The price of WTI crude oil was down 0.8 percent to $64.13 per barrel on Friday after Baker Hughes A GE Co

(NYSE: BHGE) released its weekly U.S. rotary drill rig

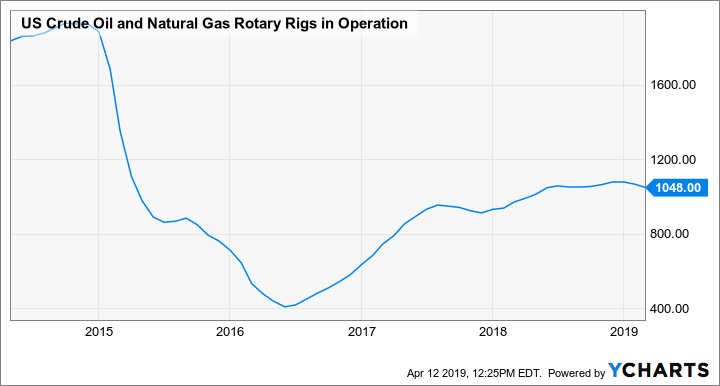

numbers. Rig counts have been slowly creeping higher for nearly three years now as the oil market recovers from a 2014 price

collapse.

The Numbers

Baker Hughes announced 1,022 active U.S. rigs on Friday, down three rigs from last week’s count. The current rig count is still

near its highest level since early 2015.

The updated count represents a year-over-year increase of 14 rigs. Out of the 1,022 active rigs, 833 are drilling primarily for

oil and 189 drill primarily for gas. There are 18 more active oil-drilling rigs year-over-year and three fewer gas-drilling

rigs.

Oil Prices React

Oil investors typically see rig shutdowns as a positive for the price of crude, as the oil market is still struggling to reach a

balance following after a oil glut caused prices to collapse in 2014.

Oil stocks got a boost Friday from news of a massive $33 billion

Chevron Corporation (NYSE: CVX) buyout of

Anadarko Petroleum Corporation (NYSE: APC).

"When deal activity picks up, you start to see multiples expand in anticipation of more deals," TD Ameritrade senior trading

specialist Shawn Cruz told Benzinga. "Anadarko was always seen as a good takeout target because they have a good balance sheet and

cash flow, and good assets in the Permian Basin and they're big in natural gas and have a deepwater drilling presence."

OPEC announced in December it intends to cut production by 1.2 million barrels per day in early 2019 to help curb global supply.

Last week, OPEC said it expects global oil demand to be 99.96 million barrels per day in 2019. Global supply in February was 99.15

million bpd, according to OPEC.

While OPEC is dialing back production, the U.S. is expected to ramp it up this year. The U.S. Energy Information Administration

says the U.S. will produce a record 12.4 million bpd of oil in 2019 and up that to 13.2 million bpd in 2020.

Related Links:

Winter Is

Over: Is It Time To Buy Natural Gas?

OPEC Maintains

2019 Global Oil Demand Growth Forecast

Latest Ratings for BHGE

| Date |

Firm |

Action |

From |

To |

| Dec 2018 |

Credit Suisse |

Upgrades |

Neutral |

Outperform |

| Nov 2018 |

UBS |

Maintains |

Buy |

Buy |

| Nov 2018 |

Citigroup |

Maintains |

Buy |

Buy |

View More Analyst Ratings for

BHGE

View the Latest Analyst

Ratings

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.