/NOT FOR DISSEMINATION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES OF AMERICA./

Outstanding Performance Demonstrates Smart Beta Delivers!

TORONTO, March 5, 2015 /CNW/ - First Asset Investment Management Inc. is pleased to announce that 5 more of its ETFs have reached a significant milestone of 3 year performance as of February 2015.

"First Asset is delighted to report outstanding performance results at this important 3 year milestone. We are considered by many to be pioneers of smart beta ETFs in Canada and the absolute return, the return relative to benchmarks, and risk-adjusted return metrics of our factor based index ETFs continue to validate the advantages of smart beta.

First Asset Morningstar Canada Value Index ETF and First Asset Morningstar Canada Momentum Index ETF are just two of many examples of First Asset solutions that have delivered impressive results and that meet real-world needs of Canadian investors. These are what we call Smart Solutions."

Barry Gordon, President and CEO, First Asset Investment Management Inc.

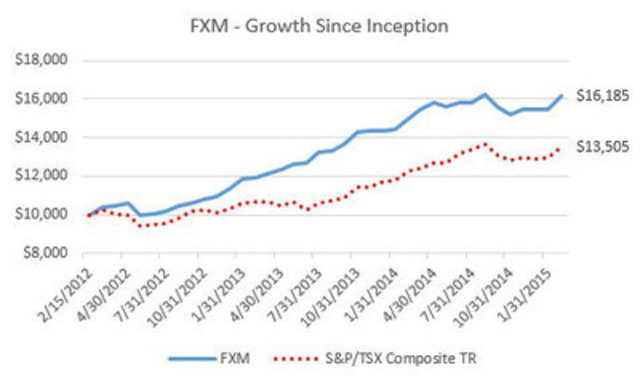

First Asset Morningstar Canada Value Index ETF (TSX:FXM) has exceeded its benchmark returns by 6.78% achieving an annualized return of 17.18% since inception and has grown to more than $180 million in AUM.

|

1 Year

|

3 Year

|

Since Inception

|

|

FXM

|

7.88%

|

15.86%

|

17.18%

|

|

S&P/TSX Composite TR

|

10.32%

|

9.68%

|

10.40%

|

|

Excess Return

|

-2.44%

|

6.18%

|

6.78%

|

|

Source: Morningstar Direct, as of February 28, 2015.

|

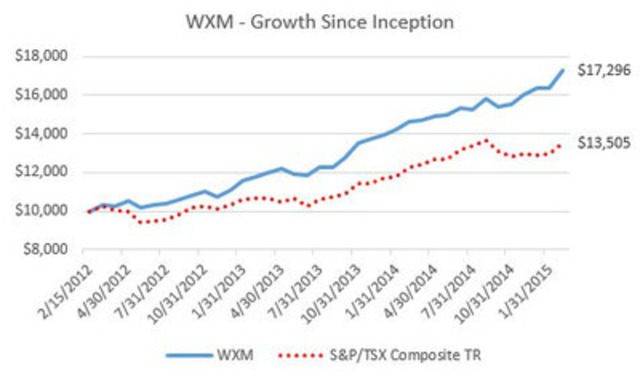

First Asset Morningstar Canada Momentum Index ETF (TSX:WXM) has delivered an annualized return of 19.78% since inception, doubling its benchmark. Outperformance over the past 1, 2 and 3 years is equally impressive.

|

1 Year

|

3 Year

|

Since Inception

|

|

WXM

|

18.11%

|

18.87%

|

19.78%

|

|

S&P/TSX Composite TR

|

10.32%

|

9.68%

|

10.40%

|

|

Excess Return

|

7.79%

|

9.19%

|

9.38%

|

|

Source: Morningstar Direct, as of February 28, 2015

|

FXM & WXM inception date: Feb 13, 2012. The rate of return tables shown are used only to illustrate the effects of the compound growth rate and are not intended to reflect future values of the fund or returns on investment in the fund. The S&P/TSX Composite Total Return Index is a capitalization-weighted index designed to measure market activity of stocks listed on the Toronto Stock Exchange. This index is used as a benchmark to help you understand each fund's performance relative to the general performance of the broader Canadian equity market.

