VANCOUVER, BC / ACCESSWIRE / April 16, 2024 / Metallic Minerals Corp. (TSXV:MMG)(OTCQB:MMNGF)("Metallic Minerals" or the "Company") is pleased to announce final results from the 2023 drill campaign at the Company's La Plata copper-silver-gold-Platinum Group Element ("Cu-Ag-Au-PGE") project in southwestern Colorado, which finished in December. The exploration program included 4,530 meters ("m") in four diamond drill holes with the dual objectives of expanding on the 1.21-billion-pound copper and 17.6-million-ounce silver inferred mineral resource1, and defining the controls to higher-grade mineralization as seen in drill hole LAP22-04. As announced in February 2023, LAP22-04 was a continuously mineralized discovery drill hole that intercepted 816 m grading 0.41% recovered copper equivalent1 ("CuEq"), with significant widths exceeding 0.5% to 0.7% Cu. The intersection also included higher grade zones exceeding 1% Cu with precious metals grades of up to 11.5 g/t Au+PGE and 47 g/t Ag (see Table 2).

The 2023 field campaign was funded by a May 2023, 9.5% strategic equity investment by Newmont Corporation ("Newmont") with the goal of accelerating the advancement of the La Plata project. Newmont provided technical support and expertise to the project through the technical committee which has included multiple site visits and assistance with geologic and geophysical interpretations and hyperspectral data acquisition. These contributions are expected to continue in 2024 and may include Newmont providing experienced personnel to the project for enhancing surface data acquisition, geologic mapping, and geophysics.

Highlight Results

- All four 2023 holes intersected porphyry-style mineralization starting from surface and continuing over their entire lengths (up to 1,350 m).

- Three of four holes intercepted continuous porphyry style Cu-Ag-Au-PGE mineralization over 500 m in width at 0.3% Cu including significant intervals exceeding 0.5% to 0.7% CuEq with associated Ag, Au and PGEs. Drill hole LAP23-05 intersected 909 m of continuous mineralization from surface grading 0.26% CuEq over the entire hole length, with a 550 m wide higher-grade zone (see Tables 1-2, Figures 1-3).

- Intensity of mineralization in all drill holes varies within the individual porphyry intrusive units based on the density of veining and concentration of associated sulphides that carry the copper, silver, gold, platinum, and palladium.

- Higher grades relate to specific intrusive phases of the porphyritic host rocks with intense potassic alteration and in zones of intense high-temperature argillic alteration, particularly with increased bornite content.

- The deposit remains open to expansion at depth and along trend. Defining the geometry of these higher-grade porphyry units and alteration zones is an important focus of follow up drilling at the Allard resource area in 2024.

- Drilling has extended mineralization vertically from surface to more than 1.5 kilometers (‘km") and 1 km along trend and is anticipated to allow for inclusion of both gold and platinum group elements in future mineral resource estimates along with copper and silver.

- Scanning of 3,848 meters of drill core was completed by GeologicAI providing high-resolution RGB digital photography, laser profilometry using LIDAR, visible and near-infrared ("VNIR") and short-wave infrared ("SWIR") hyperspectral imagery and x-ray fluorescence, allowing for detailed characterization of mineralization and alteration within the Allard deposit.

- An advanced airborne hyperspectral survey covering 157 square kilometers (453-line km) was also completed by SpecTIR in the VNIR, SWIR and long-wave infrared spectra allowing for detailed mineral and alteration mapping across the entire district for comparison with the hyperspectral scanning of mineralization from drill core.

- The U.S. Geologic Survey ("USGS") has identified the La Plata mining district as a potential critical minerals resource area under the Earth Mapping Resources Initiative program. The USGS completed detailed airborne radiometric and magnetic surveys in 2023 along with other studies that will complement surveys completed by the Company.

- An important objective in 2023 was to identify, advance and refine new priority targets outside of the Allard resource area to bring them to a drill testing stage in 2024. Significant high-grade results were received in surface rock samples taken from more than 20 different target areas during the 2023 field season as part of a district-scale surface mapping initiative (see Table 3 and Figure 4). Three of these areas have advanced to a drill testing stage.

Metallic Minerals President, Scott Petsel, stated, "The 2023 exploration program was a major step forward in our understanding of the higher-grade controls to mineralization in the Allard resource area and in the advancement of several exciting surface target zones that demonstrate percent level copper with precious metals that have never been drill tested. Our emerging vision for the La Plata project is that we have the potential for a district-scale system with multiple porphyry centers in addition to the Allard resource area. This is supported by the multi-kilometer scale metal-in-soil values that extend well beyond the area of drilling and correspond with strong alteration responses in our detailed district-scale airborne hyperspectral survey. Our drill results indicate a significant opportunity for resource expansion and have continued to return both broad zones of mineralization and internal higher-grade zones with considerable precious metal associations showing elevated gold, platinum, and palladium values. We look forward to providing further updates on La Plata and our high-grade Keno Silver project in the Yukon as we initiate the 2024 exploration programs."

