Edmonton, Alberta--(Newsfile Corp. - January 25, 2023) - Altiplano Metals Inc. (TSXV: APN) (WKN: A2JNFG) ("Altiplano" or the "Company") is pleased to report on quarterly results for Q4 2022 from the Farellon Copper-Gold-Iron (Cu-Au-Fe) mine located near La Serena, Chile.

During Q4, 2022, the Company extracted a total 11,340 tonnes of mineralized Cu-Au material at Farellon. This represents a decrease of 15% from the record Q3 results of 13,440 tonnes. Tonnes processed in Q4 represented 6,804 tonnes, down 10% from the previous quarter of 7,570 tonnes. The copper grade recovered was 2.05%, up 10% from the previous Q3 result of 1.87%. Waste removal increased by 18.5% to 1,422 tonnes in Q4 as the decline advanced to the lower 344 levels. Sales of 295,397 pounds of copper generated approximately US$691,000 in revenue (after processing costs). Q4 copper sales and revenue were in line with the previous quarter supported by higher copper grades.

At the end of December 2022, the Company had 800 tonnes in stockpiles at the Farellon site and a total of 3,160 tonnes of stockpiles at the El Peñón mill site. An additional 1,200 tonnes of lower grade material are stockpiled at the Farellon site and ready for processing at the El Peñón facility. The company currently has 1,046 tonnes of material in process with ENAMI. This material will be processed for sale and the revenue will be realized in the next coming months.

President and CEO Alastair McIntyre comments: "We are very pleased to reach another milestone at Farellon with copper sales now exceeding 5 million pounds since Q1 2018. High copper grades continue to be a driver of output and revenue at Farellon. 2022 was a productive year where we generated US$3.25 in revenue with sales of copper consistently averaging around 300,000 pounds per quarter with grade averaging close to 2%. This consistency was a result of focusing on grade control while developing new production levels at deeper areas of the mine. This work is important to set up increased capacity, output, and revenue through added value concentrate sales at El Peñón."

Figure 1. Quarterly Review of US$ Revenue and Copper Pounds Sold

| Period |

Mined |

USD Revenue* |

Cu Pounds Sold |

Copper Grade |

| Q1 2022 |

9,843 |

$908,419 |

295,199 |

2.06% |

| Q2 2022 |

10,742 |

$967,685 |

310,062 |

1.96% |

| Q3 2022 |

13,440 |

$692,731 |

297,403 |

1.87% |

| Q4 2022 |

11,340 |

$691,103 |

295,397 |

2.05% |

| TOTAL |

45,365 |

$3,259,938 |

1,198,061 |

1.98% |

* After processing costs

Figure 2. Mined, Processed, Waste Removed and Cu Grade by Quarter 2021-2022

To view an enhanced version of Figure 2, please visit:

https://images.newsfilecorp.com/files/4303/152430_d0b9f643a4864bd1_001full.jpg

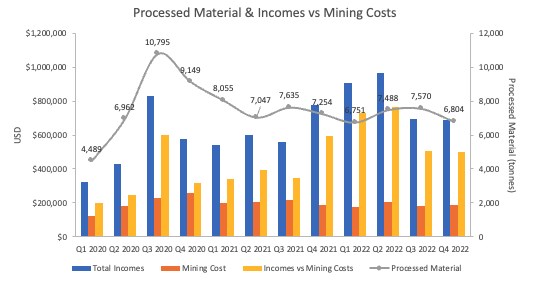

Figure 3. Processed Material, Income vs. Mining Costs by Quarter

To view an enhanced version of Figure 3, please visit:

https://images.newsfilecorp.com/files/4303/152430_d0b9f643a4864bd1_002full.jpg

Figure 4. Intersection of the Farellon Vein at the 344 m Level

To view an enhanced version of Figure 4, please visit:

https://images.newsfilecorp.com/files/4303/152430_d0b9f643a4864bd1_003full.jpg

Q4 mining activity focused on extraction of copper-gold bearing material on the 360 m and 352 m levels where selected grades in the NE section yielded copper greater than 2% with vein widths exceeding 8 m in certain locations. Bench mining continued between the 360 m and 352 m levels in the NE section of the mine. Work on widening the main parts of the Hugo Decline was conducted to improve accessibility for specialized haulage trucks to be used starting in Q1 2023 to improve extraction efficiencies. An escapeway chimney was completed between the 352 m and 382 m levels, improving accessibility and ventilation between levels. Development expansion to the 344 m level was completed in Q4 and work has begun with the extension to the 336 m level. Intersection of the 336 m level is expected in April.

Altiplano has generated over US$11.3 million from the recovery and sale (after processing costs) of more than 5 million pounds of copper with an average grade of 1.80% Cu (2018 Q1-2022 Q4). Cash flow has been re-invested into equipment, underground drilling, expanding underground development at Farellon, enhancing ventilation to increase productivity and capacity, new underground development and exploration, and the commissioning of the El Peñón fit-for-purpose mill and flotation plant located 15 km from the Farellon site.

About Altiplano

Altiplano Metals is a growing gold, silver, and copper company focused on the Americas. The Company has a diversified portfolio of assets that include an operating copper/gold/iron mine and a state-of-the-art operating copper/gold and iron processing facility in the final stages of completion. Altiplano is focused on creating long-term stakeholder value through developing safe and sustainable production, reinvesting into exploration, and pursuing acquisition opportunities to complement its existing portfolio. Management has a substantial record of success in capitalizing on opportunity, overcoming challenges and building shareholder value. Altiplano trades on the Toronto Venture Exchange trading under the symbol APN and the Frankfurt Exchange under the symbol A2JNFG.

John Williamson, B.Sc., P.Geol., a Qualified Person as defined by NI 43-101, has reviewed, and approved the technical contents of this document

Altiplano is part of the Metals Group of companies. Metals Group is an award-winning team of professionals who stand for technical excellence, painstaking project selection and uncompromising corporate governance, with a proven ability to capitalize on investment opportunities and deliver shareholder returns.

www.metalsgroup.com

ON BEHALF OF THE BOARD

/s/ "John Williamson"

Chairman

For further information, please contact:

Alastair McIntyre, CEO

alastairm@apnmetals.com

Tel: (416) 434-3799

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the (TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. A qualified person has not done sufficient work to classify any historical estimates as current mineral resources or mineral reserves and the issuer is not treating the historical estimates as current mineral resources or mineral reserves. The Farellon mine was previously in production dating back to the 1970's with a reported historical production (to a depth of 70 m) yielding approximately 300,000 tonnes at an average grade of 2.5% copper and 0.5g/t gold. This material was processed locally and sold to ENAMI. Altiplano is relying upon past production records, underground sampling and related activities and current diamond drilling to estimate grade and widths of the mineralization to reactivate production. The decision to commence production on the Farellon deposit is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and there is increased uncertainty and economic and technical risks of failure associated with any production decision. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, continuity of mineralization, uncertainties related to the ability to obtain necessary permits, licenses and title and delays due to third party opposition, changes in government policies

regarding mining and natural resource exploration and exploitation, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedar.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/152430