DailyFX.com -

Why and how do we use the SSI in trading? View our video and download the free indicator here

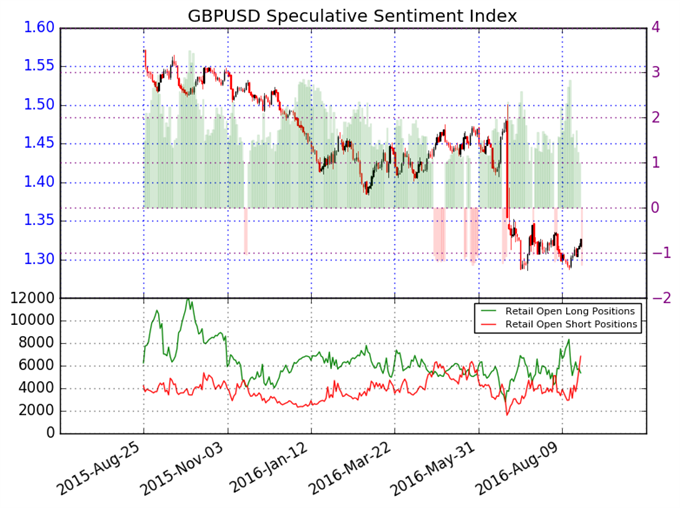

GBPUSD– Retail FX traders are now net-short the British Pound

versus the US Dollar for the first time since the pair set a key top near the $1.33 mark, and a contrarian view of ‘crowd’

sentiment leads us to watch for further GBP/USD gains. Our data has otherwise shown heavily one-sided sentiment in favor of buying

into Sterling weakness.

It is possible that the more recent flip to selling may mark another short-term top—much as a

similar flip preceded key reversals in the past several months of trading. And indeed a hold below key resistance at $1.3371 would keep the overall bearish trend intact. As it stands we will maintain a contrarian bullish bias, but a reversal and a further flip to crowd buying would

quickly act as confirmation of a trend turnaround.

See next currency section: USDJPY - US Dollar Remains a Sell versus Japanese Yen

--- Written by David Rodriguez,

Senior Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via

e-mail, sign up for his distribution list via this link.

Contact David via Twitter

at http://www.twitter.com/DRodriguezFX

original

source

DailyFX provides forex news and

technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.