(TheNewswire)

Toronto – December 03, 2024 - TheNewswire: AbraSilver Resource Corp. (TSX.V:ABRA; OTCQX: ABBRF) ("AbraSilver" or the “Company”) is pleased to announce the results of its updated Pre-Feasibility Study (“PFS” or the “Study”) for the Diablillos silver-gold project (“Diablillos” or the “Project”). The PFS demonstrates improved economics and increased confidence in the Project’s significant upside potential. The PFS was completed by a collaborative team that included Mining Plus Peru S.A.C, Whittle Consulting, BMining, INSA, SGS North America, Inc., and Envis Consulting.

All dollar ($) figures are presented in US dollars unless otherwise stated. Base case metal prices used in the PFS are $2,050 per gold (“Au”) ounce (“oz”) and $25.50 per silver (“Ag”) oz.

PFS Study Highlights:

-

Attractive project economics: 747 million after-tax Net Present Value discounted at 5% per annum (“NPV”); 27.6% Internal Rate of Return (“IRR”) and 2.0-year payback period.

-

Substantial silver and gold production – 13.4 Moz silver-equivalent “AgEq”) average annual production over a 14-year life-of-mine (“LOM”), comprised of 7.6 Moz Ag and 72 koz Au, with average annual production of 16.4 Moz AgEq over the first five years of full mine production, comprised of 11.7 Moz Ag and 59 koz Au.

-

Low All-in Sustaining Cash Costs (“AISC”)– Average AISC of $12.67/oz AgEq over LOM, and $11.23/oz AgEq over the first five years of full mine production.

-

Initial capital expenditures - Initial pre-production capital expenditure of $544 million (including contingency)with a further $77 million in sustaining capital over the LOM.

-

Significant potential for additional economic improvements – Several additional opportunities that may further enhance the economic returns as detailed later in this release:

-

Replacement of on-site self-generation from a combined solar-diesel power plant with a connection to the national grid under a long-term power purchase agreement from a third party. Capturing this opportunity would provide a meaningful reduction to initial capital, lower operating costs and, potentially, improve the carbon footprint of the Project.

-

A revised mine plan based on a new Mineral Resource and Reserve estimate that incorporates the additional Phase IV exploration drilling results at JAC and the northeast zone of Oculto as well as higher metal price assumptions. A new mine plan may present the opportunity to reduce strip ratio, and improve operating cashflow.

-

Expansion of available water resources to the Project to remove constraints on plant throughput resulting in increased metal production.

-

Treatment of marginal material currently classified as waste through secondary processing, such as heap leaching, resulting in increased metal production.

-

Improvements to the design of the Tailings Storage Facility (“TSF”) to reduce capital and operating cost, and also decrease the environmental footprint.

John Miniotis, President and CEO, commented, “The updated PFS confirms Diablillos as an economically attractive silver-gold project, with strong economics and significant growth potential that has yet to be fully-realized. With an after-tax NPV of over CAD $1 billion (USD$747M) and a rapid payback period, Diablillos is poised to deliver significant returns to our shareholders. Our team remains focused on advancing Diablillos towards production while continuing to unlock additional Mineral Resource potential through our ongoing successful exploration program.”

PFS Update – Summary of Key Changes

This PFS supersedes and incorporates several key changes and enhancements compared to the prior PFS in respect of the Project released on March 25, 2024 (the “Prior PFS”). These changes, combined with updated metal prices and capital and operating costs estimates, have resulted in a more robust study which confirms that Diablillos offers compelling future development potential due to its simplicity, grades and size. The key changes in the PFS include:

Incentive Regime for Large Investments (“RIGI”): The PFS incorporates the incentives offered under the new incentive regime for large investments, RIGI, which was passed by the Argentinean congress in July, 2024 and implemented in most Argentinean provinces, including Catamarca and Salta. These incentives include:

-

a reduction of the federal corporate income tax rate from 35% to 25%;

-

elimination of export duties levied on gold and silver sales respectively; and

-

accelerated tax depreciation of plant and equipment.

