Vancouver, British Columbia based 21C Metals Inc. (CSE: BULL) (FSE: DCR1) (OTCQB: DCNNF) announced earlier today the following highlights from the first sampling program on the East Bull Palladium Project and field program on the Agnew Lake Project:

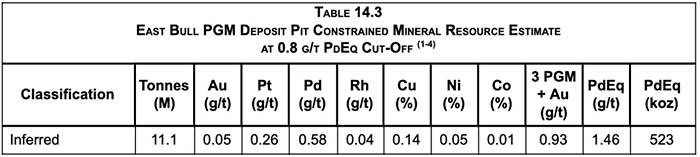

The East Bull Property hosts an inferred resource of 11.1 million tons @ 1.46 g/t Palladium Equivalent (Pd Eq) for a total estimate of 523,000 ounces of PdEq (See July 3 press release and below).

East Bull Property:

The grab sampling and mapping of the East Bay Palladium mineralization has allowed 21C to determine locations to channel sample. The sampling focused on selecting sample locations that were not previously documented. The sampling and mapping were successful in defining areas of the mineralization that when channel sampled will provide economic mineralized intercepts that will increase confidence of the mineral resource. The channel samples will also allow definition of areas of higher grade Palladium that could to direct 21C to potential starter pit locations. The channel sample is a continuous sample cut using a diamond bladed rock saw.

- 73 grab samples selected to help identify the Palladium bearing rock types of the mineralized trend. Grab samples are used to determine the presence mineralization and may not be indicative of the overall grade of the zone.

- Sampling successfully defined locations for channel sampling and the higher grades could indicate potential zones within the mineralized zone for higher grade starter pits.

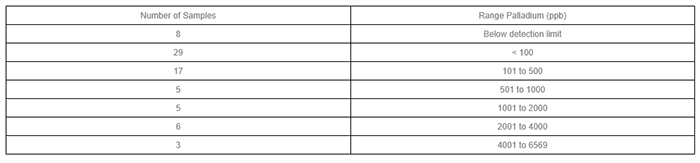

- Range of Palladium assay sample results (1000 ppb is equivalent to 1.0 grams per ton).

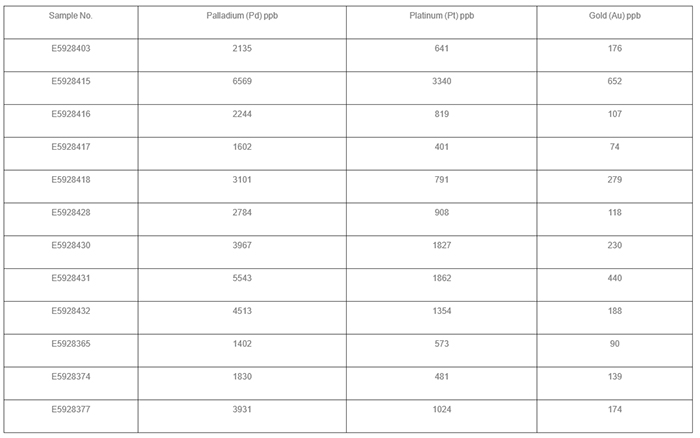

- Twelve (12) samples had values of >2000 ppb (2.0 grams per ton) Platinum + Palladium + Gold.

- Geological mapping and review of the Freewest diamond drilling in 2000, indicates the northeast trending faults are composed of multi intrusions of mafic to diabase dikes. Left lateral movement on the dikes is measured to be up to 100 meters.

Agnew Lake Property:

- Review of historical data indicated that various Palladium-Platinum showings were acquired within the staked area.

- A two-week prospecting and grab sampling program was completed to assess the locations and grade of the various showings.

- A total of 58 samples have been submitted to the lab.

Mr Wayne Tisdale commented, "The grab sample program has helped confirm the palladium bearing rock types and highlighted key areas to be targeted by a trenching program. While any grab sample grades are to be treated with caution, we are very pleased with the initial sampling program and can look forward to the trenching results with confidence."

