VANCOUVER, BC, Feb. 10, 2022 /PRNewswire/ - New Pacific Metals Corp. ("New Pacific" or the "Company") (TSX: NUAG) (NYSE American: NEWP), together with its local Bolivian partner, announces the receipt of assay results from six additional drill holes from the Discovery Drill Program completed in 2021 at the Carangas Silver Project, Oruro Department, Bolivia (the "Carangas Project" or the "Project"). To date, assay results of 17 drill holes have been received, with the remaining 18 drill holes awaiting additional analysis, specifically fire assay for gold. All seventeen drill holes intercepted near surface silver rich polymetallic mineralization.

Highlights

- An expansive, near-surface silver-rich zone of mineralization is stacked above a broad zone of gold mineralization.

- Drill hole DCAr0016 intersected a 148.48 metre ("m") interval (starting at just 8.7 m depth) grading 78 g/t Ag and 2.07% Pb+Zn and overlying a 453 m interval grading 0.49 g/t Au, including 95 m of 1.14 g/t Au and 31 g/t Ag, within which a 10.3 m interval assayed 5.66 g/t Au and 152 g/t Ag.

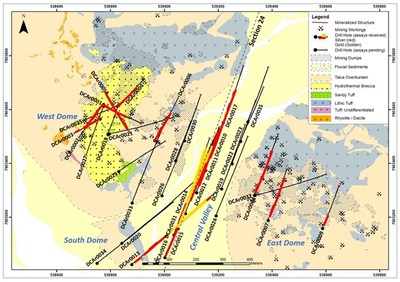

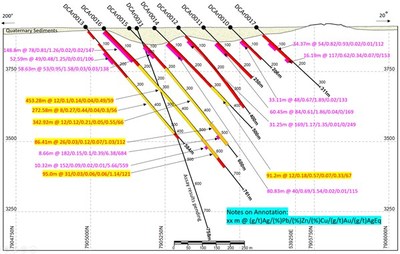

The six holes, DCAr0012, DCAr0013, DCAr0014, DCAr0015, DCAr0016, and DCAr0017, listed in Table 1 below, together with previously released holes DCAr0010 and DCAr0011 are drilled in the Central Valley in the middle of the Carangas Project (Figure 1) along a near north-south cross section (Figure 2, Section 24). The drill section is believed to be perpendicular to the east-west mineralization trend. The assay results of these eight drill holes along Section 24 have clearly defined a broad, near surface horizon of silver-lead-zinc mineralization ranging from tens of metres to over 100 m in thickness and a width of nearly 700 m (Figure 1).

In addition to the near surface broad silver-rich mineralization, four deeper drill holes, namely DCAr0013, DCAr0014, DCAr0015 and DCAr0016 all intercepted a broad zone of gold mineralization below the silver horizon.

Drill hole DCAr0016 is entirely mineralized from surface to the end of hole at 630.35 m. From 8.7 m to 157.18 m, the hole intersected a 148.8 m silver rich interval grading 78 g/t Ag, 0.81% Pb, and 1.26% Zn (147 g/t AgEq), followed by a 19.89 m interval from 157.18 m to 177 m grading 29 g/t Ag, 0.3% Pb, 0.7% Zn, 0.06% Cu, and 0.17 g/t Au (79 g/t AgEq). Further down hole, from 177.07 m to 630.35 m, a 453.28 m interval of gold-dominated mineralization grading 0.49 g/t Au, 12 g/t Ag, 0.1% Pb, 0.14% Zn, and 0.04% Cu was encountered, including a 95 m higher grade gold interval grading 1.14 g/t Au, 31 g/t Ag (121 g/t AgEq) from 535.35 m to 630.35 m, and a sub-interval of 10.32 m grading 5.66 g/t Au and 152 g/t Ag (559 g/t AgEq) from 557.08 m to 567.40 m.