Risk: Our Numbers Say It All

These ETFs have been capturing all of the upside of the market in Canada over the past 3 years, while also doing a phenomenal job mitigating losses in months where the market was negative. This is evidenced below with very compelling Up and Down Capture ratios. Furthermore, these ETFs have been far less volatile than the broad market, resulting in superior risk adjusted returns.

|

Risk (since ETFs inception)

|

Up

Capture

|

Down

Capture

|

Beta

|

Sortino

Ratio

|

|

FXM

|

100.09

|

28.16

|

0.71

|

3.25

|

|

WXM

|

102.15

|

-1.34

|

0.63

|

5.29

|

|

S&P/TSX Composite TR

|

100

|

100

|

1.00

|

1.61

|

Up Capture: This measures a fund's performance in up markets (defined as those periods in which market return is greater than 0). In essence, it tells you what percentage of the up-market was captured by the fund. For example, if the ratio is 110%, the fund has captured 110% of the up-market and therefore outperformed the market on the up side.

Down Capture: This measures a fund's performance in down markets. A down-market is defined as those periods (months or quarters) in which market return is less than 0. For example, if the ratio is 28%, the manager has captured only 28% of the down-market and therefore outperformed the market. Negative numbers indicate that the fund has moved in the opposite direction, generating an increase while the market was declining.

Beta: This measures the tendency of fund returns and benchmark returns to move together. If beta is greater than one, movements in fund returns tend to be more pronounced relative to benchmark returns and if beta is less than one, the fund is less volatile than the market. For example, an ETF with a beta of 0.71 tends to be less volatile than the market.

Sortino Ratio: The Sortino Ratio is a measure of volatility that differentiates harmful volatility from general volatility. Generally, a large Sortino ratio indicates there is a low probability of a large loss.

First Asset ETFs achieving 3 year performance in February 2015:

|

Canadian Equity:

|

TSX Symbol

|

- First Asset Morningstar Canada Momentum Index ETF

|

WXM

|

- First Asset Morningstar Canada Value Index ETF

|

FXM

|

- First Asset National Bank Quebec Index ETF

|

QXM

|

|

|

|

Canadian Dividend and Income Equity:

|

|

- First Asset Morningstar Canada Dividend Target 30 Index ETF

|

DXM

|

|

|

|

US Equity:

|

|

|

|

UXM

UXM.B

|

For a complete list and analytics of all First Asset ETFs with a 3 year history, visit www.firstasset.com/3yr.

First Asset - Smart SolutionsTM

First Asset is an independent investment firm, focused on providing smart, low cost solutions that address the real-world investment needs of Canadians - capital appreciation, income generation and risk mitigation. Rooted in strong fundamentals, First Asset's smart solutions strive to deliver better risk-adjusted returns than the broad market while helping investors achieve their personal financial goals.

First Asset's comprehensive suite of 38 ETFs allow advisors to construct smart, well diversified and solid risk adjusted client portfolios.

This communication is intended for informational purposes only. This offering is made only by prospectus. The prospectus contains important detailed information about the First Asset ETF and its units. A copy of the prospectus may be obtained from your investment advisor, First Asset or at www.sedar.com. Investors should read the prospectus before making an investment decision. Commissions, trailing fees, management fees and expenses all may be associated with investments in the First Asset ETF. The indicated rates of return are the historical annual compounded total returns, including changes in unit value and do not take into account sales, redemption or optional charges or income taxes payable by a security holder that would have reduced returns. The performance information shown is for Common units of the fund, and may not be indicative of the performance of other series of the same fund. Variations in performance data among various classes of the same fund is due to differences in management fees attributed to each series. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. The First Asset ETF is managed by First Asset Investment Management Inc.

Morningstar and the Morningstar logo are registered trademarks of Morningstar, Inc. and have been licensed for use for certain purposes by First Asset Investment Management Inc. These ETFs are not sponsored, endorsed, sold or promoted by Morningstar or any of its affiliates (collectively, "Morningstar"), and Morningstar makes no representation regarding the advisability of investing in the ETFs.

SOURCE First Asset

Image with caption: "FXM - Growth Since Inception (CNW Group/First Asset Exchange Traded Funds)". Image available at: http://photos.newswire.ca/images/download/20150305_C7499_PHOTO_EN_12846.jpg

Image with caption: "WXM - Growth Since Inception (CNW Group/First Asset Exchange Traded Funds)". Image available at: http://photos.newswire.ca/images/download/20150305_C7499_PHOTO_EN_12847.jpg

please contact Investor Relations, First Asset Investment Management Inc. at 416-642-1289 or 1-877-642-1289 or visit www.firstasset.com.Copyright CNW Group 2015