(Image via DGTL Holdings Inc.)

Demographics across the board have been shifting away from traditional media and conventional viewing habits, but in a global market that is still struggling in the clutches of the economic slowdown causes by the COVID-19 coronavirus pandemic, advertisers are targeting new digital media channels, with success.

(Image via DGTL Holdings Inc.)

Demographics across the board have been shifting away from traditional media and conventional viewing habits, but in a global market that is still struggling in the clutches of the economic slowdown causes by the COVID-19 coronavirus pandemic, advertisers are targeting new digital media channels, with success.

From social media to streaming TV and audio-based services, digital media ad spending is driving worldwide growth and investment opportunities are emerging in areas such as technology, data, and ecommerce.

In a world dominated by

Google (NASDAQ: GOOG) and

Facebook (NASDAQ: FB), the largest digital ad sellers, operating in the multi-billions in net ad revenues,

Alibaba and

Amazon (NASDAQ: AMZN) have been clawing their own gains from this duopoly on the global stage.

As highlighted in

recent Stockhouse Editorial,

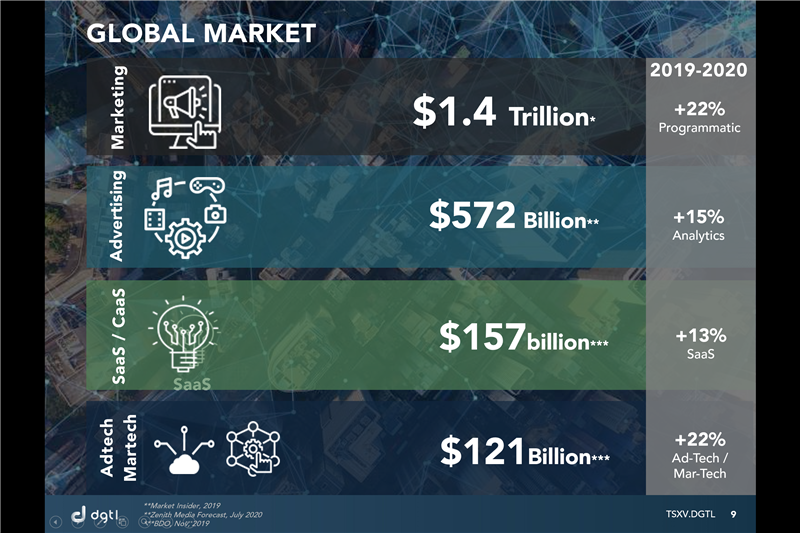

DGTL Holdings Inc. (TSX-V: DGTL, Forum) is a unique player in this market. Global digital advertising now takes up $572 billion of the $1.4 trillion marketing spend in 2019, and that figure is growing.

(Click image to enlarge)

(Click image to enlarge)

An acronym for

“Digital Growth Technologies and Licensing”, the Company is out to acquire, fund, accelerate and optimize a diversified portfolio of innovative and leading digital media and advertising technologies (Adtech) companies.

Powered by Artificial Intelligence (AI), DGTL specializes in incubating fully commercialized B2B (business to business) enterprise level AI-Adtech SaaS (software as a service) companies via a range of unique capitalization structures, including; equity investment, merger and acquisition (M&A), as well as technology licensing.

Operating as a venture capital investment Company, the DGTL technology accelerator model leverages strong sector relationships, and employs a unique and system of analytical evaluation and creative M&A structures to maximize the long-term growth opportunities for DGTL shareholders.

DGTL’s vision is to build a portfolio of 3-5 digital media tech companies, which provides investors the ability to play the entire sector in a single name, with cashflowing assets, while it empowers DGTL to develop a full service digital media and adtech platform to win more business, in fewer sales calls from its Fortune 100 clients.

This portfolio design would include innovative and distributive AI driven digital media and advertising technologies in the fields of Content, Distribution and Analytics. DGTL has completed their first acquisition, a fully commercialized enterprise level CaaS (Content as a Service) built on AI that serves global brands like ABInbev, and Novartis.

We have seen some significant success with enterprise SaaS acquisition models in the Adtech sector, especially with the historic growth of

Constellation Software (

TSX: CSU) and

The TradeDesk (

TSX:TTD). Several growth stage companies in the digital media and advertising and marketing technologies sector have also seen positive growth recently, most notably;

Acuity Ads (

TSX: AT) as well as

MediaGrif Interactive Technologies (

TSX:MDF),

EQ Inc. (

TSXV:EQ), and

IZEA Worldwide (

TSXV:IZEA).

Distributing the advertising message across a coordinated cross-channel engagement is the goal and reaching that goal will become more and more important for businesses such as DGTL in the near future, but also more difficult. The number of marketing channels is ever-growing and the need to demonstrate return on investment (ROI) is always rising. DGTL model provides incubation services, that not only acquires digital media companies entering a rapid growth stage, it streamlines, processes, increases profitability, and plugs the business into a network of top brand customers, with a management team with over $1 billion USD in career ad and digital media sales.

As 2020 rolls into 2021, marketers such as DGTL are becoming better equipped than ever to rise to this challenge. They are equipped with AI driven technologies and premium data analytics point solutions that will help them understand more fully the whole customer journey, as they can better target their audiences and offer personalized messages across the marketing landscape that much more cohesively.

Equipped with this knowledge, DGTL is offering a distinct opportunity as advertisers worldwide strategize how to leverage both their traditional and digital advertising effectively to align with how audiences consume media in 2020. DGTL Holdings Inc. is at the forefront of the larger trend of convergence within the total marketing and advertising landscape.

#HASHOFF - the future of AI based content marketing from Joel Wright on Vimeo.

(Click image to play video)

For more information about DGTL Holdings Inc. visit their website at

DGTLinc.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.