Drill hole DCAr0015 is located about 100 m north of hole DCAr0016 and was completed to depth 600 m. From 79.87 m to 138.5 m, it returned a 58.63 m interval grading 53 g/t Ag, 0.95% Pb, and 1.58% Zn (138 g/t AgEq), then followed by 342.92 m interval of gold mineralization grading 0.55 g/t Au, 12 g/t Ag, 0.15% Pb, 0.21% Zn, and 0.05% Cu from 190.44 m to 533.36 m down hole, which includes an interval of 86.41 m grading 1.03 g/t Au, 26 g/t Ag, and 0.07% Cu (112 g/t AgEq) from 446.95 m to 533.36 m including a sub-interval of 8.66 m grading 6.38 g/t Au, 182 g/t Ag, and 0.39% Cu from 497.54 m to 506.20 m.

|

Table 1 Summary of Drill Intercepts

|

|

Hole_ID

|

|

Depth_from

|

Depth_to

|

Interval_m

|

Ag_g/t

|

Au_g/t

|

Pb_%

|

Zn_%

|

Cu_%

|

AgEq_g/t

|

|

DCAr0012

|

|

40.00

|

273.85

|

233.85

|

36

|

0.04

|

0.56

|

1.29

|

0.02

|

101

|

|

incl.

|

57.35

|

88.60

|

31.25

|

169

|

|

1.17

|

1.35

|

0.01

|

249

|

|

DCAr0013

|

|

21.49

|

60.80

|

39.31

|

15

|

|

0.21

|

0.38

|

0.00

|

34

|

|

|

84.85

|

177.30

|

92.45

|

34

|

0.01

|

0.40

|

1.04

|

0.01

|

81

|

|

incl.

|

124.71

|

177.30

|

52.59

|

49

|

0.01

|

0.48

|

1.25

|

0.01

|

107

|

|

|

177.3

|

251.82

|

74.52

|

6

|

0.03

|

0.36

|

0.96

|

0.01

|

51

|

|

|

251.82

|

524.50

|

272.68

|

8

|

0.30

|

0.27

|

0.44

|

0.04

|

56

|

|

|

529.78

|

554.80

|

25.02

|

4

|

0.02

|

0.27

|

0.70

|

0.01

|

38

|

|

DCAr0014

|

|

73.17

|

154.00

|

80.83

|

40

|

0.01

|

0.69

|

1.54

|

0.02

|

115

|

|

|

154

|

292.85

|

138.85

|

7

|

0.03

|

0.26

|

0.59

|

0.03

|

39

|

|

|

292.85

|

384.05

|

91.20

|

12

|

0.33

|

0.18

|

0.57

|

0.07

|

67

|

|

DCAr0015

|

|

79.87

|

138.50

|

58.63

|

53

|

0.03

|

0.95

|

1.58

|

0.03

|

138

|

|

|

138.5

|

190.44

|

51.94

|

9

|

0.03

|

0.30

|

0.81

|

0.03

|

51

|

|

|

190.44

|

533.36

|

342.92

|

12

|

0.55

|

0.12

|

0.21

|

0.05

|

66

|

|

incl.

|

446.95

|

533.36

|

86.41

|

26

|

1.03

|

0.03

|

0.12

|

0.07

|

112

|

|

incl.

|

497.54

|

506.20

|

8.66

|

182

|

6.38

|

0.15

|

0.10

|

0.39

|

684

|

|

DCAr0016

|

|

8.7

|

157.18

|

148.48

|

78

|

0.02

|

0.81

|

1.26

|

0.02

|

147

|

|

|

157.18

|

177.07

|

19.89

|

29

|

0.17

|

0.30

|

0.70

|

0.06

|

79

|

|

|

177.07

|

630.35

|

453.28

|

12

|

0.49

|

0.10

|

0.14

|

0.04

|

59

|

|

incl.

|

535.35

|

630.35

|

95.00

|

31

|

1.14

|

0.03

|

0.06

|

0.06

|

121

|

|

incl.

