(TheNewswire)

Toronto - May 06, 2024 - TheNewswire: AbraSilver Resource Corp. (TSX.V:ABRA; OTCQX: ABBRF) ("AbraSilver" or the “Company”) is pleased to announce that the Company has commenced a 20,000-metre (“m”) diamond drilling program on its wholly-owned Diablillos property in Salta Province, Argentina (“Diablillos” or the “Project”). This milestone marks the beginning of a fully-funded, extensive exploration campaign aimed at further delineating and expanding the Project’s high-grade silver-gold mineralization.

The Phase IV drill program will prioritize target areas with known mineralization as well as exploring newly identified prospective exploration targets within the broader Diablillos land package. Drilling activities have now commenced with one drill rig and two additional drill rigs are expected to arrive at the Project within the next few weeks.

Key Highlights

-

The fully-funded Phase IV exploration campaign will consist of three diamond drill rigs, drilling a total of 20,000 m, and is expected to be completed by January 2025

-

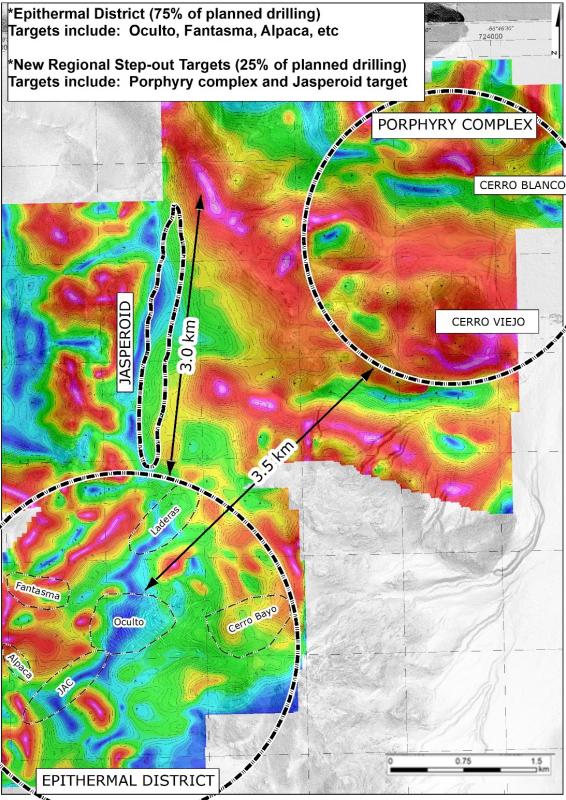

The drill program will be split approximately 75%/25% between the following respective areas:

-

The existing epithermal district, including the Oculto, JAC, Fantasma, Alpaca and Cerro Bayo deposits;

-

The prospective porphyry complex located approximately 4 km northeast of Oculto and the newly identified Jasperoid target, both of which remain largely untested to date.

John Miniotis, President and CEO, commented, “We are thrilled to re-commence drilling activities targeting the significant untested exploration potential across our Diablillos project. Following the recently announced positive Pre-Feasibility Study and the exceptional results from our prior exploration campaigns, this next phase of drilling will aim to identify multiple new mineralized zones beyond the existing Oculto and JAC deposits. We look forward to providing regular updates on our exploration progress, and we expect 2024 to be a very catalyst-rich and value adding year for AbraSilver.”

Dave O’Connor, Chief Geologist, commented, “We are very excited to be ramping up our exploration activities at site. Our Phase IV drill campaign will focus on high-priority targets which include the Alpaca trend, the Oculto-Fantasma trend, and the Oculto-JAC connection, each of which has the potential to add additional high-grade silver mineralization. Additionally, we will be testing new regional step-out targets that have had very limited historical drilling to date, and represent blue-sky upside potential.”

Fully-FundedPhase IV Drill Campaign – High-Priority Exploration Targets

The 20,000 m Phase IV drill program will focus on the following exploration targets:

Epithermal District: Approximately 75% of the drill program will focus on expanding theexisting Mineral Resource estimates near the main Oculto deposit, and on identifying additional near-surface high-grade silver-gold oxide mineralization.

-

Oculto Northeast Zone: Broad spaced drilling within the conceptual Oculto open pit and its northeast extensions in 2023 intersected silver and gold mineralization which was not included in the latest Mineral Resource estimate. This new mineralized zone represents a high-priority target.

