(Image via Crescent Point Energy.)

(Image via Crescent Point Energy.)

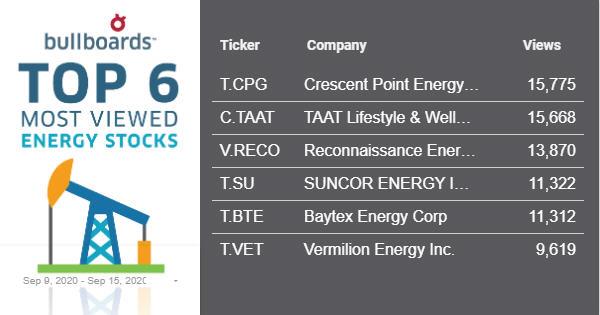

September is often seen as a “fresh start” for the markets, like a new year on the stock exchange, but this party was met with a serious hangover in the shape of poor share performances that only just recently began to turn around.

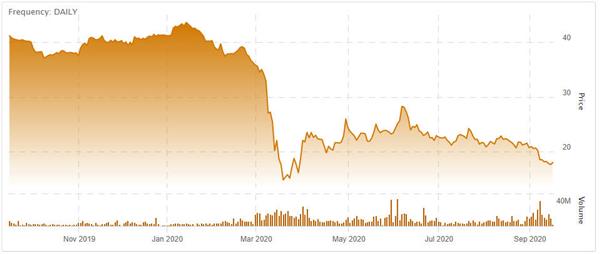

One company that hasn’t turned things around is one of Canada's largest integrated energy operations,

Suncor Energy Inc. (TSX: SU, Forum). After falling 7% in the first week of the month, SU shares lost another 10% last week.

Suncor has been a hot topic among Stockhouse Bullboard posters after it lost a lot of favour among traders when it provided its revised operational guidance and 2020 outlook earlier this month. The company forecast its total production to be between the range of

680,000 to 710,000 barrels of oil equivalent (BOE) per day, down significantly from its previous 2020 guidance of 740,000 to 780,000 BOE per day.

(Suncor Energy Inc. stock chart – Sept 2019 – Sept 2020. Click to enlarge.)

(Suncor Energy Inc. stock chart – Sept 2019 – Sept 2020. Click to enlarge.)

To make matters worse, the company is under investigation by

Pomerantz Law Firm over concerns whether

Investors of Energy Recovery Inc. (NASDAQ: ERII) and certain of its officers and / or directors have engaged in securities fraud or other unlawful business practices.

Bronstein, Gewirtz & Grossman, LLC is also investigating concerns whether Suncor and certain of its officers and/or directors have violated federal securities laws.

On the other hand, Bullboard posters seem to be very positive around

Reconnaissance Energy Africa Ltd. (TSX-V: RECO, Forum), a junior oil and gas company engaged in the exploration and development of oil and gas in Namibia. It holds an approximately 90% interest in a petroleum exploration licence in northeast Namibia which covers the entire Kavango sedimentary basin. Africa itself holds 7.5% of known global oil reserves, with great potential still unexplored.

Namibia could qualify as one of these untapped sources and RECO’s stake in this basin could account for potentially more than 18 billion barrels of oil waiting to be gathered.

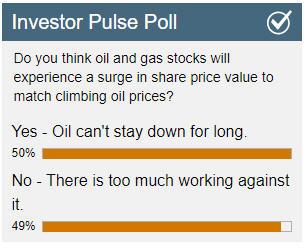

A quote from “Fight Club” may sum it up best –

“On a long enough timeline, the survival rate for everyone drops to zero.”

Could this be applied to non-renewables? Some empires fall while others establish a new foundation.

This was the subject of last week’s poll, which concluded with a near split in opinion.

That brings us to this week’s poll question, with gold resting comfortable above $1,900 an ounce after breaking a record $2,000 an ounce earlier this year, some analysts are forecasting the precious metal to reach $4,000 an ounce within three years. Do you agree with this prediction? Let us know in the poll below.

(Click image to go to poll.)

Wallbridge Mining (TSX: WM, Forum)

(Click image to go to poll.)

Wallbridge Mining (TSX: WM, Forum) has been enjoying the 2020 gold rush. Its stock has recovered from the March cratering that many businesses across multiple industries has endured and just this week announced that it had entered into a non-binding term sheet on a

joint venture of its Detour East gold property with

Kirkland Lake Gold Ltd. (TSX: KL).

Giga Metals Corp. (TSX-V: GIGA, Forum)

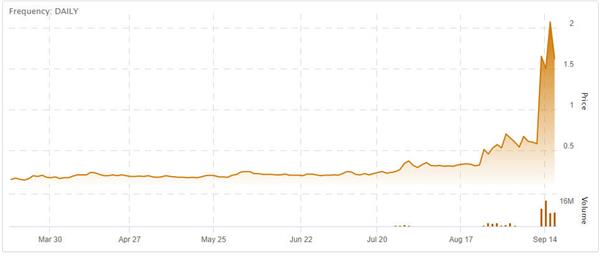

Giga Metals Corp. (TSX-V: GIGA, Forum) recently experienced a spike in its share price with some of that upward movement relating to media reports around its ongoing efforts to advance its Turnagain nickel deposit in northcentral British Columbia to commercialization.

The Company’s president, Martin Vydra, commented on this via

a news release, stating that there is no material announcement forthcoming.

“It is evident that interest in sustainable and carbon neutral nickel production is driving renewed interests in deposits such as Turnagain as the world will need significant nickel to meet future EV demand. Turnagain is one of a handful of deposits that could meet this future demand.”

