Every obstacle can be an opportunity, and the COVID-19 crisis has put the investment spotlight on companies stepping up to the plate.

What we once talked about as a looming and uncertain threat has quickly become the new norm. The coronavirus pandemic has upended lives, businesses, and the entire world, and we’ll continue to deal with it for months.

But as daily life has been upended in order to deal with the pandemic, some companies have factored into that change and been able to shine. From healthcare and technology innovations to industrials shakeups, the investors on the Stockhouse Bullboards have been digging through them all.

This week, we highlight three companies investors should be watching right now.

It’s no surprise that the healthcare sector has turned up a lot of “winners” in the current market, with many companies repositioning to assist in dealing with COVID-19 if possible. We’ve already covered a few, but a new face appeared on the most-viewed healthcare Bullboards,

Sona Nanotech Inc. (

CSE:SONA,

Forum). The company develops gold nanorod products for diagnostic tests, much needed in the current pandemic, and SONA shares have climbed accordingly.

After starting February sitting at $0.12, SONA has

shot up tenfold to $1.20 on Apr. 1. It’s been a busy few months for the company, as it started developing

rapid screening tests for coronavirus on Feb. 10 before starting to land partnerships in the cause. On Mar. 3, Sona Nanotech partnered with GE Healthcare Life Sciences for

test development, by the end of the month it had

entered into a manufacturing agreement for 2 million tests, and on Apr. 1 the company announced it was

awarded a $4.1 million grant for developing and commercializing its COVID-19 antigen test in Canada.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

With each coronavirus-related play comes a lot of speculation from investors: is this the real deal, and will it last? On the SONA Bullboard, the wave of good news has quickly elevated the company into a real deal, and with a government grant coming in, seemed to have secured the deal. What’s next? Figuring out how sales will factor into Sona’s value as Stockhouse Member

NothinButTime attempted to do.

“The market cap is currently 62 million and we now have 4 million in cash, and a LOI for 2 million units.

Let’s assume we can profit $10 per unit, because we have to be conservative on profit considering the state of the economy, and the fact we were funded by government.

That’s going to bring our market value to over 20 million on one order. It still doesn’t match the market cap. But more orders will. This is a good start.”

(Post: Breaking down market cap vs 1 order)

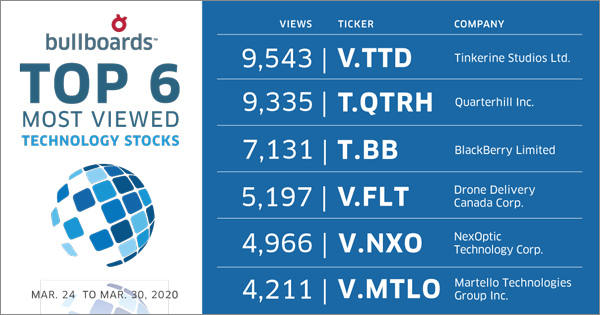

While a surge from a healthcare diagnostics company was to be expected, the top spot on last week’s most-viewed technology Bullboards was more surprising. Many knew the pandemic would cause a shortage in medical supplies, but far fewer expected 3D printing companies like

Tinkerine Studios Inc. (

TSX-V:TTD,

Forum) to fill the void. TTD has been on a tear at the end of March, climbing from $0.015 on Mar. 17 to $0.18 by Apr. 1,

an increase of 1200%.

The climb started when Tinkerine announced it would

begin providing 3D printed medical equipment assistance on Mar. 20, followed by a

breakdown of the products on Mar. 23. After a small dip, it kicked into gear on Mar. 26 as the company

announced it had secured materials, produced its first devices for evaluation, and partnered on a regional manufacturing consortium in Vancouver. Over the next days, Tinkerine’s announcements of

initial and

additional order inquiries well in excess of 30,000 sent the stock soaring.

You’d expect the TTD Bullboard chatter to be entirely positive, but there has been a healthy dose of skepticism thrown into the mix. With other companies in other production industries being called into ramp up medical equipment manufacturing, and no concrete word on “orders” versus “inquiries” yet, some are wondering if TTD won’t be the one to fill the medical community’s need. On the other side, however, Stockhouse Members like

daveholton have heard nothing but good updates from Tinkerine, and see that the recent moves to increase capacity will pay off quickly.

