Results include 4.00 meters @ 1.66 g/t Au Eq., confirming the strike extension to the north of the Main Veins target and discovery of multiple veins at the Bajo Pedernal target, include 0.60 meters @ 6.18 g/t Au Eq.

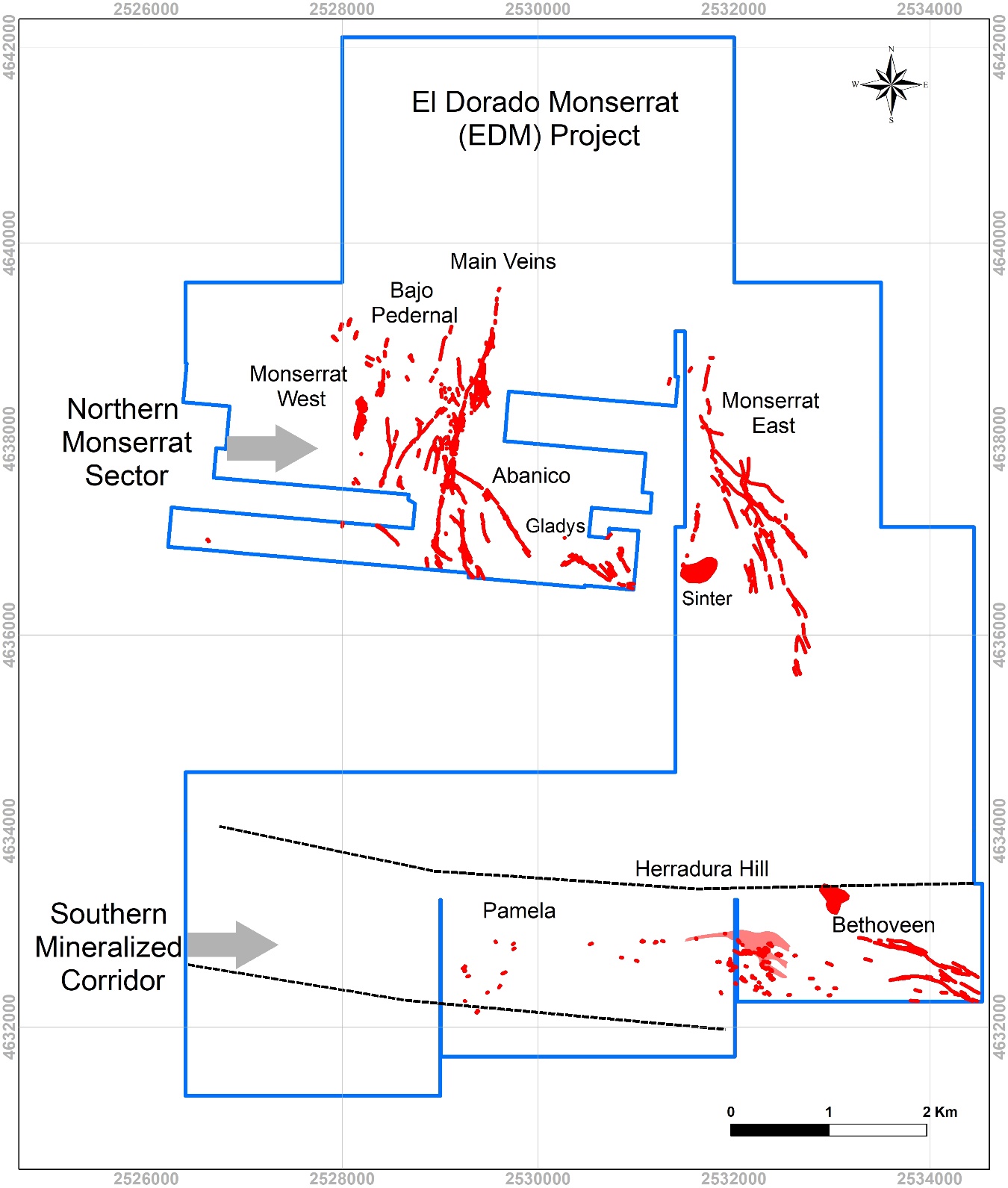

- The Northern Monserrat sector comprises a series of targets including Main Veins, Bajo Pedernal, Monserrat West, Abanico, Gladys, Entrevero, Monserrat East, among others, within our flagship El Dorado