The streak of five-consecutive record closes for the Nasdaq and S&P 500 (SPX) is over, but the Dow Jones Industrial Average

($DJI) did manage to eke out another record Thursday. The market appears to remain resilient amid hopes for business-friendly

fiscal policy.

Stocks took a turn lower in pre-market trading Friday, but market participants’ apparently widespread belief that something good

might happen brings to mind the late 1980s, when Alan Greenspan led the Fed. In those days, many traders referred to the “Greenspan

put,” which meant they believed if anything went wrong for the stock market, Greenspan and the Fed would lower rates in an effort

to send more money into stocks. (In the options market, a “put” gives its owner a measure of protection against a decline in the

price of the underlying asset).

Expectations for a rate hike appear to be getting closer, judging by action in Fed funds futures, so the scenario we saw under

Greenspan isn't necessarily valid any longer. But now there’s talk of a new type of “put” underpinning the market. We now arguably

have the “tax policy put,” and it could be a factor contributing to Wall Street’s recent resilience.

Here’s how it works: As many market participants anxiously await the new administration’s tax plan, expectation of the new tax

policy—which keeps getting promised but not revealed— seems to be protecting the market from declines.

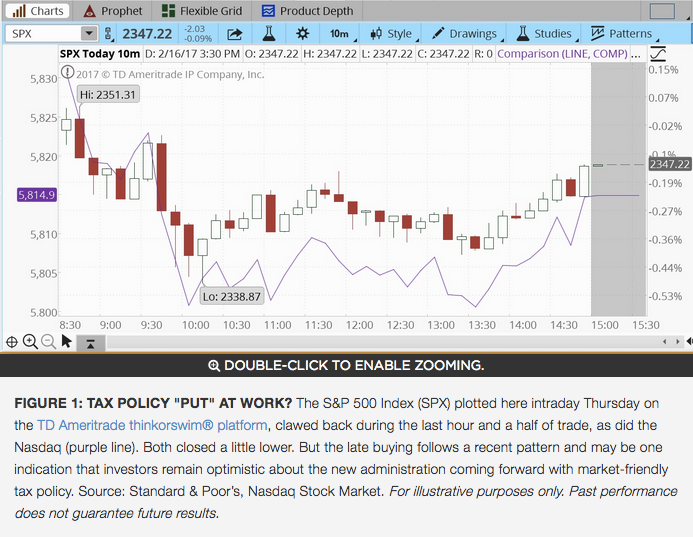

That may have been the case even on Thursday, with the Nasdaq and SPX falling. Both clawed back a good deal of their losses by

the close (see chart below), a sign of possible buying interest on dips. It might be interesting to see if this pattern continues

as investors keep waiting for President Trump to release his tax policy, which he said Thursday would come after he releases a

health care plan.

Another thing to watch is the market’s reaction once the tax policy comes out. In fact, the longer-term concern may be whether

the plan, once it’s released, will meet the market’s expectations. We’ll see if the tax policy put remains after the tax policy is

revealed.

In the markets early Friday, the rally in the fixed income market that sent rates down on Thursday continued, lowering the

10-year Treasury rate to 2.41% after it touched 2.5% earlier this week. The probability of a March rate rise now stands at 22%,

with May at 48%, according to futures prices.

The drop in rates Thursday had an effect on the financial sector, as that group struggled. Other stocks struggling

Thursday included Kraft Heinz Co (NASDAQ: KHC) and Tripadvisor Inc (NASDAQ:

TRIP), after earnings, but KHC jumped early Friday

after the company said it approached Unilever plc (ADR) (NYSE: UL) about a merger but UL rejected it, according to TheStreet.com. On the

positive side of the ledger, The Coca-Cola Co (NYSE: KO) rallied due in part to a dividend raise and Cisco Systems,

Inc. (NASDAQ: CSCO) rallied

after earnings.

Looking ahead to the rest of the day Friday, it might be prudent to stay on the lookout for more profit taking, as we started to

see some on Thursday. It’s certainly not surprising to see profit taking at the end of the week when the market’s been at record

highs and a long weekend is approaching, but it doesn’t look like the short-term bullish trend we’ve seen is changing in any major

way, for the moment at least.

On the economic data side, leading indicators come out at 10 a.m. ET, with a 0.5% rise expected, according to Briefing.com; and

the weekly Baker Hughes U.S. oil rig data may be worth checking to see if the rig count climbed yet again.

Looking farther ahead, the market is closed Monday for the President’s Day holiday, followed Tuesday by Wal-Mart

Stores Inc (NYSE: WMT) earnings.

Some of the key economic reports and other releases to watch for next week include Fed minutes, existing home sales, and new home

sales.

Defensive Assets Back in Play

Despite strong U.S. economic data and a string of record closes in the S&P 500 Index (SPX) through Thursday’s session, gold

hasn’t lost much of its luster from the rally it put together earlier this month. Gold prices rose early Friday and remain near the

recent high of $1,246 an ounce recorded Feb. 8. Actually, a number of defensive investments other than gold also showed strength

late this week, including Treasury bonds — which have risen from mid-week lows — and the Japanese yen. Perhaps this reflects some

investors taking profit and potentially diversifying their positions, with stocks near all-time highs.

Reflections on Retail Sales

Earlier this week we noted that retail sales might look better than expected once stripped of volatile auto and truck sales, and

that turned out to be the case. Overall retail sales jumped 0.4% in January, which already was better than analysts had expected.

But the really impressive number was a 0.8% gain in retail sales with autos and trucks taken out. That’s the best in some time.

Also, the government revised upward its retail sales number from December. We’ll get some more input on how the retail sales

picture looks next Tuesday when the country’s biggest retailer, Wal-Mart (WMT), reports earnings.

How’s the Consumer Doing?

What do the strong January retail sales data mean? Possibly they tell us that consumers, helped by an improving job and wages

picture, are starting to spend their extra cash. Consumer discretionary and consumer staples stocks both climbed after the report.

These positive data could end up playing into improved gross domestic product (GDP), according to Briefing.com. And the strong job,

wages, and retail sales we’re seeing may also be playing into the inflation picture, as both the consumer price index (CPI) and

producer price index (PPI) came in above expected levels in January. The Fed is likely watching this trend closely, and we’ll see

where it leads as far as rate policy is concerned.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.