Vista Gold Corp. (NYSE American and TSX: VGZ) (“Vista” or the “Company”) today announced its unaudited financial results for the quarter ended September 30, 2021, which were highlighted by reported cash of $16.0 million and substantial progress toward completion of the Definitive Feasibility Study (“DFS”) for Vista’s 100% owned Mt Todd gold project (“Mt Todd” or the “Project”). All dollar amounts in this press release are in U.S. dollars.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211027006120/en/

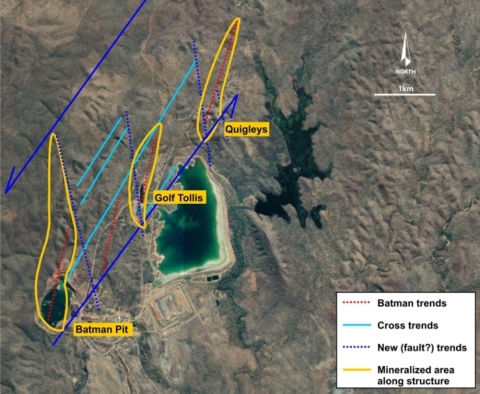

Figure 1 – Relationship of known structural trends relative to existing mineral deposits and exploration targets. (Graphic: Business Wire)

Frederick H. Earnest, President and Chief Executive Officer of Vista, commented, “Our activities during the third quarter focused on increasing shareholder value. The DFS is nearing completion and remains on budget. Mine planning using a higher gold price is expected to increase reserves and extend the life of mine. We started Phase 3 drilling of our exploration program and plan to drill an additional 2,650 meters, for approximately 9,000 meters of total drilling. Results of the drilling program have been very positive. Every drill hole has intersected mineralization, consistent with our geologic model.”

Mr. Earnest continued, “We significantly strengthened our balance sheet, with quarter-end cash of approximately $16.0 million. We believe our existing cash will fund the Company’s value enhancing programs, continue to fund working capital, and strengthen our position in discussions with potential partners.”

Important Recent Developments

- The Mt Todd DFS engineering and design are 80% complete, on track and on budget;

- Completed Phase 2 of the ongoing exploration drilling program and started Phase 3 drilling; and

- Ended Q3 2021 with cash and cash equivalents of $16.0 million and zero debt.

Definitive Feasibility Study

Engineering and design for the Mt Todd DFS are 80% complete. With new mine plans at higher gold prices, the DFS is expected to result in a larger reserve and longer mine life. This DFS will address recommendations from the 2019 pre-feasibility study, reflect minor updates of the Project design to be consistent with the approved Mine Management Plan, and advance the level of engineering and detailed costing in all areas of the Project. We are also evaluating several trade-off opportunities (e.g., contract power generation, contract mining and autonomous truck haulage).

Accretive Development Strategy

The process to seek a strategic partner is advancing, despite COVID-related travel restrictions. In particular, mining companies outside Australia have been hindered in their ability to complete site visits and perform other in-country due diligence activities. Nonetheless, we continued to see strong interest in Mt Todd. The Australian government recently announced it will begin to ease international travel restrictions for its fully vaccinated citizens and permanent residents beginning in November. The Australian government is working to define a plan to allow international travel by foreigners, but this will likely not occur until sometime in early 2022. Once Australia’s borders re-open, we expect opportunities for on-site due diligence to increase.

Positive Drilling Results

To demonstrate the resource potential at Mt Todd, the Company is drilling exploration targets adjacent to the Batman deposit and extending northeast to the Quigleys deposit, all within our mining licenses. The drilling program has focused on identifying connecting structures and mineralization between previously interpreted discreet deposits and the potential for efficient resource growth with future drilling along strike from the Batman deposit approximately 1.9 Km north to the Golf-Tollis/Penguin targets. Two principal types of structures are present in Figure 1; the red dashed lines represent structures with Batman-style sheeted vein mineralization and the light blue lines represent the connecting structures. The dark blue dashed lines show what are believed to be faults.

To date, Vista has completed 18 planned holes and drilled 6,365 meters in Phases 1 and 2 of the current program. Every drill hole has intersected mineralization consistent with our geologic model. Phase 3 drilling started in September and will include an additional 2,650 meters of drilling extending to Quigleys. Drilling is expected to continue into 2022. Our goal is to demonstrate the regional potential along a ~5.4 Km portion of the +24 Km Batman-Driffield Trend and to outline areas where future drilling can be undertaken to efficiently define additional gold resources.

Summary of Q3 2021 Financial Results

On September 30, 2021, cash and cash equivalents totaled $16.0 million, which included net proceeds of $12.3 million from the Company’s July 2021 public offering.

Vista reported a net loss of $3.1 million or $0.02 per share for the three months ended September 30, 2021, compared to net income of $4.2 million or $0.05 per share reported for the three months ended September 30, 2020. The three month period ended September 30, 2020 included a gain of $3.5 million related to the sale of the Los Reyes project. The loss for the current quarter was in line with management’s expectations.