Monserrat (“EDM”) gold-silver project (6,200 ha), located 17 km west of the multi-million oz. producing Cerro Vanguardia gold mine run by AngloGold Ashanti.1

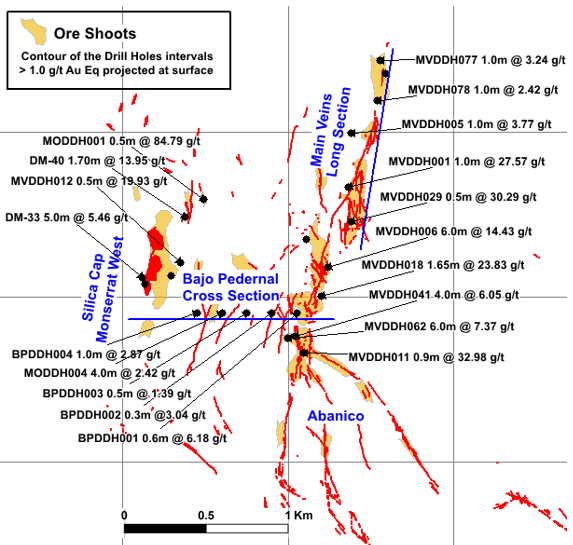

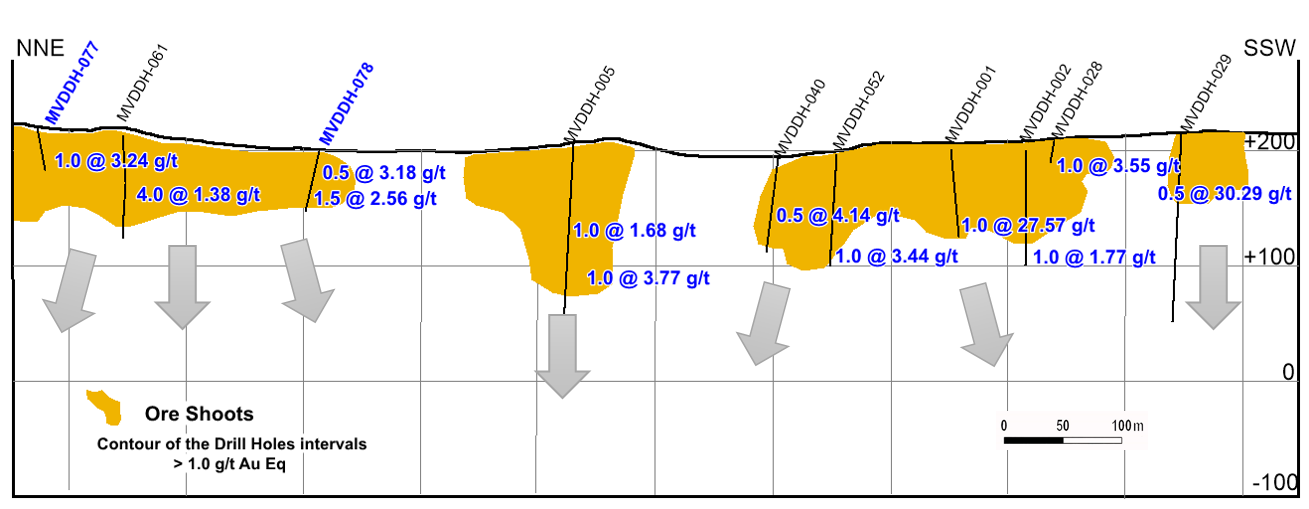

- The new drilling confirms shallow Au-Ag mineralization at the Main Veins target and extending the system to the north, including MVDDH078 intercepts at 4.5 m, 4.00 m @ 1.66 g/t Au Eq., and at 18.5 m, 4.00 m @ 1.49 g/t Au Eq.