Table 1 - La Plata Project 2023 Drill Results

| Hole |

From

(m)

|

To

(m)

|

Length

(m)

|

CuEq

(% Rec)

|

Cu

(%)

|

Ag

(g/t)

|

Au

(g/t)

|

Pt

(g/t)

|

Pd

(g/t)

|

Au+PGE

(g/t)

|

| LAP23-05 |

0.0

|

909.0

|

909.0

|

0.26

|

0.21

|

1.55

|

0.040

|

0.023

|

0.034

|

0.097

|

|

69.0

|

619.0

|

550.0

|

0.33

|

0.27

|

1.97

|

0.043

|

0.033

|

0.051

|

0.127

|

|

131.0

|

157.0

|

26.0

|

0.55

|

0.51

|

3.70

|

0.065

|

0.005

|

0.018

|

0.088

|

|

347.0

|

553.0

|

206.0

|

0.41

|

0.31

|

2.29

|

0.043

|

0.058

|

0.092

|

0.193

|

|

347.0

|

445.0

|

98.0

|

0.48

|

0.37

|

2.89

|

0.044

|

0.074

|

0.091

|

0.209

|

|

419.0

|

445.0

|

26.0

|

0.90

|

0.77

|

5.15

|

0.041

|

0.071

|

0.161

|

0.273

|

|

491.0

|

579.0

|

88.0

|

0.39

|

0.25

|

1.77

|

0.062

|

0.07

|

0.123

|

0.255

|

|

541.0

|

553.0

|

12.0

|

0.81

|

0.41

|

2.92

|

0.052

|

0.223

|

0.437

|

0.712

|

|

809.0

|

891.0

|

82.0

|

0.22

|

0.18

|

1.10

|

0.055

|

0.003

|

0.007

|

0.065

|

| LAP23-06 |

0.0

|

1350.4

|

0.0

|

0.18

|

0.15

|

1.37

|

0.023

|

0.017

|

0.030

|

0.070

|

|

221.0

|

803.0

|

582.0

|

0.30

|

0.23

|

2.23

|

0.037

|

0.030

|

0.056

|

0.123

|

|

703.0

|

807.0

|

104.0

|

0.50

|

0.32

|

3.02

|

0.077

|

0.113

|

0.149

|

0.339

|

|

1303.0

|

1335.0

|

32.0

|

0.39

|

0.39

|

1.99

|

0.016

|

0.004

|

0.023

|

0.043

|

|

703.0

|

741.0

|

38.0

|

0.60

|

0.38

|

3.52

|

0.080

|

0.133

|

0.189

|

0.402

|

|

787.0

|

805.0

|

18.0

|

0.74

|

0.43

|

3.31

|

0.133

|

0.211

|

0.244

|

0.588

|

|

1303.0

|

1335.0

|

32.0

|

0.39

|

0.39

|

1.99

|

0.016

|

0.004

|

0.023

|

0.043

|

| LAP23-07 |

30.0

|

260.0

|

230.0

|

0.16

|

0.14

|

1.18

|

0.025

|

0.003

|

0.005

|

0.033

|

|

754.0

|

812.0

|

58.0

|

0.15

|

0.13

|

1.08

|

0.024

|

0.008

|

0.011

|

0.043

|

| LAP23-08 |

0.0

|

1304.8

|

1304.8

|

0.19

|

0.16

|

1.44

|

0.021

|

0.008

|

0.016

|

0.045

|

|

87.0

|

638.0

|

551.0

|

0.28

|

0.25

|

2.17

|

0.029

|

0.009

|

0.020

|

0.058

|

|

639.0

|

711.0

|

72.0

|

0.51

|

0.47

|

4.12

|

0.029

|

0.014

|

0.036

|

0.079

|

|

93.0

|

103.0

|

10.0

|

0.54

|

0.48

|

6.27

|

0.080

|

0.002

|

0.001

|

0.083

|

|

231.0

|

245.0

|

14.0

|

0.49

|

0.48

|

3.43

|

0.006

|

0.010

|

0.000

|

0.016

|

Notes to reported values in Tables 1, 2 and 3 below.

- Recovered Copper Equivalent (CuEq) in Table 1 is determined as follows: CuEq% = [Cu% x recovery] + [Ag g/t x recovery / 31.103 x Ag price / Cu price / 2,204 x 100] + [Au g/t x recovery / 31.103 x Au price / Cu price / 2,204 x 100] + [Pt g/t x recovery / 31.103 x Pt price / Cu price / 2,204 x 100] + [Pd g/t x recovery / 31.103 x Pd price / Cu price / 2,204 x 100]

- Copper equivalent is presented for comparative purposes using conservative long-term metal prices (all USD): $3.75/lb copper, $23.50/oz silver (Ag), $1,850/oz gold (Au), $1,000/Oz platinum (Pt), $1,950/oz Palladium (Pd).

- In the above calculations: 31.103 = grams per troy ounce, 2,204 = pounds per metric tonne.

- The following recoveries have been assumed for purposes of the above equivalent calculations: 90% for Cu and all other listed metals, based on recoveries at similar operations.

- Intervals are reported as measured drill intersect lengths and may not represent true width.

- Dashes in the tables for Ag, Au, Pt and Pd results indicate incomplete assay data.

Table 2 - La Plata Project Drill Result Highlights

|

Hole

|

From

(m)

|

To

(m)

|

Length

(m)

|

CuEq

(% Rec)

|

Cu

(%)

|

Ag

(g/t)

|

Au

(g/t)

|

Pt

(g/t)

|

Pd

(g/t)

|

Au+PGE

(g/t)

|

|

LAP21-02

|

89.0

|

194.2

|

105.2

|

0.43

|

0.40

|

4.33

|

0.038

|

0.002

|

0.008

|

0.048

|

|

LAP22-04

|

0.0

|

816.0

|

816.0

|

0.41

|

0.30

|

2.48

|

0.038

|

0.073

|

0.093

|

0.206

|

|

incl

|

304.8

|

816.0

|

511.2

|

0.52

|

0.36

|

2.83

|

0.044

|

0.057

|

0.100

|

0.201

|

|

Incl

|

449.6

|

505.4

|

55.8

|

0.9

|

0.68

|

5.54

|

0.068

|

0.139

|

0.199

|

0.407

|

|

Incl

|

547.1

|

576.1

|

29.0

|

0.82

|

0.62

|

4.84

|

0.054

|

0.197

|

0.176

|

0.427

|

|

Incl

|

612.6

|

644.6

|

32.0

|

0.85

|

0.60

|

4.55

|

0.141

|

0.147

|

0.188

|

0.476

|

|

Incl

|

786.4

|

816.0

|

29.6

|

1.59

|

0.69

|

5.54

|

0.167

|

0.739

|

0.823

|

1.729

|

|

Incl

|

806.2

|

816.0

|

9.8

|

3.58

|

1.59

|

12.46

|

0.351

|

1.478

|

1.904

|

3.733

|

|

Incl

|

815.

