(Image via BlackBerry Limited.)

(Image via BlackBerry Limited.)

When the going gets tough, where do small-cap investors go?

Strong earnings growth and the increasing likelihood of additional US fiscal stimulus last week pushed Wall Street stocks toward fresh record highs. While activity moved lower earlier this week, the belief is that the economy will continue to recover to pre-pandemic levels as the year progresses on the back of monetary policy support and the gradual easing of restrictions.

Volatility still seems likely in the near-term and during the early months of the year, we have been focusing on stock prices in Buzz on the Bullboards, but it is important to remember that price is more of a useful indication for investors to see where the trends are at, but it is not a market fundamental.

However, when you have data on the current winners, it makes it easier to identify sectors (or niches) where valuations are generally rising. For bargain-hunters on the other hand, getting data on stocks that are trending lower and lower can be a head-start on due diligence.

Sponsored by

Price and value may have taken on new meaning after COVID-19 made its impact on the market. There are a variety of factors at play when an investor makes a move. The immediate concern is how companies are dealing with the impacts, and what will any future impacts look like. But soon, gears start to turn as investors shift focus to companies that are going to recover quickly or find small-caps that are riding against the tide.

This week, the weekly Buzz on the Bullboards snapshot shines a light on three companies that paint three different pictures of how the overall small-cap market is performing right now.

For starters, the tech sector has seen some highs and dips as of late – movement which has been reflected in the Nasdaq. There is a lot going on in this segment between established names and newcomers alike ….

Hitting the market this quarter with revolutionary new smart solutions in the rapidly growing electric vehicle (EV) and Energy Storage Solution (ESS) consumer segments is

Extreme Vehicle Battery Technologies Corp. (CSE: ACDC, Forum). ACDC is also powering its advisory board with equal intensity, building upon its recent partnership with

Daymak, Canada's largest supplier of Light Electric Vehicles (LEV), the Company has brought on board Aldo Baiocchi, Daymak’s CEO. He joined Jack (Jingke) Han, the Founder, Chairman, and CEO of

Jiangsu RichPower New Energy Co. Ltd. ACDC’s Chinese partner. EV Battery Tech has also just over-subscribed its non-brokered private placement for gross proceeds of approximately

$3 million (CAD).

Talking about the last week on the Bullboards would not be complete without putting the magnifying glass on

BlackBerry Limited (TSX:BB, Forum). The famed Waterloo company easily topped the Technology Bullboards once again this week and many media headlines as well, after its shares slid 8% despite releasing news on Tuesday that BlackBerry Jarvis, a software composition analysis tool, had been recognized as

“Best in Breed” by an Internal Research & Development project (IRAD).

This analysis was conducted on behalf of the United States Department of Defense (DoD), along with the Aerospace Corporation, and cited BlackBerry Jarvis as the most promising and robust binary analysis solution on the market for embedded software, after a rigorous assessment of key players.

BlackBerry also made big news with the release of the latest edition to the company’s real-time embedded hypervisor product -

QNX Hypervisor 2.2. This upgrade supports the latest silicon enhancements for interrupt control, scalable vector extensions (SVE), cryptography and enhanced security, and offers features such as fast booting of critical system services before guest launch and priority-based sharing of hardware resources and devices.

Datametrex AI Ltd. (TSX-V: DM, Forum) closed its acquisition of 100% of

Concierge Medical Consultants Inc., a group of board-certified practicing emergency physicians. Under the agreement, Datametrex issued 4,411,764 common shares to Concierge shareholders at a price of $0.17 per common share for an aggregate purchase price of $750,000. Concierge has now become a wholly owned operating subsidiary of Datametrex.

Topping the Healthcare Top 6 for the second week in a row is

The Supreme Cannabis Company Inc. (TSX: FIRE, Forum), who just activated a bought deal offering of

72,600,000 units at $0.31 (CAD) per unit.

BMO Capital Markets, on behalf of a syndicate of underwriters have agreed to buy on bought deal basis 72,600,000 units at a price of $0.31 per unit for gross proceeds of approximately $22.5 million. Each unit will include one common share and one-half of one common share purchase warrant.

A breaking healthcare-related news story that investors are tracking is about how the FDA had granted a priority review to a

Sesen Bio (NYSE: SESN), a company researching treatment for patients who live with BCG-unresponsive non-muscle invasive bladder cancer (NMIBC). This week, any company in this field, ranging from private companies like

ImmunityBio Inc. to public clinical stage pharmaceutical companies

Theralase Technologies Inc. (TSX-V: TLT, Forum).

TLT just released its

quarterly newsletter which talked about the recent progress on the company’s own Phase II NMIBC Clinical Study.

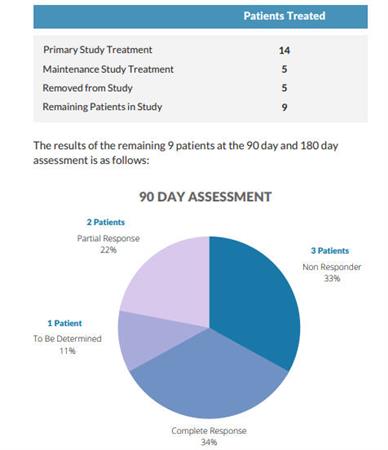

Study II Interim Results:

(Chart via Theralase Technologies Inc. quarterly report.)

