(Image via Gatekeeper Systems Inc.)

(Image via Gatekeeper Systems Inc.)

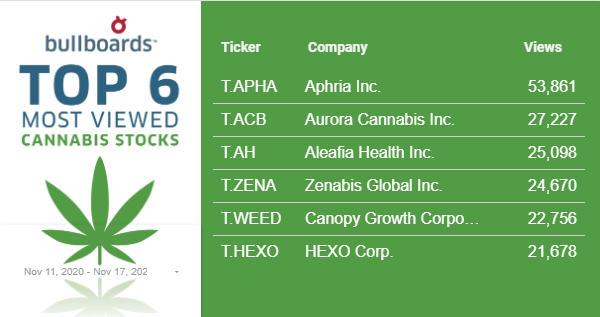

It has been another interesting week for markets on Bay Street and Wall Street, from a hot streak to a slide, back up, and down again. Every sector has seen its share of gainers and decliners, with the Stockhouse Bullboards tracking movement in all directions. A few mainstay companies have continued to dominate the top 6 of their markets, while newcomers have also joined the conversation.

One such industry heavyweight that has worked to show stability during these tumultuous times is cannabis company

Aphria Inc. (TSX: APHA, Forum), who announced the results of its annual general meeting on Wednesday, noting that all seven nominees were elected

to serve as directors of the company via a virtual meeting held earlier this autumn.

Aurora Cannabis Inc. (TSX: ACB, Forum)

Aurora Cannabis Inc. (TSX: ACB, Forum) caught a lot of attention this week

when closed its overnight marketed public offering for total gross proceeds of $172.5 million (USD). ACB sold 23 million shares at $7.50 (USD) a share.

Meanwhile, Toronto-based

Aleafia Health Inc.(TSX-V: ALEF) had some good news to share from its

Q3 2020 financial results, specifically net revenue of $4,968 for the three months ending September 30th 2020, compared to $4,958 for the same period last year. Net revenue for nine months ending Sept 30th was $29,339, compared to $10,323 for the same period a year ago.

The company’s Chief Executive Officer Geoffrey Benic is confident they will see their strongest quarter to date in Q4 2020 as the team progresses towards significant sequential growth in medical, adult-use, wholesale, and international cannabis sales.

“The strategic path we've executed upon, from building out facilities, to receiving three major licences in 2020, to formulating new products, is now bearing fruit. With the introduction of vape cartridges, sublingual strips, and with many more launches to come, the commercialization of our business at scale is truly in full swing.”

Sponsored by

A newcomer to the Buzz Top 6, Calgary-based

Birchcliff Energy Ltd. (TSX: BIR, Forum) also posted its Q3 2020 financial highlights this week, highlighted by quarterly adjusted funds flow of

$59.4 million and free funds flow of $28.5 million, with quarterly average production of 78,376 barrels of oil equivalent per day (boe/d).

President and Chief Executive Officer of Birchcliff, Jeff Tonken was more than pleased with these results, stating that BIR’s ability to drive significant cash flow in the current operating environment speaks to the strong performance of its assets and low-cost structure.

“During the third quarter, we brought our 14-well pad on production in Pouce Coupe. The 14 wells are producing significantly more condensate/light oil and less natural gas than we previously forecast, and we believe we have discovered an extension to the Gordondale light oil pool into the northeastern area of Pouce Coupe. The increased condensate/light oil rates make these 14 wells more economic than we had anticipated. In addition, our new inlet liquids-handling facility in Pouce Coupe that we completed in the third quarter of 2020 allows us to process and sell the condensate/light oil from these wells in Pouce Coupe to achieve a premium price.”

The oil and natural gas company is increasing its 2020 adjusted funds flow guidance to $195 million (from $185 million) and reducing its 2020 annual average production guidance to 76,000 to 77,000 boe/d (from 78,000 to 80,000 boe/d).

Speaking of surges,

Surge Energy Inc. (TSX:SGY, Forum) just announced that it had executed definitive agreements with the Business Development Bank of Canada, in partnership with the company’s syndicate of lenders, for a non-revolving facility of

$40 million.

