How does the market follow up a wild day like Monday? Well, stocks started with a positive tone early Tuesday, but gains seemed

to evaporate in the minutes leading up to the opening bell. That’s similar to other recent sessions where gains just haven’t been

able to hold up.

If Tuesday is anything like recent days, volatility could continue to be an issue, with swift moves one way or the other. Or

even swift moves both ways in quick succession, as we saw yesterday. Monday wasn’t a positive day, as tech stocks couldn’t hold up

even after a big acquisition announcement by IBM (NYSE: IBM). Once some of the info tech stocks gave up their gains, the rest of the market

appeared to follow.

The market evidently is repricing some assets, and this is a move that could last through the end of the year. One thing that

could continue to hurt the market is negative guidance from reporting companies, as that might reinforce ideas that the economic

and geopolitical outlook could be worsening.

Overseas, China’s central bank set the dollar’s reference rate at 6.9574 yuan, putting the Chinese currency at its weakest since

May 2008. This is a move that could make it even tougher for U.S. exports because as the dollar becomes stronger, U.S. products

become more expensive. This might be a way China’s government is pushing back at U.S. tariffs. The question is whether the yuan

could fall to 7 per dollar, a rate China might be uncomfortable with, according to The Wall Street Journal.

In earnings news this morning, General Electric Company (NYSE: GE) probably didn’t surprise too many people when it slashed its dividend to a penny a

share from 12 cents, starting next year. That move was one some analysts had predicted based on the company’s recent troubles. The

company also missed Wall Street analysts’ Q3 estimates for earnings per share and revenue, and announced it will split its power

business in two. Shares fell in pre-market trading. GE’s conference call this morning features new CEO Larry Culp and might be

interesting to review for his first observations on the company’s future.

The Coca-Cola Co. (NYSE: KO) reported

earnings and revenue that beat analysts’ estimates, so that’s a potential positive factor as the day begins. Strong sales of the

company’s diet soft drinks, tea, and smartwater helped it in Q3, KO said in a press release. Meanwhile, Boeing Co.

(NYSE: BA) shares are potentially in limbo for a bit after the

crash of one of its planes in Indonesia earlier this week. It was a new Boeing airliner, so we’ll see what the investigation

shows.

Blast of Volatility

Yesterday afternoon’s sell-off seemed to take on a life of its own as the Dow Jones Industrial Average ($DJI) plunged from early

350-point gains to late 550-point losses, picking up speed on the way. However, the index pared its deepest dive pretty

dramatically in the last 20 minutes of the session to finish down less than 250 points, or about 1 percent. Considering how far it

had fallen earlier, it seems like perhaps cooler heads prevailed at the end.

The S&P 500 (SPX) also cropped its losses, but remains down more than 9 percent this month. The Nasdaq (COMP), home to many

of the hardest hit info tech and communication services sector names, is down more than 12 percent. While it takes a 20 percent

drop in an index from its highs to formally declare a “bear market,” some of the big-name stocks down more than 20 percent so far

this year include 3M Co. (NYSE: MMM),

Caterpillar Inc. (NYSE: CAT),

DowDuPont Inc. (NYSE: DWDP), IBM, and

Kraft Heinz Co. (NASDAQ: KHC).

Still, it’s easy to overlook that many major companies, despite recent losses, are still up double digits this year, including

Apple Inc. (NASDAQ: AAPL), Boeing (BA),

Cisco Systemsn Inc. (NASDAQ: CSCO),

Merck & Co., Inc. (NYSE: MRK),

Microsoft Corporation (NASDAQ: MSFT),

Pfizer Inc. (NYSE: PFE), UnitedHealth

Group Inc. (NYSE: UNH), and Visa

Inc. (NYSE: V). Also, if you take the broader view and

look at the major indices year-to-date, the COMP is still a bit higher, while the SPX and $DJI are lower, but not by much. The last

year the SPX fell was 2015, when it lost less than 1 percent.

Sector Shuffle

One thing to consider keeping in mind is that certain sectors actually held their gains Monday, some by a sizable amount. The

sell-off wasn’t across the entire market, but only in certain neighborhoods. The wounds were deep in info tech, consumer

discretionary, and communication services, but real estate was up almost 1.5 percent. Utilities and staples sectors also actually

gained ground. Some analysts say there appears to be a move toward “value” stocks underway, and Monday’s action might play into

that thesis.

The financial sector, which had been hit hard in recent days, also moved about 1 percent higher Monday. All of the recent

volatility might be seen as potentially helping trading volume for some of the big banks. The futures market still pegs chances of

a rate hike by the end of the year at more than 70 percent, so banks might be drawing support from that, too.

