Reports 91.0 m of 0.390 g/t Au from surface and 211 g/t Au from surface grab sample

VANCOUVER, British Columbia, Feb. 14, 2023 (GLOBE NEWSWIRE) -- Apollo Silver Corp. (“Apollo” or the “Company”) (TSX.V:APGO, OTCQB:APGOF, Frankfurt:6ZF0) is pleased to report gold (“Au”) assay results from the Calico Silver Project (“Calico” or the “Project”) located in San Bernardino County, California. Results reported herein are from the remaining five reverse circulation (“RC”) drill holes from Phase 2 of the 2022 Drill Program and new surface sample assay results.

- All five drill holes intercepted Au above 0.100 g/t Au over significant thicknesses including 91.0 metres (“m”) of 0.390 g/t Au from surface (estimated 88 m true thickness) (W22-RC-080).

- Surface sampling returned several high-grade results including 211 g/t Au (P715944) and 849 g/t silver (“Ag”) (P715962).

- Gold mineralization occurs stratigraphically below silver mineralization at Waterloo and extends continuously across more than 1,000 m strike length and up to 400 m width. The gold mineralized horizon remains open along strike.

- Initial cyanide solubility tests show recoveries ranging from 75% to 95% confirming gold mineralization is oxidized and amendable to simple leaching.

- Gold mineralization represents a compelling prospect with the latest results providing further support for adding to the metal inventory for the upcoming mineral resource estimate update.

New significant gold intercepts include:

- 0.390 g/t Au over 91.0 m from surface (W22-RC-080), including;

- 1.715 g/t Au over 1.5 m from 8.5 m down hole; and

- 1.771 g/t Au over 3.0 m from 41.5 m down hole; and

- 1.373 g/t Au over 3.0 m from 79.0 m down hole.

- 0.613 g/t Au over 65.5 m from surface (W22-RC-081), including;

- 3.62 g/t Au over 1.5 m from 4.0 m down hole, and

- 1.239 g/t Au over 6.0 m from 47.5 m down hole, and

- 1.100 g/t Au over 1.5 m from 58.0 m down hole.

- 0.353 g/tAu over 52.0 m from surface (W22-RC-082), including;

- 1.204 g/t Au over 4.5 m from 4.0 m depth down hole; and

- 2.05 g/t Au over 1.5 m from 34.0 m depth down hole.

- 0.567 g/t Au over 51.0 m from 35.5 m down hole (W22-RC-083), including;

- 1.673 g/t Au over 10.5 m from 58.0 m depth down hole.

Gold intercepts are reported at a 0.100 g/t gold cut-off grade (“COG”) with significantly higher-grade intercepts reported at a 1.00 g/t COG with a maximum of 4.5 m internal dilution and are uncapped. Lengths are down hole lengths and may not represent true widths unless otherwise stated.

“These latest gold results from the Burcham area of the Waterloo Property confirm that the Calico Project has a substantial oxide gold mineralized horizon,” commented Apollo’s President and CEO Tom Peregoodoff. “This horizon which typically forms part of the footwall to our silver mineralization is extensive and remains open. The spatial relationship between this defined gold horizon and the overlying silver resource is consistent with the simple geometry of the overall resource and opens up additional development optionality in the future. The successful delivery of the objectives of the 2022 program, and the pending mineral resource update should confirm Calico is one of the largest undeveloped silver deposits in the U.S. The potential addition of oxide gold to the mineral inventory will only increase the overall investment attractiveness of the Calico Project.”

The 2022 Calico Drill Program, which is one component of the 2022 Calico Technical Program, comprised 9,840 m (32,283 feet) of drilling with 88 holes on the Waterloo property completed between April 5, 2022 and November 12, 2022. The 2022 Calico Technical Program aimed to upgrade and expand the previously announced maiden Inferred mineral resource estimate (“MRE”) at Waterloo of 116 million ounces of silver contained in 38.9 million tonnes at an average grade of 93 g/t, which forms part of the Calico maiden Inferred MRE of 166 million ounces of silver contained in 58.1 million tonnes at an average grade of 89 g/t (see news release dated February 9, 2022)1.