Qualifying projects with expenditures above $200M may apply for RIGI before the law expires in July, 2026, and must spend 40% of the investment amount within two years of approval (by no later than July 2028). Diablillos meets all of the required qualifications for RIGI. The PFS considers an execution plan to obtain RIGI approval by no later than Q2 2026, giving the Project until Q2 2028 to spend 40% of the investment, or approximately $200M. According to the Diablillos construction schedule, the $200M threshold for committed capital will be achieved in approximately 12 months after the Project investment decision. An investment decision would therefore be required no later than the end of Q2 2027 to ensure the Project captures the RIGI benefits.

Mine Plan Optimization:A new mine plan has been incorporated resulting in an after tax NPV improvement of $61M by improving the mine sequencing. These improvements include accelerated production from the Shallow Gold zone due to more favorable expectations of blasting permits availability and improves the gold grade and gold production in the first five years of the mine plan.

Updated Capital Costs:Total initial capital expenditures (including contingency) increased by $170M. Beyond general cost inflation, the primary drivers behind this increase were changes to exchange rates on imported capital goods and updating of indirect costs to reflect market conditions, as well as updated manpower estimates during construction. The figure also includes capitalized waste stripping of $50M, resulting from the change in mining sequence, which was previously allocated to operating costs.

Updated Operating Costs:Operating costsreflect updated diesel prices of $0.95/l at current market conditions compared to the price of $0.71/l in March of this year, which included government subsidies that have since been eliminated. Operating costs were also revised for updated exchange rates applied to imported consumables.

Project Economics

Table 1 – Commodity Price Sensitivity Analysis

|

Economic Parameters

|

Base Case Prices

|

Spot Prices1

|

Down-Side Prices

|

|

Silver Price ($/oz)

|

$25.50

|

$30.70

|

$23.50

|

|

Gold Price ($/oz)

|

$2,050

|

$2,651

|

$1,850

|

|

After-tax NPV (5%, USD$ / CAD$ million)

|

$747 / $1,046

|

$1,291 / $1,808

|

$552 / $772

|

|

After-tax NPV (8%, USD$ / CAD$ million)

|

$552 / $772

|

$994 / $1,392

|

$392 / $549

|

|

After-Tax IRR (%)

|

27.6%

|

39.3%

|

22.8%

|

|

Payback (years)

|

2.0

|

1.5

|

2.4

|

1Note: Spot Price as at close on November 29th, 2024, per https://www.lbma.org.uk/ USD:CAD F/X rate: 1.40

The PFS presents a range of metal pricing scenarios on an after-tax basis to evaluate the economics of both upside and downside price scenarios. The economics of Diablillos are very robust and offer significant leverage to both silver and gold prices, with an after-tax NPV5%of $1,291 Million and an IRR of 39.3% at current spot silver and gold prices (Table 1).

Production Summary

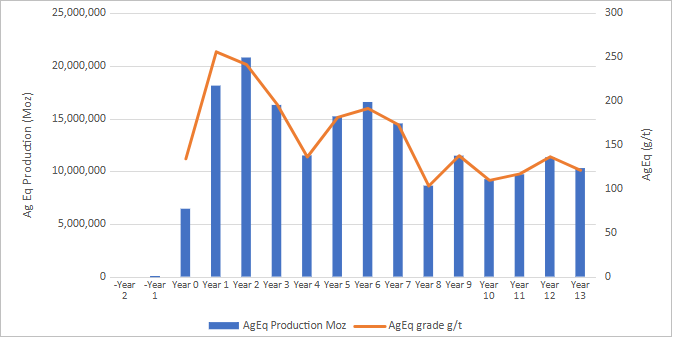

Diablillos is designed as a conventional open-pit mining operation with mill throughput of 9,000 tonnes per day (“tpd”) and an optimized production sequence targeting high-grade silver and gold mineralization in the early years of the mine plan. Over the 14-year mine life, the Project is expected to average annual production of 7.6 Moz silver and 72 koz gold, with an average of 11.7 Moz silver and 59 koz gold over the first five years of full mine production (Table 2 and Figure 1). The robust production profile in the initial years underlines the Project’s efficiency and strong cash-flow generation potential.