|

557.08

|

567.40

|

10.32

|

152

|

5.66

|

0.09

|

0.02

|

0.01

|

559

|

|

DCAr0017

|

|

35.3

|

180.06

|

144.76

|

36

|

0.01

|

0.44

|

0.56

|

0.02

|

70

|

|

incl.

|

71

|

105.37

|

34.37

|

54

|

0.01

|

0.82

|

0.93

|

0.02

|

112

|

|

incl.

|

152.23

|

168.42

|

16.19

|

117

|

|

0.62

|

0.34

|

0.07

|

153

|

|

Notes:

|

|

1. Drill location, altitude, azimuth, and dip of drill holes are provided in Table 2.

|

|

2. Drill intercept is core length, and grade is length weighted. True width of mineralization is unknown due to early stage of exploration without adequate drill data.

|

|

3. Calculation of silver equivalent ("AgEq") is based on the long-term median of the August 2021 Street Consensus Commodity Price Forecasts, which are US$22.50/oz for silver ("Ag"), US$0.95/lb for lead ("Pb"), US$1.10/lb for zinc ("Zn"), US$3.40/lb for copper ("Cu"), and US$1,600/oz for gold (Au). The formula used for the AgEq calculation is as follows: AgEq= Ag grams per tonne ("g/t") + Pb g/t * 0.0029 + Zn g/t * 0.00335 + Cu g/t * 0.01036 + Au g/t * 71.1111. This calculation assumes 100% recovery. Due to the early stage of the Project, the Company has not yet completed metallurgical test work on the mineralization encountered to date.

|

|

4. A cut-off of 20 g/t AgEq is applied for calculation of length-weighted intercept. At times, samples lower than 20 g/t AgEq may be included in the calculation of consolidation of mineralized intercepts.

|

|

5. For holes DCAr0014 and DCAr0017, gold values are results of semi quantitative ICP analysis, with fire assay results pending.

|

Silver and gold mineralization zoning from the Discovery Drilling in the Central Valley

The near-surface silver-rich mineralization is controlled by dense mineralized fractures which generally strike in northwest to west direction, and mostly dip south at high angles, continuing to a depth of 100 m to 200 m, and stretching a width of at least 700 m from north to south as shown in Section 24. Mineralization continues to depth, with the amount of silver-lead-zinc sulfides decreasing, but the amount of chalcopyrite increasing to a depth up to 700 m with the lower limit not yet defined by drilling, indicating a potentially a large silver and gold mineralized system of zonation with depth.

The chalcopyrite mineralization occurs in the form of veins and veinlets generally associated with drusy quartz, and usually carries gold mineralization evidenced by the assay results of the long holes DCAr0013 to DCAr0016. In addition to the vein type mineralization, weakly to moderately disseminated pyrite and sphalerite are common in all drill holes. Common alteration associated both in the silver and gold zones include sericitic and argillic alteration with chloritic alteration in peripheral area, and silicification occurs as selvage near mineralized veins and veinlets. Chalcopyrite mineralization is generally associated with gold, though some high grade gold intervals carry little or no chalcopyrite (see Photos 1 & 2).

Drilling Plan for year 2022

Encouraged by the successful Discovery Drilling in 2021, the Company plans to initiate a resource definition drilling program at Carangas Project in 2022. An initial 30,000 m drill program has been budgeted for this year and the Company will review the drill program from time to time which could be extended to 40,000 m or more if on-going drill results continue to be encouraging. Currently, the resource definition drilling has commenced with two rigs operating on site, and a third one may be added in due course after the rainy season.

