First Quarter Fiscal 2023 Highlights

❖Revenue of US$2.7 million, Up 15% Year-over-Year

❖Free Cash Flow of US$210,000, Significant Year-Over-Year and Quarterly Sequential Increase

❖Bookings of US$3.2 million, a 28% Increase over Q1’2022

❖Backlog of US$4.1 million, a 11% Increase over Q4’2022

❖Ended Quarter with Balance Sheet Cash of US$1.3 million, and Remain Debt-Free

TSXV: OML

OTCQX: OLNCF

LOS ANGELES, CALIFORNIA, May 17, 2023 (GLOBE NEWSWIRE) -- Omni-Lite Industries Canada Inc. (the "Company" or “Omni-Lite”; TSXV: OML) today reported results for the first quarter Fiscal 2023. Full financial results are available at sedar.com.

First Quarter Fiscal 2023 Results

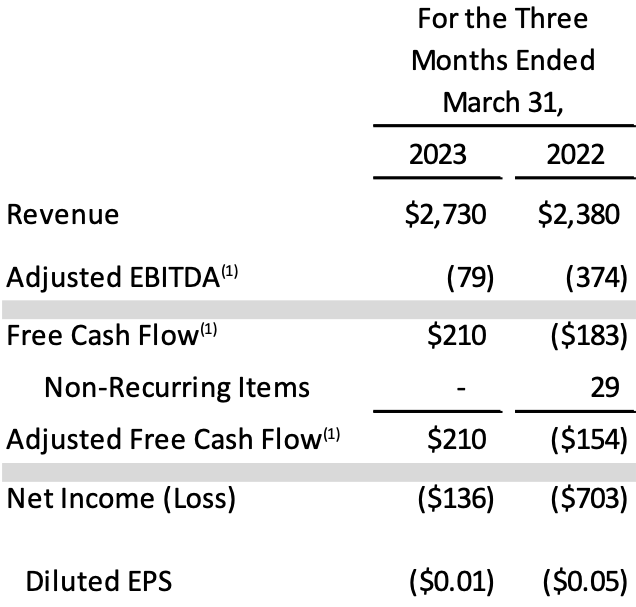

Revenue for the first quarter of fiscal 2023 was approximately US$2.7 million, an improvement of 15% as compared to the first quarter of fiscal 2022. The increase in revenue was due principally to increased demand for commercial aerospace fasteners and electronic components, as well as the production of a number of new product lines. Adjusted EBITDA (1) was approximately US$(79,000), an improvement of approximately US$295,000 as compared to approximately $(374,000) in the first quarter of fiscal 2022. The year-over-year improvement in Adjusted EBITDA (1) was a result of better utilization of fixed costs, including direct labor, as well as a reduction in SG&A expenses. The Company generated Free Cash Flow (1) (and, Adjusted Free Cash Flow (1)) of approximately US$210,000 in the first quarter of fiscal 2023, as compared to US$(154,000) and US$125,000 in the first quarter of fiscal 2022 and fourth quarter of fiscal 2022, respectively.

First quarter of fiscal 2023 bookings were US$3.2 million, as compared to bookings of US$2.5 million in the first quarter of fiscal 2022, an increase of 28%. Bookings represented a strong 1.16 book-to-bill ratio. Omni-Lite ended the first quarter of fiscal 2023 with a backlog of US$4.1 million, an increase of 11% from the first quarter of fiscal 2022.

The Company’s liquidity position remains strong due to our disciplined approach to management of our cost structure, working capital and capital spending. As a result, the Company ended the first quarter of fiscal 2023 with approximately US$1.3 million in cash and no indebtedness outstanding, which is consistent with the fourth quarter of fiscal 2022.

Management Comments

David Robbins, Omni-Lite’s CEO, stated "Omni-Lite Industries started fiscal 2023 with a solid first quarter, with an organic revenue increase of 15% year-over-year. I am pleased with the improvement in production levels and bottom-line performance as we expect see to further improvements with the return of higher commercial aerospace and defense component needs, and as new products mature and convert from engineering to production. Our backlog is the strongest we have seen, ending the first quarter of fiscal 2023 at US$4.1 million, the majority of which we expect to convert to sales throughout the remainder of 2023. In recent years, we have taken steps to reduce our costs, which has allowed us to be near Adjusted EBITDA (1) break-even at our first quarter revenue level. We believe that we now have strong operating leverage that allows us to achieve positive Adjusted EBITDA (1) levels as we can increase revenues. Our Q1’23 bookings performance is a positive indicator as we make further progress in fiscal 2023.”