-

Fantasma:Historical drilling at Fantasma outlined a Mineral Resource estimate which is located approximately 1 km west-northwest of the Oculto deposit. Recent intercepts suggest that silver mineralization continues from Oculto towards the Fantasma zone and that these zones may connect.

-

Alpaca: Recent drilling in this area has uncovered a trend of silver mineralization perpendicular to the JAC zone which is believed to connect the Alpaca target to the high-grade JAC zone.

-

Laderas: Drilling is planned to explore for extensions of the existing gold dominant Mineral Resource historically outlined in this area which is immediately north of the conceptual Oculto open pit boundary.

-

Cerro Bayo: A recent reinterpretation of geology has emphasised the possibility of shallow mineralisation in the Cerro Bayo area, which is located approximately 500 m east of the Oculto open pit boundary. A previous geochemical survey obtained highly anomalous gold results and a historical drill hole intersected shallow gold mineralization.

New Regional Step-out Targets: Approximately 25% of the drill program will be focused on new regional step-out exploration targets that remain largely untested to date. These targets include the substantial alteration zone and associated anomalous gold in historical shallow holes drilled at Cerro Viejo and the newly defined Jasperoid magnetic target (Figure 1).

-

Porphyry Complex (Cerro Blanco / Cerro Viejo): The Cerro Blanco / Cerro Viejo area is located approximately 3.5 km northeast of Oculto. Following an electromagnetic survey the Company plans to drill select deeper holes to explore for an underlying porphyry system. Gold mineralization in this area is typically associated with pyrite in quartz-sericite alteration, which is interpreted as potentially representing the upper part of a mineralised porphyry system.

-

Jasperoid Target: This is an elongated zone of low magnetic response which was identified in the geophysical survey conducted in late 2023. The zone follows the trend of a major north-south regional fault and a nearby historical drill hole intersected anomalous gold in vuggy silica. The geology of this zone makes it is a high priority target for epithermal gold-silver mineralisation.

Figure 1 – Phase IV Exploration Key Target Areas

Click Image To View Full Size

About Diablillos

The Diablillos property is located within the Puna region of Argentina, in the southern part of Salta Province along the border with Catamarca Province, approximately 160 km southwest of the city of Salta and 375 km northwest of the city of Catamarca. The property comprises 15 contiguous and overlapping mineral concessions acquired by AbraSilver in 2016. The project site has good year-round accessibility through a 150 km paved road, followed by a well-maintained gravel road, shared with other adjacent projects.

There are several known mineral zones on the Diablillos property. Approximately 150,000 m have been drilled to date, which has outlined multiple occurrences of epithermal silver-gold mineralization at Oculto, JAC, Laderas and Fantasma. Additionally, several satellites zones of silver/gold-rich epithermal mineralization have been located within a 500 m to 1.5 km distance surrounding the Oculto/JAC epicentre.

Comparatively nearby examples of high sulphidation epithermal deposits include: La Coipa (Chile); Yanacocha (Peru); El Indio (Chile); Lagunas Nortes/Alto Chicama (Peru) Veladero (Argentina); and Filo del Sol (Argentina).

Table 1 shows the Measured and Indicated Mineral Resources at Diablillos.

Table 1 – Diablillos Mineral Resource Estimate

|

Deposit

|

Zone

|

Category

|

Tonnes

(000 t)

|

Ag

(g/t)

|

Au

(g/t)

|

AgEq

(g/t)

|

Contained Ag

(k oz Ag)

|

Contained

Au

(k oz Au)

|

Contained

AgEq

(k oz AgEq)