|

816.0

|

0.6

|

11.34

|

5.42

|

47.00

|

0.643

|

5.245

|

5.610

|

11.498

|

|

Allard UG

|

48.6

|

137.6

|

89.0

|

0.50

|

0.48

|

5.05

|

0.033

|

0.005

|

0.008

|

0.046

|

|

C-01

|

299.3

|

412.1

|

112.8

|

0.36

|

0.40

|

-

|

-

|

-

|

-

|

-

|

|

CA-03

|

0.0

|

304.8

|

304.8

|

0.35

|

0.39

|

-

|

-

|

-

|

-

|

-

|

|

Incl

|

100.6

|

304.8

|

204.2

|

0.44

|

0.48

|

-

|

-

|

-

|

-

|

-

|

|

CA-04

|

30.5

|

79.2

|

48.8

|

0.41

|

0.46

|

-

|

-

|

-

|

-

|

-

|

|

HEN-01

|

0.0

|

77.0

|

77.0

|

0.41

|

0.28

|

3.79

|

0.190

|

-

|

-

|

-

|

|

HEN-03

|

0.0

|

61.4

|

61.4

|

0.54

|

0.42

|

5.41

|

0.180

|

-

|

-

|

-

|

|

HEN-04

|

0.0

|

91.9

|

91.9

|

0.71

|

0.36

|

5.50

|

0.520

|

-

|

-

|

-

|

|

LP-01

|

0.0

|

854.4

|

854.4

|

0.24

|

0.26

|

-

|

-

|

-

|

-

|

-

|

|

incl

|

743.7

|

828.4

|

84.7

|

0.51

|

0.57

|

-

|

-

|

-

|

-

|

-

|

|

LP-03

|

1.5

|

396.8

|

395.3

|

0.47

|

0.5

|

1.06

|

0.017

|

-

|

-

|

-

|

|

Incl

|

1.5

|

107.6

|

107.5

|

0.62

|

0.65

|

1.42

|

0.034

|

0.034

|

-

|

-

|

|

LP-04

|

1.5

|

304.8

|

303.3

|

0.36

|

0.40

|

0.30

|

-

|

-

|

-

|

-

|

|

Incl

|

1.5

|

102.7

|

101.2

|

0.61

|

0.67

|

0.81

|

-

|

-

|

-

|

-

|

|

LP-08

|

10.4

|

43.9

|

33.5

|

0.60

|

0.66

|

-

|

-

|

-

|

-

|

-

|

|

95-01

|

592.0

|

1039.4

|

447.4

|

0.21

|

0.16

|

1.68

|

0.026

|

0.029

|

0.030

|

0.085

|

See notes above for reported values in Tables 1, 2 and 3 below.

La Plata Project Overview

The La Plata project is centered on the alteration footprint of a 10 km2 precious metal-rich alkaline copper porphyry system that shows multiple centers of Cu-Ag-Au-PGE mineralization occurring over extensive areas as disseminated porphyry-style mineralization. Surrounding the central porphyry system is an associated high-grade silver and gold-rich epithermal system measuring at least 8 km by 12 km that hosts over 50 identified mineralized veins, replacement, and breccia structures. Historical production from some of these high-grade structures included bonanza grades for silver and gold.

The Allard target area-where over 95% of the recent and historic drilling that has occurred to date-is defined by multiple chalcopyrite and bornite-rich porphyritic intrusions over 1 km length by 800 m width and 1,500 m vertically representing just a small fraction of the larger unexplored project area. Mineralization is hosted in an expansive disseminated chalcopyrite and bornite copper sulphide body that remains open at depth and to the W, NE and SW as defined by drilling. A total of 21,745 m in 63 drill holes have been drilled on the property from the 1950s to present.