The processing plant has been designed for a nameplate capacity of 9,000 tpd, or 3.15 million tonnes per annum (“tpa”) considering 350 days a year of operation. A conventional silver/gold processing plant flowsheet was developed that incorporates crushing, grinding, gravity concentration, an intense cyanidation circuit, cyanide leaching with oxygen addition, counter current decantation washing thickeners and Merrill-Crowe precious metal recovery from solution followed by on-site smelting to doré bars. The leached solids are detoxified, thickened, and pumped to a TSF for permanent disposal.

Metallurgical test work has been carried out in a range of different laboratories between 1996 and 2023 and all the results have been considered as part of the PFS. A geo-metallurgical model has been developed segregating the deposit into five distinct domains, with overall LOM silver and gold recoveries averaging 83.6% and 86.8%, respectively.

Tailings from the process plant will be stored in a multi-phase, fully lined, cross valley TSF. The facility will be raised using the downstream method with the initial starter impoundment, constructed from borrow material and open pit pre-strip waste, providing storage for the first three years of production.

Table 2 – Grade and Production Profile

|

Units

|

Avg.

First 5 Years Full Production

|

Avg. LOM

(Year 1 – 14)

|

|

Silver Grades

|

(g/t)

|

143 g/t

|

91 g/t

|

|

Gold Grades

|

(g/t)

|

0.71 g/t

|

0.81 g/t

|

|

Silver-Equivalent Grades

|

(g/t)

|

201 g/t

|

159 g/t

|

|

Silver Production

|

(M oz)

|

11.7

|

7.6

|

|

Gold Production

|

(k oz)

|

59

|

72

|

|

AgEq Production

|

(M oz)

|

16.4

|

13.4

|

Note: AgEq is calculated using base case prices for silver and gold (Au/Ag price ratio of 80.39)

Figure 1 – Annual Silver Equivalent Production and Grade Profile

Operating Costs

The operating cost estimates are based on an owner-operated truck and shovel mining operation, conventional processing plant, and TSF with power provided from an on-site combined solar-diesel power plant.

The PFS operating cost estimates are shown on a per tonne milled basis in Table 3. The PFS estimates that the AISC averages $11.23/oz AgEq the first five years of production, and $12.67/oz AgEq over the LOM. This AISC is believed to be at the low end of the primary silver production cost curve2.

Table 3 – Mine Operating Cost Estimates

|

Operating Costs

|

Basis

|

Avg. LOM ($)

|

|

Mining (ore and waste)

|

per tonne milled

|

14.50

|

|

Processing Plant, Utilities and Maintenance

|

per tonne milled

|

22.71

|

|

Camp and Service Hub

|

per tonne milled

|

4.29

|

|

G&A and Logistics

|

per tonne milled

|

3.91

|

|

Total Operating Cost

|

per tonne milled

|

45.42

|

Project Capital Costs

The initial pre-production capital expenditures for the Project are summarized in Table 4. Capital expenditures to be incurred after the start-up of operations are assigned to sustaining capital and are projected to be covered by operating cash flows. Initial capital costs are estimated at $544 million including contingency and total sustaining capital costs are estimated at $77 million. Approximately 80% of the costs are based on quoted prices and this has resulted in a lower estimated contingency cost of $26 million.Over 60% of equipment, supplies, construction, and service procurement packages will be sourced from local companies, complying with local regulations.

