Transparency improved globally in 2024, with Asia rising as a standout as markets make progress toward sustainability goals and AI adoption

CHICAGO, Aug. 27, 2024 /PRNewswire/ -- Real estate transparency is more critical than ever in times of uncertainty, and markets emerging as the most transparent are pulling further ahead based on investments in technology integration and AI, data availability and sustainability. This is according to JLL and LaSalle's (NYSE: JLL) biennial, proprietary Global Real Estate Transparency Index (GRETI), which benchmarks market transparency to help inform how real estate is invested in, developed, and occupied in different regions around the globe.

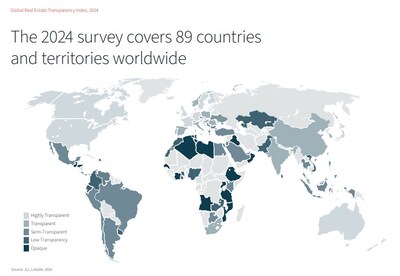

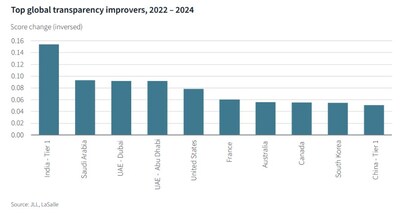

While transparency has increased across most nations and territories since JLL's 2022 report, the index finds that Europe remains the most transparent region, and highly transparent commercial real estate markets have seen the strongest progress. Among the global top improvers are the U.S., Canada, France, and Australia, while Singapore has entered the 'Highly Transparent' group for the first time, boosted by a focus on sustainability and digital services. The top set of countries has attracted over $1.2 trillion in direct commercial real estate investment over the last two years, representing over 80% of the global total, positioning them to lead the cyclical recovery in liquidity as capital market activity increases.

In step with Singapore, countries in Asia have recorded the strongest average transparency improvements since 2022. Globally, India is the top improver in transparency, with greater data coverage and quality across property sectors ranging from industrial to data centers. Japan, Australia, cities in Mainland China, South Korea, the United Arab Emirates, and Saudi Arabia also saw progress in 2024. By contrast, the Sub-Saharan Africa region saw the least progress in transparency, though some signs of improvement emerged in Kenya, Nigeria, and Ghana.

"The focus on transparency for investors has never been greater in global real estate markets as external challenges such as geopolitical tensions and election cycles draw increased attention in the near term," said Richard Bloxam, CEO, Capital Markets, JLL. "On the horizon, additional drivers like artificial intelligence and higher standards of sustainability obligations and reporting will continue to push investors to seek greater transparency."

"Highly transparent markets in this year's Index represent over half of income-producing real estate worldwide. Countries with transparent pricing and fundamentals, especially across the diverse range of specialty sectors and sub-sectors, will likely lead the real estate liquidity recovery," said Brian Klinksiek, Global Head of Research and Strategy for LaSalle Investment Management. "Diversification will be critical as the investible universe continues to expand in terms of breadth and complexity."

AI and sustainability drive new transparency opportunities and challenges

The proliferation of AI has been rapid, hastening expectations for its impact on real estate with the influence of tools including JLL's AI platform, JLL GPT. It is estimated that over 500 companies are currently providing real estate-specific AI services, and with investment growing significantly, early findings suggest AI will boost transparency across the industry with its ability to review and summarize large volumes of data and analytics, automate building management, and power urban and architectural design. However, experts and policymakers have raised the risks of AI and introduced policies such as the U.S. Executive Order on AI and recently approved EU AI Act to ensure the responsible deployment of the technology to maintain transparency.

In parallel, sustainability marked the largest improvement in the 2024 Index, as nations race to halve carbon emissions by 2030 to meet the Paris Agreement, and the introduction of mandatory decarbonization pathways set new building performance standards, sustainability reporting requirements, and corporate commitments. France, Japan, and the U.S.- with 40 U.S. cities committed to passing a Building Performance Standard requiring building energy use or emission reductions by 2026 – emerged as leaders in sustainability for implementing energy performance requirements for both existing and new buildings, energy use reporting, and biodiversity protection and restoration. These markets with the clearest long-term pathway to more sustainable real estate will offer the most transparent and predictable environments, allowing occupiers to make decisions with confidence, governments to meet decarbonization targets, and investors to future-proof their portfolios.

However, despite significant progress made, sustainability metrics continue to be among the least transparent globally. Beyond the most transparent markets, mandatory building performance standards, public disclosure of buildings' energy use, climate risk reporting, and resilience planning are still limited. The rate of building decarbonization retrofits will need to triple to align with net zero carbon pathways, while demand for green buildings significantly outstrips demand – only 30% of demand for low carbon office space in the major global markets is likely to be met by 2030. Looking ahead, sustainability transparency is expected to grow over the next two years across the world's largest economies including the U.S., EU, U.K., China, Japan, Korea, Canada, and Australia as new requirements are enacted.

With these emerging trends, such as technology integration and sustainability, comes diversification, as investors look to identify assets that will benefit most from these long-term themes. This is resulting in an expansion of the investible universe, and a significant reallocation of capital; the share of global investment into the industrial and living sectors has risen from 29% ten years ago, to account for 50% of global direct investment over the past year, while institutional investors are increasingly active in emerging asset types such as data centers or lab space.

Debt markets, money laundering, and beneficial ownership are among key transparency themes to watch

Approximately US$3.1 trillion of global real estate assets have maturing debt between 2024 and 2025, and US$2.1 trillion of debt will need refinancing. Roughly 30% has been completed over the first half of 2024; however, monetary authorities have raised concerns about the potential risks from the relative lack of transparency as non-bank lenders expand and complement traditional sources of credit. While commercial real estate lending was historically dominated by regulated banks, the lender landscape has broadened with new credit sources such as debt funds, pensions and insurance companies emerging. This diversification has created a more balanced market, but also one with less visibility into financing conditions in many countries, raising new transparency concerns.

Alongside debt markets, money laundering and beneficial ownership regulations have surfaced as transparency areas to watch. New guidance from the Financial Action Task Force (FATF), requiring countries to ensure they can track the true ownership of companies, paired with widening financial sanctions regimes, have maintained momentum for improving anti-money laundering (AML) and beneficial ownership (BO) regulations. Despite global action, the effectiveness of these regulations remains under scrutiny as implementation and definitions are often inconsistent and easy to circumvent. Countries such as India, Indonesia, the United Arab Emirates and the U.S have introduced changes to AML and BO regulations to help drive transparency, and additional regulations are underway in the U.S., Singapore, Switzerland, Canada, Australia, and the EU.

Global Real Estate Transparency Index (GRETI)

JLL and LaSalle's Global Real Estate Transparency Index (GRETI), which is published every two years, is a unique benchmark of market transparency for property investors, developers and corporate occupiers. The index evaluates the legal and regulatory environment, enforcement mechanisms and data availability and provides a global comparison of operating conditions across a wide range of geographies. This year's 13th edition includes 256 individual indicators to assess market transparency across 89 countries and territories and 151 cities globally.

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500 company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 110,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Contact: Allison Heraty

Phone: 312 228 3128

Email: Allison.Heraty@jll.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/highly-transparent-real-estate-markets-make-strong-progress-outpacing-peers-302231655.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/highly-transparent-real-estate-markets-make-strong-progress-outpacing-peers-302231655.html

SOURCE JLL-IR