In recent days, weeks, even months, markets on both sides of the 49

th parallel have been erratic as volatility has returned with a vengeance. Investors continue to gather at Stockhouse. What is a buying opportunity for one investor is a "selling window" for another.

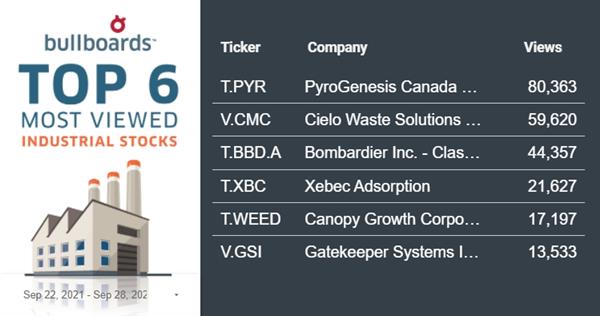

On the Stockhouse Bullboards, the cannabis sector remains one of the largest hubs of investor activity. However, the Stockhouse Community also discusses and invests in companies representing the full spectrum of the economy.

Big news from

Aurora Cannabis (TSX: ACB, Forum) – The top Canadian LP in global medical cannabis released its financial and operational results for the fourth quarter and full year fiscal 2021, highlighting Medical cannabis net revenue was

$35 million (CAD), a 9% increase from the prior year period. However, consumer cannabis net revenue was $19.5 million ($20.2 million excluding provisions), a 45% decrease from $35.3 million ($37.1 million excluding provisions) in the prior year. Adjusted gross margin before fair value adjustments on cannabis net revenue1 was 54% in Q4 2021 versus 49% in the prior year period and 44% in Q3 2021.

Aurora’s Chief Executive Officer, Miguel Martin said that the company is positioned for long-term success by delivering further improvement in the adjusted gross margin and substantially narrowing its adjusted EBITDA loss compared to the year-ago period.

“With annual cost savings of approximately $60 to $80 million across selling, general and administrative, production cost, facility, and logistic expenses, we have a clear pathway to achieve Adjusted EBITDA profitability. Importantly, our considerable cash balance of $440.9 million, substantial improvement in working capital, and strong balance sheet support our organic growth and can be utilized for opportunistic M&A, particularly in the US.”

Tilray Inc. (NASDAQ: TLRY) will release financial results for its first quarter fiscal 2022 ended August 31, 2021 before financial markets open on Thursday, October 7th, 2021 at 8:30 am Eastern Time.

For full details on how to join, click

here.

Integrated health care company

Empower Clinics Inc. (CSE: CBDT, Forum) has signed an MOU to get supply from

SoLVBL Solutions Inc. (CSE: SOLV, Forum) for a

custom cybersecurity program.

The program will detect cyberattacks and provide data security to Empower's diagnostic testing programs.

Empower CEO Steven McAuley called SoLVBL Solutions, a company with broad know-how in data verification and cybersecurity.

“We feel this verification solution will allow us to continue to grow and meet the demands and needs of our patients and health care administrations. The collaboration aligns with our expansion and growth plans to become a global technological leader in the health care diagnostic sector.”

Empower is an provides digital and telemedicine care, as well as world-class medical diagnostics, to patients across North America. SoLVBL is a cybersecurity company developing a universal standard for establishing digital record authenticity.

SoLVBL Solutions CO Raymond Pomroy added that this collaboration with Empower will yield a comprehensive cybersecurity solution for its diagnostic testing platforms, answering a growing global cyber threat.

“We believe this will be the first of many such opportunities in the health care vertical.”

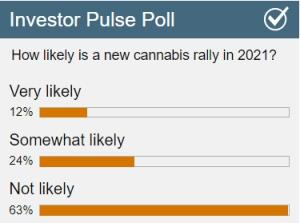

Cannabis was the subject of our Investor Pulse Poll this past week and it seems a solid majority of those who responded are not believers in the second coming (or is it third?) of a new cannabis rally.

Another market that has been making waves recently is the technology sector, which has been climbing to new highs in recent months, only to struggle and fall on Bay Street and Wall Street.

With this in mind, we ask you, how do you predict your tech-heavy investments will fare in your portfolio? Let us know your thoughts by casting your vote in the new survey below.