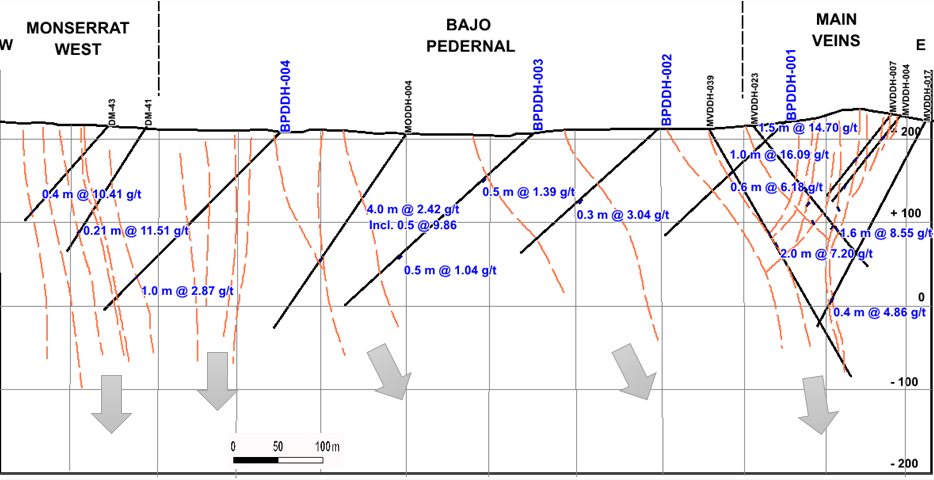

- New veins were intercepted between the Main Veins and Monserrat West targets, confirming the existence of additional high-grade veins under the modern rock cover at the Bajo Pedernal target (which lies between Main Veins and Monserrat West) - BPDDH001 intercepts significant gold mineralization at 92.5 m, 0.60 m @ 6.18 g/t Au Eq.

- Prior significant drill results at these targets include: 6.0 m @ 14.43 g/t Au Eq. at Main Veins; 2.4 m @ 18.05 g/t Au Eq. at Monserrat West; and 4.0 m @ 2.42 g/t Au Eq. at Bajo Pedernal (see Fredonia news release dated January 20th , 2022).

- Additionally, the Southern Mineralized Corridor that includes the Herradura Hill target, and which was part of this phase III drilling campaign, produced significant drill results, including 8.00 m @ 6.00 g/t Au Eq. (see Fredonia news release dated January 31st, 2023).

1 2.5 million oz. Au in the measured and indicated mineral resource category (including reserves) per AngloGold Ashanti Mineral Resource and Ore Reserve Report as at 31 December 2021; 145,000 oz production in 2021 per Cerro Vanguardia Operational Profile 2021; available at www.anglogoldashanti.com.

TORONTO, Feb. 13, 2023 (GLOBE NEWSWIRE) -- Fredonia Mining Inc. (“Fredonia” or the “Company”) (TSXV:FRED) announces successful completion of its phase III drilling program, with results of the remaining 6 HQ diamond drill holes totaling 1,143.00 m. drilled at the Northern Monserrat sector of its EDM project. The phase III drill program included an aggregate of 12 holes for a total of 2,955 m – 6 holes in the southern Herradura Hill target (see Fredonia news release dated January 31st, 2023) and the last 6 holes at the Northern Monserrat sector (drilled at the Main Veins, Bajo Pedernal and Monserrat West targets).

