(TheNewswire)

February 8, 2024 -Vancouver, B.C., Canada; Belmont Resources Ltd. (“Belmont” or the “Company”) (TSX.V: BEA; FSE: L3L2) is pleased to announce that it has entered into a Convertible Loan Agreement for $368,000 Cdn. with HMS Bergbau AG, Berlin Germany (“HMS”).

The HMS investment follows a previous $420,000 Cdn investment from two European private investment holding companies (see NR Oct. 19, 2023).

HMS is non-arm’s length to the Company as Patrick Brandl, a director of Belmont, is also on the Supervisory Board of HMS. As such, this transaction constitutes a “related party transaction” as defined under Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Such participation is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as neither the fair market value of the Convertible Loan by the insider exceed 25% of the Company’s market capitalization.

The Loan shall bear no interest and payable on or before July 1, 2024. If Belmont fails to repay the Loan in full on or before July 1, 2024, interest on arrears of 12% p.a. will be payable by Belmont beginning July 2, 2024.

HMS has the option to have the Debt paid through the issuance of 9,200,000 common shares, at a deemed value of $0.04 per share, subject to the approval of the TSX Venture Exchange.

The Use of Proceeds will be allocated as: $210,000 exploration and incurred exploration expenditures; $60,000 office and administration (salaries, management, audit & legal); unallocated working capital $98,000. While the Company intends to spend the net proceeds from the loan as stated above, there may be circumstances where, for sound business reasons, funds may be reallocated at the discretion of the Board.

The closing of the transaction is subject to the approval of the TSX Venture Exchange.

George Sookochoff, President & CEO commented “We're thrilled to collaborate with a multinational corporation like HMS Bergbau AG as they venture into commodity production, broadening their scope. Their investment serves as a vote of confidence in our team, our initiatives, and our outlook.”

About HMS Bergbau AG

HMS Bergbau AG (HMS) stands out as a prominent independent commodity trading enterprise based in Germany. Its primary focus lies in the global procurement and distribution of energy commodities, metals, ores, and various renewable resources.

The company's global presence is further underscored by its subsidiaries, including HMS Bergbau Africa (Pty) Ltd., HMS Bergbau Singapore Pte Ltd., PT. HMS Bergbau Indonesia, HMS Bergbau Dubai FZCO, and HMS Bergbau USA Corp.

HMS is increasingly developing into a diversified international commodity trading group and is actively expanding towards commodity production and logistical solutions.

In July 2023 HMS announced the acquisition of two majority shareholdings in Kazakhstan-based companies with mining and exploration licenses for lithium, cobalt, nickel, tantalum and rare earths in the Alatau region of Kazakhstan. Investment is expected to amount to $500 million in East Kazakhstan. Kazakhstan has an estimated 8.6 million tonnes of lithium resources, making it the fifth-largest holder of lithium reserves in the world, according to the United States Geological Survey.

Dennes Schwindt, CEO of HMS Bergbau AG stated “We also see the new majority shareholdings in Kazakhstan as another milestone in the transformation process of HMS Bergbau AG, which is transforming into an internationally positioned raw materials trading and marketing group.”

HMS Bergbau AG (HMS) is listed on the Basic Board of the Frankfurt Stock Exchange. (HMU.DE)

About Belmont Resources

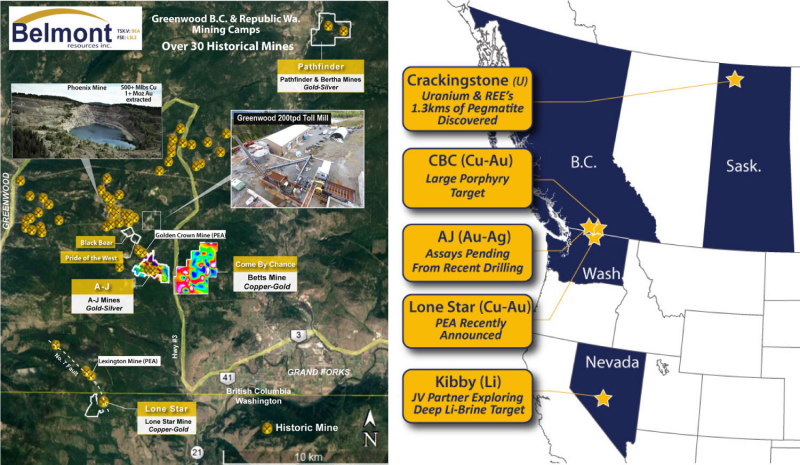

Belmont Resources has assembled a portfolio of highly prospective uranium, gold, copper, lithium and rare earths projects situated in North America. Its holdings include:

Situated in the Uranium City area of northern Saskatchewan where sixteen uranium deposits were brought into production. Crackingstone has a rich history of high grade uranium sampling.

- 11 tons were shipped to the Lorado mill grading 2.3% U3O8.

- Rix Athabasca Uranium Mines Ltd. reported a grab assay of 12.53% U308

- 46 ton hand sorted bulk sample assaying 0.5% U308.

- 6.5 ton hand sorted bulk sample assaying 0.5% U308.

Some of the highest grade Rare Earth Elements (REE’s) are being discovered nearby Crackingstone in Northern Saskatchewan within coincident Thorium & Pegmatite anomalies. Crackingstone along with its high grade uranium, has similar criteria for Rare Earth discoveries (Thorium & Pegmatite anomalies) which will be aggressively explored for in Q2 2024.

2023 drilling targeted a potential feeder system to 2 former gold mines. Initial results provide important vectors pointing further east to the major Jackpot fault which may have provided the conduit for hydrothermal mineralization to flow to surface.

-

Come By Chance (CBC) Copper-Gold: 2021 geophysics delineated potential large copper-gold porphyry; 2022 drilling provided further vectors towards potential core of porphyry;

-

The Lone StarCopper-Gold: optioned to Australian Marquee Resources ASX:MQR. MQR has spent in excess of $2.5M in drilling, In November 2023 MQR announced a Preliminary Economic Assessment and currently holds a 50% interest in the project.

Click Image To View Full Size

NI 43-101 Disclosure:

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101 and has been reviewed and approved by Laurence Sookochoff, P.Eng.

ON BEHALF OF THE BOARD OF DIRECTORS

“George Sookochoff”

George Sookochoff, CEO/President/Chairman

Neither the TSX Venture Exchange nor its Regulation Services Provider (as the term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This Press Release may contain forward-looking statements that may involve a number of risks and uncertainties, based on assumptions and judgments of management regarding future events or results that may prove to be inaccurate as a result of exploration and other risk factors beyond its control. Actual events or results could differ materially from the Companies forward-looking statements and expectations. These risks and uncertainties include, among other things, that we may not be able to obtain regulatory approval; that we may not be able to raise funds required, that conditions to closing may not be fulfilled and we may not be able to organize and carry out an exploration program in 2023, and other risks associated with being a mineral exploration and development company. These forward-looking statements are made as of the date of this news release and, except as required by applicable laws, the Company assumes no obligation to update these forward-looking statements, or to update the reasons why actual results differed from those projected in the forward-looking statements.

Copyright (c) 2024 TheNewswire - All rights reserved.