The Stockhouse Bullboards serve a number of functions for our Community. They can be convenient sources for news and information, and on the more active Bullboards there is also discussion/debate among Members.

Overall traffic to the various Bullboards allows Stockhouse to monitor which sectors are currently attracting the most attention from investors as well as the top stocks in each sector (in terms of investor interest). This is one of the functions of Buzz on the Bullboards, to get this information out to our Community to keep you as fully informed as possible in your investing.

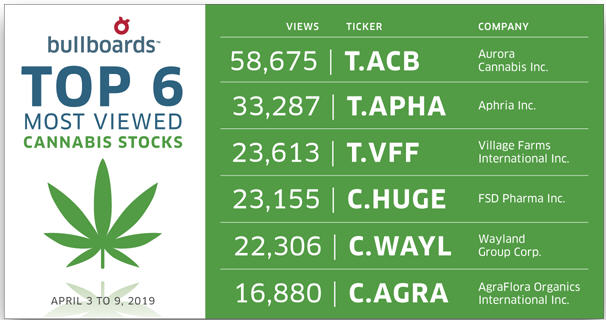

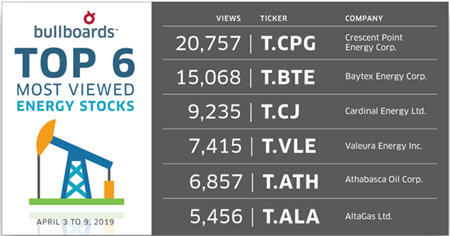

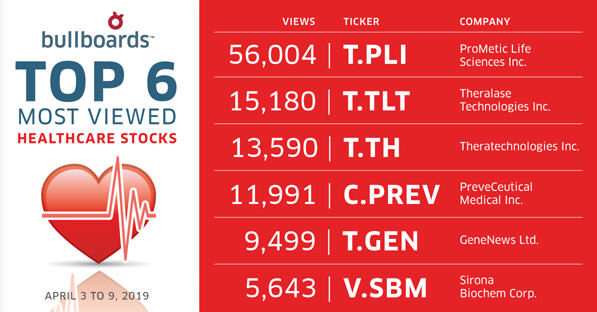

With that said, here is a quick snapshot of the Bullboard leaders for the individual sector groupings that we track.

Familiar names remain atop this leaderboard, but more recent additions (apart from Wayland Group) include

Village Farms International Inc and

AgraFlora Organics International Inc. -- two companies we've mentioned already in recent editions of Buzz.

With the rise in oil prices (and the share prices of energy companies), interest is picking up on Stockhouse's energy company Bullboards. We'll have more to say later in this edition concerning Energy leader,

Crescent Point Energy Corp.

On the opposite side of the sentiment curve, activity has dropped off on the Metals & Mining Bullboards, an indiction of softening sentiment. And on some of the Bullboards that are active, "the natives are restless'. Contrarian investors may smell opportunity in mining.

Dominating the Healthcare Bullboards by a wide margin (but not for the right reasons) is

ProMetic Life Sciences Inc. A more positive story is

Theralase Technologies Inc., up recently on significant anti-cancer news. We'll have more on these companies later.

Small-cap tech stocks, in particular, are a tough sell at the moment, despite the importance of improving/emerging technologies in the 21st century economy. This is another investment disconnect that may be of interest to forward-looking investors.

Looking at individual companies, in our cannabis Bullboard leaders,

Wayland Group Corp. (

CSE: WAYL,

OTCQB: MRRCF,

Forum) has jumped on our cannabis Bullboard rankings as a result of favorable reaction to the Company’s news that it’s one of

“three groups” in Germany currently under review for initial cannabis production licenses in that nation.

(click to enlarge)

(click to enlarge)

After bottoming on April 2

nd at $0.81, WAYL has jumped more than 20% since that time. With a large facility in Germany that has been retrofitted for cannabis cultivation and a major, new partnership with respect to its international operations, there is plenty of “buzz” about Wayland Group at the moment.

The story is not as investor-friendly with respect to

Harte Gold Corp (

TSX: HRT,

OTCQB: HRTFF,

Forum). Fairly or unfairly, the market has reacted negatively to the Company’s recently released Feasibility Study for its Sugar Zone Mine. HRT is down on the news, and off by roughly 25% versus its share price at the start of the month. Mining investors need to do their due diligence to determine if there is a value opportunity here or whether they agree with the market in bidding HRT lower.

Then there is

Crescent Point Energy Corporation (

TSX: CPG,

NYSE: CPG,

Forum). Regular followers of Buzz on the Bullboards will recall that we mentioned this Company in the last edition of Buzz – as a classic example of a (successful)

swing trade opportunity.

(click to enlarge)

(click to enlarge)

We pointed to the long-term low that Crescent Point had hit with its share price on February 11, 2019, closing at $3.26, and coinciding with a dip in the price of crude. Since that time, the price of oil has risen substantially and CPG has taken off.

Last week, we alerted Stockhouse investors that CPG had already logged a strong gain:

On February 11, 2019, CPG hit a short-term(?) bottom: closing at $3.26. On March 21, 2019, Crescent Point closed at $4.66, reaching an intraday high of $4.76. That’s very nearly a 50% swing in less than 6 weeks.

Since that time, the price of oil has continued higher and Crescent Point Energy and its shareholders have continued to capitalize on these gains. Currently trading at $5.31,

CPG is now up over 63% in 59 days – not bad for an oil & gas large cap with a market cap approaching $3 billion.

On the other end of the spectrum is

ProMetic Life Sciences Inc. (

TSX: PLI,

OTCQB: PFSCF,

Forum). A perennial favorite at Stockhouse among healthcare investors, the Company has fallen from much loftier levels and (to date) has shown no signs of being able to turnaround its performance. Clearly ProMetic still has support among some investors, but patience is being severely strained.

On a more positive note, #2 on the Healthcare Bullboards, sentiment is strong on the Bullboard of

Theralase Technologies Inc. (

TSX: V.TLT,

OTCQB: TLTFF,

Forum). Very postive news in a Phase Ib clinical study on its

revolutionary anti-cancer treatment has stoked investors and helped the Company's share price.

(click to enlarge)

(click to enlarge)

Regular Stockhouse users may have noticed some change on site, including new formatting for our charts and company “quote pages”. Among the goals of these changes to Stockhouse are to not only improve site performance on your desktop (in terms of faster loading of pages), but to make Stockhouse “mobile friendly” for users who wish to access the website from their other devices. Expect further changes to the site over the coming months to support mobile browsing.

Readers interested in viewing previous editions of Buzz on the Bullboards can find these

here, as well as displays of our current Bullboard leaders for each sector grouping.

FULL DISCLOSURE: Wayland Group Corp. is a paid client of Stockhouse Publishing.