Stockhouse is a site for serious investors. For many (most?) members of the Stockhouse Community that means buy-and-hold investing. Indeed, we’ve previously observed that short-term trading and/or chasing momentum to look for a quick gain is not

“investing” at all. It’s pure gambling.

Some people enjoy gambling. Fine. There are lots of casinos around where people can fully satisfy that itch. Markets are for

investing. With respect to “trading” (i.e. gambling) in markets, the statistic most commonly cited is that

95% of traders lose money. (Short-term) trading in stock markets isn’t merely a low-odds bet. It is a terrible-odds bet.

At the same time, there is a middle ground between short-term trading and long-term investing: swing trading. Swing trading is effectively a hybrid between “trading” and “investing”. As with short-term trading, investors looking to “trade the swings” need to be more cognizant of entry prices than in long-term investing.

The reason is simple. Over a shorter investment horizon, the entry price for any purchase is more-determinative of overall returns than it is in long-term investing. However, as with investing, swing-traders also need to be very focused on the fundamentals for the particular company in which they are taking a position.

Because a swing trade typically plays out over a period of many weeks (or even several months), swing-traders cannot afford to simplistically rely upon price momentum and (so-called) “technical analysis”. It’s not enough to merely identify stocks that are relatively cheap, swing-traders also need to pick companies supported by solid fundamentals – that can generate robust gains.

Start by identifying some strong companies in your favorite sector(s). Then look for a few of these companies that appear to be at a short-term or medium-term low, perhaps because they have fallen significantly (and excessively?) in share price. Now you’re ready to start trading the swings.

The motive for augmenting standard investing with some swing-trading is obvious. Given the inherent volatility of markets, investors can boost their percentage gains (over any given investment horizon) if they can more or less capture any bottom-to-top swing. An illustrative example here will be helpful.

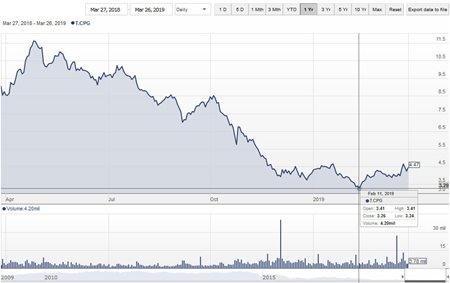

Number eleven among all Stockhouse Bullboards over the most recent week is

Crescent Point Energy Corp. (

TSX: CPG,

NYSE: CPG,

Forum). Even with the depressed conditions in the energy sector, this is a multi-billion dollar company that has a strong following at Stockhouse.

(click to enlarge)

(click to enlarge)

The chart above shows a clear “swing” opportunity. On February 11, 2019, CPG hit a short-term(?) bottom: closing at $3.26. On March 21, 2019, Crescent Point closed at $4.66, reaching an intraday high of $4.76. That’s very nearly a 50% swing in less than 6 weeks. In proportionate terms, this would equate to a 1-year return of approximately 400%.

What happened here? To answer that question, investors need to begin by referring to a chart of crude oil prices. On February 11

th, the quote for West Texas Intermediate crude (WTI) dipped to US$52.41 per barrel. By the time that Crescent Point was cresting on March 21

st, the price for WTI crude was breaking above $60 per barrel.

Obviously, CPG appreciated by much more over that interval than the approximate 15% rise in the price of crude oil. Part of this can be explained by the fact that commodity producers tend to leverage gains (and losses) versus the commodity they produce. Further explanation is found by looking at a 1-year chart.

(click to enlarge)

(click to enlarge)

It’s not a pretty picture. While many (most?) energy companies have produced a weak performance over the past year – given the soft conditions in this sector – CPG has under-performed. On February 11

th, Crescent Point hit what was actually

a long-term bottom. It was clearly oversold.

(click to enlarge)

(click to enlarge)

Investors who crunched the numbers on this company would have seen this. Tying in a long-term low in Crescent Point’s share price with a short-term dip in the price of crude, savvy investors would have seen an opportunity for a swing trade.

Of course, if we could do our trading/investing in hindsight, we would all be billionaires. There is no guarantee that a company that looks like a strong candidate for a swing trade will reward investors like Crescent Point did for those who took advantage of that swing.

That’s why it’s necessary for investors seeking to swing-trade to do careful due diligence on their picks. A company that (for one reason or another) does

not generate any significant short-term appreciation simply becomes a longer-term investment. Alternately, if circumstances have changed (for the worse), investors can exit in favor of other opportunities.

