With markets more volatile and uncertain these days, we’ve been focusing a lot more on

prices on Buzz on the Bullboards. While price isn’t a market fundamental, it’s always useful for investors to see what’s hot and what’s not.

On the one hand, data on current winners makes it easier to identify sectors or niches where valuations are generally rising. On the other hand, for bargain-hunters, getting data on stocks that are currently bottoming(?) can be a head-start on due diligence.

For the week January 29 – February 4, 2019, here are the biggest winners and losers among Stockhouse's Bullboard leaders in our different industry groups.

Cannabis stocks continue to draw the most “buzz” within the Stockhouse Community, so we will lead with data here.

Winners:

Aphria Inc (

TSX: APHA,

OTCQB: APHQF,

Forum)

+11.05%

Aphria has been in the news in recent months, although not necessarily for the right reasons. A one-year chart provides part of the story.

(click to enlarge)

(click to enlarge)

This is a cannabis company that has been subject to rumors/accusations, with the share price suffering severely at one point. With the chart now pointing in the right direction, cannabis investors may see APHA as a bargain.

HEXO Corp (

TSX: HEXO,

OTCQB: HYYDF,

Forum)

+10.97%

HEXO is a cannabis industry leader with less ambiguous fundamentals. With its massive supply agreement with the province of Quebec ($1+ billion) over the next 5 years, HEXO Corp is well-positioned for future growth.

Losers:

A couple of the bigger names in the cannabis sector were down from January 29 – February 4, perhaps looking attractively priced for bargain-hungry investors?

Green Organic Dutchman Holdings Ltd. (

TSX: TGOD,

OTCQB: TGOWF,

Forum)

-9.57%

Canopy Growth Corp. (

TSX: WEED,

NYSE: CGC, Forum)

-7.88%

Resource stocks are perennially popular with Stockhouse investors, and currently the second most popular industry group at Stockhouse. For this one-week period, here is a glimpse of some of the biggest winners and losers.

Winners:

Ivanhoe Mines Ltd. (TSX: IVN, OTCQB: IVPAF, Forum)

+18.11%

This large-cap miner hasn’t simply been higher in recent days, it’s been strongly higher over the past few weeks. Investors seem to be excited over a recent copper discovery and PFS for its Kakula copper mine in the DRC. Investors need to decide if this positive news is fully baked into the price or whether IVN is poised for further gains.

(click to enlarge)

Largo Resources Ltd

(click to enlarge)

Largo Resources Ltd. (

TSX: LGO,

OTCQB: LGORF,

Forum)

+7.72%

Another large-cap mining company ($1+ billion), Largo gave back ground at the end of 2018, like a lot of mining companies. With a producing vanadium mine and other assets, mining investors looking for an established company in a hot sector may see LGO as a bargain.

Losers:

Rusoro Mining Ltd. (

TSX: V. RML,

OTCQB: RMLFF,

Forum)

-42.85%

Rusoro took it on the chin after a

mostly negative legal decision from an international tribunal. For investors with the risk tolerance for such scenarios, this company may bear further examination.

Euro Sun Mining Inc. (

TSX: ESM,

OTCQB: CPNFF,

Forum)

-22%

This TSX-listed mining company has been in a long-term down trend. Another “falling knife” scenario.

The big winner for this weekly period didn’t come from cannabis or the resource sectors. It was a tech company. We’ve been reminding investors in recent weeks that while small-cap valuations are generally weak across the board, some sectors that have been especially quiet (in terms of investor sentiment) may offer particularly strong value opportunities at present.

Winners:

Reliq Health Technologies Inc. (

TSX: V.RHT,

OTCQB: RQHTF,

Forum)

+42.42%

Straddling the boundary between technology and healthcare, RHT has powered higher on favorable market response to its

January 31st news. This is multi-faceted technology that would be of interest to more tech-savvy investors.

NexOptic Technology Corp (

TSX: V.NVO,

OTCQB: NXOPF,

Forum)

+18.33%

Another tech company with recent, positive news, including

a tech award. Technically oriented investors may be encouraged by the break-out above the trend line.

(click to enlarge)

Losers:

(click to enlarge)

Losers:

There were no significant losers over this weekly period, perhaps reflecting how compressed valuations are already are for these companies.

Winners:

Winners:

Theralase Technologies Inc. (

TSX: V.TLT,

OTCQB: TLTFF,

Forum)

+26.67

This healthcare/tech company has been a favorite with Stockhouse investors in recent years. It’s promising research into safe, highly-effective anti-cancer treatments (using benign laser light) has captured the interest of many investors – and recent positive

clinical trials results has sent the share price higher.

Protech Home Medical Corp. (

TSX: V. PTQ,

PTCQB: PHMZF,

Forum)

+25.32%

Less familiar to the Stockhouse audience is Protech Home Medical. After announcing strong year-end financial results in January, the stock has made substantial gains, with a very bullish one-month chart.

(click to enlarge)

Losers:

ProMetic Life Sciences Inc

(click to enlarge)

Losers:

ProMetic Life Sciences Inc (

TSX: PLI,

OTCQB: PFSCF,

Forum)

-9.68%

The only significant healthcare loser over this weekly period was PLI. This company has also had a strong following over the years at Stockhouse. But this support has wilted in the face of a long, agonizing down trend for ProMetic and its shareholders.

(click to enlarge)

(click to enlarge)

High volatility and uncertain markets have shaken a number of investors in recent months. However, with small-cap valuations very compressed in most sectors, this “volatility” can work strongly in investors’ favor when one of these companies announces some breakthrough.

Investors may have to work somewhat harder for their gains in current conditions. But as we see with a number of these small-cap companies, there are substantial gains to be made as investors scoop up some of these bargains.

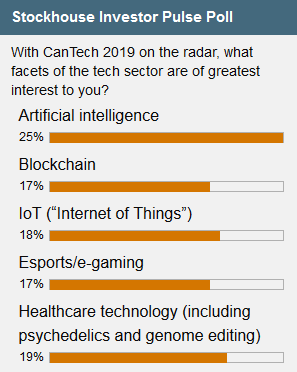

Now for our Stockhouse Investor Pulse Polls. In our last poll, we wanted to know what tech niches were of most interest to our Community. Here is what you told us.

This week (as the PDAC conference in Toronto approaches) we’re switching back to metals & mining. We want to know how Stockhouse investors are evaluating current market conditions with respect to these resource companies.

Mining company valuations have badly lagged metals prices in most markets in recent years. Is 2019 the year that these valuations catch up to fundamentals?

- Lock and load, the miners are ready to rally

- Nothing to see here folks, valuations will stay the same

- Valuations are going to get even worse before we see the Next Rally

- Unsure/no opinion

Look for this new poll on the Stockhouse homepage and share your own thoughts here.

FULL DISCLOSURE: HEXO Corp and Theralase Technologies Inc are paid clients of Stockhouse Publishing.