VANCOUVER, BC / ACCESSWIRE / October 16, 2024 / Mako Mining Corp. (TSXV:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide additional exploration results from the 2024 reverse circulation ("RC") drill program at Mako's newest mining area, Las Conchitas, located immediately south of the Company's San Albino gold mine in northern Nicaragua.

The main objective of the RC drill program is to test for new extensions of high-grade gold veins outside of the limits defined by the Company's 2023 mineral resource estimate ("MRE") for the San Albino Project (see press release dated December 6th, 2023).

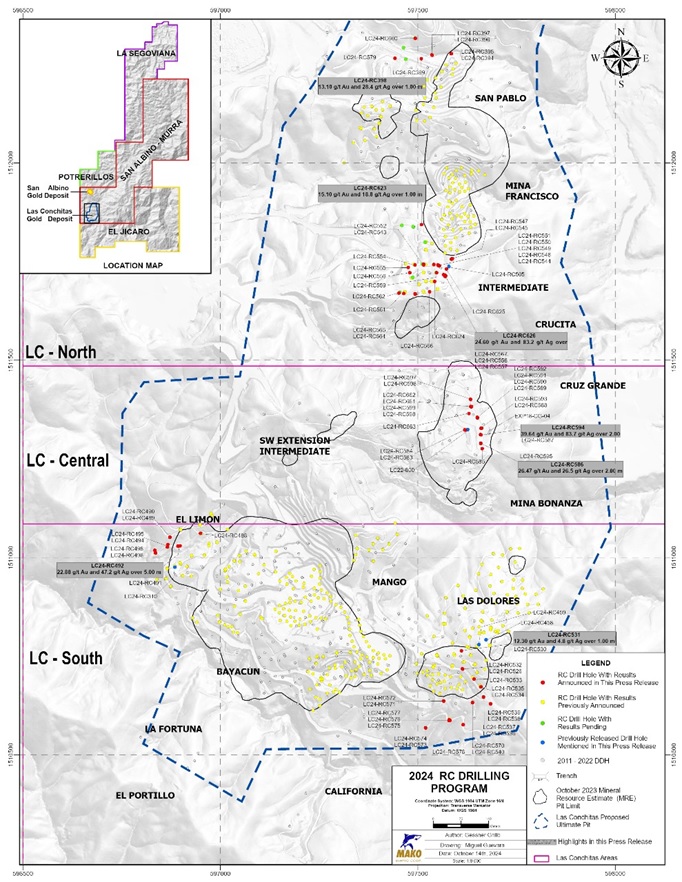

The drill results reported in this release are from multiple subparallel, northeast-southwest striking and gently dipping gold-bearing veins from three principal areas within Los Conchitas: (1) Las Conchitas North ("LC-N"); (2) Las Conchitas Central ("LC-C"); and (3) Las Conchitas South ("LC-S") (see Figure below).

Drilling Highlights

Las Conchitas South (LC-S)

Las Conchitas Central (LC-C)

Las Conchitas North (LC-N)

-

Intermediate Vein

-

San Pablo Vein

-

Mina Francisco Vein

-

24.60 g/t Au and 83.2 g/t Ag over 1.0 m (1.0 m ETW)

-

13.10 g/t Au and 28.4 g/t Ag over 1.0 m (0.8 m ETW)

-

15.10 g/t Au and 18.8 g/t Ag over 1.0 m (0.9 m ETW)

Akiba Leisman, CEO of Mako states: "After receiving the full Environmental Impact Assessment approval for Las Conchitas in early July, the Company is no longer constrained on where it can mine at Las Conchitas. Therefore, the focus of our exploration has been on expanding the Las Conchitas resource in areas we previously did not have mining access to, and deeper material, which will be part of our high-grade underground resource. We aim to begin extracting underground material along with open pit material over the course of the next year. These results, and previous exploration results, are demonstrating the growth potential at San Albino, which to date has only drill-tested a small percentage of our current mineral concessions."

Las Conchitas South (LC-S)

Recent drilling at the Mango area within LC-S intersected a wide, high-grade gold vein 61 m below the pit limit defined by the current MRE. Drill hole LC24-RC492 intersected 22.88 g/t Au and 47.2 g/t Ag over 5.0 m (4.6 m ETW), 85 m from surface. This drill hole confirmed a 48 m down-dip extension from LC24-RC310, which intersected 9.83 g/t Au and 20.4 g/t Ag over 4.0 m (ETW) at a vertical depth of 69 m (see press release dated July 10, 2024). Drilling in this area continues to support the expansion of high-grade gold mineralization outside the pit limits defined by the current MRE.