Meanwhile,

Enbridge Inc. (TSX: ENB, Forum) tried to quell any concern around its Line 5 across the Straits of Mackinac after the Michigan Department of Natural Resources chose to conduct its

assessment of easement compliance in a non-public manner.

The company’s Executive Vice President and President, Liquids Pipelines, Vern Yu said the leadership team is confident that Line 5 continues to operate safely and that there was no credible basis for terminating the 1953 Easement.

“This notice and the report from Michigan Department of Natural Resources are a distraction from the fundamental facts,” he said. “Line 5 remains safe, as envisioned by the 1953 Easement, and as recently validated by our federal safety regulator.”

The debate around the energy industry and its consumption continues to be top-of-mind for many, which has directed a lot of attention toward renewable energy companies. This brings us to this week’s Investor Pulse Poll question. With renewable energy gaining in popularity, do you have many companies in your portfolio, or have you investigated adding a few from that space? Let us know your thoughts by clicking the poll image below and check back next week to see the results.

(Click image to vote.)

(Click image to vote.)

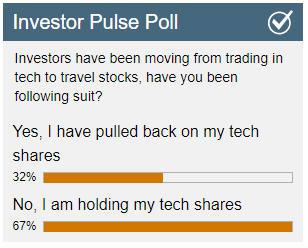

Positive news around potential COVID vaccines have taken a bite out of the tech sector lately, as traders had been moving their money into more safe haven assets, or so the story goes under media analysis. We posed this question in our Investor Pulse Poll last week and it seems as if more than half of you are staying the course on tech.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Having already claimed a lot of investor attention around its “Venue Bubble”, a fully integrated contact tracing to rapid COVID testing solution,

Loop Insights Inc. (TSX-V: MTRX, OTCQB RACMF, Forum) declared this week that it had been selected to join

the Impact Radius Marketplace, which is expected to provide the company with the opportunity to connect with and leverage marketing opportunities with Impact global brand partners such as Fanatics, Uber, Nike, Adidas, Airbnb, Levi’s and a lot more.

(Image via Gatekeeper Systems Inc.)

(Image via Gatekeeper Systems Inc.)

While most companies adapt to doing businesses under this pandemic, the team at

Gatekeeper Systems Inc. (TSX-V: GSI, Forum) has been making the pandemic work for them. The company began its

national marketing campaign this week to raise awareness of how Intelligent Temperature Sensing Systems (ITSS) can help organizations with health monitoring and contact tracing. The marketing campaign has been designed to reach over 50,000 influencers and decision makers in school districts, universities, transit authorities and others.

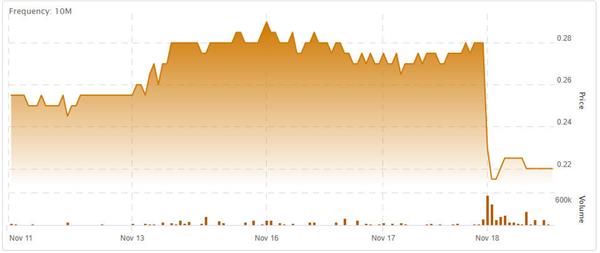

Finally, another newcomer to the Buzz top 6, this time in the tech space, is -

Martello Technologies Group Inc. (TSX-V: MTLO, Forum). This developer of enterprise digital experience monitoring solutions just released its Fiscal Q2 2021 financial results, highlighting 63% growth to $4.4 million (from $2.69M reported for the same quarter in the prior year), with positive adjusted EBITDA, even though the news caused a sell-off in the company’s stock, as several posters on MTLO’s Bullboard pointed out that they had expected more.

(Martello Technologies Group Inc. stock chart. Click to enlarge.)

(Martello Technologies Group Inc. stock chart. Click to enlarge.)

As they say, with time comes wisdom … next week we will be able to better determine how the economy is faring heading into December 2020.

Where does cannabis stand, is energy’s latest rally for real, and what small cap companies are Stockhouse Bullboard users raving about? You can find out on next week’s Buzz on the Bullboards and for previous editions of Buzz:

click here.

FULL DISCLOSURE: Gatekeeper Systems Inc. and Loop Insights Inc. are clients of Stockhouse Publishing.