Table 4 – Summary of Capital Cost Estimates

|

Description

|

Updated PFS Study

|

Prior PFS

(Mar. 25, 2024)

|

Change

|

|

Updated PFS vs. Prior PFS

|

|

$ millions

|

$ millions

|

% Change

|

$ Change

|

|

Surface Mining

|

128.6

|

39.3

|

227%

|

89.3

|

|

Processing

|

111.7

|

96.9

|

15%

|

14.8

|

|

Site Infrastructure

|

166.7

|

152.0

|

10%

|

14.7

|

|

Owner and Indirect Costs

|

110.2

|

64.9

|

70%

|

45.3

|

|

Initial Capital Costs (excl. contingency)

|

517.2

|

353.2

|

46%

|

164

|

|

Contingency & Other Provisions

|

26.3

|

20.3

|

30%

|

6

|

|

Initial Capital Costs

|

543.5

|

373.5

|

46%

|

170

|

|

Sustaining Capital

|

76.5

|

65.0

|

18%

|

11.5

|

|

Closure

|

26.4

|

11.1

|

138%

|

15.3

|

|

Total Capital Costs

|

646.4

|

449.6

|

44%

|

196.8

|

Taxes and Royalties

The PFS incorporates the impact of Argentina’s recently enacted RIGI legislation designed to stimulate new large-scale investments. Under this framework, the Company expects a competitive fiscal regime, with key rates as follows:

In total, the updated taxes, royalties and export duties total $536 million in the PFS, compared to $965 million under the Prior PFS. Additionally, the RIGI program provides benefits such as the removal of all foreign exchange restrictions, value-added tax (VAT) reimbursement on capital expenditures, and tax stability for the life of mine.

A 1% NSR royalty is payable to EMX Royalty Corporation.

Summary of Economic Results

Table 5 summarizes the key economic results and parameters of the PFS.

Table 5 – Summary of Project Economics

|

Metrics

|

Units

|

Results

|

|

Life of mine

|

years

|

14

|

|

Total mineralized material mined

|

M tonnes

|

42.3

|

|

Total contained silver

|

M oz

|

123.4

|

|

Total contained gold

|

k oz

|

1,108.2

|

|

Strip ratio (excludes pre-stripping)

|

Waste:ore

|

6.2

|

|

Throughput

|

tpd

|

9,000

|

|

Head grade – silver (first 5 years / LOM)

|

g/t

|

143 / 91

|

|

Head grade – gold (first 5 years / LOM)

|

g/t

|

0.71 / 0.81

|

|

Recoveries – silver (first 5 years / LOM)

|

%

|

83.5 / 83.6

|

|

Recoveries – gold (first 5 years / LOM)

|

%

|

85.2 / 86.8

|

|

Average Production – silver (first 5 years / LOM)

|

M oz

|

11.7 / 7.6

|

|

Average Production – gold (first 5 years / LOM)

|

k oz

|

58.7 / 71.9

|

|

AISC (LOM) – silver equivalent (first 5 years / LOM)

|

$/oz AgEq

|

11.23 / 12.67

|

|

Initial Capital Costs (including contingency)

|

$ M

|

544

|

|

Sustaining Capital Costs

|

$ M

|

77

|

|

Pre-Tax NPV5%

|

$ M

|

1,114

|

|

After-Tax NPV5%

|

$ M

|

747

|

Next Steps – Definitive Feasibility Study

AbraSilver plans to advance the Project towards the completion of a Definitive Feasibility Study (“DFS”), which is expected to be finalized in H1/2026. The DFS will build upon the PFS by assessing all of the opportunities identified, will incorporate all the exploration results from the ongoing Phase IV, 20,000-metre drill program and provide a more detailed and comprehensive evaluation of the Project’s economics, engineering and environmental aspects.

The DFS will be led by a team of experienced engineers and consultants, with support from the Company’s technical team. It will be competitively tendered to qualifying Engineering, Procurement, Construction and Management firms and is expected to be awarded by no later than Q2 2025. The Company will provide regular updates on the progress of the DFS and looks forward to sharing the results, which are expected to further demonstrate the Company’s potential to become a significant low-cost silver-gold producer.