There’s also the economy to think about. It’s not going downhill like the stock market, at least judging from recent data. Last

week’s GDP report showing growth of 3.5 percent looked right down the middle of the fairway in terms of not being low enough or

high enough to cause worries on the slowdown or inflation fronts, respectively. There’s a lot of debate about whether Q4 can

continue this string of firm growth in the economy, with the Atlanta Fed’s GDP Now indicator predicting a pullback to 2.6 percent

GDP gains this quarter. That’s near the lower end of Wall Street analysts’ estimates.

One thing that sometimes gets lost in the shuffle a bit is what looks like a slowdown across Europe and emerging markets.

China’s economy is growing more slowly, and Europe is sputtering a bit. A year ago, when U.S. stocks seemed to go up and up, there

was a lot of talk about how U.S. and world economies were growing in sync. You don’t hear so much of that now, and that could be a

big factor behind this month’s market losses. The European Central Bank (ECB) holds a non-monetary policy meeting next week, so

consider listening for any observations or news coming out of that.

On Edge As Trade Still Weighs

It wouldn’t be too surprising if some investors are suffering after all the downward action this month, and the way the market

reacted to fresh tariff news in the China trade war saga yesterday could signal just how nervous people might be. The strange thing

is, the threat of new U.S. tariffs, reported by Bloomberg around midday Monday, wasn’t really new information. It’s been reported

for a while now that the U.S. might consider additional tariffs, and a lot of focus remains on planned talks next month between

President Trump and Chinese President Xi.

The market’s violent reaction after the tariff news could remind long-term investors to try and stay disciplined. Markets like

this one can be dangerous, so any moves made now should be carefully considered.

Facebook Results After Close

There’s a whole basket of familiar names reporting after the close today, but let’s face it, one of them is likely to get most

of the headlines. Facebook (FB) is scheduled to

unveil its Q3 numbers, and it steps into the spotlight with its shares under all kinds of pressure.

It’s been a tough stretch for Facebook, Inc. (NASDAQ: FB) since it reported earnings at the end of July. In that time, the stock went from

an all-time high of $218.62 to $143.80, flipping from a 20 percent year-to-date return to about a 20 percent decline.

One area that analysts and investors are likely bracing for is a deceleration in the company’s revenue growth rate, which CFO

David Wehner said would continue to happen in the second half of the year, after it slowed by 7 percent in Q2. For Q3, FB is

expected to report adjusted EPS of $1.47, down from $1.59 in the prior-year period, on revenue of $13.78 billion, according to

third-party consensus analyst estimates. Revenue is projected to increase 33.4 percent year over year, per analysts’ estimates,

slowing from the 42 percent growth the company reported in Q2.