Results for five RC holes are reported below, which total 483.5 m (1,586 feet) and were completed between November 8, 2022, and November 12, 2022. These drill holes were completed in the Burcham area of the Waterloo property, approximately 225 m southeast of the southern extent of the current Waterloo silver MRE. These holes specifically targeted shallow oxide gold mineralization hosted in the lower Barstow and Pickhandle formations. The overlying Barstow stratigraphy, host to the silver mineralization, is interpreted to have been eroded off in this area.

Also reported are gold and silver assay results from a surface rock grab sampling program completed in the fall of 2022, in which 82 samples were collected across the Waterloo property to further understand the distribution of gold mineralization at surface (following up results from 46 surface samples reported September 14, 2022).

1The 2022 MRE was prepared by Derek Loveday, P. Geo. of Stantec Consulting Services Ltd., in conformance with Canadian Institute of Mining and Metallurgy’s “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. It is effective January 28, 2022. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve. Mr. Loveday is an independent Qualified Person for Apollo’s MRE. Please refer to the Company’s news release dated February 9, 2022, for more information.

GOLD HORIZON

As previously reported (see news release January 11, 2022), a review by the Company of historic drilling data for the Waterloo property identified a 25 m thick, gold bearing horizon stratigraphically below silver mineralization and associated with the contact between the Barstow sediments and Pickhandle volcaniclastics. The Burcham mine was the only mine in the district to have produced gold as its primary commodity. The identification of these drill intercepts in the historic data suggested that gold mineralization extended further north from the Burcham area than previously known. Further, surface geological mapping completed by the Company in December 2021 identified evidence that the entire 2.2 km long Barstow/Pickhandle contact at Waterloo is prospective for gold (see news release January 11, 2022).