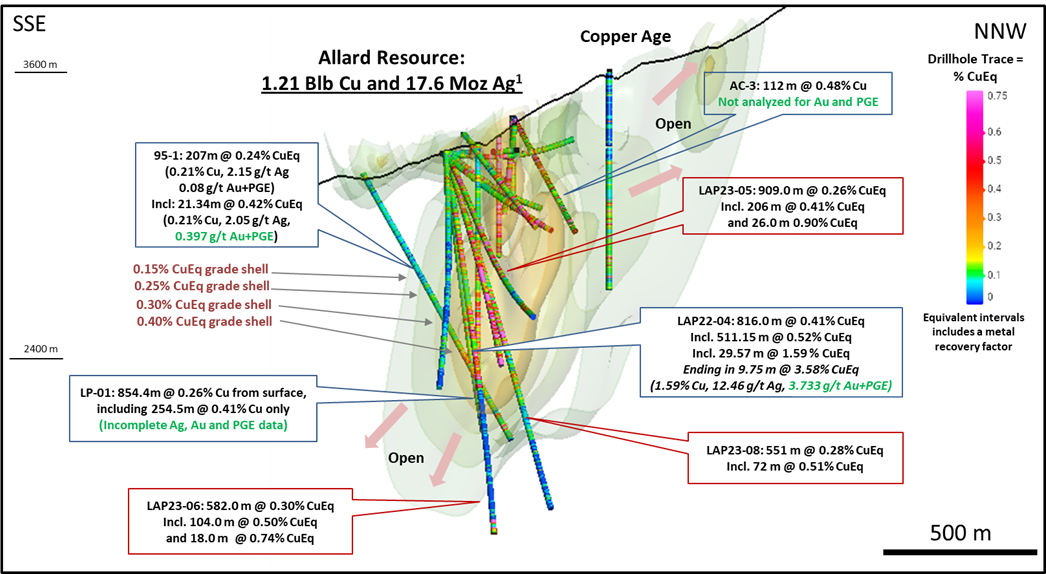

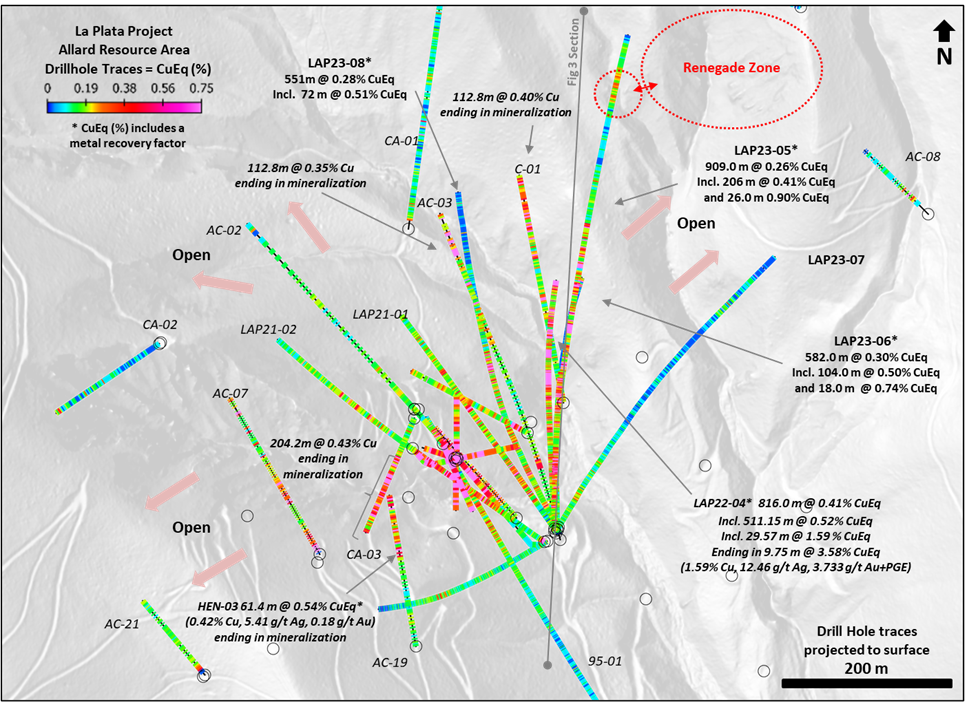

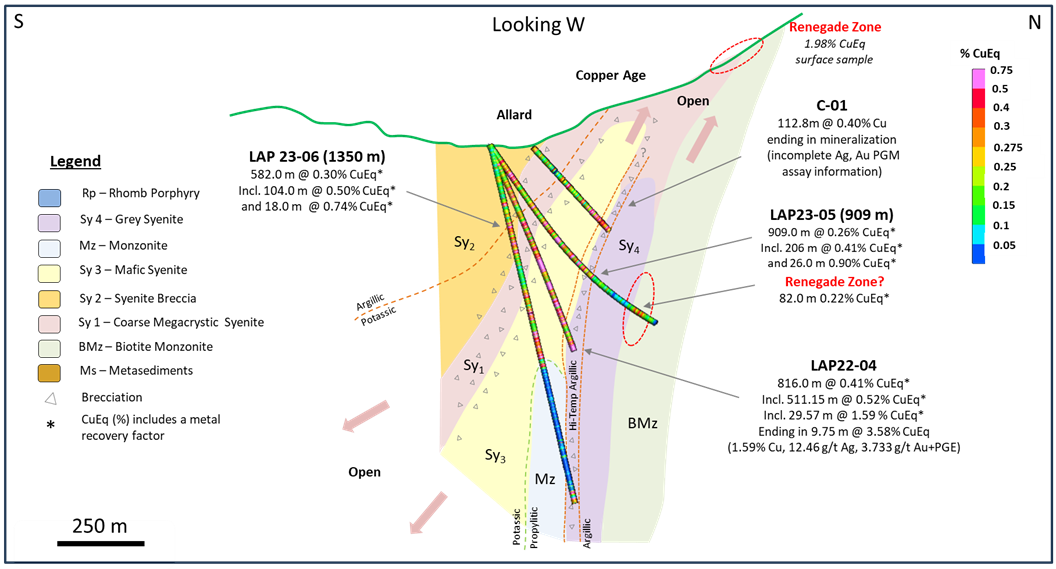

Figures 1-3 display this drill data as an isometric long section, plan and cross-sectional views of the drill results on the La Plata project to date. Higher-grade assays are shown on the drill traces in the red to magenta colors with significant composite grades included as callouts.

Figure 1 -La Plata Isometric Long Sectional View (Looking west, significant drill intervals and mineralized grade shells are shown. Drill holes are shown indicating nearly 1.5 kilometers of vertical mineralization open at depth and along trend to the north, south and to the west. Note 0.25% CuEq cut-off grade shell and higher-grade 0.4% CuEq shell.)

Figure 2 - Plan map of the Allard Resource Area (Showing surface projections of the drill hole traces with CuEq (%) or just Cu (%) in historic holes without precious metals assays.)

Figure 3 - Cross Section Through Holes LAP23-05, LAP23-06, C-01 and LAP22-04 (Showing the geologic relationship of multiple mineralized porphyritic intrusions and identifies significant grade associated with Sy 1, Sy 2, Sy 3 (the Mafic Syenite), with a structural/breccia zone at the contact of Sy 3 and Sy 4 (the Grey Syenite).)

