This article originally appeared on Finbox.io.

Summary

United Continental Holdings (NYSE: UAL) is expected to report earnings Tuesday after the market closes. The company's

shares last traded at $74.15 as of Friday, approximately 98 percent of its 52 week high. Although the stock is near its high,

finbox.io fair value data implies that shares are still over 20 percent undervalued while Wall Street's consensus price target of

$80.91 implies nearly 10 percent upside.

Comparable Company Analysis

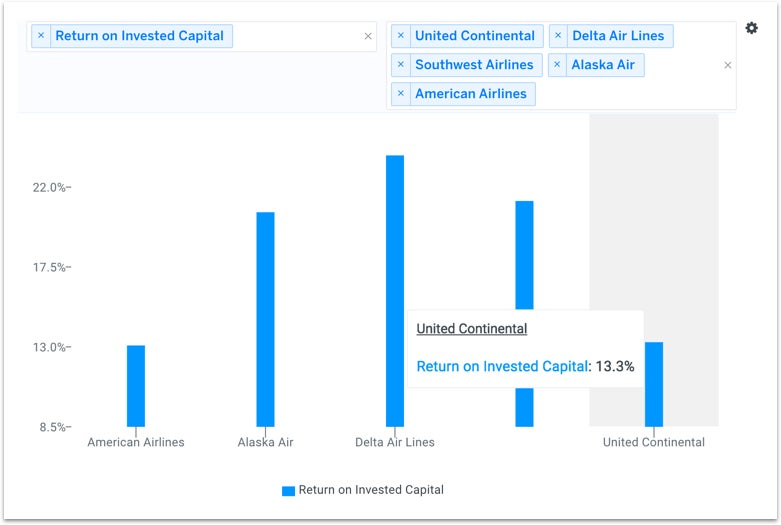

Return on Invested Capital (ROIC) is a metric often used to

evaluate the ability of the company to create value for all its stakeholders, debt and equity.

ROIC = NOPAT / Average Invested Capital

NOPAT is defined as Net Operating Profit After Tax and Average Invested Capital is the average Debt + Equity over the same time

period.

United's ROIC does not immediately stick out when compared to its publicly traded peer group: Alaska Air Group, Inc. (NYSE: ALK), Delta Air Lines, Inc.

(NYSE: DAL), Southwest

Airlines Co. (NYSE: LUV) and American Airlines Group Inc. (NASDAQ: AAL).

The company's ROIC over the prior twelve months of 13.3 percent is slightly above AAL (13.1 percent) and below ALK (20.6

percent), DAL (23.8 percent), and LUV (21.2 percent).

These return figures, in part, help explain why the company's EBITDA

multiples trade at a discount to this same comparable company group.

United's forward EBITDA multiple of 4.1x is well below all of its peers: ALK (5.6x), DAL (4.7x), LUV (6.1x), and AAL (4.8x).

However, note how the airline's returns have generally improved since its 2008 low of -30 percent. Compare this to United's

fiscal year 2015 ROIC of 18 percent - a big improvement!

The company's financial performance has improved over the last several years and is expected to continue improving.

When inputting consensus Wall Street projections into finbox.io's various discounted cash flow (DCF) analyses and comparable company models, United appears to be fundamentally undervalued.

The chart below compares our calculated margin of safety for each peer company vs Wall Street's.

Note how Wall Street's generally bullish on this entire airline group. However, our unbiased analyses concludes that only United

and American Airlines are materially undervalued.

Furthermore, S&P Capital IQ just reiterated its Buy rating on United and noted its positive fundamental outlook on the US

airline industry. The research firm believes that, "valuations across the group are likely to expand in '17, on better unit

revenue performance."

But which stock's valuation is positioned to improve the most?

Investors may want to take a closer look at United prior to earnings.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.