FinancialSummary

Allfiguresin(US$000)unless noted.

Investor Conference Call

Omni-Lite will host a conference call for investors on May 18, 2023, beginning at 11:00 A.M. (EDT) to discuss the First Quarter Fiscal 2023 results and review of its business and operations. To join the conference call, 888-437-3179 in the USA and Canada, or 862-298-0702 for all other countries. Please call five to ten minutes prior to the scheduled start time. A replay of the conference call will be available 48 hours after the call and archived on the Company’s investors page of the Company’s website at www.omni-lite.com for 12 months.

(1)AdjustedEBITDAisanon-IFRSfinancialmeasuredefinedasearningsbeforeinterest,taxes,depreciation (net of lease expense),amortization,stock- based compensation provision, gains (losses) on sale of assets, and non-recurring items, if any.Free Cash Flow is a non-IFRS financial measure defined as cash flow from operations minus capital expenditures. Adjusted Free Cash Flow is a non-IFRS financial measure defined as Free Cash Flow excluding special items, among others, gains (losses) on sale of assets and non- recurring items, net of tax effects, if any.These are non-IFRS financial measures, as defined herein, and should be read in conjunctionwithIFRSfinancialmeasuresandtheyarenotintendedtobeconsideredinisolationorasasubstitutefor,orsuperior to, financial information prepared and presented in accordance with IFRS. The non-IFRS financial measures used herein may not be comparable to similarly titled measures reported by other companies. We believe the use of Adjusted EBITDA, Adjusted FreeCashFlowandFreeCashFlowalongwithIFRSfinancialmeasuresenhancestheunderstandingofouroperatingresultsand maybeusefultoinvestorsincomparingouroperatingperformancewiththatofothercompaniesandestimatingourenterprise value. Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash Flow are also useful toolsin evaluating the operating resultsof theCompanygiventhesignificantvariationthatcanresultfrom,forexample,thetimingofcapitalexpendituresandtheamount of working capital in support of our customer programs and contracts. We also use Adjusted EBITDA, Adjusted Free Cash Flow and Free Cash Flow internallyto evaluate the operating performance ofthe Company, to allocate resources andcapital,and to evaluate future growth opportunities.

Please see 2022 Management Discussion and Analysis for additional notes and definitions.

About Omni-Lite Industries Canada Inc.

Omni-Lite Industries Canada Inc. is an innovative company that develops and manufactures mission critical, precision components utilized by Fortune 100 companies in the aerospace, defense, industrial and energy industries.

For further information, please contact:

Mr. David Robbins

Chief Executive Officer

Tel. No. (562) 404-8510 or (800) 577-6664

Email: d.robbins@omni-lite.com

Website: www.omni-lite.com

Forward Looking Statements

Except for statements of historical fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intent”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking information in this press release includes, but is not limited to, the expected future performance of the Company. Although we believe that the expectations reflected in the forward-looking information are reasonable, there can be no assurance that such expectations will prove to be correct. We cannot guarantee future results, performance, or achievements. Consequently, there is no representation that the actual results achieved will be the same, in whole or in part, as those set out in the forward- looking information. Forward-looking information is based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward- looking information include, but are not limited to: general economic conditions in Canada, the United States and globally; industry conditions, governmental regulation, including environmental consents and approvals, if and when required; stock market volatility; competition for, among other things, capital, skilled personnel and supplies; changes in tax laws; and the other risk factors disclosed under our profile on SEDAR at www.sedar.com. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

The forward-looking information contained in this news release is expressly qualified by this cautionary statement. We undertake no duty to update any of the forward-looking information to conform such information to actual results or to changes in our expectations except as otherwise required by applicable securities legislation. Readers are cautioned not to place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.