|

|

Oculto

|

Oxides

|

Measured

|

12,170

|

101

|

0.95

|

178

|

39,519

|

372

|

69,523

|

|

Indicated

|

34,654

|

64

|

0.85

|

133

|

71,306

|

947

|

147,748

|

|

Measured &

Indicated

|

46,824

|

74

|

0.88

|

145

|

111,401

|

1,325

|

218,335

|

|

Inferred

|

3,146

|

21

|

0.68

|

76

|

2,124

|

69

|

7,677

|

|

JAC

|

Oxides

|

Measured

|

1,870

|

210

|

0.17

|

224

|

12,627

|

10

|

13,452

|

|

Indicated

|

3,416

|

198

|

0.12

|

208

|

21,744

|

13

|

22,808

|

|

Measured &

Indicated

|

5,286

|

202

|

0.13

|

212

|

34,329

|

22

|

36,191

|

|

Inferred

|

77

|

77

|

-

|

77

|

190

|

-

|

190

|

|

Fantasma

|

Oxides

|

Measured

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Indicated

|

683

|

105

|

-

|

105

|

2,306

|

-

|

2,306

|

|

Measured &

Indicated

|

683

|

105

|

-

|

105

|

2,306

|

-

|

2,306

|

|

Inferred

|

10

|

76

|

-

|

76

|

24

|

-

|

24

|

|

Laderas

|

Oxides

|

Measured

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Indicated

|

464

|

16

|

0.91

|

89

|

239

|

14

|

1,334

|

|

Measured &

Indicated

|

464

|

16

|

0.91

|

89

|

239

|

14

|

1,334

|

|

Inferred

|

55

|

43

|

0.57

|

89

|

76

|

1

|

157

|

|

Total

|

Oxides

|

Measured

|

14,040

|

116

|

0.85

|

184

|

52,146

|

382

|

82,975

|

|

Indicated

|

39,217

|

76

|

0.77

|

138

|

95,594

|

974

|

174,196

|

|

Measured &

Indicated

|

53,257

|

87

|

0.79

|

151

|

148,275

|

1,360

|

258,087

|

|

Inferred

|

3,288

|

23

|

0.66

|

76

|

2,415

|

70

|

8,049

|

Notes for Mineral Resource Estimate – as of November 22, 2023:

-

Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

-

The formula for calculating AgEq is as follows: Silver Eq oz = Silver oz + Gold oz x (Gold Price/Silver Price) x (Gold Recovery/Silver Recovery).

-

The Mineral Resource model was populated using Ordinary Kriging grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids, which are a combination of lithology and alteration domains. The 1m composite grades were capped where appropriate.

-

The Mineral Resource is reported inside a conceptual Whittle open pit shell derived using US$ 24.00/oz Ag price, US $1,850/oz Au price, 82.6% process recovery for Ag, and 86.5% process recovery for Au. The constraining open pit optimization parameters used were US $1.94/t mining cost, US $22.97/t processing cost, US $3.32/t GA cost, and average 51-degree open pit slopes.

-

The MRE has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

-

A Net Value per block ("NVB") cut-off was used to constrain the Mineral Resource with the conceptual open pit. The NVB was based on "Benefits = Revenue-Cost" being positive, where, Revenue = [(Au Selling Price (US$/oz) - Au Selling Cost (US$/oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (US$/oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + GA Cost (US$/t) + [Royalty Cost (%) x Revenue]. The NVB method resulted in an average equivalent cut-off grade of approximately 45g/t AgEq.

-

The Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods.

-

In-situ bulk density was assigned to each model domain, according to samples averages of each lithology domain, separated by alteration zones and subset by oxidation.

-

All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

-

Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

-

The Mineral Resource was estimated by Mr. Luis Rodrigo Peralta, B.Sc., FAusIMM CP (Geo), Independent Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

-

Mr. Peralta is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

-

All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

Technical information in this news release has been approved by David O’Connor P.Geo., Chief Geologist for AbraSilver, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina. The current Proven and Probable Mineral Reserve estimate for Diablillos consists of 42.3 Mt grading 91 g/t Ag and 0.81 g/t Au, containing approximately 124 Moz silver and 1.1 Moz gold, with significant further exploration upside potential. In addition, the Company has entered into an earn-in option and joint venture agreement with Teck on the La Coipita project, whereby Teck can fund up to US$20 million in exploration expenditures and make certain other payments to earn up to an 80% interest. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. on the OTCQX under the symbol “ABBRF.”

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively please contact:

John Miniotis, President and CEO

info@abrasilver.com

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. When considering this forward-looking information, readers should keep in mind the risk factors and other cautionary statements in the Company’s disclosure documents filed with the applicable Canadian securities regulatory authorities on SEDAR+ at www.sedarplus.ca. The risk factors and other factors noted in the disclosure documents could cause actual events or results to differ materially from those described in any forward-looking information. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Copyright (c) 2024 TheNewswire - All rights reserved.