(Image via Kontrol Energy Corp.)

Many investors may have anticipated a relaxed market heading into the holidays to cap off a tumultuous 2020 for the record books, yet 2020 continues to surprise us as we see engagement and announcements stay steady across the board ....

(Image via Kontrol Energy Corp.)

Many investors may have anticipated a relaxed market heading into the holidays to cap off a tumultuous 2020 for the record books, yet 2020 continues to surprise us as we see engagement and announcements stay steady across the board ....

Staying active has proven to be the right move for many companies working to endure every twist and turn the global economy has thrown our way. Just as predicted last week, the stars have aligned for more than just a few of these companies and shareholders have received some early gifts in the form of rising stock values. Even so, not everyone can be this lucky and there have been a few operations that have already found some “coal” in their stockings, but regardless, users on the Stockhouse Bullboard are adept at sifting through and highlighting the top value plays.

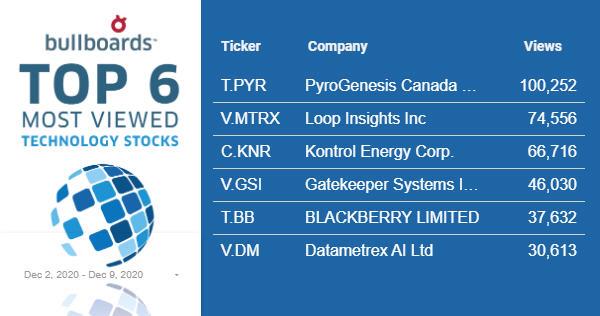

Sponsored by

We are just around the corner from the end of the personal fiscal years and wherever you look, there are signs of increased activity. Those who are looking to cash in, or brokers looking for a couple solid deals, are making their last-minute moves while companies look to impress. As everyone races toward the finish line, let’s take a look at some of the stocks that are standing out from the rest, starting with a couple of companies that are out to uplist their business ….

High-tech company

PyroGenesis Canada Inc. (TSX-V: PYR, Forum) announced this week that it has been approved to file an application to list its common shares on the

NASDAQ Stock Exchange over the next several days. The NASDAQ is the second largest exchange by market capitalization worldwide and is home to many of the world’s best technology companies.

PyroGenesis Chair and Chief Executive Officer, Peter Pascali called this a significant step towards ultimately enhancing shareholder value.

“The United States has the largest capital market in the world and, as such, a NASDAQ listing has always been on our radar as one of the many strategies to execute as part of our long-term vision for the Company. On the back of our recent achievements, and our successful uplisting to the Toronto Stock Exchange, the Board decided that the timing was right to proceed with this application. After discussions with our US legal counsel, and a representative of NASDAQ, it was confirmed that the Company meets the standard requirements for a listing. However, there still remains a rigorous application procedure which the Company must pass before a final listing is granted. The listing, barring any delays or objections, is expected before the end of Q1 2021.”

Shares of Vancouver-based tech Company

Loop Insights Inc. (TSX-V: MTRX, Forum) spiked more than 50% on Monday after it announced its intent this week to

uplist its shares to the Toronto Stock Exchange and NASDAQ, followed by a 60% jump on Tuesday.

The Company believes that a NASDAQ listing application would be better served coming from a TSX listed company, as opposed to a direct application from the TSX Venture Exchange.

Upon laying out this uplist plan to attract new investors, the Company’s Chief Executive Officer, Rob Anson stated -

“As a result of our immutable relevancy, high demand for Loop’s products, pipeline growth, and ability to easily scale into a global marketplace that is in full press digital transformation, we expect a continued accelerated pace that now warrants an uplist and dual list strategy that will attract institutional investors commensurate with our anticipated profile in 2021 and far beyond.”

Kontrol Energy Corp. (CSE.KNR, Forum) is set to ship its COVID-19 technology to customers and distributors around the world.

BioCloud is a real-time analyzer designed to detect airborne viruses, including SARS-COV-2, by continuously sampling air quality and triggering a silent, cloud-based alert to facility managers. KNR estimates a $12,000 (USD) per unit sale price for BioCloud based on current supply chain components.

Switching over to the Industrial Bullboards, one industry that appears to have the potential to make a comeback in the near-term over the COVID pandemic is the travel industry, with

Air Canada Inc. (TSX: AC, Forum) poised to see solid gains once more if this pans out.

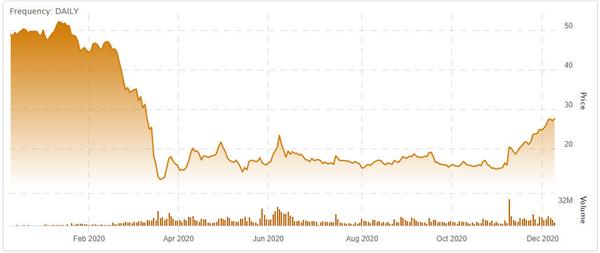

(Air Canada Inc. stock chart – Dec 2019 – Dec 2020. Click to enlarge.)