In the Las Dolores area, the key objective of the 2024 drilling program has been to test extensions of shallow, high-grade mineralized zones beyond the current MRE pit limits. Drill hole LC24-RC531 intersected 12.30 g/t Au and 4.8 g/t Ag over 1.0 m (0.7 m ETW), 30 m below surface and 22 m below the pit limit defined by the MRE. These results for Las Dolores are consistent with those from previous releases, including drill hole LC24-RC459 which intersected 16.83 g/t Au and 26.4 g/t Ag over 6.0 m (4.7 m ETW), 17 m below surface confirming a 16 m southwest strike extension of the mineralization intersected by LC24-RC458 of 30.85 g/t Au and 34.0 g/t Ag over 2.0 m (1.8 m ETW), 11 m below surface (see press releases dated August 28th, 2024 and July 29th, 2024).

Las Conchitas Central (LC-C)

Drilling near the Cruz Grande area was designed to test the continuity of shallow gold mineralization, which was defined in the MRE with sparse data from trench samples. Confirmation of this data has been positive and mining has commenced in this area.

Drill hole LC24-RC594 intersected 39.64 g/t Au and 83.7 g/t Ag over 2.0 m (2.0 m ETW), 12 m below surface. LC24-RC594 confirmed a 14 m down-dip extension of the gold vein exposed in previous trenching (EXP18-CG-04) which yielded 6.45 g/t Au and 3.7 g/t Ag over 1.0 m (see press releases dated December 5th, 2018).

Drill hole LC24-RC586 intersected 26.47 g/t Au and 26.5 g/t Ag over 2.0 m (1.8 m ETW), 21 m below surface and confirmed a 24 m up-dip extension of the gold vein intersected by diamond drill hole LC22-800 which intersected 16.92 g/t Au and 29.5 g/t Ag over 2.1 m (2.0 m ETW) at a vertical distance of 37 m (see press release dated July 28, 2022). LC24-RC586 also intersected another gold vein (see table below) at 8 m from surface grading 7.77 g/t Au and 16.8 g/t Ag over 4.0 m (3.5 m ETW).

Las Conchitas North (LC-N)

Drilling at the Intermediate area within LC-N was designed to test a previously identified high-grade mineralized zone outside the MRE pit limits.

LC24-RC626, situated between two pits defined in the MRE, intersected 24.6 g/t Au and 83.2 g/t Ag over 1.0 m (1.0 m ETW), 38 m below surface. This drill hole confirms structural continuity of the vein and demonstrates a 20 m down-dip extension from LC24-RC505 (see press release dated July 29, 2024) which intersected 25.01 g/t Au and 76.2 g/t Ag over 2.0 m (1.3 m ETW) at 28 m below surface. In addition, the same drill hole, LC24-RC626, intersected the Mina Francisco vein (see table below), 21 m below the surface, grading 3.03 g/t Au and 15.2 g/t Ag over 2.0 m (1.3 m ETW).

These results for the Intermediate and Mina Francisco areas (see Figure below) further support the potential to merge the two MRE pits and increase open-pittable material.

Two drill holes, reported in this press release, LC24-RC398 and LC24-RC623, successfully tested the down-dip extension of two high-grade gold veins, San Pablo and Mina Francisco, both exposed in two pits within the current MRE. Drill hole LC24-RC398 intersected 13.10 g/t Au and 28.4 g/t Ag over 1.0 m (0.8 m ETW), 76 m below surface and 88 m down-dip outside the current San Pablo pit. Drill hole LC24-RC623 intersected 15.10 g/t Au and 18.8 g/t Ag over 1.0 m (0.9 m ETW), 33 m below surface. This drill hole extends the high-grade gold vein 55 m down-dip, outside the current MRE pit limit.

