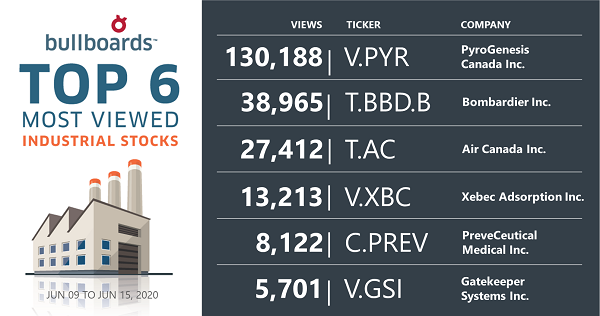

The reign of COVID-19 related gains is over on the Stockhouse Bullboards. Instead, the new king comes from the unlikeliest of sectors: Industrials.

Of course, it’s not surprising to have a profitable and quickly rising small-cap company in the industrials sector, and investors will often start to gravitate towards such plays. But to have it eclipse more consistently popular sectors like healthcare, cannabis, and metals & mining is noteworthy.

Over the past few weeks, volatility has seemingly returned to the markets, and the most-viewed stocks have been in constant upheaval because of it. For investors focused on the markets and small-cap opportunities within them, it can be hard to keep up with which cannabis company is on top, which energy producer is recovering the fastest, and which tech play is making the most impressive advancements.

That’s why it’s as good a time as any to check in with the most-viewed stocks of each sector on the Stockhouse Bullboards and see where the market is currently at.

If you haven’t heard of

PyroGenesis Canada Inc. (

TSX-V:PYR,

Forum) by now, you haven’t been paying attention. This marks the second week in a row that PYR has topped the Bullboards, and for good reason. The most impressive thing about the company’s ascent in share price and popularity is how consistent it has been, with

major milestones and

new contract deals adding fuel to the fire. Last week was no different, with PYR climbing from $1.62 on June 10 to $2.37 on June 15.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

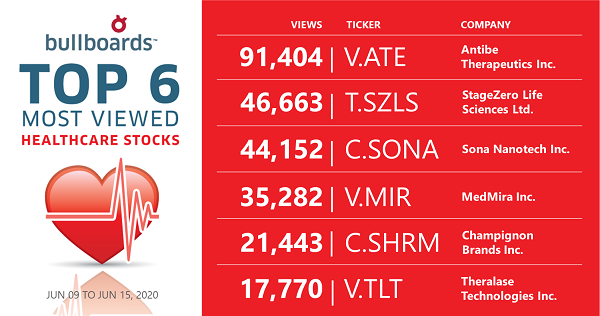

The excitement of COVID-19 related gains seems to have waned, especially with most of the respective gains seemingly stalled or in the rear-view already. Far more exciting on the healthcare Bullboards is the recent descent of

Antibe Therapeutics Inc. (

TSX-V:ATE,

Forum), which had impressed shareholders and small-cap hunters alike with a climb into June before

recently falling off. The question now is if the pain medication developer hit a new floor or had lower to go, and last week did little to solve the puzzle, as ATE climbed from $0.45 on June 9 to $0.52 on June 12 before erasing those gains a few days later.

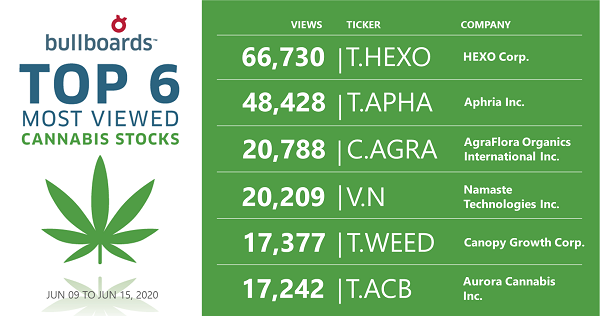

With much of the cannabis market back in a positive mood, LP’s were starting to rally left and right, but

HEXO Corp. (

TSX:HEXO,

Forum) took the cake. The previously-beleaguered producer partook in the general market uptick, then took off overnight from $1.08 on June 5 to $1.56 on June 8. Unfortunately, the rally was too big to sustain, as HEXO posted

mediocre financial results, was

removed from the TSX/S&P Composite Index, and saw shares drop back down to $1.11 on June 17.