“We are very encouraged to learn that the Bajo Pedernal target, which joins the Monserrat West target to the Main Veins target, has multiple veins under modern rock cover, with potential to host high-grade ore shoots, similar to those already detected at the Main Veins and Monserrat West targets,” said Estanislao Auriemma, Chief Executive Officer of Fredonia. “Also very pleased to learn that the strike of the veins continues to the north under the post-mineral basalt flow, which indicates a significant increase in the mineralized area at the EDM project. The high-grades of gold and silver drilled in the Northern Monserrat sector, and those drilled at the Herradura Hill target in this current exploration program, confirm the growing potential of the EDM project.”

This phase III drill program was design to cover two targets within the Northern Monserrat sector:

- A four-hole fence completes a full 1.1 km long cross-section to encompass a large unexposed Bajo Pedernal target covered by modern rocks. This cross-section spans the area between the Main Veins and Monserrat West targets.

- The drill-hole fence intercepted multiple zones of stockworks, veins and breccias containing high- grade of gold and silver, with 0.60m @ 6.18 g/t Au Eq. at BPDDH001. The new intercepts added to the historical intercepts at Main Veins and Monserrat West, in the Northern Monserrat sector. (see Figure 3).

The two additional drill holes at the Main Veins target extend its strike and open the system to the north, under the basalt flow, intersecting a wide ore shoot with high-grade - 4.00m @ 1.66 g/t Au Eq. and 4.00m @ 1.49 g/t Au Eq at MVDDH078. (see Figure 4).

Figure 1: Map showing the location of the main targets at the Northern Monserrat sector - El Dorado Monserrat gold-silver project (6,200 ha licenses).

The Northern Monserrat sector comprises an area 3.5 km long by 3.2 km wide, made up of mineralized corridors hosted in andesitic lavas that form country rock, and contains more than 20 kilometers of epithermal veins, not all of which have been explored or drilled. There is evidence of buried veins unexplored or as extensions to understand the vein systems. All prospects discovered up to date have not been limited along strike or dip.

Two different strikes of faults host the mineralization: north-south "horst and graben" faults, and NW-SW shear faults. The crossings, nodes, and inflexion between both structures control the location of the high-grade gold and silver ore shoots, and reveal the potential at the Northern Monserrat sector.

Figure 2: Map showing drill holes location and intercepts at the Northern Monserrat sector:

Table I. Drill-hole statistics:

| Drill Hole |

Target |

Easting |

Northing |

Altitude |

Azimuth |

Dip |

EOH |

| BPDDH001 |

Bajo Pedernal |

2529054 |

4637900 |

223 |

279 |

-45 |

200.00 |

| BPDDH002 |

Bajo Pedernal |

2528900 |

4637900 |

214 |

279 |

-45 |

221.00 |

| BPDDH003 |

Bajo Pedernal |

2528750 |

4637900 |

211 |

279 |

-45 |

302.00 |

| BPDDH004 |

Bajo Pedernal |

2528450 |

4637900 |

214 |

279 |

-45 |

302.00 |

| MVDDH077 |

Main Veins |

2529555 |

4639429 |

222 |

110 |

-45 |

56.00 |

| MVDDH078 |

Main Veins |

2529538 |

4639184 |

201 |

79 |

-60 |

62.00 |

| Total: |

|

|

|

|

|

|

1,143.00 |

Table II. The intercepts of current Phase III drilling at Bajo Pedernal and Main Veins Targets - Northern Monserrat sector, are shown below:

