After last week’s round of bank earnings, three more financial giants are set to report Q2 results this week. Bank of

America Corp (NYSE: BAC) and Goldman Sachs

Group Inc (NYSE: GS) report before market open on

Tuesday, and Morgan Stanley (NYSE: MS) reports

before market open on Wednesday.

Over the past several weeks, bank stocks rallied following the House’s proposal to roll back the Dodd-Frank Act and on results

of the Fed’s stress test—a yearly examination to ensure the nation’s largest banks have enough capital to weather a financial

crisis and still be able to lend to consumers and businesses. These rallies shows that one of the things helping to drive the

sector is policy reform out of Washington.

Beyond the stress tests, another area of focus for banks has been the Fed’s rate hikes and how they plan to go about reducing

their $4.5 trillion balance sheet. Fed Chair Janet Yellen’s recent Congressional testimony shined a little more light on the Fed’s

approach to rate hikes and unwinding its balance sheet. However, it still remains to be seen how that might impact markets and

companies with large lending and trading divisions.

Bank of America Earnings

Bank of America has a large lending business andmany analysts expect it to benefit if interest rates continue to rise. In the

first quarter of 2017, the bank’s net interest income—the difference between revenue the bank generates from assets and the

expenses associated with paying its liabilities—increased 5% to $11.1 billion.

For Q2, Bank of America is expected to report earnings of $0.43 per share on revenue of $21.91 billion, up from $0.36 per share

on revenue of $20.6 billion in Q2 2016, according to third-party consensus analyst estimates. Over the past few months, several

analysts lowered earnings estimates for the big banks, including Bank of America, due, in part, to expectations for weaker trading

revenues.

Looking at trading activity, Bank of America’s stock hit a 52-week high of $25.80 on March 2 and has been bouncing between $22

and $25 for the past several months. Options traders have priced in just over a 2% potential share price move in either direction

around the earnings release, according to the Market Maker Move™ indicator on the thinkorswim® platform.

Going into this week, Bank of America’s options had the highest open interest in terms of contracts out of any individual

equity. At the July 21 monthly expiration, options trading in calls has been active at the 24.5 and 25 strike prices while puts

have been active at the 24 strike. The implied volatility sits at the 24th percentile.

Note: Call options represent the right, but not the obligation, to buy the underlying security at a predetermined price over

a set period of time. Put options represent the right, but not the obligation to sell the underlying security at a predetermined

price over a set period of time.

FIGURE 1: RISING MORTGAGE RATES. Mortgage rates have been declining from recent highs, but still remain above 2016 lows.

Some analysts think BAC could potentially benefit if the interest rates continue to rise. The chart shows 30-year fixed rate

mortgage averages in the United States since early 2009 on the thinkorswim® platform by TD Ameritrade. Source: Federal

Reserve's FRED database. For illustrative purposes only. Past performance does not guarantee future results.

Goldman Sachs Earnings

Low volatility, low interest rates, and other factors have pressured trading revenues at Goldman Sachs, along with other banks

with trading business such as JPMorgan Chase & Co. (NYSE: JPM) and Citgroup Inc (NYSE: C). Last month, Citigroup CFO John Gerspach said “volatility has been very low this

quarter, which has certainly led to somewhat of a softer trading environment, especially in the fixed income and equity

markets.”

When Goldman Sachs releases results, it’s expected to report earnings of $3.51 on revenue of $7.57 billion, according to

consensus third-party analyst estimates. Those estimates are down from Q2 2016, when the company reported earnings of $3.72 per

share on revenue of $7.93 billion, partially due to the weaker trading environment.

Goldman Sachs’ stock also hit a 52-week high at the beginning of March, but has since retreated and is down about 5.5%

year-to-date. Since the middle of June, the stock has been trading in a pretty tight range between $210 and $230. Options traders

have priced in a just under a 2.5% potential share price move in either direction around the earnings release, according to the

Market Maker Move indicator. In short-term options activity at the July 21 monthly expiration, calls have been active at the 230

strike price while puts have been active at the 220 strike. The implied volatility sits at the 26th percentile.