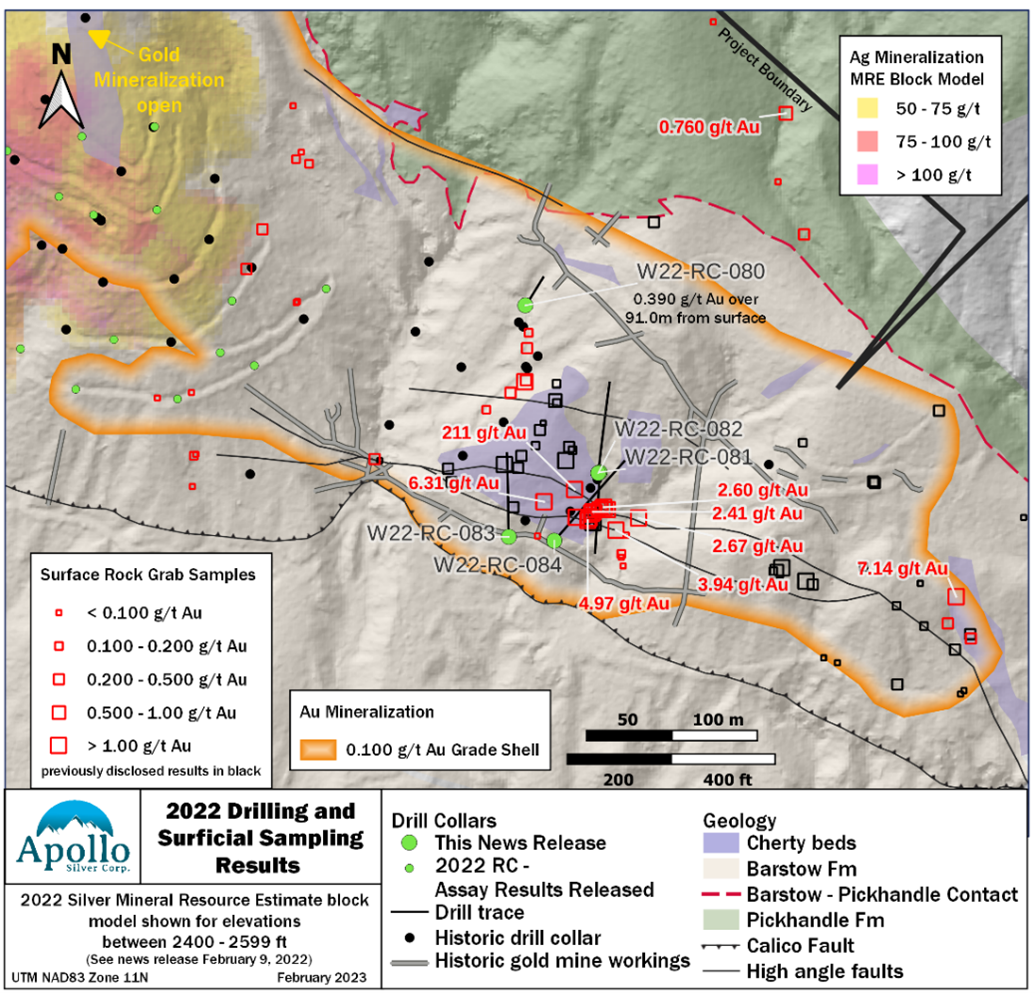

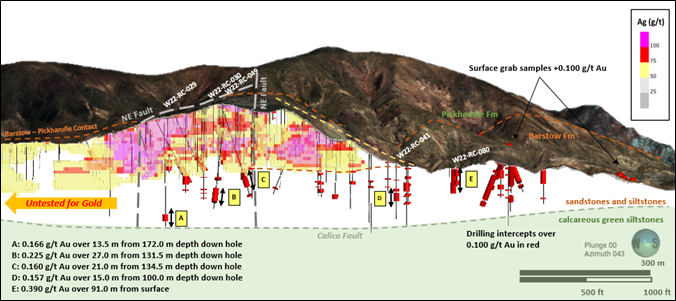

Based on this work, one goal of the 2022 Calico Drill Program was to better understand the distribution and styles of gold mineralization across the property. The drill program design included holes targeting the prospective Barstow-Pickhandle contact at depth below the Waterloo silver MRE and along strike from the Burcham area. It also aimed to verify historic drilling completed at Burcham and assess to what extent the Pickhandle volcaniclastics may be mineralized with gold. All five drill holes reported herein intersected gold mineralization across significant widths at or above a 0.100 g/t Au cut-off grade, the longest intercept being 91.0 m of 0.390 g/t Au from surface. More than 74 m of this intercept is hosted within Pickhandle volcaniclastics suggesting this lithostratigraphic unit may be more prospective for gold than previously understood. Refer to Table 1 and Figure 1 for drill hole information and locations and Table 2 for drilling gold assay results. Figure 2 shows the spatial relationship between the silver MRE and gold in drilling results.

Table 1: Drill hole information for results reported February 14, 2023, fortheCalico Project2022 Drill Program.

| Hole |

Easting (m) |

Northing (m) |

Elevation (m) |

Total Depth (m) |

Total Depth (ft) |

Azimuth |

Dip |

| W22-RC-080 |

511271 |

3867591 |

745 |

92.5 |

302 |

45 |

-80 |

| W22-RC-081 |

511315 |

3867493 |

733 |

88.0 |

289 |

180 |

-55 |

| W22-RC-082 |

511314 |

3867492 |

733 |

88.0 |

289 |

0 |

-55 |

| W22-RC-083 |

511261 |

3867456 |

721 |

100.0 |

328 |

0 |

-60 |

| W22-RC-084 |

511286 |

3867452 |

719 |

115.0 |

377 |

35 |

-55 |

Figure 1: Drill hole collar locations for results reported February 14, 2023, for Phase 2 of the Calico Project 2022 Drill Program and select surface sampling.