Grab samples are selected samples and are not necessarily indicative or reflective of mineralization that may be hosted on the property.

Mr. Garry Clark, P. Geo., of Clark Exploration Consulting, is the "Qualified Person" as defined in NI 43-101, who has reviewed and approved the technical content in this press release.

To join 21C Metals' investor group please follow this link: http://bit.ly/Join21CGroup.

For additional information please contact:

21C Metals Inc.

Wayne Tisdale, President and CEO

T: (604) 639-4455

The Company believes that the information contained in this press release is relevant to continuing exploration on the Property because they identify significant mineralization that will be the target of the Company's exploration program.

21C Metals geologists delivered the samples to the SGS Canada Inc. preparation facility in Sudbury and analysis was completed at the SGS lab in Lakefield, ON. Gold, platinum and palladium are analysed using a fire assay (30 gm) with an inductively coupled plasma mass spectrometry (ICP-AES) finish (method code: GE-FA1313). Detection limits are Au: 1 ppb; Pt: 10 ppb; and Pd 1 ppb.

Base metals are analyzed using a multi-element atomic emission spectroscopy (ICP-OES; method code GO-ICP90Q) technique following Na2O2 fusion.

For prospecting sampling 21C relied on the SGS internal QA/QC process.

The Company engaged P&E Mining Consultants Inc. to complete a Technical Report and Initial Mineral Resource Estimate on the East Bull property (see July 3, 2019 press release).

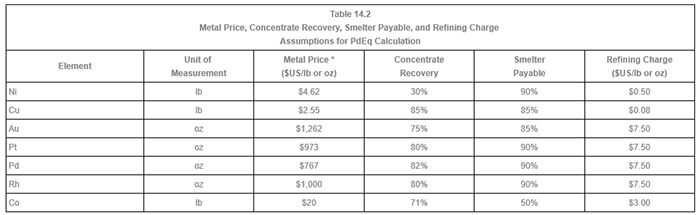

The PdEq calculation is based on the assumptions in Table 14.2. Metal prices are based on 24 month trailing averages at January 31, 2018. Concentrate recovery, smelter payables and refining charges are based on comparable projects.

* January 31, 2018 two year trailing average prices

Using these assumptions the PdEq in g/t is calculated as:

PdEq g/t = (Ni % x 1.36) + (Cu % x 2.18) + (Au g/t x 1.43) + (Pt g/t x 1.24) + (Rh g/t x 1.27) + (Co % x 7.38) + Pd g/t

Mineral Resource Estimate PdEq Cut-Off Grade Calculation CDN$

Pd Price US$914/oz

$US=$CDN Exchange Rate $ US$0.77 = CAD$1.00

Pd Recovery 80%

Smelter Payable 90%

Mining Cost $2.00/t

Overburden Mining $1.50/t

Process Cost $18/t

G&A Cost $4/t

Therefore, the PdEq cut-off grade for the pit constrained Mineral Resource Estimate is calculated as follows:

Operating costs per mineralized tonne = ($18 + $4) = $22/tonne

[($22)/[($914/$0.77 Exchange Rate/ 31.1035 x 80% Recovery x 90% Payable)] = 0.8 g/t Pd

(1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues, although 21C Metals is not aware of any such issues.

(2) The Inferred Mineral Resource in this estimate has a lower level of confidence that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

(3) The Mineral Resources were estimated using the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines.

(4) Values in the table may differ due to rounding.

A technical report supporting the mineral resource is filed on SEDAR.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Legal Disclaimer/Disclosure: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for 21C Metals, Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares of 21C Metals, Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of 21C Metals, Inc. which were purchased as a part of a private placement that was entered into on April 11, 2019. MIQ will not buy or sell shares of 21C Metals, Inc. for a minimum of 72 hours from June 19, 2019, but reserve the right to buy and sell, and will buy and sell shares of 21C Metals, Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through further private placements. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.