(Click image to vote.)

(Click image to vote.)

Focusing on some companies in the tech space,

Fobi AI Inc. Inc. (TSX-V: FOBI, Forum) is partnering with

Kiaro Holdings to implement

a big data and operational intelligence platform.

Fobi will assist Kiaro in the development of a big data and operational intelligence platform to help optimize and monetize its sales data by generating insights, analytics, and audience segmentation capabilities, providing Kiaro with a competitive advantage in the fast-growing cannabis retail market.

Kiaro CEO Daniel Petrov commented on the partnership:

“This partnership with Fobi will allow Kiaro to greatly improve its overall operational efficiencies and enable the company to benefit from enhanced data aggregation and segmentation capabilities, as Kiaro continues to execute on our scale and growth plans.

With the sensitivity and importance of the large amounts of client data that can now be collected and optimized through Fobi’s AI-driven insights solution, I look forward to working with the Fobi team and advancing our internal data strategy and roadmap. As a result of this agreement, we are now well-positioned to monetize our existing data streams across the industry.”

This partnership will allow Fobi to demonstrate the financial value of its data analytics capabilities to the entire industry, leading to future opportunities within the massive and growing cannabis vertical.

Fobi CEO Rob Anson also commented:

“I see the cannabis industry as a very lucrative opportunity for Fobi. This agreement with Kiaro will allow Fobi to demonstrate the power of our real-time data applications and analytics to provide a disjointed and fragmented market with the technologies and strategies necessary to improve existing siloed data systems. The power of Fobi’s real-time artificial intelligence and data capabilities will be key to driving profitability and supporting the growth and scale plans of Kiaro.”

Fobi is in advanced stage discussions with several potential clients and expects further such agreements in 2021 and beyond.

One of Canada’s largest retailers of cannabis, Kiaro operates 16 locations and forecasted annual revenue of $42.7 million. Kiaro is an independent, omnichannel cannabis retailer and distributor with storefronts across British Columbia, Saskatchewan and Ontario Fobi is a cutting-edge data intelligence company that helps clients turn real-time data into actionable insights and personalized customer engagement to generate increased profits. Fobi's unique IoT device has the ability to integrate seamlessly into existing infrastructure to enable data connectivity across online and on-premises platforms creating highly scalable solutions.

Datametrex AI Ltd. (TSX-V: DM, Forum) has entered into a COVID-19 testing service agreement for a cruise line operated by one of the world's largest entertainment companies.

Datametrex will be providing the

1copy COVID-19 qPCR Multi Kit, that can identify the new variants of COVID-19, for use in testing officers, crew performers, directors, choreographers, audio technicians, stagehands, and costume technicians at the Toronto area rehearsal facility.

The testing will commence September 30th continuing into the first quarter of 2022 and will increase each month until the full entertainment operations are hired and trained.

Datametrex CEO Marshall Gunter commented on the agreement:

“This new testing service for the cruise industry gets our feet in a new revenue stream. When the pandemic hit in March 2020, cruise ships were particularly hit hard, which brought the industry to a halt worldwide stranding over 50 cruise lines and more than 270 ships. In an industry worth approximately $150 billion, and 1,177,000 jobs equaling $50.24 billion in wages and salaries, it is important to test crew regularly to minimize the threat of a shutdown again.”

Once known for being the world's largest smartphone manufacturer

, BlackBerry Limited (TSX: BB, Forum) is now exclusively a software provider who announced a collaboration to bring a next generation fleet operations and ADAS data platform to automotive original equipment manufacturers (OEMs) via the

BlackBerry IVY intelligent vehicle data platform on Wednesday.

Leading the way in the digital transformation of fleet businesses and operations, Ridecell’s internet of things (IoT)-driven automation and mobility platform helps businesses modernize and monetize their fleets by combining data insights with digital vehicle control to turn today's manual processes into automated workflows.

Ridecell chose BlackBerry because of the company's position as a leading embedded software partner for the automotive industry and the potential of BlackBerry IVY to scale across global automakers.

This platform can enable OEMs to provide fleet operators with the tools they need to turn fleet management insights into automated actions that include responding to maintenance and diagnostics alerts, automating vehicle access control, and vehicle disablement if stolen, along with generating crash analytics reports to satisfy government regulations.