“Here's another thing I forgot to mention from my conversation with IR. Adding 500 printers means their manufacturing capacity increases 10x times! And they are looking to secure more 3D printers. With 1000+ machines outputting PPE devices and ventilator parts at max capacity, all this silly chatter will be in the rear view mirror very quickly.”

(Post: RE:Additional orders are incoming on an hourly basis)

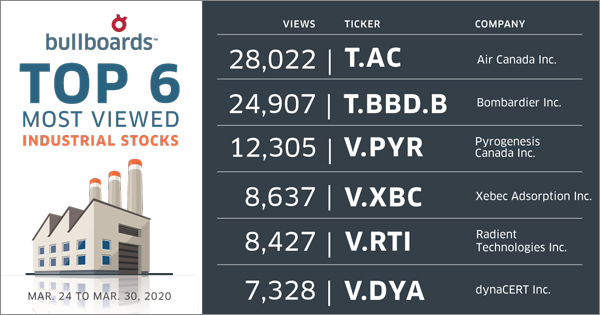

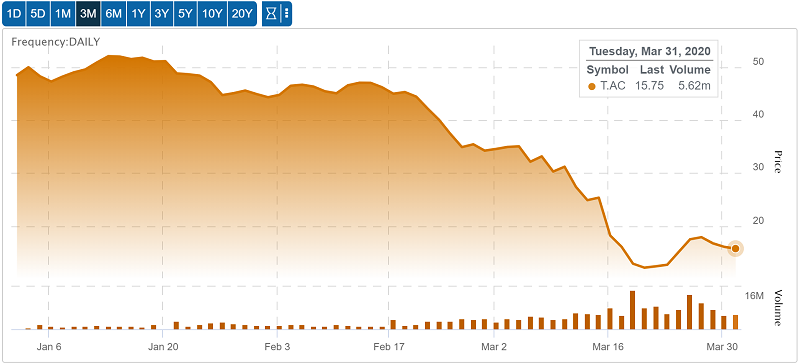

The final coronavirus opportunity has been on everyone’s minds during the pandemic, so it’s no surprise that

Air Canada Inc. (

TSX:AC,

Forum) topped the most-viewed industrials Bullboards again last week. When the initial downturn started in late February, AC was trading around $45.00, but by Mar. 18 it had fallen to $12.90. Last week, interest increased again as shares started to recover to just shy of $18.00, but they’ve since started to retreat again.

As airlines around the world have struggled during the pandemic, with flights grounded and cancelled and borders closed, Air Canada has tried to keep going. On Mar. 25, the company announced it was

operating cargo-only flights to assist with the transportation of medical supplies, and on Mar. 28 announced it was working with the Government of Canada on

emergency flights to repatriate standed Canadians. Still, on Mar. 30, Air Canada announced it had to

reduce capacity by at least 85% and temporarily lay off 16,500 staff.

The opportunity on the AC Bullboard is simple: will the airline recover, and when? The longer the pandemic has stretched out, the more dire the situation and measurements taken to combat it, including governments extending social distancing into the summer. Recently, the airline was also hit with a class-action suit to refund money to travellers instead of offering credit. Will it recover? The consensus says yes, but as Stockhouse Member

trader520 points out, investors might want to wait because things might not have hit bottom yet.

“The summer is shot. By end of June, for the rest of the summer, a few dribbles of flights starting up, half or more empty, at rock-bottom low prices.

The first decent return to normal (whatever the new normal will be), will be winter 2020/2021. Even then, prices will still be low, and profits will likely be negative.

This won't end well. [But] AC will live, so will WJ…”

(Post: RE:no seats are selling, lawsuit and virus)

Weeks ago we debated how long the pandemic would affect the world (and the markets), but by now, people have started to become acclimated to the new reality. The big question for investors now is what the investment strategy looks like if you can afford to make a move. We’ve been polling Stockhouse readers on our latest Investor Pulse Poll and so far, the results are split.

There’s still a ways to go before the situation unfolds and the markets return to normalcy, so the opportunity continues. We’ll keep the poll open, so head over to the

Stockhouse homepage or click the image below to cast your vote on what COVID-19 investing strategy you’re following!

(Click image to go to the poll)

(Click image to go to the poll)

The only thing that’s clear in today’s market is that every week has brought new stories, and new companies, to the forefront. What potential diamond in the rough will the Stockhouse Bullboards find next week? For previous editions of Buzz on the Bullboards:

click here.