| Hole ID |

Target |

From |

To |

Length

(*) |

Au Eq g/t

(**) |

Au g/t |

Ag g/t |

| BPDDH001 |

Bajo Pedernal |

92.50 |

93.10 |

0.60 |

6.18 |

5.98 |

14.91 |

| BPDDH001 |

Bajo Pedernal |

106.00 |

106.50 |

0.50 |

1.39 |

0.43 |

72.28 |

| BPDDH002 |

Bajo Pedernal |

126.70 |

127.00 |

0.30 |

3.04 |

0.14 |

217.18 |

| BPDDH003 |

Bajo Pedernal |

79.50 |

80.00 |

0.50 |

1.39 |

0.02 |

102.69 |

| BPDDH003 |

Bajo Pedernal |

214.00 |

214.50 |

0.50 |

1.04 |

0.30 |

55.73 |

| BPDDH004 |

Bajo Pedernal |

246.00 |

247.00 |

1.00 |

2.87 |

0.02 |

213.55 |

| MVDDH077 |

Main Veins |

25.00 |

28.00 |

3.00 |

1.41 |

1.24 |

12.62 |

| including |

Main Veins |

25.00 |

26.00 |

1.00 |

3.24 |

3.02 |

16.65 |

| MVDDH078 |

Main Veins |

4.50 |

8.50 |

4.00 |

1.66 |

0.81 |

63.81 |

| including |

Main Veins |

4.50 |

5.00 |

0.50 |

3.18 |

0.73 |

184.05 |

| and |

Main Veins |

7.00 |

8.50 |

1.50 |

2.56 |

1.79 |

58.30 |

| MVDDH078 |

Main Veins |

18.50 |

22.50 |

4.00 |

1.49 |

0.90 |

43.98 |

| including |

Main Veins |

19.50 |

20.50 |

1.00 |

2.46 |

1.78 |

51.50 |

(*) Reported interval lengths are down-hole widths and not true widths.

(**) Gold equivalent (“Au Eq.”) is calculated using metal prices of US$ 1,800/oz for Au and US$ 24/oz for Ag. The equation used is: Au Eq g/t = Au g/t + (Ag g/t ÷ 75).

Au Eq assumes Au recovery of 90%. The limited metallurgical studies by Fredonia (selective Bottle rolls from Main Veins material) have indicated high (>90%) recovery of gold in oxide material. The Cerro Vanguardia mine to the east of EDM with similar mineralization reports recoveries in the high 90% for Au.

Main Veins Target

To the east, the current drill-hole fence integrated with Main Veins target has received most of the historical exploration focus and remains as an advanced target of merit. Main Veins extends for over 2.0 km long and a 25 m wide. The mineralization show multiple ore shoots open at depth, with subvertical plunge that has been tested down to -200 m below the surface, and remains open significantly to the north and at depth. To the south the Main Veins target merges with the Abanico target veins field.

The Main Vein target has received the most drilling thus far, including:

Table III. Historical drill holes intercepts (reported in Fredonia’s technical report dated February 15th, 2021) from Main Vein Target - Northern Monserrat sector shown below:

Hole ID

|

Target

|

From

|

To

|

Interval |

Au Eq g/t |

Au_ppm

|

Ag_ppm

|

| (*) |

(**) |

| MVDDH006 |

Main Veins |

82 |

88 |

6 |

14.43 |

4.41 |

751.67 |

| MVDDH062 |

Main Veins |

106 |

112 |

6 |

7.37 |

6.54 |

61.99 |

| MVDDH018 |

Main Veins |

51.5 |

53.15 |

1.65 |

23.83 |

16.75 |

531.03 |

| MVDDH011 |

Main Veins |

76.6 |

77.5 |

0.9 |

32.98 |

15.59 |

1304.14 |

| MVDDH001 |

Main Veins |

85 |

86 |

1 |

27.57 |

26.85 |

53.71 |

| MVDDH041 |

Main Veins |

71 |

75 |

4 |

6.05 |

5.25 |

59.88 |

| MVDDH004 |

Main Veins |

36 |

37.5 |

1.5 |

14.71 |

12.12 |

193.91 |

| MVDDH007 |

Main Veins |

67 |

68 |

1 |

16.1 |

14.59 |

113.25 |

| MVDDH029 |

Main Veins |

59 |

59.5 |

0.5 |

30.28 |

1.05 |

2192.53 |

| MVDDH039 |

Main Veins |

160 |

162 |

2 |

7.2 |

6.08 |

83.96 |

| MVDDH046 |

Main Veins |

131 |

133 |

2 |

7.07 |

6.71 |

27.34 |

| MVDDH054 |

Main Veins |

49.5 |

53.5 |

4 |

3.51 |

3.11 |

30.11 |

| MVDDH053 |

Main Veins |

123 |

125 |

2 |

6.9 |

6.36 |

40.23 |

| MVDDH023 |

Main Veins |

162.4 |

164 |

1.6 |

8.55 |

7.44 |

83.47 |

| MVDDH021 |

Main Veins |

94.15 |

95.8 |

1.65 |

7.81 |

7.26 |

40.93 |

| MVDDH039 |

Main Veins |

146 |

148 |

2 |

5.98 |

5.43 |

41.61 |

| MVDDH043 |

Main Veins |

29 |

30.5 |

1.5 |

7.72 |

7.24 |

35.88 |

| MVDDH027 |

Main Veins |

48.85 |

52.5 |

3.65 |

3.13 |

1.48 |

123.49 |

| MVDDH051 |

Main Veins |

130 |

134 |

4 |

2.84 |

1.77 |

80.12 |

| MVDDH020 |

Main Veins |

47 |

49 |

2 |

5.65 |

4.49 |

86.87 |

| MVDDH058 |

Main Veins |

43 |

46 |

3 |

3.61 |

1.79 |

136.61 |

| MVDDH070 |

Main Veins |

79 |

81 |

2 |

5.01 |

1.72 |

246.94 |

| MVDDH019 |

Main Veins |

135 |

136 |

1 |

9.55 |

0.08 |

710.55 |

| MVDDH061 |

Main Vein |

52 |

56 |

4 |

1.38 |

1.14 |

17.92 |

| MVDDH005 |

Main Vein |

124 |

125 |

1 |

3.77 |

3.64 |

10 |

| MVDDH028 |

Main Vein |

53 |

54 |

1 |

3.55 |

3.34 |

16.01 |

| MVDDH052 |

Main Vein |

84 |

85 |

1 |

3.44 |

3.22 |

16.1 |

| MVDDH040 |

Main Vein |

58.5 |

59 |

0.5 |

4.14 |

1.99 |

161.09 |

| MVDDH017 |

Main Vein |

242.6 |

243 |

0.4 |

4.86 |

2.13 |

204.55 |

| MVDDH002 |

Main Vein |

124 |

125 |

1 |

1.77 |

1.54 |

17.28 |

| MVDDH005 |

Main Vein |

118 |

119 |

1 |

1.68 |

1.64 |

3.61 |

Monserrat West Target

To the west, the drill-hole fence integrating with Monserrat West target is located on a north-south dilatational, 1.6km long corridor that contains ore shoots expressed as veining and brecciation, that open in both directions. The sparce surface expression is characterized by a silica cap, secondary oxidation, leaching, breccia and residual quartz textures. The historical drill holes intersected the target structure and contain high-grade significant gold and silver intervals demonstrating the potential for further strike and down dip extension, but also the possibility of further high-grade gold and silver ore shoot zones.

Table IV. Historical drill holes intercepts (reported in Fredonia news release dated January 20th, 2022) from Monserrat West and Bajo Pedernal targets - Northern Monserrat sector, shown below:

| Hole ID |

Target |

From |

To |

Interval

(*) |

Au Eq g/t

(**) |

Au g/t |

Ag g/t |

| MODDH001 |

Monserrat West |

174.3 |

176.7 |

2.4 |

18.05 |

0.18 |

1491.00 |

| Including |

Monserrat West |

176.2 |

176.7 |

0.5 |

84.79 |

0.38 |

7037.40 |

| DM-33 |

Monserrat West |

170 |

175 |

5 |

4.91 |

3.17 |

171.80 |

| DM-40 |

Monserrat West |

195.23 |

196.9 |

1.67 |

12.56 |

13.51 |

32.96 |

| DM-34 |

Monserrat West |

216.1 |

219 |

2.9 |

5.49 |

0.41 |

426.45 |

| DM-19 |

Monserrat West |

135.52 |

138.4 |

2.88 |

4.58 |

3.20 |

141.79 |

| DM-13 |

Monserrat West |

188.9 |

190.5 |

1.6 |

7.06 |

1.08 |

507.69 |

| MVDDH012 |

Monserrat West |

179.5 |

180 |

0.5 |

19.93 |

3.78 |

1377.48 |

| MODDH004 |

Bajo Pedernal |

87 |

91 |

4 |

2.42 |

0.51 |

163.04 |

| Including |

Bajo Pedernal |

87 |

87.5 |

0.5 |

9.86 |

2.15 |

660.42 |

| DM-19 |

Monserrat West |

128.9 |

130.4 |

1.5 |

6.00 |

0.63 |

453.00 |

| DM-18 |

Monserrat West |

211 |

211.67 |

0.67 |

12.87 |

12.43 |

140.00 |

| DM-22 |

Monserrat West |

219.96 |

221 |

1.04 |

7.91 |

8.62 |

13.00 |

| MODDH001 |

Monserrat West |

168 |

169 |

1 |

4.96 |

4.81 |

52.70 |

| DM-43 |

Monserrat West |

140 |

140.4 |

0.4 |

10.41 |

1.19 |

778.00 |

| MODDH005 |

Monserrat West |

91 |

92 |

1 |

2.48 |

0.01 |

206.09 |

| DM-41 |

Monserrat West |

149.00 |

149.21 |

0.21 |

11.51 |

0.10 |

856.00 |

| MODDH002 |

Monserrat West |

302 |

303.4 |

1.4 |

1.55 |

1.38 |

25.38 |

| MODDH002 |

Monserrat West |

72.1 |

72.45 |

0.35 |

2.71 |

0.08 |

219.91 |

(*) Reported interval lengths are down-hole widths and not true widths.

(**) Gold equivalent (“Au Eq.”) is calculated using metal prices of US$ 1,800/oz for Au and US$ 24/oz for Ag. The equation used is: Au Eq g/t = Au g/t + (Ag g/t ÷ 75).

Au Eq assumes Au recovery of 90%. The limited metallurgical studies by Fredonia (selective Bottle rolls from Main Veins material) have indicated high (>90%) recovery of gold in oxide material. The Cerro Vanguardia mine to the east of EDM with similar mineralization reports recoveries in the high 90% for Au.

Figure 3. Cross Section showing fence of current drill holes from Main Veins to Monserrat West, with Bajo Pedernal target in the middle.

Figure 4. Long Section showing north segment of Main Veins with current drill holes testing under post mineral-basalt flow and extending the system to the north.

Phase III drilling has confirmed the location of multiple ore shoots in the Northern Monserrat sector, with extensive intersections of gold and silver mineralized veins, extending the known mineralization to the north at the Main Veins target, under the basalt flow. It also extended the Bajo Pedernal target, which has very little surface expression (jasperoidal veins) but which now show similar potential as the more advanced Main Veins and Monserrat West targets.

In addition, there are numerous targets that are yet to be drilled such as Abanico, that comprise at least four distinct veins traceable over 1.0 km of strike; and Monserrat East, a silicified trend reaching 3.0km long by 8m wide located 2.5km east of Main Veins.

Based on all of the above, the Northern Monserrat sector requires additional systematic drilling to define the true extent of the sector, currently open in all directions.

The interpretation of this new phase of drilling is currently being carried out, including integrating it with the historical drilling. This will provide the basis for future exploration drilling and selection of other potential high-grade zones.