PyroGenesis Canada Inc. (TSX-V: PYR, Forum)

PyroGenesis Canada Inc. (TSX-V: PYR, Forum) entered a joint venture to convert aluminum dross residue into

chemical products.

The 50/50 agreement, with a leading residue processor, will see the company build and operate dross residue valorization facilities worldwide. Aluminum dross is typically comprised of aluminum metal (60%) and aluminum oxides (40%). PyroGenesis’ Drosrite system can recover up to 98% of the aluminum metal, while the aluminum oxides (dross residue) are often landfilled or sold as a cheap additive.

PyroGenesis has secured an exclusive license to a technology expected to convert dross residue into high-value chemical products. Access to the technology initially applies to projects in North America and the Gulf Cooperation Council nations. Upon successful completion of the first project, access will expand to include most of the world.

The first plant, within the Gulf region, is expected to convert 25,000 tonnes of aluminum dross residue per year into chemicals - like aluminum sulfate and ammonium sulfate - to be sold between US$200 and US$450 per tonne.

PyroGenesis’ CEO and chair, P. Peter Pascali, CEO stated:

“This JV not only solidifies our Drosrite offering, but it is also able to address a downstream problem that is increasingly plaguing the industry; namely, how to handle dross residues which are becoming more and more regulated and banned from landfills.This is the ultimate coffee & donut strategy where, with very little additional effort, we are able to sell, alongside Drosrite, a separate compelling green solution, which also further secures Drosrite’s commercial competitiveness.”

Cielo Waste Solutions (CSE: CMC, Forum) reported its financial results for its Q1 2022, pointing to an in crease of total assets by

$1.2 million (CAD) as at July 31st, 2021 compared to April 30th, 2021, due to the increase in property, plant and equipment related to the construction activities at the Aldersyde facility, and the increase of prepaid expenses, partially offset by the decrease in cash related to increased research and development and general and administrative expenditures.

Aviation heavyweight

Bombardier Inc. (TSX: BBD, Forum) announce that two of its leading business jets are on a

tour of several European countries.

The showcase has begun in Germany and will include stops in the Netherlands, Belgium, Spain, and Denmark before wrapping up in Sweden on October 5th, 2021. BBD’s Regional Vice President of Sales, Europe, Middle East and Africa, Emmanuel Bornand, said that as interest in business aviation grows in Europe and all over the world, it’s important for customers to see first-hand how the cabins and attention to detail aboard Bombardier jets set themselves apart.

The Global 7500 aircraft created a new space at the upper end of the business jet spectrum since its entry-into-service, with the 100 aircraft already being manufactured. This business jet offers four true living areas, including a master suite with a full-size bed, and Bombardier’s patented Nuage seating collection for the ultimate comfort on long flights. Its industry-leading range of 7,700 nautical miles means passengers can fly nonstop from Western Europe to virtually anywhere on the planet, including Bali, Tokyo, and Honolulu.

The Global 7500 aircraft’s steep approach capabilities allow it to access London City and a variety of challenging airfields – and to fly out of these airports with excellent range. The Challenger 350 aircraft is the industry’s best-selling super mid-size jet for seven years running, thanks to its performance, reliability, and advantageous operating costs, not to mention its best-in-class cabin experience and smooth ride.

This tour will provide an occasion for guests to learn more about the future of this renowned business jet, which will soon be evolving into the Challenger 3500 aircraft, entering service in the second half of 2022. This aircraft will have a brand-new interior and a host of innovations and was proudly designed through a sustainable lens.

Small-cap stocks are inherently more volatile than large caps, this could test the resolve of small-cap investors like it never has before. This means that disconnects between value and price will continue to become more extreme. The “momentum” that many investors/traders have relied upon to fuel gains in recent years will become increasingly capricious. In short, for many investors, “value investing” is back.

If you look for an undervalued stock, strap yourself in for what will be a long and wild ride. As these stocks rise and fall, Stockhouse remains your best destination to exchange information and ideas with other investors.

For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: SoLVBL Solutions Inc., Datametrex AI Ltd., and PyroGenesis Canada Inc. are clients of Stockhouse Publishing.