Table2:Goldassayresults reported February 14, 2023, for Phase 2 of theCalico Project2022 Drill Program.

| Hole |

|

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

W22-RC-080

|

|

0.0 |

91.0 |

91.0 |

0.390 |

| including |

8.5 |

10.0 |

1.5 |

1.715 |

| including |

41.5 |

44.5 |

3.0 |

1.771 |

|

including |

79.0 |

82.0 |

3.0 |

1.373 |

W22-RC-081

|

|

0.0 |

65.5 |

65.5 |

0.613 |

| including |

4.0 |

5.5 |

1.5 |

3.62 |

| including |

32.5 |

34.0 |

1.5 |

1.250 |

| including |

37.0 |

41.5 |

1.5 |

1.094 |

| including |

47.5 |

53.5 |

6.0 |

1.239 |

| including |

58.0 |

59.5 |

1.5 |

1.100 |

| and |

73.0 |

76.0 |

3.0 |

0.139 |

W22-RC-082

|

|

0.0 |

52.0 |

52.0 |

0.353 |

| including |

4.0 |

8.5 |

4.5 |

1.204 |

| including |

34.0 |

35.5 |

1.5 |

2.05 |

| and |

58.0 |

59.5 |

1.5 |

0.175 |

| and |

79.0 |

85.0 |

6.0 |

0.265 |

W22-RC-083

|

|

7.0 |

10.0 |

3.0 |

0.126 |

| and |

25.0 |

28.0 |

3.0 |

0.143 |

| and |

35.5 |

86.5 |

51.0 |

0.567 |

| including |

58.0 |

68.5 |

10.5 |

1.637 |

| and |

92.5 |

100.0 |

7.5 |

0.203 |

W22-RC-084

|

|

0.0 |

1.0 |

1.0 |

0.102 |

| and |

8.5 |

56.5 |

48.0 |

0.532 |

| including |

37.0 |

40.0 |

3.0 |

1.265 |

| including |

49.0 |

55.0 |

6.0 |

1.670 |

| and |

82.0 |

88.0 |

6.0 |

0.122 |

| and |

91.0 |

92.5 |

1.5 |

0.115 |

Gold intercepts calculated using 0.100 g/t cut-off grade (“COG”) with higher-grade intercepts calculated at 1.000 g/t COG.Interceptsaredownholelengthsandmaynotrepresent true widths.

Definition of gold mineralization is further supported by 2022 surface rock grab sampling for which a total of 128 samples have now been reported. Surface sampling targeted historically and newly identified northwest and north-south oriented high-angle structures, structural intersections, surface mapped silicified rocks and bleached/brecciated fault gouge in the basal Barstow formation siltstones. Notable results reported from the latest samples include 211 g/t Au, 7.14 g/t Au, 6.31 g/t Au, and 4.97 g/t Au from the Burcham area. Refer to Figure 1 above and Table 3 below for locations and results for select surface samples. Full results are listed on the Apollo website at the link provided below Table 3. Results from drilling and surface sampling completed to date at Waterloo show that gold mineralization is spatially continuous along more than 1,000 m strike length (Figure 2) and remains open along strike. Gold was intercepted in several holes 625 m further north of the current northern extent; however, the continuity of the mineralized horizon in this gap and across the northern half of the Waterloo property has not been fully tested.