Discussion of Drill Results

The 2023 exploration drilling focused on testing of extensions to the mineral resource laterally and at depth and to better define the geologic controls and vectors to higher-grade mineralization within the Allard deposit. A key finding from the 2023 program was the recognition that the highest-grade mineralization occurs within specific porphyry units with the most intense potassic alteration and in zones of intense high-temperature argillic alteration particularly with increased sulphide content as bornite.

Broad zones of continuous mineralization over 500 m in width were intersected in three of the four drill holes with significant intervals exceeding 0.5% to 0.7% CuEq with associated Ag, Au, and PGEs. This is broadly consistent with the tenor of results from LAP22-04, which intersected 816 m of continuous mineralization, and historic hole C-01 which also intersected the same porphyry units (See Tables 1-2, Figures 1-3 above). La Plata drill holes 04, 05, 06 and 08 show four of the highest grade-thickness values in the Allard deposit to date ranging from 232 %-m to 334 %-m. These values place all four holes in the top 10 for copper drill hole results in the U.S. last year, as documented by www.juniormininghub.com.

This detailed logging of the drill core, combined with the extensive hyperspectral data from scanned drill holes, allowed the recognition and delineation of multiple mineralized intrusive phases, which provided important understanding of the relationship between individual porphyry units in the system and the controls to higher-grade mineralization.

Up to seven igneous rock types were encountered in the drilling, and several of the syenitic porphyritic rocks appear to be the most receptive hosts for higher-grade mineralization. Variably porphyritic syenites, Sy 1 to Sy 3, host the strongest copper sulphide mineralization. The Sy 3 unit, also known as the Mafic Syenite, may represent an important causative intrusive. All three of these porphyry units are believed to continue to the SW and NE and to depth and may underlie the higher-grade mineralization seen in the Allard tunnel area.

Recognition of the geologic relationships between these porphyritic rock types and delineation of their alteration patterns provides a strong basis to target the higher-grade receptive porphyry units. Follow-up drilling at the Allard deposit will focus on drilling below the higher-grade Allard tunnel area and testing the strike extensions along the SW to NE structural corridor that hosts key higher-grade porphyry units which remain open to expansion.

Surface Exploration Results and Targeting

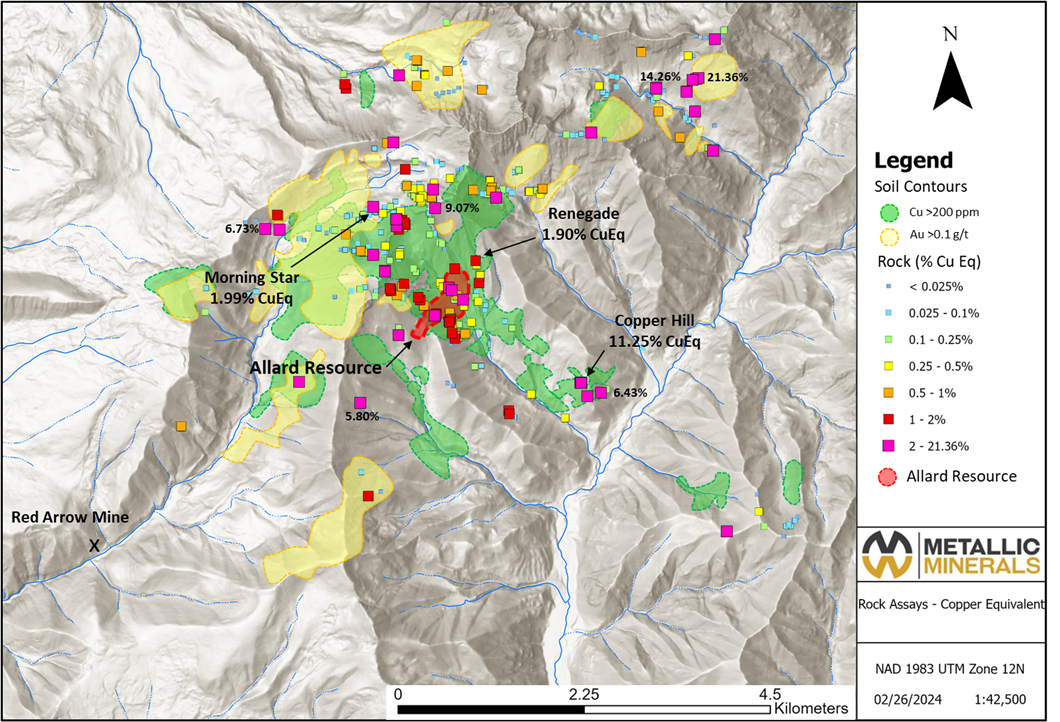

An important additional objective in the La Plata 2023 exploration program was to identify, advance and refine new priority targets outside of the Allard resource area to bring them to a drill testing stage in 2024. La Plata has the potential to host a district-scale alkalic porphyry system with multiple porphyry centers, similar to the Alkalic systems at Cadia in Australia, and Red Chris and Galore Creek in the Golden Triangle of British Columbia.

This concept is supported by the multi-kilometer scale metal-in-soil values at La Plata that extend well beyond the area of drilling and correspond with strong alteration responses in the detailed district-scale airborne hyperspectral survey.

In 2023, an extensive program of rock sampling in conjunction with detailed geologic surface mapping both inside and outside of the Allard resource area was completed with support from the district scale hyperspectral survey. This work has identified new high-priority target areas for follow-up exploration and has expanded the known surface footprint of the Allard mineral system.

Significant high-grade results were received in surface rock samples taken from more than 20 different target areas during the field season. Several of these surface target zones have returned percent level copper grades with significant silver, gold, and PGE values in rock sampling that have never been drill tested (see Table 3 and Figure 4).