Quality Assurance/Quality Control:

All core samples were submitted to the principal Alex Stewart Laboratories in San Julián city for preparation and in Mendoza city for the analysis. All samples were analyzed for Au and Ag by fire assay/ AA finish 50 g, plus a 39-element ICP-AR finish. Fredonia followed industry standard procedures for the work with a quality assurance/quality control (QA/QC) program. Blanks and reference material of High grade/ Low grade Gold and High grade/ Low grade Silver standards were included with all sample shipments to the principal laboratory. Field duplicates were made from Coarse Reject. Fredonia detected no significant QA/QC issues during review of the data.

Mr. Fernando Ganem, Professional Geoscientist, VP - Exploration of the Company, is a qualified person (“QP”) as defined by Canadian National Instrument 43-101. Mr. Ganem visited the property and has read and approved the technical contents of this release.

Data Verification

Mr. Ganem has previous experience with the EDM property and the historical QA/QC procedures undertaken for the preparation of previous results and has previously conducted the verification activities on drilling and sampling results described in Fredonia’s technical report entitled “Technical Report on the El Dorado-Monserrat Property in Santa Cruz Province, Argentina” dated February 15th, 2021 (the “EDM Technical Report”).

Mr. Ganem was physically present to inspect and take verification samples from drill core in the most recent drilling campaign, and verify drill results against data-base information provided by management to ensure the assay results presented are those in the database. Digital ‘original’ final assay reports (certificates) were provided to the QP at the time of disclosure for verification.

About Fredonia

Fredonia holds gold and silver license areas totaling approximately 18,300 ha. in the prolific Deseado Massif geological region in the Province of Santa Cruz, Argentina, including the following principal areas: its flagship - the advanced EDM project (approx. 6,200 ha.) located close to AngloGold Ashanti’s producing multi-million Au-Ag Cerro Vanguardia mine2, the El Aguila project (approx. 9,100 ha.), and the Petrificados project (approx. 3,000 ha).

For further information: Please visit the Company website www.fredoniamanagement.com or contact: Omar Salas, Chief Financial Officer, Direct: +1-416-846-7807, Email: omar.salas@icloud.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “Forward-Looking Statements” within the meaning of applicable securities legislation relating to the Company and the EDM project, including statements regarding the prospectivity of the EDM project for gold and silver mineralization, including the potential for metal recoveries from any mineral processing activity, the potential for a mineral resource estimate at the Project, and the Company’s future exploration plans. Words such as “might”, “will”, “should”, “anticipate”, “plan”, “expect”, “believe”, “estimate”, “forecast” and similar terminology are used to identify forward looking statements and forward-looking information. Such statements and information are based on assumptions, estimates, opinions and analysis made by the Company considering its experience, current conditions and its expectations of future developments as well as other factors which it believes to be reasonable and relevant. Forward-looking statements and information involve known and unknown risks, uncertainties and other factors, including, without limitation, the factors described in the Company’s filing statement dated June 22, 2021 available on SEDAR at www.sedar.com under the heading “Risk Factors” that may cause actual results to differ materially from those expressed or implied in the forward-looking statements and information and accordingly, readers should not place undue reliance on such statements and information and the Company can give no assurance that they will prove to be correct. The statements in this press release are made as of the date of this release. The Company undertakes no obligation to update forward-looking statements made herein, or comment on analyses, expectations or statements made by third parties in respect of the Company or its securities, other than as required by law.

2 2.5 million oz. Au in the measured and indicated mineral resource category (including reserves) per AngloGold Ashanti Mineral Resource and Ore Reserve Report as at 31 December 2021; 145,000 oz production in 2021 per Cerro Vanguardia Operational Profile 2021; available at www.anglogoldashanti.com.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ed776c3-a867-4b37-97f7-9f200d3f0006

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce382aea-632e-408a-bc6a-dc5bdc400c03

https://www.globenewswire.com/NewsRoom/AttachmentNg/48b9b287-18d8-4179-8dc1-aa1d2d516f18

https://www.globenewswire.com/NewsRoom/AttachmentNg/c8765ca8-ad62-4168-b598-10d7e0883f93