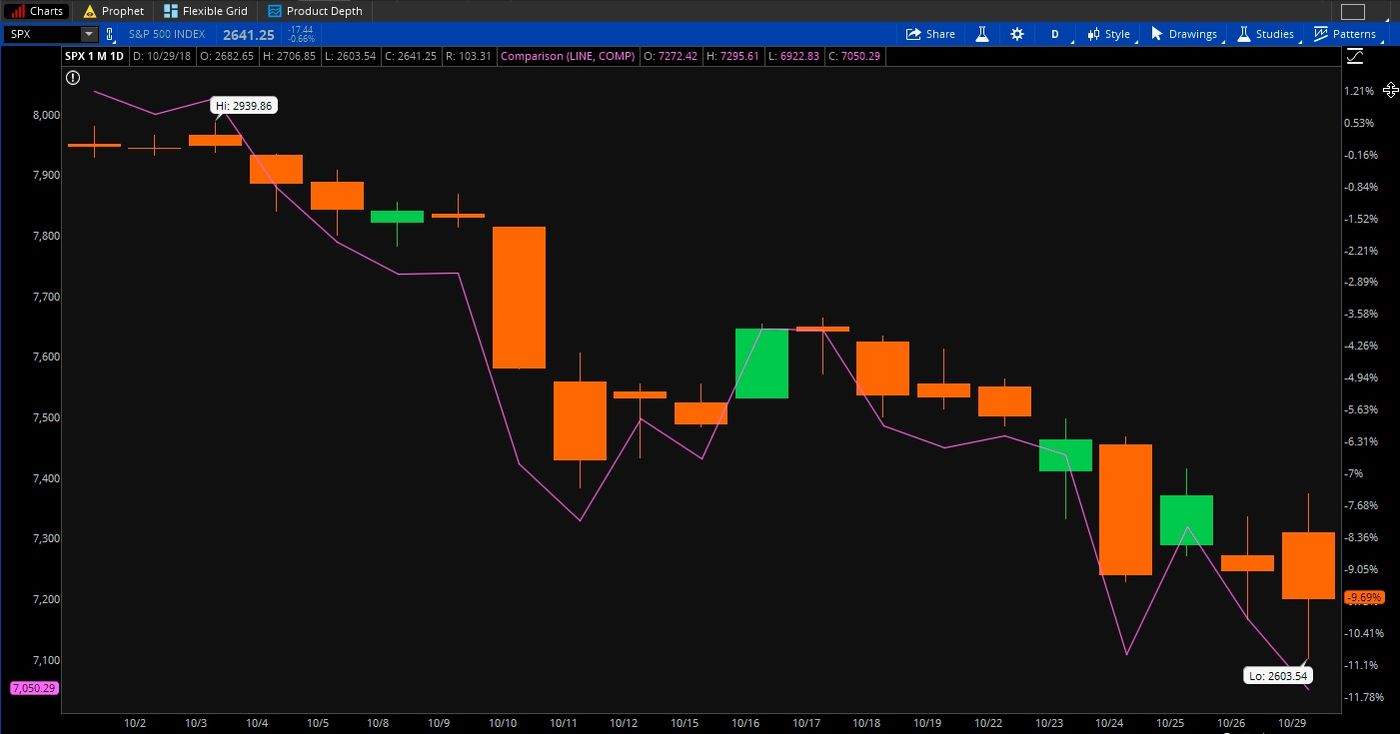

FIGURE 1: The Month That’s Been: The month is mercifully coming to an end after tomorrow, and here’s how the

S&P 500 (candlestick) and Nasdaq (purple line) are doing. The COMP is already in a correction, down 10 percent from recent

highs, while the SPX is near a 10 percent drop. Data Sources: S&P Dow Jones Indices, Nasdaq. The thinkorswim® platform from TD Ameritrade. For illustrative

purposes only. Past performance does not guarantee future results.

Where’s My Ride?

The next data update that might indicate how consumers fared as the markets plunged in October comes Thursday when auto

manufacturers release their monthly sales numbers. Like homes and major appliances, auto sales can often provide a sense of whether

people feel confident enough to go out and make a big purchase. When markets tumble, that can sometimes eat into what’s called the

“wealth effect,” when investors feel wealthy because their stocks are doing well. Studies have shown people tend to be more willing

to make major purchases like a car if they feel like they’re succeeding with their stock investments. In September, when the

markets were hitting all-time highs, U.S. light vehicle sales revved up, reaching 17.34 million on a seasonally adjusted basis.

That was stronger than the August figure of 16.62 million. Did sales hit the brakes in October as some investors started feeling

the “wealth effect” dissipate a little? Stay tuned.

Working Without a Net

For about a week now, the major indices have been trading well below levels that once formed key support. The S&P 500 (SPX),

had bounced off of its 200-day moving average a bunch of times earlier this year, but this month that level just didn’t hold, and

the SPX now trades well below it. To get back to the 200-day where it now stands near 2765, the SPX would have to mount a pretty

significant rally. This is arguably one of those occasions where support has become resistance. Meanwhile, it’s a bit harder to say

what support might exist below current levels. One region is just below 2650, where the SPX is now as it flirts with a 10 percent

correction. The average correction, when it occurs, is 14 percent from the highs, research firm CFRA notes. A 14 percent drop from

the September 20 closing high of 2930 would bring the SPX down to 2533. That’s actually right near the 2018 low. A band of

support between roughly 2530 and 2550 could be a level that technicians start watching, according to some analysts.

Speculators Abandoning Bullish Crude Positions

Crude oil has fallen pretty much in line with the stock market over the last month, with U.S. futures losing $10 during that

time and settling at just above $67 a barrel on Monday. Judging from recent data, it appears speculators have really dialed down

their expectations for more gains in crude. Hedge funds’ net-long position—the difference between speculation on higher prices and

on lower ones—in U.S. crude oil fell 15 percent to 206,295 futures and options the week ended Oct. 23, according to the U.S.

Commodity Futures Trading Commission. That was the lowest “long” position on oil in nearly three years, reported Energy Voice, an

industry newsletter.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any

particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with

each strategy, including commission costs, before attempting to place any trade.

© 2018 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.