Management Conference Call

Management’s quarterly conference call to review financial results for the quarter ended September 30, 2021 and to discuss corporate and project activities is scheduled on Thursday, October 28, 2021 at 10:00 am MDT (12:00 pm EDT).

Participant Toll Free: (844) 898-8648

Participant International: (647) 689-4225

Conference ID: 8590039

This call will also be archived and available at www.vistagold.com after October 28, 2021. Audio replay will be available through November 18, 2021 by calling toll-free in North America (855) 859-2056 or (404) 537-3406.

If you are unable to access the audio or phone-in on the day of the conference call, please email your questions to ir@vistagold.com.

About Vista Gold Corp.

Vista is a gold project developer. The Company’s flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs. All major operating and environmental permits have now been approved.

For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as our belief that management is nearing completion of a DFS; our expectation that the DFS will address recommendations from the 2019 pre-feasibility study and include minor updates of the Project design to be consistent with the approved Mining Management Plan and engineering and detailed costing in areas of the Project; our belief that using a higher gold price for mine planning purposes is expected to increase reserves and the life of mine; our expectation that our existing cash will fund the Company’s value enhancing programs, continue to fund working capital, and strengthen our position in discussions with potential partners; our expectation to drill an additional 2,650 meters in Phase 3 of the drill program and continue drilling into 2022; our expectation to advance on-site due diligence activities with potential partners once Australia’s borders re-open; and our belief that Mt Todd is the largest undeveloped gold project in Australia and, if developed as presently designed, would potentially be Australia’s fourth largest gold producer on an annual basis, with lowest tertile in-country and global all-in sustaining costs are forward-looking statements and forward-looking information. The material factors and assumptions used to develop the forward-looking statements and forward-looking information contained in this press release include the following: our approved business plans, exploration and assay results, results of our test work for process area improvements, mineral resource and reserve estimates and results of preliminary economic assessments, prefeasibility studies and feasibility studies on our projects, if any, our experience with regulators, and positive changes to current economic conditions and the price of gold. When used in this press release, the words “optimistic,” “potential,” “indicate,” “expect,” “intend,” “hopes,” “believe,” “may,” “will,” “if,” “anticipate,” and similar expressions are intended to identify forward-looking statements and forward-looking information. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such statements. Such factors include, among others, uncertainties inherent in the exploration of mineral properties, the possibility that future exploration results will not be consistent with the Company’s expectations; there being no assurance that the exploration program or programs of the Company will result in expanded mineral resources; uncertainty of resource and reserve estimates, uncertainty as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; uncertainty as to the results of bulk metallurgical test work; and uncertainty as to completion of critical milestones for Mt Todd; as well as those factors discussed under the headings “Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s latest Annual Report on Form 10-K as filed February 25, 2021 and other documents filed with the U.S. Securities and Exchange Commission and Canadian securities regulatory authorities. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Except as required by law, we assume no obligation to publicly update any forward-looking statements or forward-looking information; whether as a result of new information, future events or otherwise.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission (“SEC”) limits disclosure for U.S. reporting purposes to mineral deposits that a company can economically and legally extract or produce. The technical reports referenced in this press release uses the terms defined in Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards are not the same as reserves under the SEC’s Industry Guide 7 and may not constitute reserves or resources under the SEC’s newly adopted disclosure rules to modernize mineral property disclosure requirements (“SEC Modernization Rules”), which became effective February 25, 2019 and will be applicable to the Company in its annual report for the fiscal year ending December 31, 2021. Under the currently applicable SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and all necessary permits and government approvals must be filed with the appropriate governmental authority. Additionally, the technical reports uses the terms “measured resources”, “indicated resources”, and “measured & indicated resources”. We advise U.S. investors that while these terms are Canadian mining terms as defined in accordance with NI 43-101, such terms are not recognized under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Mineral resources described in the technical reports have a great amount of uncertainty as to their economic and legal feasibility. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade, without reference to unit measures. “Inferred resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that any or all part of an inferred resource will ever be upgraded to a higher category. U.S. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves.

Under the SEC Modernization Rules, the definitions of “proven mineral reserves” and “probable mineral reserves” have been amended to be substantially similar to the corresponding CIM Definition Standards and the SEC has added definitions to recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” which are also substantially similar to the corresponding CIM Definition Standard. However there are differences between the definitions and standards under the SEC Modernization Rules and those under the CIM Definition Standards and therefore once the Company begins reporting under the SEC Modernization Rules there is no assurance that the Company’s mineral reserve and mineral estimates will be the same as those reported under CIM Definition Standards as contained in the technical reports prepared under CIM Definition Standards or that the economics for the Mt Todd project estimated in such technical reports will be the same as those estimated in any technical report prepared by the Company under the SEC Modernization Rules in the future.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211027006120/en/