(Image via Canopy Growth Corp.)

(Image via Canopy Growth Corp.)

In Canada, the cannabis, resource, and tech sectors have made a lot of noise this autumn season, and in this week’s Buzz we look at some of those companies that have been talked about on the Bullboards. In some cases, the opportunity for investors has been clear-cut, while in others, a lack of information makes for deep-dive discussions into what’s available.

Cannabis, hemp, and cannabis device company

Canopy Growth Corp. (TSX: WEED, Forum) unveiled

a new lineup of premium flower offerings across its 7ACRES, 7ACRES Craft Collective and DOJA brands, including a range of national and limited-edition craft strains. These sought-after strains meet the growing demand of the Canadian flower market and deliver the Company's commitment to deliver on consumers' evolving preferences.

The Tinley Beverage Company Inc. (CSE: TNY, Forum)

The Tinley Beverage Company Inc. (CSE: TNY, Forum) will be producing

Soma Beverage Company’s non-alcoholic craft-style beverage, Hoppin’ High Ride.

The new High Ride beverages were developed in collaboration with the brewmasters at BJ’s Restaurant & Brewhouse.

The Hoppin’ High Ride is the first of Soma’s new THCeer’s! High Ride beverages. It is produced without preservatives through a new closed-loop cannabis infusion and pasteurization process at Tinley’s Long Beach facility.

Soma collaborated with two master brewers from BJ’s to create their traditionally styled, non-alcoholic craft brews.

Alex Puchner, BJ’s original brewmaster and current senior VP of Brewing Operations, and Aaron Stueck, Director of R&D, applied their skills and experience to the challenge: removing the alcohol without impacting the freshness and complexity of flavours experienced with traditional craft brews.

After two years of crafting, dealcoholizing, recrafting, and testing, Soma’s cannabis-infused THCeer’s! Hoppin’ High Ride is ready for production.

“The team in Long Beach is experienced in both large-scale CPG beverages as well as craft brewing,” said Soma CFO Eric Cernich. “They share our deep commitment to quality and have engineered solutions that respect and protect the art and science behind these products.”

Richard Gillis, President and COO of Tinley USA, commented on the collaboration.

“This innovative partnership between Soma and BJ’s,” he said, “taps several new capabilities in our facility, including closed-loop intake and infusion, tunnel pasteurization to avoid added preservatives, and exacting control of product specifications—all to help ensure consistent craft quality, THC potency and performance, and overall taste experience.”

Aleafia Health Inc. (TSX-V: ALEF, Forum) reported its

financial results for the three and nine months ending September 30

th, 2021.

The company’s Q3 2021 unaudited, consolidated financial statements and management discussion and analysis.

Highlights:

- $9.6 million net revenue with an improved sales mix focused on the high-growth adult-use and recurring medical cannabis sales channels.

- 2,044% y/y increase in adult-use cannabis net revenue.

- 31% y/y increase in medical cannabis net revenue

- Top 10 in national market share in pre-rolls achieved subsequent to the reporting period.

- Top 10 in national adult-use market share in edibles and oils categories.

- Outdoor harvest produced average yield on THC-dominant dried flower of 22%

- SG&A expenses declined 24% over the previous quarter.

- Strengthened product portfolio with a total of 35 and 46 SKUs listed in Ontario and Alberta respectively by January 2022.

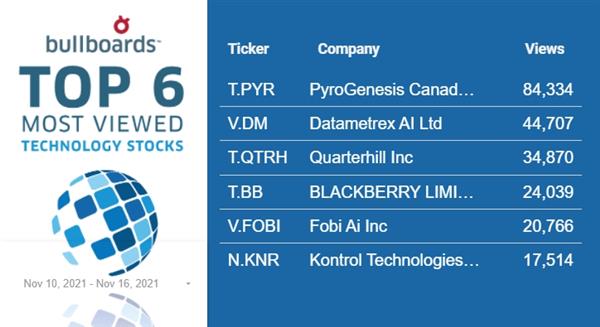

PyroGenesis Canada Inc. (TSX-V: PYR, Forum)

PyroGenesis Canada Inc. (TSX-V: PYR, Forum) announce today its

financial and operational results for the Q3, ended September 30, 2021.