Let’s look at a different scenario.

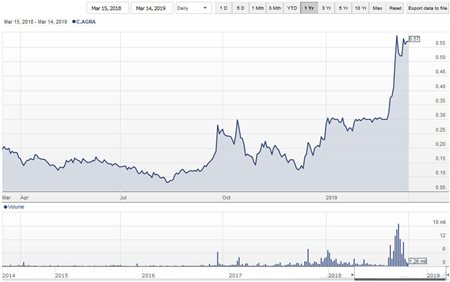

In the most

recent edition of Buzz on the Bullboards, we alerted investors to some companies with sharply rising support on the Stockhouse Bullboards that had begun to make strong moves in share price. One of these companies was

AgraFlora Organics International Inc (

CSE: AGRA,

OTCQB: PUFXF,

Forum).

At that time, this is what the AGRA chart looked like…

(click to enlarge)

(click to enlarge)

The Company had increased by roughly a factor of five and had just doubled in price in recent days. In fact, AGRA continued moving higher, closing at $0.85 on March 22, 2019. From the low of its $0.08 close on August 14, 2018, AgraFlora generated more than a 10X move.

More recently, AGRA pulled back. From its March 22

nd high, AgraFlora promptly gave back roughly 40% of its gains. By March 27

th, it had dipped to a close of $0.52. This was a time for investor due diligence.

Was this a company that went too far, too soon – and was now fairly valued? Or, had profit-taking investors and/or short-sellers taken AGRA down to the level where it was once again a buying opportunity? As of this writing,

AGRA is up 14.55% on the day, suggesting that investors who moved quickly following the sell-off may have found another strong swing trade.

(click to enlarge)

(click to enlarge)

An illustration of how/why investors contemplating a swing trade need to be careful with their due diligence is found with another company we featured in the last edition of Buzz. When we covered

GeneNews Ltd. (

TSX: GEN,

OTCQB: GNWSF,

Forum), this was a company whose 1-year chart

seemed to show an impressive reversal higher following a down-trend.

(click to enlarge)

(click to enlarge)

However, look at this company over a much longer time horizon, and we see a chart that is painting a radically different picture:

(click to enlarge)

(click to enlarge)

GeneNews closed at $4.50 on October 7, 2009. In 2019; it’s now trading below 20 cents. Scary. As we said at the time:

This presents an interesting question to potential investors: is the recent rebound in share price a mere “dead-cat bounce” or is this the early stages of a much more substantial recovery? This is what investor due diligence is all about.

Today,

GEN is trading up 25% on the day. For investors with a high risk-tolerance, this

could be an exciting swing-trading opportunity. Or, it could be a dead-cat bounce that won’t last.

Swing trading is not for all investors. As with any shorter-term strategy, it requires more actively monitoring one’s holdings (and making buy/sell decisions) than with traditional buy-and-hold investing. As with any shorter-term strategy, it increases the degree of risk in investing – although not nearly as much with short-term trading (i.e. pure gambling).

On the other hand, in depressed market conditions, sometimes swing-trading is the only way for investors to attempt to achieve a respectable overall return. The other strategy for “trading a swing” in a depressed market is short-selling. However, as with short-term trading, this is also a very high-risk strategy – and only suitable for experienced investors who also have a high risk-tolerance.

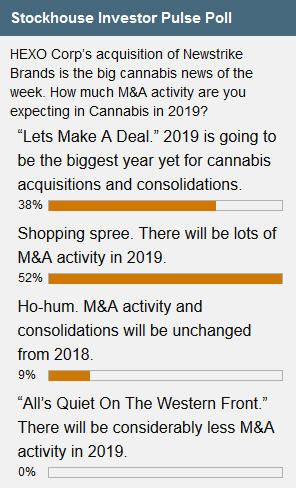

This brings us to the review of our most recent Stockhouse poll:

In the cannabis space, investors clearly see 2019 as year for cannabis deals. And where M&A activity heats up, opportunities for out-sized gains usually also materialize. Now for our

new Investor Pulse Poll. This week we’re asking:

In which category(ies) of companies do you prefer to invest?

- Large caps

- Mid-caps

- Large caps and mid-caps

- Juniors

- Micro-caps

- Juniors and Micro-caps

- All of the above

As always, our Investor Pulse Poll is located on the Stockhouse

homepage and the new poll should be going up shortly. Go to the homepage to register your vote. Readers interested in previous editions of Buzz on the Bullboards can find these

here.