(Air Canada Inc. stock chart – Dec 2019 – Dec 2020. Click to enlarge.)

AC shares had been hit hard by COVID-imposed travel restrictions, but in the last few months, it has turned things around significantly to climb to around $27 (CAD). Though it is only about half its value from a year ago, it is still much higher than its $12 lows from March.

The airline announced

a new collaboration this week with Uplift, (a point-of-sale financing company focused exclusively on travel) giving the airline's customers access to Uplift's flexible, financing options. Travellers can now book flights from Canada and the US to destinations throughout Air Canada's global network and pay for those trips over time with Uplift.

Canadian transport manufacturer

Bombardier Inc. (TSX: BBD , Forum) caught a lot of Bullboard attention when it appointed

Annie Torkia Lagacé as Senior Vice President, General Counsel and Corporate Secretary. Her new role follows an Executive Vice Presidency at Stornoway Diamonds, with a focus on corporate and commercial law. She will be replacing role’s previous occupant, Steeve Robitaille, who is remaining with Bombardier while the sale of its transportation arm to Alstom finalises.

Environmental salvation and protection is still top of mind among many investors and those who want to advance their portfolio in this segment should take a deeper look at

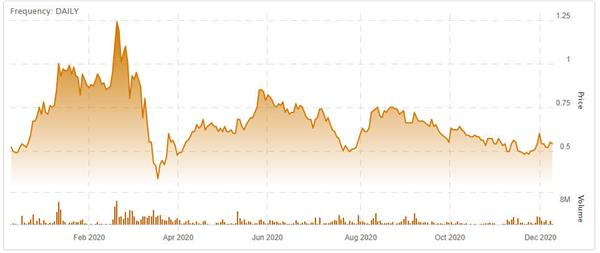

dynaCERT Inc. (TSX: DYA, Forum) and its hydrogen technology, which can be retrofitted to existing diesel engines.

This is an innovation that offers higher combustion efficiency with reduced consumption and significantly lower emissions of pollutants. On top of this, another advantage is that existing vehicles do not need to be replaced. DYA shares have bounced high and low this year, but looking at its performance a year ago, it sits at roughly the same position now at $0.50 a share.

(dynaCERT Inc. stock chart – Dec 2019 – Dec 2020. Click to enlarge.)

(dynaCERT Inc. stock chart – Dec 2019 – Dec 2020. Click to enlarge.)

This brings us to this week’s Investor Pulse Poll question; how do you manage your portfolio differently during tax loss season? Let us know your thoughts by clicking the poll image below.

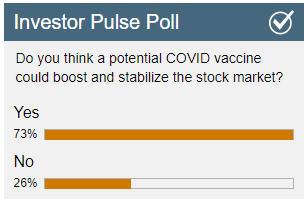

(Click image to vote.)

(Click image to vote.)

The consensus is pretty solid for last week’s survey and a majority of you are optimistic around news that a COVID vaccine is rolling out in the imminent future and its implications for the global stock market.

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Finally, we look to the Top 6 stocks among the Energy Bullboards and three Calgary-based companies therein who have reported their budgets for next year ….

Baytex Energy Corp. (TSX: BTE, Forum)

Baytex Energy Corp. (TSX: BTE, Forum) has declared a 2021 capital budget

of $225 to $275 million (CAD), which is designed to generate free cash flow and average annual production of 73,000 to 77,000 boe/d (barrels of oil per day equivalent).

Crescent Point Energy Corp. (TSX: CPG, Forum), an independent exploration company stated its capital expenditures will be between

$475 to $525 million (CAD) and annual average production guidance of 108,000 to 112,000 boe/d. CPG noted that its 2021 budget is fully funded at approximately $40 (USD) /bbl WTI. The Company expects to generate approximately $150 million to $300 million of excess cash flow at $45 (USD) /bbl to $50 (USD) /bbl WTI and has targeted a reinvestment ratio of less than 75%.

We end with a look at

Athabasca Oil Corporation (TSX: ATH, Forum), who is planning expenditures of

$75 million (CAD) where capital will be allocated under its two operational segments, $70 million to Thermal Oil and the remainder to Light Oil. Annual corporate production is projected between 31,000 – 33,000 boe/d which maintains annual 2020 production estimated to average approximately 32,250 boe/d.

Next week we’ll be doing our 2020 wrap-up, priming up the year ahead, and seeing if the holidays have a positive effect on the markets in the form of a “Santa Claus Rally,” so stay tuned, and for previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: PyroGenesis Canada Inc., Kontrol Energy Corp., Loop Insights Inc. are clients of Stockhouse Publishing.