|

Table 2 Summary of Drill Holes Locationsfor the Carangas Project

|

|

Hole_ID

|

Easting

|

Northing

|

Altitude

|

Depth_m

|

Azimuth (°)

|

Dip (°)

|

Date_start

|

Date_complete

|

Target

|

|

DCAr0001

|

538772.76

|

7905618.95

|

4041.21

|

300.40

|

120

|

-55

|

6/21/2021

|

6/30/2021

|

W. Dome

|

|

DCAr0002

|

538770.64

|

7905615.47

|

4041.15

|

200.00

|

225

|

-40

|

7/2/2021

|

7/8/2021

|

W. Dome

|

|

DCAr0003

|

538760.06

|

7905564.79

|

4026.90

|

150.00

|

240

|

-40

|

7/8/2021

|

7/12/2021

|

W. Dome

|

|

DCAr0004

|

538825.50

|

7905612.16

|

4036.96

|

250.00

|

46

|

-50

|

7/12/2021

|

7/16/2021

|

W. Dome

|

|

DCAr0005

|

538783.47

|

7905661.22

|

4053.84

|

250.00

|

151

|

-40

|

7/16/2021

|

7/26/2021

|

W. Dome

|

|

DCAr0006

|

538963.00

|

7905485.07

|

3942.23

|

300.00

|

30

|

-45

|

7/27/2021

|

8/3/2021

|

W. Dome

|

|

DCAr0007

|

539384.66

|

7905187.61

|

3936.85

|

300.00

|

20

|

-45

|

8/4/2021

|

8/9/2021

|

E. Dome

|

|

DCAr0008

|

539333.52

|

7905281.06

|

3921.15

|

350.00

|

20

|

-45

|

8/10/2021

|

8/15/2021

|

E. Dome

|

|

DCAr0009

|

539586.93

|

7905157.90

|

4006.31

|

250.00

|

20

|

-45

|

8/16/2021

|

8/19/2021

|

E. Dome

|

|

DCAr0010

|

539181.76

|

7905464.48

|

3907.98

|

206.00

|

20

|

-45

|

8/19/2021

|

8/24/2021

|

C. Valley

|

|

DCAr0011

|

539151.56

|

7905372.66

|

3907.46

|

250.00

|

20

|

-45

|

8/26/2021

|

8/30/2021

|

C. Valley

|

|

DCAr0012

|

539118.40

|

7905290.73

|

3907.18

|

400.00

|

20

|

-45

|

8/31/2021

|

9/12/2021

|

C. Valley

|

|

DCAr0013

|

538877.56

|

7905023.91

|

3911.64

|

584.00

|

50

|

-45

|

9/13/2021

|

9/25/2021

|

S. Dome

|

|

DCAr0014

|

539076.98

|

7905212.97

|

3906.16

|

500.00

|

20

|

-45

|

10/6/2021

|

10/13/2021

|

C. Valley

|

|

DCAr0015

|

539034.51

|

7905133.70

|

3905.39

|

600.00

|

20

|

-45

|

10/6/2021

|

10/15/2021

|

C. Valley

|

|

DCAr0016

|

539001.02

|

7905050.01

|

3904.10

|

761.00

|

20

|

-45

|

10/17/2021

|

10/31/2021

|

C. Valley

|

|

DCAr0017

|

539217.59

|

7905550.63

|

3907.29

|

311.00

|

20

|

-45

|

10/15/2021

|

10/20/2021

|

C. Valley

|

|

DCAr0018

|

538788.93

|

7905507.35

|

4012.26

|

400.00

|

20

|

-70

|

10/18/2021

|

10/27/2021

|

W. Dome

|

|

DCAr0019

|

539211.99

|

7905304.71

|

3907.55

|

353.00

|

20

|

-45

|

10/21/2021

|

10/27/2021

|

C. Valley

|

|

DCAr0020

|

538841.11

|

7905102.85

|

3918.24

|

650.00

|

50

|

-45

|

11/2/2021

|

11/13/2021

|

S. Dome

|

|

DCAr0021

|

538794.55

|

7905508.55

|

4012.67

|

350.00

|

77

|

-45

|

10/28/2021

|

11/9/2021

|

W. Dome

|

|

DCAr0022

|

539250.95

|

7905397.84

|

3908.65

|

350.00

|

20

|

-45

|

10/28/2021

|

11/3/2021

|

C. Valley

|

|

DCAr0023

|