Mineral Reserve Estimate – Effective as of March 7, 2024

Table 6 shows the Proven and Probable Mineral Reserves at Diablillos by deposit. The Mineral Reserves were estimated in March, 2024 using a silver price of $22.50/oz and a gold price of $1,750/oz.

Table 6 – Diablillos Mineral Reserve Estimate

|

Mineral Reserve

(all domains)

|

Tonnage

(000 t)

|

Au

(g/t)

|

Ag

(g/t)

|

AgEq

(g/t)

|

Contained Ag

(koz)

|

Contained Au

(koz)

|

Contained AgEq

(koz)

|

|

Proven

|

12,364

|

0.86

|

118

|

185

|

46,796

|

341

|

73,352

|

|

Probable

|

29,930

|

0.80

|

80

|

142

|

76,684

|

766

|

136,267

|

|

Total Proven and Probable

|

42,294

|

0.81

|

91

|

154

|

123,480

|

1,107

|

209,619

|

Notes for Mineral Reserve Estimate:

1. Mineral reserves have an effective date of March 7, 2024. Please refer to the Prior PFS.

2. The Qualified Person for the Mineral Reserve Estimate is Mr. Miguel Fuentealba, P.Eng.

3. The mineral reserves were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), Definition Standards for Mineral Resources and Reserves, as prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

4. The mineral reserves were based on a pit design which in turn aligned with an ultimate pit shell selected from a WhittleTM pit optimization exercise. Key inputs for that process are:

-

Metal prices of U$S 1,750/oz Au; U$S 22.50/oz Ag

-

Variable Mining cost by bench and material type. Average costs are U$S 1.94/t for all lithologies except for “cover” Cover mining cost of U$U 1.73/t, respectively.

-

Processing costs for all zone, U$S 22.97/t.

-

Infrastructure and GA cost of U$S 3.32/t.

-

Pit average slope angles varying from 37° to 60°

-

The average recovery is estimated to be 82.6% for silver and 86.5% for gold.

5. The Mineral Reserve Estimate has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

6. A Net Value per block (“NVB”) cut-off was used to constrain the Mineral Reserve with the reserve pitshell. The NVB was based on "Benefits = Revenue-Cost" being positive, where, Revenue = [(Au Selling Price (US$/oz) - Au Selling Cost (US$/oz)) x (Au grade (g/t)/31.1035)) x Au Recovery (%)] + [(Ag Selling Price (US$/oz) - Ag Selling Cost (US$/oz)) x (Ag grade (g/t)/31.1035)) x Ag Recovery (%)] and Cost = Mining Cost (US$/t) + Process Cost (US$/t) + Transport Cost (US$/t) + G&A Cost (US$/t) + [Royalty Cost (%) x Revenue]. The NVB method resulted in an average equivalent cut-off grade of approximately 46g/t AgEq.

7. In-situ bulk density was read from the block model, assigned previously to each model domain during the process of mineral resource estimation, according to samples averages of each lithology domain, separated by alteration zones and subset by oxidation.

8. All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

9. Mining recovery and dilution factors have not been applied to the Mineral Resource estimates.

Technical Disclosure and Qualified Persons

The PFS supersedes the prior study reported in “Amended and Restated NI 43-101 Technical Report, Pre-Feasibility Study for the Diablillos Ag-Au Project” filed on SEDAR+ by AbraSilver on May 29, 2024.

A Technical Report in respect of the PFS (the “Technical Report”) will be completed in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and will be filed and available on the Company’s profile on SEDAR+ within 45 days of this news release. The Technical Report will be authored and certified by the Qualified Persons listed in Table 7.

Jeremy Weyland, P.Eng., Senior Vice President, Projects and Development, is a Qualified Person as defined by NI 43-101 and has reviewed and approved the scientific and technical information in this news release.