Highlights:

- Revenues of $9,317,926, an increase of 14% from $8,149,427 in Q3 2020,

- Revenues of $3,712,000 from the recent acquisition of Pyro Green-Gas,

- Entering the Renewable Natural Gas market via acquisition, and establishing a presence in India and Italy,

- Third consecutive quarter of revenue growth, $6,264,503, $8,280,572 & $9,317,926,

- Gross margin profit of $4,052,531 or 43.5% of revenue,

- Net income and comprehensive income of $623,664,

- EBITDA of $968,667 and Adjusted EBITDA of $1,641,861 for Q3, 2021,

- Cash and cash equivalents at September 30, 2021 of $15,781,528 (December 31, 2020 - $18,104,899),

- Backlog of signed and/or awarded contracts of $44.9MM,

The company said it plans to execute on organic growth strategies, such as the recent acquisition of Pyro Green-Gas as well as to continue actively pursuing growth through synergistic mergers & acquisitions. Pyro also recently focused its offerings to highlight its GHG emissions reduction benefits, which has been enhanced by Pyro Green-Gas offerings. Most of PyroGenesis’ product lines do not depend on environmental incentives (tax credits GHG certificates, environmental subsidies, etc.) to be economically viable.

Datametrex AI Ltd. (TSX-V: DM, Forum) received a purchase order for up to $1,000,000 from an

electric vehicle charging platform company.

“Under the terms of the purchase order, Datametrex will be providing its AI technology to enhance the experience of EV owners, contributing to the development of sustainable EV infrastructure,” stated Marshall Gunter, CEO of Datmetrex.

According to the Patterns Journal, the market for EV charging stations is projected to reach $27 billion by 2027. The growth in the number of EV charging stations and the development of vehicle-to-grid technologies to optimize charging systems will be driven by AI. In a market report with marketsandmarkets.com, the global Electric Vehicle Charging Station market size is projected to grow from 2 million units in 2020 to 30 million units by 2027, at a CAGR of 46.6%.

“Datametrex feels that AI will improve the efficiency and forecasting that support EV charging platforms. With the innovations that its AI brings, Datametrex will be in a leadership position as the market expands,” stated Andrew Ryu, Chairman of Datametrex.

Fobi AI Inc. Inc. (TSX-V: FOBI, Forum) will provide digital vaccination and testing verification for Sammy Hagar’s sold-out concerts at the

STRAT Hotel & SkyPod in Las Vegas.

Fobi will generate revenue through an initial setup fee and ongoing wallet pass license fees.

Fobi CEO Rob Anson commented on the opportunity.

“Las Vegas is the entertainment capital of the world and implementing the Fobi Wallet pass technology at Sammy Hagar’s sold-out shows at The STRAT Hotel, Casino & SkyPod in Las Vegas is a big opportunity and another big milestone for the company.”

What the "Buzz"

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get "Buzz on the Bullboards" delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Kontrol Energy Corp. (CSE: KNR, Forum) also released of its

financial results for the three- and nine-month periods ended September 30, 2021.

Highlights:

- Record revenues of $21.5 million (CAD) in Q3 2021, up 614% year-over-year

- Record net income of $2.1 million in the third quarter of 2021, representing second consecutive quarter of positive net income

- Record adjusted EBITDA of $2.8 million (CAD) in q3 2021, up 224% year-over-year

- Cash flows from operating activities of $4.8 million (CAD) in 2021 year-to-date

- Strengthened balance sheet by eliminating $4.0 million (CAD) in debt in 2021 year-to-date

- Completed acquisition of Global HVAC & Automation Inc. (“Global”), the largest acquisition in Kontrol’s history

- Raising Fiscal Year 2021 Outlook

- Revenues of $43 million to $46 million (CAD), up from previous $38 million estimate

- Adjusted EBITDA of $6 million to $7 million (CAD), up from previous $3.7 million estimate

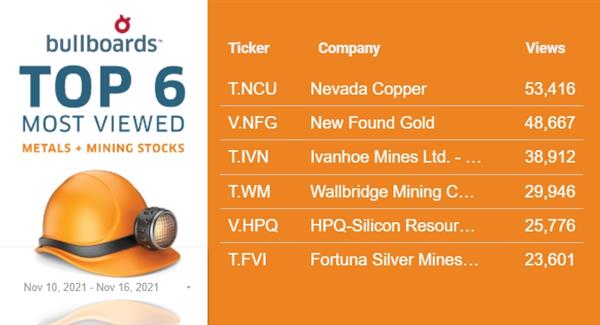

Nevada Copper Corp. (TSX: NCU, Forum)

Nevada Copper Corp. (TSX: NCU, Forum) announced

an upsizing and pricing of its marketed public offering.

The company has upsized the offering from $75 million (CAD) to approximately $114 million (CAD). The increase in proceeds will provide the company with additional funds to advance the ramp-up of its underground mine at its Pumpkin Hollow Project and continue exploration and expansion studies at its open pit project at Pumpkin Hollow.

Pala Investments Limited, Nevada Copper’s biggest investor, has committed to purchasing, on a private placement basis, a total of 89,331,682 units to maintain its current shareholding percentage in the company.