539282.77

|

7905481.73

|

3908.50

|

300.00

|

20

|

-45

|

11/4/2021

|

11/9/2021

|

C. Valley

|

|

DCAr0024

|

539191.18

|

7905204.23

|

3907.07

|

476.10

|

20

|

-45

|

11/10/2021

|

11/16/2021

|

C. Valley

|

|

DCAr0025

|

538829.52

|

7905615.97

|

4036.95

|

200.00

|

250

|

-40

|

11/10/2021

|

11/14/2021

|

W. Dome

|

|

DCAr0026

|

538990.16

|

7905279.65

|

3905.53

|

450.00

|

20

|

-45

|

11/14/2021

|

11/22/2021

|

C. Valley

|

|

DCAr0027

|

538773.94

|

7905612.53

|

4041.03

|

401.00

|

200

|

-60

|

11/15/2021

|

11/22/2021

|

W. Dome

|

|

DCAr0028

|

539040.73

|

7905409.95

|

3907.11

|

300.00

|

20

|

-45

|

11/18/2021

|

11/22/2021

|

C. Valley

|

|

DCAr0029

|

538829.40

|

7905369.78

|

3966.60

|

300.00

|

55

|

-45

|

11/24/2021

|

11/28/2021

|

W. Come

|

|

DCAr0030

|

539073.78

|

7905483.71

|

3908.83

|

257.00

|

20

|

-45

|

11/23/2021

|

11/28/2021

|

C. Valley

|

|

DCAr0031

|

539049.54

|

7905156.60

|

3905.49

|

758.00

|

20

|

-68

|

11/22/2021

|

12/18/2021

|

C. Valley

|

|

DCAr0032

|

539336.17

|

7905281.10

|

3921.04

|

400.00

|

75

|

-45

|

11/29/2021

|

12/5/2021

|

C. Valley

|

|

DCAr0033

|

538879.37

|

7905252.35

|

3908.11

|

401.00

|

20

|

-45

|

11/29/2021

|

12/4/2021

|

W. Dome

|

|

DCAr0034

|

538748.85

|

7905028.31

|

3905.85

|

600.00

|

50

|

-50

|

12/5/2021

|

12/15/2021

|

S. Dome

|

|

DCAr0035

|

539308.99

|

7905554.21

|

3908.65

|

302.00

|

20

|

-43

|

12/6/2021

|

12/12/2021

|

C. Valley

|

|

|

|

Total

|

13,210.50

|

|

|

|

|

|

|

Notes:

|

|

1. Drill collar coordinate system is WGS1984 UTM Zone 19S.

|

|

2. Coordinate of drill collar is picked with Real Time Kinematics (RTK) GPS.

|

QUALITY ASSURANCE AND QUALITY CONTROL

All samples in respect of the exploration program at the Carangas Project, conducted by the Company and discussed in this news release, are shipped in securely-sealed bags by New Pacific staff in the Company's vehicles, directly from the field to ALS Global in Oruro, Bolivia for preparation, and ALS Global in Lima, Peru for geochemical analysis. ALS Global is an ISO 17025 accredited laboratory independent from New Pacific. All samples are first analyzed by a multi-element ICP package (ALS code ME-MS41) with ore grade over specified limits for silver, lead and zinc further analyzed using ALS code OG46. Further silver samples over specified limits are analyzed by gravimetric analysis (ALS code of GRA21). Gold is assayed firstly by ICP method then by fire assay with AAS finish (ALS code of Au-AA25). Certified reference materials, various types of blank samples and duplicate samples are inserted to normal drill core sample sequences prior to delivery to laboratory for preparation and analysis. The overall ratio of quality control samples in sample sequences is around twenty percent.

