TSX.V: DAU

Frankfurt: QXR2

OTC: DAUGF

DELTA, BC, Feb. 15, 2018 /CNW/ - Desert Gold Ventures

Inc. ("Desert Gold" or "the Company") (TSX.V: DAU, FF: QXR2, OTC: DAUGF) is pleased to announce that drilling has begun on

its Farabantourou project located in western Mali.

Highlights

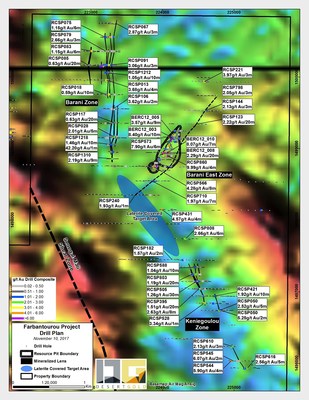

Desert Gold's initial drill program will focus on three target areas including Barani

East, Barani and Keniegoulou. The drill program plans for 31 holes consisting of 780 meters diamond drilling and 3,265

meters of RC drilling. A summary of the prospects to be drilled follows:

- Barani East Prospect

-

- Past drilling returned intercepts up to 7.8 g/t gold over 10 meters

- Four moderate to steep east-dipping lenses ranging in width from 4.5 meters to 15 meters

- The mineralized zones have approximately 550 meters of strike and may be open along strike and depth

- Potential for additional parallel zones with mineralized intercepts up to 2.22 g/t gold over 20 metres will be tested

and followed up

- Barani Prospect

-

- Drilling returned intercepts of 2.19 g/t gold over 9 meters

- The prospect is subparallel and proximal to the Mali-Senegal Shear Zone (MSSZ), along which the World Class gold mines

of Sadiola, Loulo-Gounkoto complex and Fekola are situated

- The gold mineralization is contained in several lenses and has been traced over an approximate strike of 1,900

meters

- The mineralization is open along strike and depth

- Keniegoulou Prospect

-

- Drilling returned intercepts of 5.92 g/t gold over 4 meters

- This prospect is close to and subparallel to the MSSZ on the southern strike extension of the Barani Propsect

- This zone comprises 5 lenses of gold mineralization traced over approximately 1,500 meters

- The mineralization is open ended along strike and depth

Figure 1: Locality plan of the Farabantourou Prospects with historic drill results

Desert Gold holds two gold Exploration Permits (Farabantourou and Segala Ouest) within the Kenieba Birimian Inlier of

Western Mali. The Farabantourou project lies 40 km to the south of Anglo

Gold's Sadiola gold mine and 50 km north of Randgold's Loulo-Gounkoto complex of gold mines.

*Figure 2: Location of Desert Gold's Segala Ouest and Farabantourou exploration permits in western Mali

Jared Scharf, Desert Gold's President commented, "This drill program is focussing on our

Farabantourou property which straddles the Mali-Senegal Shear Zone which hosts, in the management's opinion, some of the best

gold deposits in the world combining high grade, multimillion ounce reserves and low mining costs. After an extended period of

inactivity we are very excited to be actively developing this target again."

This note was reviewed by Dr. Luc Antoine who is a director of the Company and is registered

as a Member of the Geological Society of South Africa (MGSSA 967397). He approves the

scientific and technical disclosure in the news release and has the necessary experience relevant to the style of

mineralization and types of deposits under consideration and to the activity as a Qualified Person as defined in the National

Instrument 43-101.

ON BEHALF OF THE BOARD

"Jared Scharf"

___________________________

Jared Scharf

President & Director

+1 (858) 247-8195

For further information please visit www.SEDAR.com under

the company's profile.

This news release contains forward-looking statements respecting the Company's ability to successfully complete the

Offering. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ

materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are

subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements,

including the inability of the Company to successfully complete the Offering. These uncertainties and risks include, but are not

limited to, the strength of the capital markets, the price of gold; operational, funding, and liquidity risks; the degree to

which mineral resource estimates are reflective of actual mineral resources; and the degree to which factors which would make a

mineral deposit commercially viable are present; the risks and hazards associated with mining operations. Risks and uncertainties

about the Company's business are more fully discussed in the company's disclosure materials filed with the securities regulatory

authorities in Canada and available at www.sedar.com and readers are urged to read these materials. The Company assumes no

obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements

unless required by law.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release does not

constitute an offer to sell or a solicitation of an offer to buy the securities described herein in the

United States. The securities described herein have not been and will not be registered under the united states securities

act of 1933, as amended, and may not be offered or sold in the united states or to the account or benefit of a U.S. person absent

an exemption from the registration requirements of such act.

* Randgold's Loulo-Gounkoto mine complex to the west with ore reserves of 32 Mt average at 4.6 g.t for 3.7 million oz

Au in the Proven and Probably category.

Endeavour Mining's Tabakoto and Segala mines which hosts ~3 million oz Au (18.5 Mt at 3.5 g/t for 1.8 million oz au measured

and indicated, 9 Mt at 3.6 g/t for 1 million oz Au inferred and 6.4 Mt at 3.5 g/t for 0.7 million oz au proven and probable.

B2Gold Fekola mine to the south with ore reserves of 48.3 million Mt average at 2.37 g/t gold for 3.34 million oz au in the

Proven and Probably category and 65.8 million Mt average at 2.13 g/t gold for 4.5 million oz au.

To the north Sadiola/Yatela mine contains ore reserves of 38 million Mt at 1.57 g/t gold for 2 million oz au and 87 million Mt at

1.58 g/t gold for 6 million oz au in the measured and indicated category.

SOURCE Desert Gold Ventures Inc.

View original content with multimedia: http://www.newswire.ca/en/releases/archive/February2018/15/c2623.html