Nevada Copper has entered into an underwriting agreement with a syndicate of underwriters led by Scotiabank for the sale of 148,100,000 units at a price of $0.77 per unit for aggregate gross proceeds of approximately $114 million (CAD). Each unit will consist of one common share and one-half of one common share purchase warrant. Each warrant will be exercisable for one common share for a period of 18 months following the closing of the offering at a price of $1.00 per warrant share.

The company has granted the underwriters an over-allotment option to purchase up to an additional 22,215,000 units. If the over-allotment option is exercised in full, the aggregate gross proceeds of the offering will be approximately $131 million (CAD).

The offering is expected to close on or about November 29, 2021.

Net proceeds will be used to fund the development and ramp-up of the Underground Mine, the full repayment of bridge loans, Open Pit Project exploration and general corporate purposes.

The net proceeds from the private placement with Pala Investments will be used to retire and prepay an equivalent portion of the existing loans outstanding under the promissory note issued by the company to Pala on June 10, 2021. In the event all or part of the over-allotment option is exercised by the underwriters, Pala has committed to increase the number of units it purchases.

New Found Gold (TSX-V: NFG, Forum) also released an update regarding its non-brokered private placement with billionaire businessman

Eric Sprott of 5 million common shares of New Found, at a price of $9.60 (CAD) per Common Share, for gross proceeds of $48 million (CAD). The mining company added that it had received conditional approval of the Offering from the TSX Venture Exchange and approval by the shareholders of the Company is not required by the TSXV. The Offering is expected to close on November 24, 2021.

Ivanhoe Mines Ltd. (TSX: IVN, Forum) released quarterly results after its first quarter of commercial production at the

Kamoa-Kakula Project.

The Kamoa-Kakula Project is located in the Democratic Republic of Congo (DRC).

The company reported revenue of $342.6 million from sales in Q3, with nearly 41,500 tonnes of payable copper sold during the first production quarter at the Kamoa-Kakula joint venture.

The Kamoa-Kakula Project began producing copper in May 2021 and achieved commercial production on July 1, 2021.

Production for the third quarter was 41,545 tonnes of copper in concentrate, with year-to-date production of more than 77,500 tonnes as of November 15, 2021.

The quarter’s cost of sales reflects the measured ramp-up of production at Kamoa-Kakula to steady-state, coming in at $1.08/lb.

Costs are expected to trend downward as the Phase 2 concentrator plant is commissioned and the mine’s fixed operating costs are spread over increased copper production. Construction on the Phase 2 plant is expected to reach completion in Q2 2022.

The company has a strong balance sheet with cash and cash equivalents of $579.7 million on hand at the end of the quarter. Total assets increased by $591.9 million compared to the previous year.

Robert Friedland, executive co-chair and founder of Ivanhoe Mines, commented on the quarterly results.

“We are immensely proud,” he said, “to say that Kamoa-Kakula […] is well on its way to joining the ranks of the world’s largest and greenest copper producers, with the highest copper grades by a wide margin.”

“Turning an operating profit in just the first quarter of commercial production at Kamoa-Kakula highlights the ability of the mine to deliver as promised,” added Mr. Friedland, “and to self-fund its expansion to produce up to 800,000 tonnes of copper yearly, as demonstrated in previous independent studies.”

Ivanhoe also released an update for its Platreef Project in South Africa, the Kipushi Project in the DRC, and the Western Foreland Exploration Project, also in the DRC.

The company is conducting a feasibility study for its phased development plan at Platreef and expects to complete the study in early 2022.

At Kipushi, Ivanhoe continues to support the local community through its Sustainable Livelihoods Program and educational initiatives.

Exploration activities at the Western Foreland area continued during Q3 2021, with diamond drilling covering a total of 9,699 metres across the property.

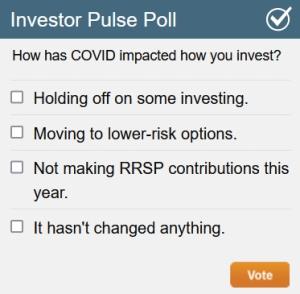

It doesn’t seem that long ago where every news release from companies was referencing how COVID-19 impacted their business. Now nobody is talking about it. Have we crossed that Rubicon, or is it lying in wait? That’s what we want to know from you as we revisit the question in our Investor Pulse Poll below.

(Click image to vote.)

(Click image to vote.)

Looking at last week, it seems most of you know where you are putting your strategy as we head into the 2021 tax loss season.

As always, look for undervalued stocks, and then strap yourselves in for what will be (in many cases) a long and wild ride. As these stocks rise and fall, Stockhouse remains your best destination to exchange information and ideas with other investors.

For previous editions of Buzz on the Bullboards:

click here.

FULL DISCLOSURE: PyroGenesis Canada Inc. and Datametrex AI Ltd. are clients of Stockhouse Publishing.