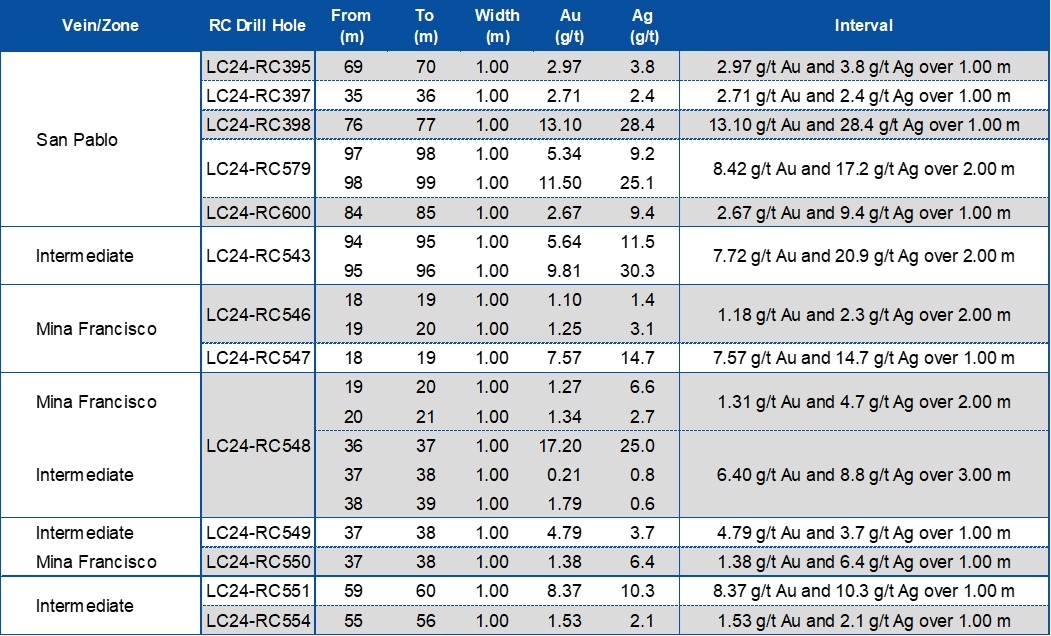

Table - Assay Results Reported in This Press Release

Note: The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 m of internal dilution. *Widths are reported as drill hole lengths. True width is estimated to be between 70% and 100% of the downhole width. In addition to the drill holes presented in the table above, the following drill holes returned only anomalous values: LC24-RC394, LC24-RC396, LC24-RC399, LC24-RC555, LC24-RC556, LC24-RC576, LC24-RC577, LC24-RC596, LC24-RC598, LC24-RC489, LC24-RC490, LC24-RC494, LC24-RC530, LC24-RC533, LC24-RC537, LC24-RC538, LC24-RC571 and LC24-RC573. In addition to the drill holes presented in the table above, the following drill holes returned no significant values: LC24-RC544, LC24-RC545, LC24-RC552, LC24-RC564, LC24-RC565, LC24-RC578, LC24-RC624, LC24-RC592, LC24-RC495, LC24-RC496, LC24-RC498, LC24-RC534 to LC24-RC536, LC24-RC539, LC24-RC540, LC24-RC570, LC24-RC572, LC24-RC574 and LC24-RC575..

Figure - Drill Hole Plan for Las Conchitas

Sampling, Assaying, QA/QC and Data Verification

All reverse circulation (RC) holes were drilled dry i.e., above the water table and no water or other fluids were injected into the hole. RC drill samples were collected every 1 meter using a center-return hammer and samples were obtained from a Gilson chip splitter which is cleaned using compressed air after each sample. Samples were bagged and labeled at the drill site under a geologist's supervision and are logged on site by a geologist who visually selects potential mineralized intervals for fire assay. The mineralized interval(s) including 3-5 samples above and below, the selected intervals are continuously sampled and shipped to the Bureau Veritas Lab (BV) in Managua, respecting the best chain of custody practices. Pulps are sent by Bureau Veritas to their laboratory in Vancouver under their chain of custody for analysis. Gold was analyzed by standard fire assay fusion, 30 gr aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards and blanks were inserted into the sample stream at a minimum ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data.

Qualified Person

Brian Ray, M.Sc., P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Ray is a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, E-mail: aleisman@makominingcorp.com, phone: (917) 558-5289 or visit our website at www.makominingcorp.com and SEDARPLUS www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, that the Company is expected to positively reconcile to the published mineral resource with additional drilling at Las Conchitas; that the Company high-grade production will generate significant cash flows for the foreseeable future. Mako's primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedarplus.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original

press release on accesswire.com