Although gold has long been considered a safe haven asset, the gold market itself has been under scrutiny over the past several years because of access to capital, environmental and climate change pressure and social and geopolitical risks – which Goldshore Resources (TSXV:GSHR) CEO Brett Richards says has been particularly concerning to junior mining companies.

In an interview with The Market Herald Canada, Richards said a deteriorating capital market environment has materialized over the past 18 to 24 months as a result of global geopolitical events and hostilities, including the war between Russia and Ukraine as well as the geopolitical conflict between China and Taiwan, and now Israel and Palestine.

“This has made a lot of investors quite apprehensive to put money into play and put money in the market for fear of a larger event that has a catastrophic impact on the capital markets,” Richards told The Market Herald Canada.

He also explained that inflation and rising interest rates are having an impact on the capital markets. Richards said the retail scene has played such an important part in the capital markets by providing liquidity when institutions have more outflows than inflows.

“These two factors are compounding the ability for junior mining companies, with non-cash flow producing entities, to seek development capital to continue their progress,” he explained, adding that the only strategy is to find where there are pools of capital, which are mostly in private equity firms, mid-tier and senior producers that have balance sheets that can assist the junior mining sector and advance the development in tough times.

Richards said the next catalyst will come when mid-tier mining companies start to participate in the junior mining space through joint ventures, earn-ins and partnerships, adding that these are the only kinds of capital available to the junior mining sector at the moment.

How Goldshore Resources is navigating the market

So where does this position a company like Goldshore Resources? Richards said the company is not unlike hundreds of other companies in the junior gold space that have faced challenges in that its share price has dropped more than 50 per cent since the start of the year, but it is working to put together enough capital to complete its short-term objectives.

Notably, the company completed a summer field program and is working towards a preliminary economic assessment (PEA) study, which is a study that includes an economic analysis of the potential viability of mineral resources done at an early stage of a project before completing a preliminary feasibility study.

Richards said the company has adequate cash to get through that period, but that Goldshore Resources is looking at alternative sources of capital so it can continue to advance its work on the ground.

However, Richards explained he doesn’t foresee advancing its Moss Gold project until sometime in 2024 because of current market constraints.

“For us, this is all about managing our cash; continuing to look for a strategic partner; and making smart decisions in difficult markets,” he said. “That’s the reality of what everybody is facing.”

Richards said the company also needs to keep the development process going but not at the expense of blowing up the cap structure.

Goldshore Resources‘ Moss Gold Project

Located in Northwest Ontario, the Moss Gold Project is 100 per cent owned by Goldshore Resources and has a global inferred resource estimate of 6 million ounces at 1.02 gpt.

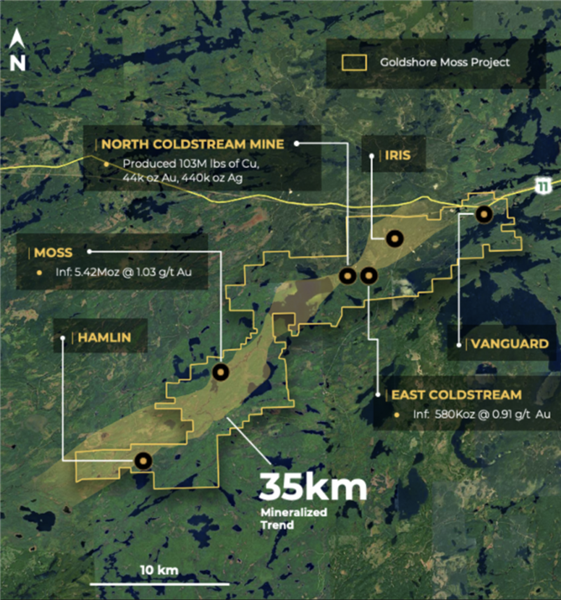

The project is ideally located with year-round exploration in a highly prospective area and has 30 high-priority targets identified in its 2022 program. Notably, the strike length for the Moss-type targets has expanded from 2.5 kilometres to 11 kilometres.

To date, less than 10 per cent of drilling has tested high-priority targets with significant upside potential for cobalt and copper at select targets.

In September 2023, the company released results from its summer field program, which identified five new gold trends as well as two high-grade copper gold trends.

Richards told The Market Herald Canada in a previous interview that the company has expanded its trend of known mineralization to more than 35 km up from just 11 km.

“This system is much larger than we originally identified,” he said. “The trend and the parallel structures along strike are extremely encouraging.”

Richards explained to The Market Herald Canada that the project is “quite large” and deserves capital to be developed and said the company hopes to be able to find a partner so the project can realize its full potential.

Notably, an updated mineral resource and maiden resource estimate was completed back in May, growing the inferred resource by 44 per cent. The maiden resource estimate also grew with 24 per cent more contained gold ounces and 32 per cent more tons to 5.42 million ounces of gold at 1.03 grams per ton (g/t) gold within 163.6 million tons open pit and underground.