This work has identified significant drill-ready targets at Morningstar, Renegade, and Copper Hill, which may represent new porphyry center discoveries on the La Plata property. Follow up work is planned on at these targets in 2024 along with work to advance additional surface targets to a drill-ready stage.

Table 3- Surface Grab and Chip Rock Sample Highlights from Across the La Plata Project

|

Target

|

Style

|

CuEq

(% Rec)

|

AuEq (g/t Rec)

|

Cu

(%)

|

Ag (g/t)

|

Au (g/t)

|

Pt

(g/t)

|

Pd

(g/t)

|

Au+PGE (g/t)

|

|

Apex

|

Porphyry

|

4.33

|

6.02

|

3.55

|

127.99

|

0.03

|

0.164

|

0.012

|

0.207

|

|

Apex

|

Porphyry

|

4.11

|

5.71

|

4.37

|

19.22

|

0.02

|

0.009

|

0.002

|

0.027

|

|

Copper Age

|

Porphyry

|

9.10

|

12.65

|

10.00

|

1.09

|

0.03

|

0.006

|

0.103

|

0.138

|

|

Copper Hill

|

Porphyry

|

18.36

|

25.52

|

17.90

|

169.31

|

1.18

|

0.085

|

0.105

|

1.370

|

|

Copper Hill

|

Porphyry

|

6.43

|

8.94

|

0.01

|

6.24

|

9.82

|

0.001

|

0.005

|

9.829

|

|

Copper Hill

|

Porphyry

|

5.94

|

8.26

|

5.35

|

53.00

|

0.46

|

0.653

|

0.241

|

1.351

|

|

Divide

|

Porphyry

|

9.07

|

12.61

|

10.00

|

0.90

|

0.03

|

0.046

|

0.048

|

0.123

|

|

Divide

|

Epithermal

|

4.87

|

6.77

|

0.09

|

0.79

|

7.38

|

0.002

|

0.001

|

7.385

|

|

Dolly

|

Porphyry

|

0.91

|

1.26

|

0.10

|

48.60

|

0.64

|

0.007

|

0.001

|

0.651

|

|

Evening Star

|

Porphyry

|

6.73

|

9.35

|

7.41

|

0.20

|

0.09

|

0.001

|

0.005

|

0.092

|

|

Evening Star

|

Epithermal

|

5.88

|

8.17

|

0.00

|

0.87

|

9.07

|

0.002

|

0.001

|

9.073

|

|

Little Kate

|

Epithermal

|

21.36

|

29.69

|

0.11

|

66.33

|

32.00

|

0.002

|

0.001

|

32.003

|

|

Little Kate

|

Epithermal

|

11.28

|

15.68

|

0.04

|

83.30

|

16.30

|

0.002

|

0.001

|

16.303

|

|

Little Kate

|

Epithermal

|

6.59

|

9.16

|

1.11

|

228.00

|

5.75

|

0.002

|

0.001

|

5.752

|

|

Little Kate

|

Epithermal

|

5.42

|

7.53

|

0.06

|

14.00

|

8.12

|

0.002

|

0.001

|

8.118

|

|

Madden

|

Skarn

|

5.80

|

8.06

|

1.53

|

532.00

|

0.09

|

0.004

|

0.001

|

0.090

|

|

Morning Star

|

Porphyry

|

5.85

|

8.13

|

5.99

|

46.37

|

0.10

|

0.001

|

0.011

|

0.110

|

|

Morning Star

|

Porphyry

|

5.13

|

7.13

|

3.83

|

19.47

|

0.18

|

0.112

|

2.020

|

2.308

|

|

Morning Star

|

Porphyry

|

4.46

|

6.20

|

4.56

|

26.17

|

0.12

|

0.005

|

0.087

|

0.216

|

|

Morning Star

|

Porphyry

|

1.70

|

2.36

|

1.02

|

4.14

|

0.04

|

0.012

|

1.048

|

1.102

|

|

N. Gauge

|

Epithermal

|

6.11

|

8.49

|

0.02

|

95.00

|

8.21

|

0.001

|

0.005

|

8.214

|

|

Renegade

|

Porphyry

|

1.99

|

2.77

|

1.90

|

3.22

|

0.39

|

0.002

|

0.001

|

0.390

|

|

South Rush

|

Epithermal

|

5.07

|

7.05

|

0.12

|

30.33

|

7.28

|

0.001

|

0.005

|

7.288

|

|

T-29

|

Epithermal

|

14.26

|

19.82

|

0.04

|

13.20

|

21.80

|

0.000

|

0.000

|

21.800

|

|

T-29

|

Epithermal

|

5.44

|

7.56

|

0.11

|

0.54

|

8.23

|

0.002

|

0.001

|

8.236

|

See notes above under Table 1.

Figure 4 - Plan Map of La Plata Project Claims Showing Surface Rock Sample Resultsover Generalized Soil Geochemistry Contours with Copper >200 ppm and Gold > 0.1 ppm (Map shows the area of high Au-Ag-Te epithermal mineralization in veins, replacements, skarns and breccias (represented by Au >0.1 g/t contour) around a broad central area of porphyritic alkaline intrusions (represented by Cu >200 ppm). The Allard resource and new drill ready targets are identified.)