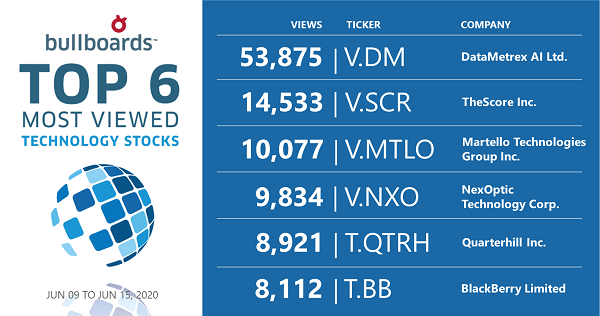

No king rules forever, and

DataMetrex AI Ltd. (

TSX-V:DM,

Forum), very recently the most-popular company on the Stockhouse Bullboards, has lagged behind. The AI company that saw major gains after a pivot to import COVID-19 testing kits has petered out in excitement and share rallies despite continuing to sign new sales deals for its imported tests. From $0.015 on March 27 to $0.185 on April 16, DM has since retreated to just above midway at $0.115. The reason DataMetrex is staying level and hasn’t dropped back down is the same reason the company retreated in the first place: it is still awaiting the green light from Health Canada.

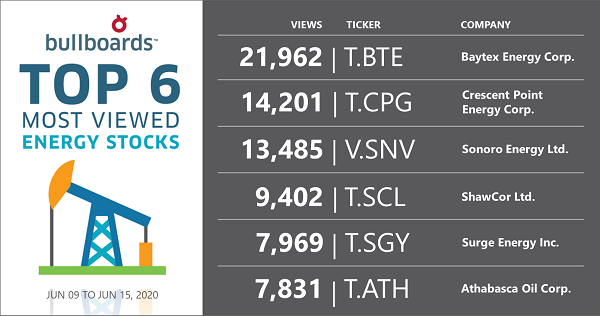

Last week, the economy was opening up, crude prices were climbing, and oil and gas was back in business. A week later and the excitement has been replaced with resurgent worries, and producers like

Baytex Energy Corp. (

TSX:BTE,

Forum) paid the price. Though many other oil and gas producers had rallied alongside BTE previously, the Calgary-based Baytex saw one of the highest gains, and therefore, one of the largest corrections. After climbing from $0.44 on June 1 to a high of $0.94 on June 8, BTE quickly dropped back down to $0.64 on June 11 and has hovered around that mark. It’s still an improvement, but optimism is at a low, as investors and experts aren’t sure if things are about to get better or worse for energy.

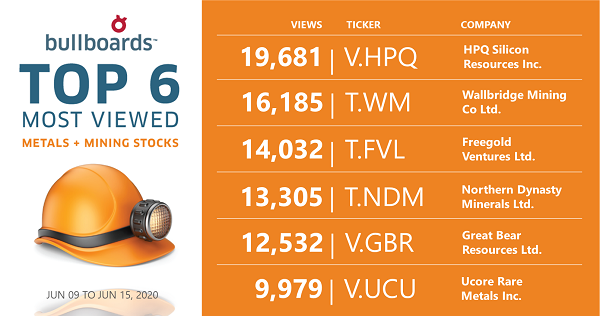

Despite being one of the most consistent and safe sectors tracked by Stockhouse, and a favorite of long-term investors, metals and mining just isn’t as exciting during uncertain times. While gold and other metals have remained strong markets and investors have been impressed by restarting productions and exploration programs, basic materials company

HPQ Silicon Resources Inc. (

TSX-V:HPQ,

Forum) once again took the cake. The developer of silicon nano-materials has been busy on its own, but a strong partnership with the soaring PyroGenesis is allowing HPQ to post its own rally, from $0.12 on June 9 to $0.175 on June 15.

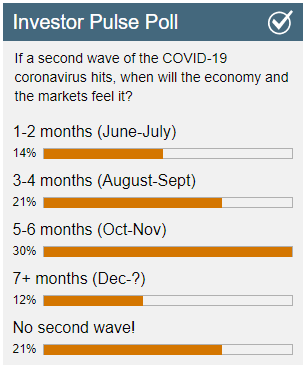

With uncertainty back in the markets following the gradual (and in some places abrupt) reopening of many economies, investors are keeping a wary eye on COVID-19 developments. If the world is able to ease back into swing without the coronavirus wreaking havoc, we’re due for a resurgence across the board. If, however, a second wave of infectors approaches as many fear, we might be headed back down. Our latest Investor Pulse Poll asks when (and if) the “second wave” is coming, and so far Fall seems to be the leading suspect.

But many expect it will happen sooner, and 20% of respondent aren’t expecting a second wave at all. As the picture becomes clearer with each day, we’re keeping the poll open to let more people add their voices, so head over to the

Stockhouse Homepage or click the image below to cast your vote!

(Click image to go to the poll)

(Click image to go to the poll)

Next week we’ll dive back into the Bullboards and see where the small-cap markets are headed. PyroGenesis may be on top for now, but no king lasts forever, and an uncertain market demands constant attention from investors to stay up-to-date and ready. For previous editions of Buzz on the Bullboards:

click here.