QUALIFIED PERSON

The scientific and technical information contained in this news release has been reviewed and approved by Alex Zhang, P. Geo., Vice President of Exploration, who is a Qualified Person for the purposes of National Instrument 43-101 — Standards of Disclosure for Mineral Projects ("NI 43-101"). The Qualified Person has verified the information disclosed herein, including the sampling, preparation, security and analytical procedures underlying such information, and is not aware of any significant risks and uncertainties that could be expected to affect the reliability or confidence in the information discussed herein.

ABOUT NEW PACIFIC

New Pacific is a Canadian exploration and development company with precious metal projects, including the flagship Silver Sand Project, the Silverstrike Project and the Carangas Project, all of which are located in Bolivia. The Company is focused on progressing the development of the Silver Sand Project, while growing its Mineral Resources through the exploration and acquisition of properties in the Americas.

For further information, please contact:

New Pacific Metals Corp.

Phone: (604) 633-1368

U.S. & Canada toll-free: 1-877-631-0593

E-mail: info@newpacificmetals.com

www.newpacificmetals.com

To receive company news by e-mail, please register using New Pacific's website at www.newpacificmetals.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information. Such statements include, but are not limited to: statements regarding the anticipated timing, amount and completion of exploration, drilling, development, construction, and other activities or achievements of the Company; anticipated outcomes therefrom; future economics of the Company's projects; timing of receipt of permits and regulatory approvals; estimates of the Company's revenues and capital expenditures; and other future plans, objectives or expectations of the Company.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating equity prices, bond prices, commodity prices; calculation of resources, reserves and mineralization, general economic conditions, foreign exchange risks, interest rate risk, foreign investment risk; loss of key personnel; conflicts of interest; dependence on management, uncertainties relating to the availability and costs of financing needed in the future, environmental risks, operations and political conditions, the regulatory environment in Bolivia and Canada; risks associated with community relations and corporate social responsibility, and other factors described under the heading "Risk Factors" in the Company's Annual Information Form and its other public filings.

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements or information.

The forward-looking statements are necessarily based on a number of estimates, assumptions, beliefs, expectations and opinions of management as of the date of this news release that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates, assumptions, beliefs, expectations and options include, but are not limited to, those related to the Company's ability to carry on current and future operations, including: the duration and effects of COVID-19 on our operations and workforce; development and exploration activities; the timing, extent, duration and economic viability of such operations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company's ability to meet or achieve estimates, projections and forecasts; the stabilization of the political climate in Bolivia; the Company's ability to obtain and maintain social license at its mineral properties; the availability and cost of inputs; the price and market for outputs; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits, including the ratification and approval of the Mining Production Contract with COMIBOL by the Plurinational Legislative Assembly of Bolivia; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Although the forward-looking statements contained in this news release are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. All forward-looking statements in this news release are qualified by these cautionary statements. Accordingly, readers should not place undue reliance on such statements. Other than specifically required by applicable laws, the Company is under no obligation and expressly disclaims any such obligation to update or alter the forward-looking statements whether as a result of new information, future events or otherwise except as may be required by law. These forward-looking statements are made as of the date of this news release.

CAUTIONARY NOTE TO US INVESTORS

This news release, including the documents incorporated by reference herein, has been prepared in accordance with the requirements of the securities laws in effect in Canada which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise defined have the meanings set forth in NI 43-101.

Accordingly, information contained in this news release and the documents incorporated by reference herein containing descriptions of the Company's mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-intersects-148-m-interval-of-silver-mineralization-grading-78-gt-silver-2-07-lead--zinc-stacked-on-top-of-95-m-interval-of-gold-mineralization-grading-1-14-gt-gold-and-31-gt-silver-at-the-carangas-silver-project-301479705.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-pacific-intersects-148-m-interval-of-silver-mineralization-grading-78-gt-silver-2-07-lead--zinc-stacked-on-top-of-95-m-interval-of-gold-mineralization-grading-1-14-gt-gold-and-31-gt-silver-at-the-carangas-silver-project-301479705.html

SOURCE New Pacific Metals Corp.