Alkaline Porphyry Systems

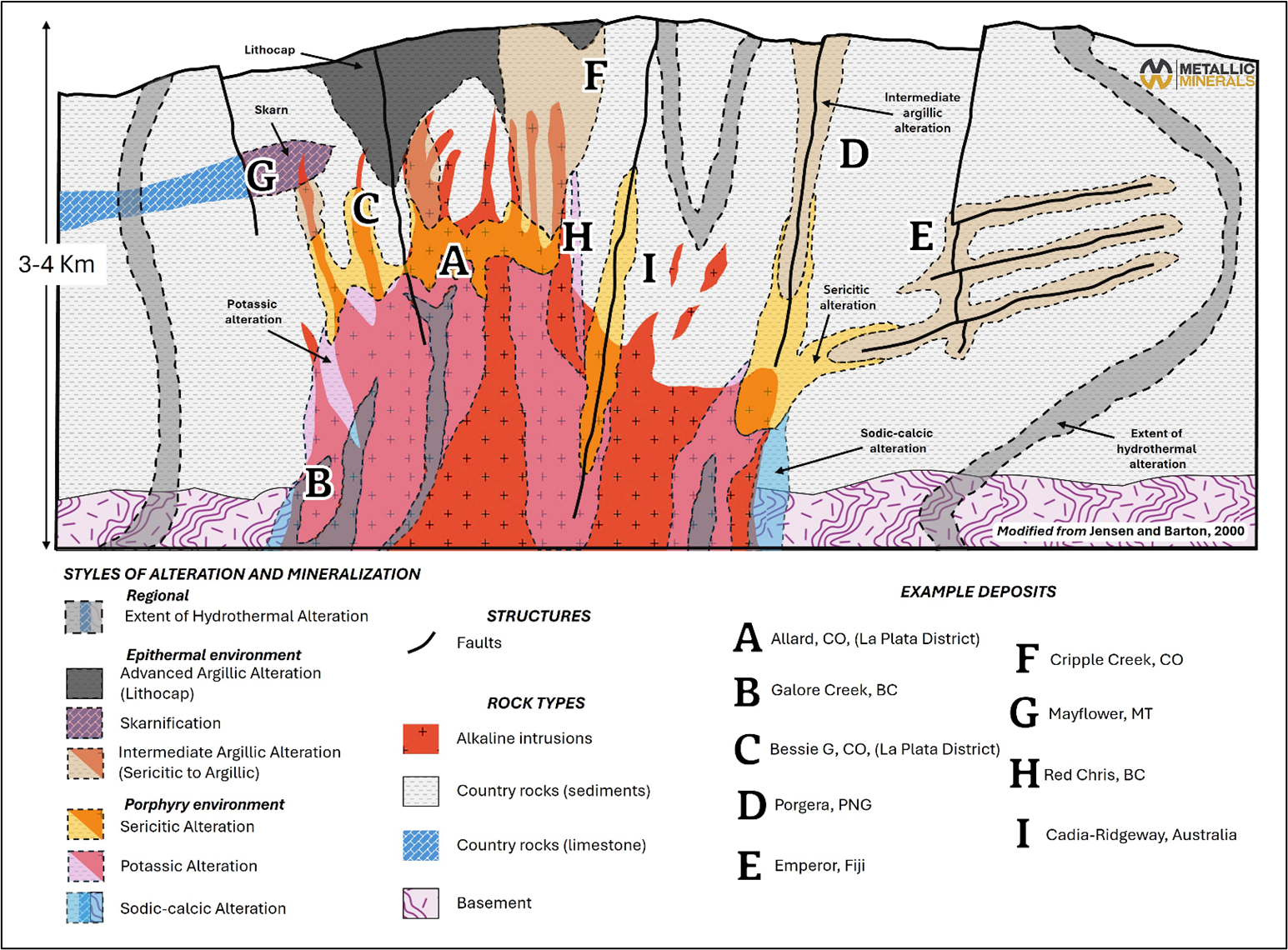

Alkaline porphyry intrusions are a specific type of porphyry deposit with distinct characteristics that include alkaline compositions, associated anomalous precious metal mineralization (Ag-Au-PGEs) and distinctive alteration patterns that are characteristic of their formation processes. Alkaline-related systems can range from porphyry-related to epithermal systems and include some of the world's largest economic deposits for copper and gold such as Bingham Canyon (Rio Tinto), Cadia, Galore Creek and Red Chris (Newmont) and as well as world class gold deposits including Porgera (Barrick) and Cripple Creek (Newmont) (Jenson and Barton, 20002). Figure 5, shows deposits from the La Plata district, including Allard and Bessie G, placed in context in terms of their relative setting with these other Alkalic related systems. The Metallic Minerals management team has extensive experience from the development of the Galore Creek deposit with NovaGold Resources through the period of resource growth and development to feasibility. The Galore Creek deposit contains 13.6 Blbs of copper, 10.8 Moz Au and 193.8 Moz Ag3 in Resources, and is considered one of the closest analogs to the geologic setting at the Allard Resource and La Plata project.

The La Plata project represents a district-scale opportunity for additional discoveries of both high-level alkalic porphyry Cu-Ag-Au-PGE deposits and epithermal Au-Ag-Tellurium vein deposits centered on a 10 km2 area of alteration. Recent field work and previous machine-learning efforts with ALS GoldSpot Discoveries, have identified over 20 surface target areas outside of the Allard resource area for additional exploration.

Figure 5 - Schematic illustration of the relationship between magmatic intrusive rocks, host rocks, hydrothermal alteration and metal distribution in major alkaline-related copper and gold systems (after Jensen and Barton 2000).

The La Plata Property Overview

Metallic Minerals' 100% owned La Plata project covers 44 square kilometers 20 km north of Mancos, Colorado, within the historic La Plata mining district, which is in the southwest portion of the prolific Colorado Mineral Belt. The La Plata project is accessible by highways and improved gravel roads and is near significant power transmission lines.