Table 3: Surface rock grab sample location and results for select samples above 1.000 g/t Au or above 100 g/t Ag as reported February 14, 2023 for the Calico Project.

| Sample ID |

Easting (m) |

Northing (m) |

Elevation (m) |

Au (g/t) |

Ag (g/t) |

| P715944 |

511,301 |

3,867,484 |

734 |

211 |

49 |

| P715953 |

511,524 |

3,867,419 |

735 |

7.14 |

26 |

| P715943 |

511,283 |

3,867,477 |

731 |

6.31 |

39 |

| P715941 |

511,309 |

3,867,466 |

722 |

4.97 |

92 |

| P715929 |

511,325 |

3,867,460 |

716 |

3.94 |

76 |

| P715928 |

511,338 |

3,867,467 |

719 |

2.67 |

16 |

| P715932 |

511,318 |

3,867,473 |

723 |

2.60 |

16 |

| P715937 |

511,312 |

3,867,471 |

724 |

2.41 |

23 |

| P715948 |

511,272 |

3,867,547 |

741 |

1.885 |

15 |

| P715938 |

511,311 |

3,867,470 |

723 |

1.535 |

19 |

| P715962 |

510,123 |

3,868,507 |

815 |

0.007 |

849 |

| P715897 |

510,691 |

3,867,875 |

771 |

0.006 |

529 |

| P715961 |

511,120 |

3,867,638 |

773 |

0.418 |

339 |

| P715960 |

511,120 |

3,867,638 |

773 |

0.221 |

253 |

| P715916 |

510,879 |

3,867,620 |

748 |

0.009 |

221 |

| P715917 |

510,879 |

3,867,620 |

748 |

0.012 |

215 |

| P715900 |

510,927 |

3,867,599 |

753 |

0.012 |

134 |

The reader is cautioned that grab samples are selective by nature and do not necessarily represent the true metal content of the mineralized zones. Complete rock sampling results are available on the Company’s website

GOLD CYANIDE SOLUBILITY

To assess gold recovery in a preliminary fashion, 66 samples from gold mineralized intercepts (0.100 g/t Au cutoff grade) from three 2022 RC drill holes were selected for cyanide solubility testing, all of which had been previously assayed using fire assay (see news releases dated June 29, 2022 and July 26, 2022). Results of this preliminary testing show a range of average recoveries of 75-95% which confirms that gold mineralization is oxide in nature and is amenable to recovery by traditional cyanide leaching methods (Table 4). Additional metallurgical test work to better define gold recoveries is being planned as part of the 2023 Phase 2 Metallurgical program.

Table 4: Summary of preliminary gold cyanide solubility data for February 14, 2023 fortheCalico Project.

| Hole |

From (m) |

To (m) |

Intercept (m) |

Au (g/t) |

AuCN* Recovery % (Average) |

| W22-RC-008 |

107.5 |

160.0 |

52.5 |

0.235 |

75 |

| W22-RC-013 |

134.5 |

154.0 |

19.5 |

0.417 |

81 |

| W22-RC-022 |

79.0 |

106.0 |

27.0 |

0.219 |

95 |

Gold recovery based on cyanide shakes (“AuCN”) run on all samples within the reported interval with Au assays (via fire assay) at a 0.100 g/t Au. Recovery% is defined as the ratio of gold grade measured by A) a cyanide shake flask test and B) conventional fire assay. A/B*100 = Recovery %. This is an arithmetic average and not weighted. See news releases data June 29, 2022 and July 26, 2022 for drill hole location and orientation information and gold intercept data.

Figure 2: 3D view across the southern half of the Waterloo property showing the relationship of the silver MRE with gold mineralization in drilling, as reported February 14, 2023 for the Calico Project.

SAMPLINGANDQUALITYASSURANCE/QUALITYCONTROL

Drilling was undertaken by Cooper Drilling LLC, of Monte Vista, Colorado. RC chip samples were collected in 1.5 m lifts with 15 lb representative samples sent for analysis. Representative chip samples were also collected for logging purposes (lithology, alteration, mineralization), detailed photography and analysis by portable X-Ray Fluorescence. RC samples are catalogued and securely stored in a warehouse facility in Barstow, California until they are ready for secure shipment to ALS Global-Geochemistry in Reno, Nevada (“ALS Reno”) for sample preparation and gold analysis. ALS Reno may selectively ship samples to other ALS laboratories for preparation. After preparation, splits of prepared pulps are securely shipped to ALS Vancouver, British Columbia for multi-element analysis.

