History often repeats itself and for Norra Metals that’s a goodthing. That’s because Norra ( TSX.V:NORA ) is the ‘first to hold the last’ producing sulphide metal mine in Norway, a Scandinavian country with plenty of untapped natural resources. More recently, however, new mining laws have been enacted and there was a bit of a fire sale in 2017-2018 when a series of 7-year terms ended. Norra and its partner, EMX Royalty Corpwas the first to jump on dozens of mining claims that suddenly came available throughout the land. This set in motion an opportunity for Norra to acquire the 6000-hectare Bleikvassliproject, a massive sulphide deposit and past-producing mine that produced five million tonnes of ore at high grade levels of zinc-lead-copper-silver/gold. Norra now has an opportunity to take advantage of data from over 50 years of mining, drilling, trenching, geophysics, underground development and sampling and very, very inexpensively repeat that history at today’s commodity prices. That’s the ‘steak’ and here’s the ‘sizzle’: initial review of the historic data and geologic modelling suggest an expansion potential to further expand the resource. This in a company that recently completed a $1.37 million financing to fund exploration, bringing it to a market cap of $14 M.

BREAKING NEWS: Norra has announced the appointment of Mr. Jeet Basi to its board of directors. Basi is an established mining industry professional with over 15 years of technical leadership experience in global public mining companies including Newmont, Goldcorp, and Teck Resources. He brings deep-level mining experience as a senior advisor in the areas of technical services, project development, and strategic planning across all of Newmont’s Canadian, U.S., and Mexican assets. Prior to Newmont, Basiheld an 8-year position as corporate manager of processing & metallurgy for Goldcorp.

Bleikvassli Project, Norway

“Norway has a long history of mining, but in recent history an alarmingly low amount of exploration has meant the mineral potential of this country has been completely overlooked” says CEO, Mike Devji. Mining has occurred since the Viking days(mid 1600’s), according to Devji, up until WWI and WWII when there was war and too much political uncertainty to undertake exploration and extraction. Post ‘ancient history’ and two world wars, Norway’s priority was its vast North Sea oil endowment with the first major discoveries being made in the late 1960’s. As mineral-rich as the country is, its mining laws were also antiquated. “Up until 2010 Norway had in place a system where you could effectively hold an asset in perpetuity with very little capital expenditure.” That all changed in 2010 when the government of Norway put in place a system whereby permits were granted for a 7-year period and minimum work was required. So, when the first 7-year term was up, those sleepers came available under a new regime that also permitted foreign investment. “By early 2017, a surge of properties opened up for acquisition and we jumped on that incredible opportunity” says Devji. From summer 2018 to late November2019, Norra performed its due-diligence process and settled on two projects.

What Norra retained, at a minimal cost of $500,000, was the last past-producing sulphide metal mine in Norway and the vast amount of the exploration ground around it. Bleikvassli is a former massive sulphide Zn-Cu–Pb-Ag-(Au) producer. The mine produced more than five million tonnes of ore in a 40 year period ending in 1997.

The other property, Meråker, hosts an extensive area of Au enriched volcanic massive sulphide (VMS) style with numerous copper-zinc-gold mineralized occurrences. It also had some past small-scale mining operations.

“The sheer volume of data from these two projects was amazing,” says Devji. “While performing our due diligence, wemet the former mining engineer and the manager who told us ‘we stopped mining because metal prices were low and uneconomic in the late 1990s’.” Since that time commodity prices have ballooned while mining is depleting world resources.