Table 7 – NI 43-101 Technical Report Summary

|

Qualified Person(s)

|

Company

|

|

Luis Rodrigo Peralta, FAusIMM CP (Geo)

|

INSA Consultora

|

|

Joseph M. Keane, P.Eng. (Met)

|

Consultant to SGS North America Inc.

|

|

Miguel Fuentealba, MAusIMM P. Eng.

|

Bmining Chile

|

|

William Van Breugel, P. Eng.

|

SGS Geological Services

|

|

Shaida Miranda, MAusIMM CP (Mining)

|

Mining Plus Peru S.A.C.

|

About AbraSilver

AbraSilver is an advanced-stage exploration company focused on rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta and Catamarca provinces of Argentina. The current Proven and Probable Mineral Reserve estimate for Diablillos, consists of 42.3 Mt grading 91 g/t Ag and 0.81 g/t Au, containing approximately 123.5 Moz silver and 1.1 Moz gold, with significant further exploration upside potential. In addition, the Company has entered into an earn-in option and joint venture agreement with Teck on the La Coipita project, located in the San Juan province of Argentina. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. on the OTCQX under the symbol “ABBRF.”

For further information please visit the AbraSilver website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively, please contact:

John Miniotis, President and CEO

john@abrasilver.com

Tel: +1 416-306-8334

Non-IFRS Financial Measures

This news release contains certain non-IFRS measures, including AISC. AISC includes operating costs, royalties, sustaining capital, closure costs, and corporate G&A and is calculated based on guidance provided by the World Gold Council (“WGC”). WGC is not a regulatory industry organization and does not have the authority to develop accounting standards for disclosure requirements. The Company believes that these measures, together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company and the results of the PFS. Non-IFRS measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Forward-Looking Statements

This news release contains “forward-looking statements” and/or “forward-looking information” (collectively, “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expect”, “is expected”, “in order to”, “is focused on” (a future event), “estimates”, “intends”, “anticipates”, “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, or the negative connotation thereof. In particular, statements regarding the Company’s future operations, future exploration and development activities or other development plans constitute forward-looking statements. By their nature, statements referring to mineral reserves or mineral resources constitute forward-looking statements. Forward-looking statements in this news release include, but are not limited to statements with respect to the results (if any) of further exploration work to define and expand or upgrade mineral resources and reserves at the Project; the anticipated exploration, drilling, development, construction and other activities of the Company and the results of such activities, including the completion of a Feasibility Study in H1/2026; the mineral reserve estimates of the Project (and the assumptions underlying such estimates); the ability of exploration work (including drilling) to accurately predict mineralization; the focus of the anticipated Phase IV exploration campaign at the Project; the completion and timing for the filing of the Technical Report; the ability to realize upon mineralization in a manner that is economic; the ability of the Project to become a significant low-cost silver-gold producer; and any other information herein that is not a historical fact.

The Company considers its assumptions to be reasonable based on information currently available but cautions the reader that these assumptions regarding future events, many of which are beyond the control of the Company, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect the Company, its properties and business. Such risks and uncertainties include, but are not limited to, changes in demand for and price of gold, silver and other commodities (such as fuel and electricity) and currencies; changes or disruptions in the securities markets; legislative, political or economic developments in Argentina; changes in any of the assumptions underlying the PFS; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of the Company's projects; risks of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining or development activities; the speculative nature of exploration and development, including the risks of diminishing quantities of grades of reserves and resources; and the risks involved in the exploration, development and mining business and the additional risks described in the Company’s most recently filed Annual Information Form, annual and interim management’s discussion and analysis and other disclosure documents which are available on SEDAR+ (www.sedarplus.ca) under the Company’s issuer profile. The Company’s anticipation of and success in managing the foregoing risks could cause actual results to differ materially from what is anticipated in such forward-looking statements. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

1 Spot prices: $30.70/oz Ag & $2,651/oz Au closing prices on November 29th, 2024 (Source: https://www.lbma.org.uk/

2 Please see “Non-IFRS Financial Measures”

2 www.silverinstitute.org/wp-content/uploads/2023/11/SilverMarket2023_interim-report.pdf

Copyright (c) 2024 TheNewswire - All rights reserved.