Drilling and surface samples were prepared at ALS Reno (Prep-31 package) with each sample crushed to better than 70% passing a 2 mm (Tyler 9 mesh, U.S. Std. No.10) screen. A split of up to 250 g was taken and pulverized to better than 85% passing a 75-micron (Tyler 200 mesh, U.S. Std. No. 200) screen. All samples were analyzed for 48 elements via ICP-MS following a four-acid digestion with reportable ranges for silver of 0.01 to 100 ppm (method ME-MS61). Over-range samples analyzed for silver were re-submitted for analysis using a four-acid digestion and ICP-AES finish with a silver range of 1-1,500 ppm (method Ag-OG62). When results were over 400 ppm silver, they were re-submitted for analysis by fire assay with a gravimetric finish using a 30 g nominal sample weight with reportable silver range of 5-10,000 ppm (method Ag-GRA21). Over-range samples analyzed for copper, lead and zinc were re-submitted for analysis using a four-acid digestion and ICP-AES finish with range of 0.001-50% for copper, 0.001-20% for lead, and 0.001-30% for zinc. Gold was analyzed by fire assay with atomic absorption finish (method Au-AA26) with a reportable range of 0.01-100 ppm Au. All analyses were completed at ALS Vancouver except for gold by fire assay, which was completed at ALS Reno. For cyanide solubility testing, pulps representing individual drill samples from within gold intercepts (at a 0.100 g/t Au cut-off grade) for which fire assay gold results were previously reported were analyzed. Pulps were submitted to ALS Reno and analyzed using method Au-AA13 (reported range of 0.03 to 50 ppm) which measures Au by cyanide leach with follow up gold analysis via AAS.

The Company maintains its own comprehensive quality assurance and quality control (“QA/QC”) program to ensure best practices in sample preparation and analysis. The QA/QC program includes the insertion and analysis of certified reference materials, commercial pulp blanks, preparation blanks, and field duplicates to the laboratories. Apollo’s QA/QC program includes ongoing auditing of all laboratory results. The Company’s Qualified Person is of the opinion that the sample preparation, analytical, and security procedures followed are sufficient and reliable. The Company is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data reported herein.

ABOUTTHEPROJECT

Location

The Project is located in San Bernardino County, California and comprises the adjacent Waterloo and Langtry properties which total 2,950 acres. The Project is 15 km (9 miles) from the city of Barstow and has an extensive private gravel road network spanning the property. There is commercial electric power within 5 km (3 miles) of the Project.

GeologyandMineralization

The Calico Project is situated in the southern Calico Mountains of the Mojave Desert, in the south-western region of the Basin and Range tectonic province. This mountain range is a 15 km (9 mile) long northwest- southeast trending range dominantly composed of Tertiary (Miocene) volcanics, volcaniclastics, sedimentary rocks and dacitic intrusions. Mineralization at Calico comprises high-level low-sulfidation silver-dominant epithermal vein-type, stockwork-type and disseminated-style associated with northwest-trending faults and fracture zones and mid-Tertiary (~ 19-17 Ma) volcanic activity. Calico represents a district-scale mineral system endowment with approximately 6,000 m (19,685 ft) in mineralized strike length controlled by Apollo. Silver and gold mineralization are oxidized and hosted within the basal stratigraphic horizons of the sedimentary Barstow Formation and in contact and within the upper volcaniclastic units of the Pickhandle formation. The current mineral resource estimate at Calico comprises 166 million ounces of silver contained in 58.1 million tonnes at an average grade of 89 g/t, at a cut-off grade of 50 g/t Ag (see news release February 9, 2022).