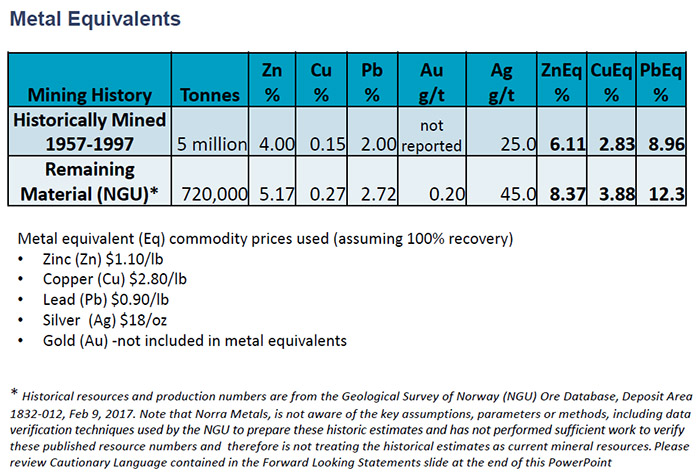

During the 40-year mine life, from 1957-98, Bleikvassli produced five million tonnes of metal at 6.11% zinc equivalent (see table below for breakdown). Historic resources remaining at the time of mine closure of Bleikvassli was estimated to be720,000 tonnes at 5.17% Zn, 2.72% Pb, 0.27% Cu, 45g/t Ag, 0.2g/t Au*. Those are exceptional grades at today’s prices. Devji believes Norra’s aggressive exploration plan, which includes hole twinning and expansion drilling, could lead to one of the lowest cost metal discoveries recently uncovered.

Historic Mining and Internal (non-NI-43-101) Resource Estimate

Norra hired Norwegian students who started digitizing the data from August last year. “We discovered over 1,400 drill holes representing hundreds of thousands of metres of drilling,” says Devji. “many were drill holes in an area that they were yet to mine. A significant chunk of the core is still there, we can touch, log it, and re-assay some of it, making the entire targeting process much simpler, “The data showed us previous operators mined five million tonnes and it looks like there is potential for additional tonnes —They drilled to a down hole depth of 480m but only mined down to the 280m level. It was mineralized at depth and open to the north.”

WHY is this exciting you may ask? Devji points to the geologically-analogous Zinkgruvan mine in Sweden, now 100% held by Lundin Mining. “In Sweden, you have Zinkgruvan with similar geology, currently being mined by Lundin mining. Zinkgruvan is a low-cost mine that has been in continuous production since 1857”. 2020 Guidance for Zinkgruvan estimates 72,000 – 77,000 tonnes zinc and 3,000 – 4,000 tonnes copper being mined (Lundin Mining website). “These systems can be large, high margin operations. It’s hard to beat that when you are in a favorable mining jurisdiction” Mr. Devji is keen to point out.

“On our property we have very similar geology, mineralization and similar structure, located in an area with exceptional infrastructure including power right on site, road system, a railway half an hour away, you have two ports; one in the Norway, one hour away and one in Sweden, six hours away.”

It now appears Bleikvassli and Meråker are finally in the hands of a team capable of leveraging these assets into something formidable. Consider the track record of the group’s development-to-acquisition strategy, all handsomely rewarding shareholders:

- Orko Silver, La Preciosa Silver Deposit: taken over by Coeur Mining for US$384 million

- Primary Metals, Panasqueira Tungsten Mine: taken over by Sojitz Inc. for CDN$50 million

- St Phillips Resources, Kemess South Copper/Gold Deposit: taken over by Royal Oak Mines for CDN$380 million (for 40%)

With nearly 54 million shares outstanding, 25% held by Devjiand his team, 9.9% held by EMX Royalty Corp. there is a strong management position in the company, leaving a healthy level of volatility to the trading float. Post financing takes the share count to 81.3 million with $1.3 million in the treasury adding27.55 million warrants at a strike price of $0.15. Turning data from the historic work at Bleikvassli into a resource will just be a starting point, one which should bring significant value to shareholders in a relatively short period of time. To stoke the fire they’ve just added to the board Basi, who brings a high level of pedigree from the likes of Newmont (TSX: NGT), Teck and Goldcorp. And that will just be the beginning of a new era of exploration and mining for Norra—and for Norway—for the next century.

Legal Disclaimer/Disclosure: While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of one thousand nine hundred dollars for Norra Metals Corp. advertising from Financial Press. There may be 3rd parties who may have shares of Norra Metals Corp. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.