TAAT Lifestyle & Wellness Ltd. (CSE: TAAT, Forum)

(Chart via Theralase Technologies Inc. quarterly report.)

TAAT Lifestyle & Wellness Ltd. (CSE: TAAT, Forum) could likely see big business coming its way.

Its flagship product TAAT is now available for purchase online by the majority of smokers aged 21+ in the United States through

its e-commerce portal, which launched yesterday. Through the TAAT’s online shop, cartons of TAAT Original, Smooth, and Menthol are available and can be shipped to addresses in eligible jurisdictions. This news provided another bump to TAAT’s otherwise healthy stock.

(TAAT Lifestyle & Wellness Ltd. stock chart – Nov 2020 to Feb 2021. Click to enlarge.)

(TAAT Lifestyle & Wellness Ltd. stock chart – Nov 2020 to Feb 2021. Click to enlarge.)

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Finally, to the big names in Metals and Mining this week, we have several businesses advancing three resources you should check out if you are looking to diversify your portfolio.

First is

Nouveau Monde Graphite (TSX-V: NOU, Forum). The renewable energy company recently retained

Evercore Group LLC as its financial advisor to assist with the evaluation of a potential listing of the Company’s shares in the United States on either the New York Stock Exchange or the Nasdaq Stock Market.

Nouveau Monde’s President and Chief Executive Officer, Eric Desaulniers explained that with the key governmental approvals in hand for the construction of the company’s “mine-to-market” production facilities, Nouveau Monde’s focus remains on the development of a fully integrated source of environmentally friendly battery anode materials in North America.

“The addition of a listing on the NYSE or Nasdaq will further enhance the Company’s US presence. With our strategic use of hydroelectricity and plans to rely on a fully electrical mining fleet, Nouveau Monde is uniquely positioned to deliver a North American source of carbon-neutral graphite-based material solutions for the growing lithium-ion and fuel cell markets, with full-scale commercial production targeted for 2023. The addition of a major U.S. stock exchange listing will provide enhanced trading access to US-based investors and further enhance Nouveau Monde’s stock market visibility. A potential additional listing in the U.S. is a natural step in the growth and evolution of the Company.”

American Creek Resources Ltd. (TSX-V: AMK, Forum) completed the spin-out of shares of

Stinger Resources Inc., which holds interests in gold and silver properties in British Columbia, including the 100% owned past producing Dunwell Mine which is located in the prolific “Golden Triangle”.

That brings us to this week’s Investor Pulse Poll question: Gold prices recently rose above $2,000 (USD) / oz. which drove many analysts to predict that it would climb higher in the near future. Fast-forward a few weeks and gold prices are down to $1,700 / oz. Do you think we will see new highs in gold prices in 2021? Cast your vote by clicking the image below.

(Click image to vote.)

(Click image to vote.)

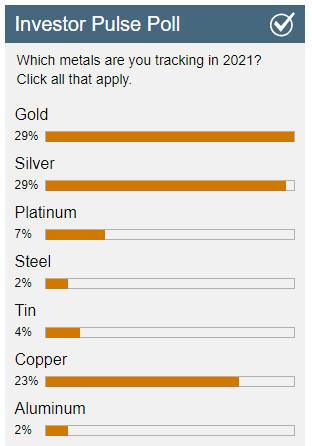

Taking a look at last week's survey, it seems gold and silver are neck-and-neck in terms of capitating investor attention, but every sector has at least some level of interest, which goes to show how diverse the interests is among our Bullboard audience.

Finally, we have

Critical Elements Lithium Corporation (TSX-V: CRE, Forum) who just closed its bought deal private placement offering of 13,636,400 units of the company issued at $1.10 per Unit for gross proceeds of

$15,000,040. The net proceeds from the Offering will be primarily used for exploration and development of its wholly owned Rose Lithium-Tantalum project, located approximately 40 kilometres north of the Cree village of Nemaska on the territory of the Eeyou Istchee James Bay Regional Government in Quebec.

Next week (as the PDAC conference approaches) we will lead off with a focus on metals and mining. We want to know how Stockhouse investors are evaluating the current market conditions with respect to resource companies like these, as well as any others.

You never know what a week will bring for the markets, but next week promises one thing for sure -clarity. On deck is a better understanding of how COVID 19 stimulus will impact the market, as well as a clearer outlook into political developments on both sides of the border. On top of that, we can expect small-cap investors to react and explore what the market has to offer, and the Stockhouse Bullboards to broadcast their findings. For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: TAAT Lifestyle & Wellness Ltd., American Creek Resources Ltd., Datametrex AI Ltd. and Extreme Vehicle Battery Technologies Corp. are clients of Stockhouse Publishing.