In June 2023, Goldshore filed an updated technical report for the project and is advancing towards a preliminary economic assessment. High-grade shears were visible in low-grade altered wall rock, three viable process routes and varying mining scales and rates.

This makes the project a likely optimum project that will be staged hybrid rather than a simple mine-to-mill operation.

Next catalysts for Goldshore Resources

With the company’s primary focus now shifted to 2024, Richards told The Market Herald Canada that Goldshore Resources will be balancing dilution with what the company sees as “value-adding activities.”

He said that although he doesn’t anticipate the company to be drilling during the winter months, Goldshore Resources will look to prepare and look to prioritize what will create the most value for the company into next year.

“[Goldshore Resources is] actively looking for a partner that can help support this project,” Richards said. “I think we have the right strategy to weather the storm.”

Moving into next year, the company also anticipates having its PEA ready, depending on the markets.

Goldshore Resources management team

Brett Richards, CEO

Brett Richards has more than 34 years of experience in mining and metals, including mine financing and mine development. He also has experience in senior-level operations and mergers and acquisitions.

Richards also led Banro Corp. through an operational transition as a private company through to divesting certain assets. He has also served as the former transition CEO of Roxgold (TSX:ROXG), a former senior executive of Katanga Mining (TSX:KAT) and has held former senior executive positions with Kinross Gold (TSX:K) and Co-Steel (TSX:CEI).

Peter Flindell, vice president of exploration

Peter Flindell has 35 years of experience in mineral exploration and feasibility studies. Notably, Flindell has led teams to discover, develop and expand several gold and copper mines across Southeast Asia, Central Asia, West Africa, Central Africa, Europe and Central America.

Flindell also has experience in base metal and iron ore projects and spent 12 years with Newmont Mining, 11 years with Avocet Mining and eight years with Signal Delta.

Marlis Yassin, CFO

Marlis Yassin has more than 15 years of experience working with companies in various sectors such as mining, technology and industrial products.

Additionally, Yassin has held senior finance management positions with various public companies, such as at a large industrial products company and at mid-tier mining companies. Yassin has extensive experience at Deloitte, providing reporting, advisory and assurance services to publicly traded companies, mostly in natural resources.

Yassin holds a bachelor of commerce degree from the University of British Columbia.

The investment opportunity

As it currently stands, Goldshore Resources has a share price of $0.10, which is down 84.17 per cent from its initial public offering when it began trading on the TSXV in June 2021.

That being said, however, Richards told The Market Herald Canada that the company has one of the lowest discovery costs in the sector at C$10 per ounce, including acquisition costs, which he said is below the $20-to-$25 average in the sector for finding ounces.

“There isn’t anyone trading lower (on a per ounce basis) than we are, and I think we have one of the most prospective projects in our sector in Canada,” he said.

Richards explained that Goldshore Resources has the potential to grow the resource “exponentially,” to 15 million to 20 million ounces with 60,000 or 70,000 metres of drilling.

“The prize, at the end of the day, is not only [the company’s] starting point, but where we can potentially get to. The Moss Gold deposit will host a mine one day, our role is defining and shaping what the resource looks like that takes us there,” he said.

When it comes to its goals for 2024, Richards said the company will be “preparing the company” for when the market eventually turns around, adding that investors will get the largest and best return from a company like Goldshore Resources.

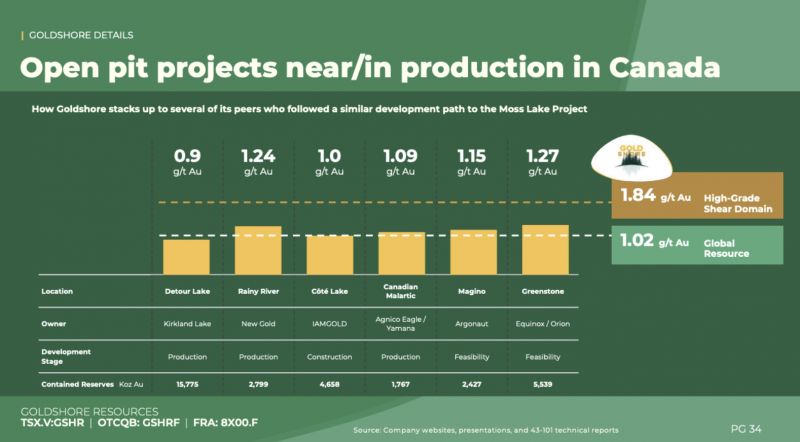

In line with this, he explained that the company’s peers are trading at five or six times of what the company is on a per-ounce basis.

“When this market turns – and it will – and when the U.S. dollar starts to weaken – and it will – we are going to see a higher gold price environment, and we are going to see activity in our space to invest with companies who can deliver the best return, and that’s Goldshore,” he said.

Despite challenges in the market, and as Goldshore Resources looks to carefully execute its goals into 2024 and beyond, investors will be keen to watch how this undervalued company will impact the gold sector.

Join the discussion: Find out what everybody’s saying about this stock on the Goldshore Resources Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.