Its share price has begun to calm down upon this clarification.

(Giga Metals Corp. stock chart – March 2020 – Sept 2020.)

(Giga Metals Corp. stock chart – March 2020 – Sept 2020.)

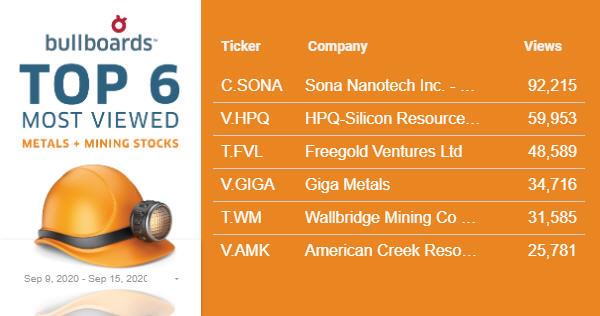

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

PyroGenesis Canada Inc. (TSX-V: PYR, Forum) can often be found at the top of the Industrial Bullboard charts and this week is no different. The high-tech company recently commented on investor speculation that had been picked up by posters on the boards. PYR’s President and CEO P. Peter Pascali stated in

a recent news release that the company on track with our current and prospective projects.

“I can confirm that the current status of torch negotiations with various clients anticipate closing more than 1-2 torch deals in well under 3 months, let alone 3-6 months. These comments are not meant to reflect badly on the analyst in question, but merely to provide additional insight that only a CEO with full information can, and which I felt, under the circumstances, was necessary.”

Bombardier Inc. (TSX: BBD , Forum)

Bombardier Inc. (TSX: BBD , Forum) made news on September 16th with its announcement that it signed a deal to

sell its transportation business to its rail business to France-based

Alstom (EPA: ALO) for $8.4 billion (USD), $350 million less that initially expected.

Bombardier CEO Eric Martel said the company will use the cash to pay down some of its remaining $9.3 billion debt load.

In more positive news,

dynaCERT Inc. (TSX: DYA, Forum) has begun

equipping diesel powered vehicles for the City of Woodstock, Ontario with its proprietary HydraGEN Technology to reduce carbon emissions and reduce fuel costs.

Another Canadian tech success story talked about widely -

Gatekeeper Systems Inc. (TSX-V: GSI, Forum) has been busy in recent weeks, focusing on the health of students and school staff during this “back to class” time.

A leading provider of intelligent video solutions for public transport and smart cities, GSI announced this week that it had received an initial purchase order for four of the its

new Intelligent Temperature Sensing Systems (ITSS) from a leading original equipment manufacturer (OEM) school bus dealer located in Northeastern USA. Together, they will finalize the design of installation brackets and installation procedures for the many different school bus models already in service.

Gatekeeper’s CEO, Doug Dyment explained that each year, on average more than 30,000 school buses are manufactured and distributed by the school bus OEM dealer network.

“As we prepare for a nationwide ITSS deployment, I'm excited that our partner dealers are working closely with our engineering department to ensure our ITSS solution seamlessly integrates with various bus models. Collaborating together with our school bus dealer ensures that all ITSS installations will be completed professionally and efficiently. There are numerous school bus models, regulatory requirements and differing temperature check protocols in each state. This will help ensure that all ITSS installations achieve the high-quality standards that our customers expect from us as we help them provide a safer transportation environment for the 25 million schoolchildren who ride approximately 500,000 school buses daily in the United States.”

Gatekeeper also just increased the size of its non-brokered private placement from $5 million up

to $6 million, due to increased interest.

Health and wellness is still top-of-mind for many people and the Healthcare field is also seeing a lot of attention, both among the general public (and governments) where

telehealth and virtual care are seeing immense growth in these times of physical distancing, but also among posters on our Bullboards.

Biopharmaceutical company

Theratechnologies Inc. (TSX: TH, Forum) has been making headlines this past week, specifically around its work to treat a serious ailment - Non-Alcoholic Steatohepatitis (NASH), by advancing development clinical development of tesamorelin into its third phase.

In a news release, the study’s principal investigator, Dr. Steven Grinspoon, Professor of Medicine, Harvard Medical School, Chief of the Metabolism Unit at Massachusetts General Hospital, explained- “Given that tesamorelin improves critical mechanistic NASH pathways common to both the general population and in people living with HIV, we believe tesamorelin could bring favorable results in both patient populations.”

Theratechnologies President and Chief Executive Officer, Paul Lévesque, also noted:

“From 10 years of real-life experience, the safety profile of tesamorelin in HIV patients with lipodystrophy is well established. Based on current scientific evidence showing a reduction in liver fat and delayed progression of liver fibrosis in patients with HIV infection and NAFLD or NASH, combined with robust intellectual property, a new investigational formulation and the development of a multi-dose pen injector, we believe that we have a potential best-in-class candidate for the treatment of NASH in the general population.”

Meanwhile, consumer packaged goods cannabis company

HEXO Corp. (TSX: HEXO, Forum) announced this week that it had hired

Trent MacDonald as Chief Financial Officer. He comes to the role having served as CFO for

Rx Drug Mart and was also Vice President Finance of

Indigo (TSX: IDG) and Vice President Finance for some of

Sobeys’ (TSX: EMP.A) largest divisions and regions.

We’ll dive back into the Bullboards again next week and see where the small-cap markets are headed. PyroGenesis may be on top for now, but no empire is forever, and an uncertain market demands constant attention from investors to stay up-to-date and ready. For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: Gatekeeper Systems Inc., dynaCERT Inc., and PyroGenesis Canada Inc. are clients of Stockhouse Publishing.