle, and as the scope of the pandemic grew in March, Lime and other blitzscaling scooter companies saw a sharp decline in transportation spending and a newfound aversion to the sharing economy.

Since then, however, investors have wizened up to the massive market growth ridesharing is heading towards. On one hand you’re seeing the effects of an initial disinterest in ridesharing, with Lime’s shutting down of services and

Lyft recently announcing cuts to 17% of its workforce. On the other, however, are ridesharing companies and other investors eager to take advantage. That’s how Lime raised $170 million in a down market from investors like Uber and Alphabet, with Uber also recently offering to takeover food delivery company

Grubhub.

One ridesharing company in particular has actually excelled during the pandemic,

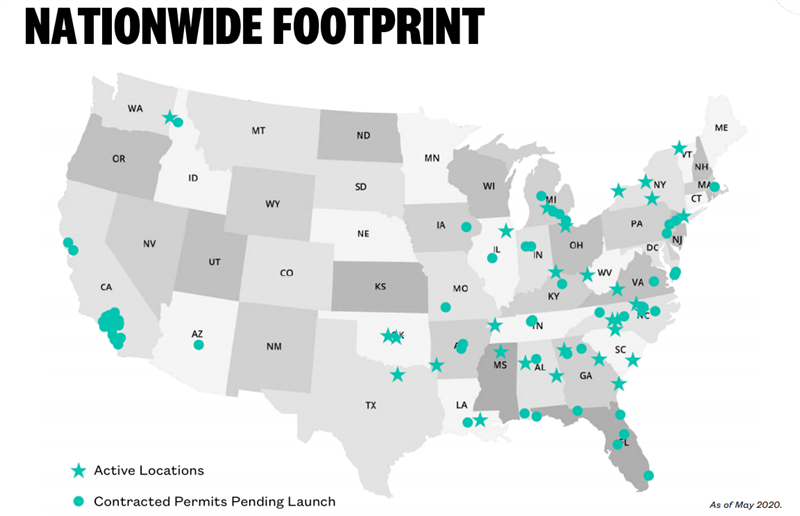

Last Mile Holdings Ltd. (

TSX-V:MILE,

OTC:AZNVF,

Forum). The Company has quickly grown into one of the largest micro-mobility companies in the US over the past year with the acquisition of

Gotcha Mobility, but that growth wasn’t using a blitzscaling model; Instead, Last Mile targeted smaller municipalities and universities that needed one, consistent provider of ridesharing solutions.

(Image via Last Mile Holdings)

(Image via Last Mile Holdings)

When the pandemic began, Last Mile’s subsidiary implemented a strict cleaning procedure for COVID-19 recommended by the CDC and worked individually with its partners to continue to stay open as an essential form of transportation. As a result,

the Company has seen a substantial increase in ridership in several markets.

From January to May of 2020, Gotcha saw total ridership in Baton Rouge, Louisiana surge across the board, with total riders increasing by 1,090%, total trips taken increasing by 906%, and total minutes increasing by 1,886%. The numbers were more staggering in Syracuse, New York, with a 2,694% increase in total riders and 3,523% increase in total minutes, and results from many of the Company’s other 32 active markets showed similar results with growth rate well above 100%, including Memphis, Dallas, and the University of Georgia.

At the same time, Last Mile has also been able to expand into deliveries at a crucial time with the launch of Gotcha TO GO. The program offers local merchants and drivers electric bikes and cruisers to facilitate deliveries for only $15 per vehicle each day and has already been a hit in targeted municipalities.

The resulting growth, especially in light of COVID-19, is staggering. By being able to manage a specific number of vehicles directly with partners, Last Mile has been able to avoid the headache that plagued Lime. Additionally, the organic growth in existing markets is buoyed further by launches of new e-mobility systems in Atlanta (Gotcha TO GO), Dallas (multi-modal), Durham (scooter share), East Lansing (scooter share), and the University of North Carolina at Charlotte (scooter share).

By having a more focused business model, Last Mile was able to position itself for operations and growth even in otherwise tough times. It has been able to do the “right thing” in helping out local municipalities, businesses, and customers that still need ridesharing services, and it has also done the “smart thing” by creating new and loyal customers that will continue on past the pandemic with the expected macro-economic growth of ridesharing.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.