QUALIFIEDPERSONS

The scientific and technical data contained in this news release was reviewed, and approved by Isabelle Lépine, M.Sc., P.Geo., Apollo’s Director of Mineral Resources, a Qualified Person as defined by NI 43-101 Standards of Disclosure for Minerals Projects. Ms. Lépine is a registered Professional Geoscientist in British Columbia, Canada.

Please visit www.apollosilver.com for further information.

ON BEHALF OF THE BOARD OF DIRECTORS

Tom Peregoodoff

Chief Executive Officer

AboutApolloSilverCorp.

Apollo Silver Corp. has assembled an experienced and technically strong leadership team who have joined to advance world class precious metals projects in tier-one jurisdictions. The Company is focused on advancing its portfolio of two significant silver exploration and resource development projects, the Calico Silver Project, in San Bernardino County, California and Silver District Project in La Paz County, Arizona.

Neither the TSXVentureExchangenoritsRegulationServicesProvider(asthattermisdefinedinpolicies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CautionaryStatementRegarding“Forward-Looking”Information

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect tothe potentialof the Calico Project and its overall investment attractiveness; the potential for identification of gold and barite resources at Calico; the potential recovery rates;the potential to expand the resource estimate and upgrade its confidence level, including prospective silver and gold mineralization on strike and at depth; timing and execution of future planned drilling and exploration activities; timing of completion of the updated mineral resource estimate and timing of commencement and completion of a preliminary economic assessment. Forward-looking statements include predictions, projections and forecasts and are often, but notalways,identifiedbytheuseofwordssuchas“anticipate”,“believe”,“plan”,“estimate”,“expect”,“potential”,“target”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based onthe reasonable assumptions,estimates, analysis, and opinions of the management of the Company made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made.Forward-looking information is based on reasonable assumptions that have been made by the Company as at the date of such information and is subject to known and unknown risks, uncertainties and other factors that may have caused actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, includingbutnot limited to: risks associated with mineral exploration and development; metal and mineral prices; availability of capital; accuracy of the Company’s projections and estimates; realization of mineral resource estimates, interest and exchange rates; competition; stock price fluctuations; availability of drilling equipment and access; actual results of current exploration activities; government regulation; political or economic developments; environmental risks; insurance risks; capital expenditures; operating or technical difficulties in connection with development activities; personnel relations;contests over title to properties; changes in project parametersasplanscontinuetoberefined;andimpactoftheCOVID-19pandemic.Theestimateofmineralresources maybemateriallyaffectedbyenvironmental,permitting,legal,title,taxation,sociopolitical,marketing,orotherrelevant issues. The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and therehasbeeninsufficientexplorationtodefinetheseinferredmineral resourcesasanindicatedormeasuredmineral resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured mineral resource category. Forward-looking statements are based on assumptions management believes to be reasonable, includingbutnotlimitedtothepriceofsilver,goldandbarite;thedemandforsilver,goldandbarite;theability tocarry on exploration and development activities; the timely receipt of any required approvals; the ability to obtain qualified personnel, equipment and services in a timely and cost-efficient manner; the ability to operate in a safe, efficient and effective matter; and the regulatory framework regarding environmental matters, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause resultsnottobeasanticipated,estimatedorintended.Therecanbenoassurancethatforward-lookingstatementswill prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking information contained herein, exceptinaccordancewithapplicablesecuritieslaws.Theforward-lookinginformationcontainedhereinispresentedfor thepurposeofassistinginvestorsinunderstandingtheCompany’sexpectedfinancialandoperationalperformanceand theCompany’splansandobjectivesandmaynotbeappropriateforotherpurposes.TheCompanydoesnotundertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d225b00-2a0d-4b53-b06e-c7513d8e2970

https://www.globenewswire.com/NewsRoom/AttachmentNg/67d91d6e-abfd-407f-8a57-802acc45f0f8

For further information, please contact: Tom Peregoodoff Chief Executive Officer Telephone: +1 (604) 428-6128 tomp@apollosilver.com