- Nvidia’s GPU renders at about 50x to 100x faster than CPU rendering

- Nvidia stock (NDAQ:NVDA) soared 239 per cent in 2023 as its GPU became the gold standard for AI developers

- Nasdaq.com states that among the 39 analysts covering the Nvidia shares story, 34 recommend “strong buy”

- Free cash flow is up 430% in the last year to US$27B

The top performing stock on S&P 500 as well as in the “Magnificent Seven,” Nvidia (NDAQ:NVDA) took the S&P 500 by storm in 2023, gaining 239 per cent. Nvidia pioneered GPU (graphics processing unit)-accelerated computing in 1999 and is now embedded in the next era of technology and computing with the adoption and acceleration of AI.

In 2023, Nvidia soared 239 per cent as its GPU became the gold standard for artificial intelligence developers.

In March, Nvidia released its GB200 Grace Blackwell Superchip, which connects two Nvidia B200 Tensor Core GPUs to the Nvidia Grace CPU. The new flagship chip is expected to be used by Amazon, Alphabet’s Google, Meta Platforms, Microsoft, OpenAI and Tesla. The chip can enable organizations to build and run real-time generative AI on large language models at up to 25 times less cost and energy consumption than its predecessor.

Nvidia’s GPU is a specialized processor designed to accelerate graphics rendering. GPU is faster than a CPU (central processing unit). GPUs perform mathematical calculations at high speed and provide rendering at about 50 to 100 times faster than CPU rendering – a massive accelerator in processing things such as 3D scenes used in gaming and movies.

Nvidia’s markets

- PC gaming segment

- Data centre markets

- Automotive markets

- Crypto currency mining

- Any mega tech trend

Nvidia is capitalizing on its first to market position. Senior Investment Analyst at Morningstar, Shani Jayamanne, notes: “Nvidia’s valuation really hinges on whether, and for how long, the company can stay ahead of the rest of the pack.”

Nvidia’s free cash flow

In Nvidia’s most recent quarter ending in January 2024, the company’s revenue increased by 265 per cent year-over-year to US$22 billion. Nvidia’s head start into AI and its free cash flow are two strong advantages for the chip company. Free cash flow is up 430 per cent in the last year to US$27 billion, significantly higher than AMD’s US$1 billion and Intel’s negative US$14 billion.

Nvidia stock recap

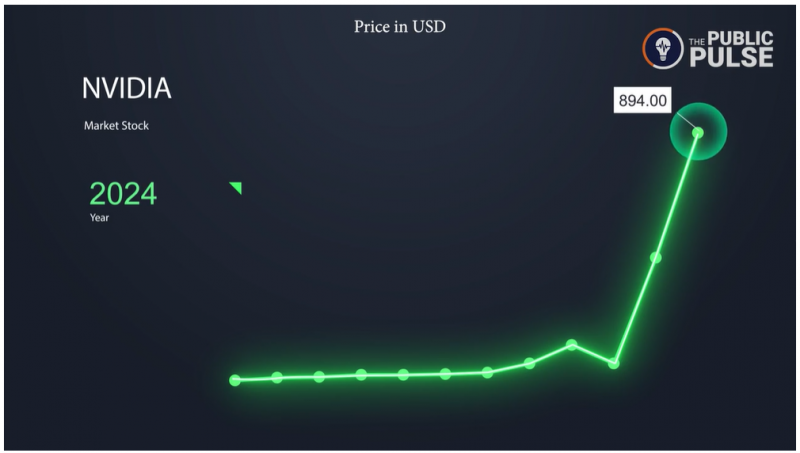

Nvidia stock opened at under US$1 in January 1999. By the end of 2016 it was just under US$23. And fast forward to the end of 2019, shares traded at just under US$60. The following year they traded around US$130 and up to almost US$500 at the end of 2023. For the first part of 2024 shares saw an explosion, reaching as high as US$950.

Nvidia stock predictions

Nasdaq.com states that among the 39 analysts covering the Nvidia shares story, 34 recommend “strong buy.” Just two analysts have a “moderate buy” rating, and three maintain a “hold.” As well, according to the same article, “The new street-high price target for Nvidia stock is US$1,400, via Hans Mosesmann of Rosenblatt, which surpasses the previous street-high of US$1,200 from Loop Capital.”

Nvidia Corp. (NDAQ:NVDA) stock was last trading at US$859.05.

Join the discussion: Find out what everybody’s saying about this stock on the Nvidia Corp. Bullboard as well as other companies on Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.