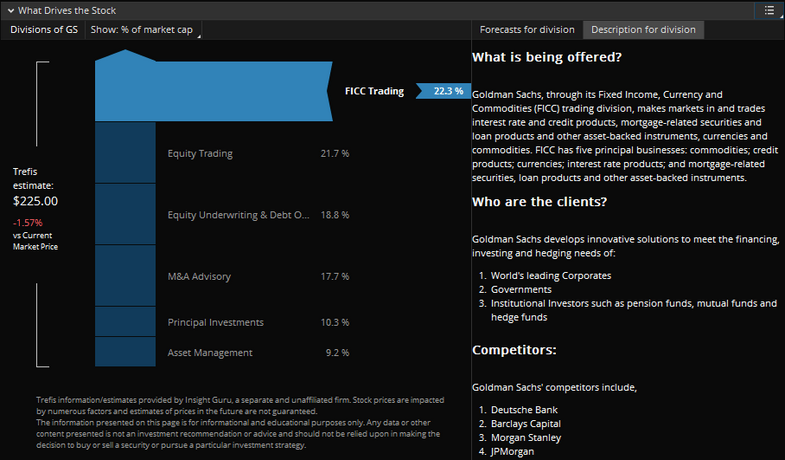

FIGURE 2: GOLDMAN SACHS COMPANY PROFILE. Fixed Income, Currency and Commodities (FICC) trading is widely considered Goldman

Sachs’ most important division. The Company Profile tool on the Fundamentals tab on the thinkorswim® platform allows TD Ameritrade clients to analyze

potential revenue drivers of a stock. Trefis information and estimates used in Company Profile are provided by Insight

Guru, a separate and unaffiliated firm. Not a recommendation. For illustrative purposes only. Past performance does not

guarantee future results.

Morgan Stanley Earnings

Comparable to Goldman Sachs, equity and FICC trading makes up a large portion of Morgan Stanley’s revenue, which analysts expect

to be pressured by low volatility the same as other banks in the business. For Q2, Morgan Stanley is expected to report earnings of

$0.76 on revenue of $9.28 billion, according to third-party consensus analyst estimates. Revenue is projected to increase 4.2%,

while earnings are expected to be roughly flat to Q2 2016’s $0.75 per share.

Looking at options trading, short-term traders have priced in just over a 2% potential share price move in either direction

around the earnings release, according to the Market Maker Move indicator. At the July 21 monthly expiration leading up to

earnings, trading has been heavier on the calls side, with a lot of activity at the 44 and 45 strike prices while puts have been

active at the 44 strike. The implied volatility sits at the 28th percentile.

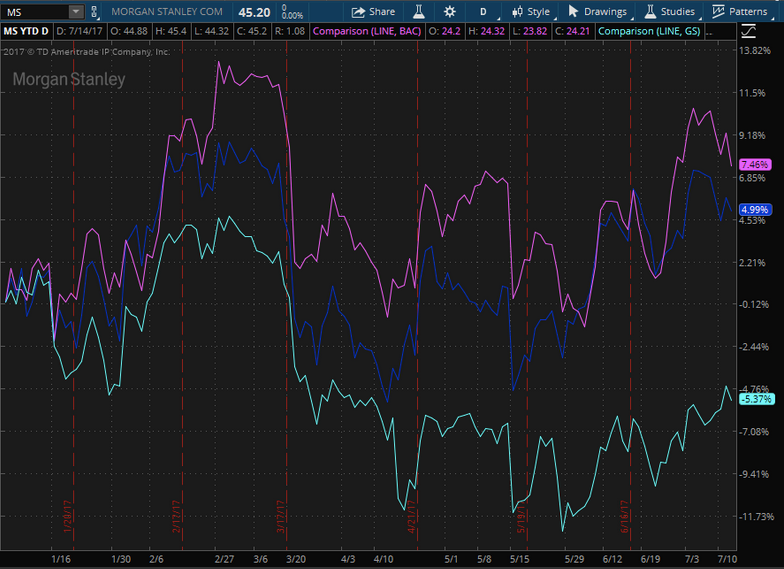

FIGURE 3: BANK STOCKS YTD PERFORMANCE. The year-to-date stock performance of Morgan Stanley (blue line), Bank of America

(purple line) and Goldman Sachs (teal line). Chart source: thinkorswim® by TD Ameritrade. Data source:

Standard & Poor’s. Not a recommendation. For illustrative purposes only. Past performance does not guarantee future

results.

Looking Ahead

In addition to the banks, earnings season is ramping up with Dow components Johnson & Johnson (NYSE: JNJ) and International Business Machines Corp. (NYSE:

IBM) reporting earnings before market open tomorrow, and

General Electric Company (NYSE: GE) and

Microsoft Corporation (NASDAQ: MSFT) later

in the week. For more earnings coverage, check out what might be expected when Netflix, Inc. (NASDAQ: NFLX) reports after

the bell today.

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.