The La Plata district has a long and rich history of mining with the first silver deposits discovered in the 1700s by Spanish explorers. High-grade silver and gold production has been documented from the 1870s through the early 1940s from mineralized deposits at over ninety individual mines and prospects4. From the 1950s to 1970s, major miners, including Rio Tinto (Bear Creek) and Freeport-McMoRan (Phelps Dodge), explored the district focused on potential for bulk-tonnage disseminated and stockwork hosted mineralization5. Freeport-McMoRan retained ownership of claims in the district until 2002 when they sold their holdings to the underlying vendors during the lows of the last metal price cycle.

About Metallic Minerals

Metallic Minerals Corp. is a resource-stage mineral exploration and development company, focused on copper, silver, gold, and platinum group elements in the La Plata mining district in Colorado, and silver and gold in the high-grade Keno Hill and Klondike districts of the Yukon. Our objective is to create shareholder value through a systematic, entrepreneurial approach to making exploration discoveries, growing resources, and advancing projects toward development.

At the Company's La Plata project in southwestern Colorado, the expanded 2023 NI 43-101 mineral resource estimate highlights a significant porphyry copper-silver resource containing 1.2 Blbs copper and 17.6 Moz of silver with numerous additional targets showing potential for a district scale porphyry corridor. In May 2023, the Company announced a 9.5% strategic investment by Newcrest Mining Limited (acquired by Newmont Corporation in November 2023) to accelerate the advancement of the La Plata project. The U.S. Geologic Survey ("USGS") has identified the La Plata mining district as a potential critical minerals resource area under the Earth Mapping Resources Initiative program and in 2023 completed significant geologic and geophysical studies to enhance understanding of the critical mineral occurrence in the district. In the 2023 Fraser Institute's Annual Survey of Mining Companies, Colorado ranked 5th globally for investment attractiveness and 2nd in the USA.

In Canada's Yukon Territory, Metallic Minerals has consolidated the second-largest land position in the historic high-grade Keno Hill silver district, directly adjacent to Hecla Mining Company's operations, with more than 300 Moz of high-grade silver in past production and current M&I resources. The new 2024 Resource Estimate at the Company's Keno Silver project adds 18.16 Moz silver equivalent (including 9.81 Moz silver) to the district, representing an 8.4% increase to the district's total silver resource3. Hecla, the largest primary silver producer in the USA and third largest in the world, is anticipating full production at its Keno Hill operations in 2024.

The Company is also one of the largest holders of alluvial gold claims in the Yukon and is building a production royalty business by partnering with experienced mining operators.

All of the districts in which Metallic Minerals operates have seen significant mineral production and have existing infrastructure, including power and road access. Metallic Minerals is led by a team with a track record of discovery and exploration success on several major precious and base metal deposits in North America, as well as having large-scale development, permitting and project financing expertise. The Metallic Minerals team is committed to responsible and sustainable resource development and has worked closely with Canadian First Nation groups, US Tribal / Native Corporations, and local communities to support successful project development.

Footnotes:

- See news release dated July 31, 2023. The Mineral Resource has been estimated in conformity with CIM Estimation of Mineral Resource and Mineral Reserve Best Practices Guidelines (2019) and current CIM Definition Standards. The constrained Mineral Resources are reported at a base case cut-off grade of 0.25% copper equivalent, based on metal prices of $3.75/lb Cu and $22.50/oz Ag, assumed metal recoveries of 90% for Cu and 65% for Ag, a mining cost of US$5.30/t rock and processing and G&A cost of US$11.50/t mineralized material. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Jensen, E.P., and Barton, M.D. (2000). Gold deposits related to alkaline magmatism, in Hagemann, S.G., and Brown, P.E., eds., Gold in 2000: Littleton, Society of Economic Geologists, Inc., p. 279-314.

- Newmont 2023 Reserves and Resources Release (https://operations.newmont.com/_doc/Newmont-2023-Reserves-and-Resources-Release.pdf).

- Eckel, USGS Prof Paper 219, Geology and Ore Deposits of the La Plata Mining District, 1949.

- Bear Creek Mining (now Rio Tinto), Humble Oil (now Exxon) and Phelps Dodge (now Freeport-McMoRan) company reports.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Website: www.mmgsilver.com Phone: 604-629-7800

Email: cackerman@mmgsilver.com Toll Free: 1-888-570-4420

Qualified Person

The disclosure in this news release of scientific and technical information regarding exploration projects on Metallic Minerals' mineral properties has been reviewed and approved by Jeff Cary, CPG, who is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

Quality Assurance / Quality Control

All samples were prepared by Bureau Veritas' (BV) Sparks, Nevada, USA facility and analyzed at their Burnaby, British Columbia, Canada facility. All samples were prepared using BV code PRP70-250 producing a 250 g pulp for subsequent analysis. All samples were analyzed using the MA-250 method with a 0.25-gram sample size, four-acid digestion with an ICP-MS analysis. Over-limit copper and silver samples were analyzed using the MA-401 method with a 1.0-gram sample size, four-acid digestion with atomic absorption spectrometry analysis. In addition, all samples were analysed using the FA330 method with a 30-gram sample size, fire assay fusion with an ICP-ES finish to obtain gold, platinum, and palladium values. All results have passed the QAQC screening by the lab and the company utilized a quality control and quality assurance program which included blank, duplicate, and multiple certified standard reference samples and third-party umpire samples.

Forward-Looking Statements

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding potential mineralization, historic production, estimation of mineral resources, the realization of mineral resource estimates, interpretation of prior exploration and potential exploration results, the timing and success of exploration activities generally, the timing and results of future resource estimates, permitting time lines, metal prices and currency exchange rates, availability of capital, government regulation of exploration operations, environmental risks, reclamation, title, statements about expected results of operations, royalties, cash flows, financial position and future dividends as well as financial position, prospects, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Metallic Minerals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, unsuccessful exploration results, unsuccessful operations, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration, development of mines and mining operations is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Metallic Minerals and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Metallic Minerals Corp.

View the original

press release on accesswire.com