Mark the Calendar: Applying for College Financial Aid Now Begins Oct. 1 with the Release of the Free

Application for Federal Student Aid

Sallie Mae Offers Tips and Resources to Help Families Navigate the Process and Understand

Important Changes to the FAFSA

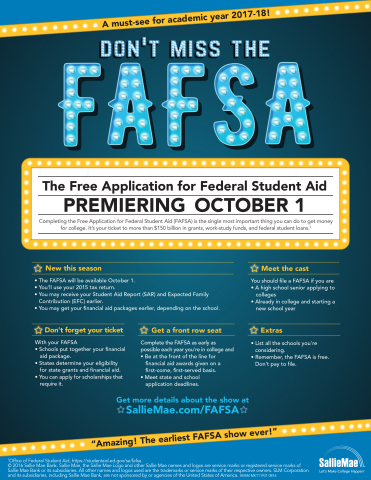

For families with students heading to college next year, there’s a new date to circle on the calendar: Oct. 1, 2016. That’s the

new release date for the Free Application for Federal Student Aid (FAFSA), the gateway to more than $150 billion in grants,

work-study funds, and federal student loans. Schools use the FAFSA to put together financial aid packages, states use it to

determine student eligibility for state aid, and some scholarships require it as part of their application.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20160830005273/en/

New in 2016: The Free Application for Federal Student Aid (FAFSA) Premieres Oct. 1 (Graphic: Business Wire)

Sallie Mae, the nation’s saving, planning, and paying for college company, has created an online library of tips, tools, and resources and a visual to help families navigate the FAFSA process for academic year 2017-18, understand some additional changes

designed to simplify the application, and prepare to complete it.

Here’s what families need to know about this year’s changes:

-

For the first time, the FAFSA will be available on Oct. 1; that’s three months earlier. Why it’s important: some

financial aid is awarded on a first-come, first-served basis, or from programs with limited funds, so the earlier families fill

out the FAFSA, the better the chance to be in line for that aid. Families can get a head start on the process by creating their

Federal Student Aid ID username and password at www.fafsa.gov.

- Families will use their 2015 tax information. Why it’s important: This will simplify the

process, as families will no longer need to estimate their taxes to complete the FAFSA, or put off completing it until they file

their 2016 taxes. Asking families to use their 2015 tax return, or what the Department of Education calls “prior-prior year” tax

information, also means more families will be able to use the IRS Data Retrieval Tool, which saves time by importing tax

information directly into the FAFSA.

-

Completing the FAFSA earlier means families can receive critical information like the Student Aid Report (SAR) sooner. Why it’s important: The SAR includes the Estimated Family

Contribution (EFC), which provides a clearer picture about eligibility for financial aid as families begin applying to

colleges. In addition, families who complete and submit the FAFSA soon after Oct. 1 may receive financial aid award letters

from schools earlier. Timing of award letters will vary by school, so families should check with financial aid offices and

school websites for more information.

“The White House estimates that more than 2 million students who would have been eligible for Pell grants and other financial

aid did not complete the FAFSA last year,” said Martha Holler, senior vice president, Sallie Mae. “That’s 2 million too many. With

a bunch of financial information automatically filled for you, completing the application is easier than ever. The only thing it

costs you is a little time.”

In addition to understanding changes, families should always remember the following tips for completing the FAFSA:

- Gather necessary information in advance. In addition to creating a username and password —

Federal Student Aid ID — families will need Social Security numbers, driver’s license numbers, bank statements, 2015 tax returns,

and W-2 forms. Having this information ready before Oct. 1 can expedite the process.

- Complete the FAFSA as a high school senior — and every year in college. Filing a new FAFSA

each year is the only way to remain eligible for federal student aid, and the amount of aid could change year-over-year. In

addition, nearly every student is eligible for some form of financial aid, so it’s important all families complete it.

-

The easiest and fastest way to fill out a FAFSA is at www.fafsa.gov. Families who complete the FAFSA online usually receive their Student Aid Report in

three to five days. And remember, filing the FAFSA is free. Never pay a fee to file the FAFSA, and make sure to file at

www.fafsa.gov.

-

List schools on the FAFSA. Families will need to list at least one school on the FAFSA. Some state aid is based on the

order of how schools are listed, so families should consider listing state schools first to be in line for state aid.

Additional information, including state deadlines for completing the FAFSA, is available at https://studentaid.ed.gov/sa/fafsa.

Sallie Mae and Smart College Visit will host a Twitter chat on all things FAFSA on Sept. 21 at 1 p.m. EDT. Use #CampusChat to

participate.

To watch Sallie Mae’s “Beginner’s Guide to FAFSA” video, get additional details about completing and submitting the FAFSA, and

download the College AheadSM Mobile App to keep track of important deadlines, visit www.salliemae.com/fafsa.

Sallie Mae (NASDAQ: SLM) is the nation’s saving, planning, and paying for college company. Whether college is a long way

off or just around the corner, Sallie Mae offers products that promote responsible personal finance, including private education

loans, Upromise rewards, scholarship search, college financial planning tools, and online retail banking. Learn more at SallieMae.com. Commonly known as Sallie Mae, SLM Corporation and its subsidiaries are not sponsored by or

agencies of the United States of America.

Sallie Mae

Ellen J. Roberts, 302-451-0428

Ellen.Roberts@SallieMae.com

View source version on businesswire.com: http://www.businesswire.com/news/home/20160830005273/en/