As investors assess the strategy of liquidating positions before the summer, lingering concerns over an impending economic recession haven’t appeared to slow down activity on the Bullboards.

Instead, as we approach zero hour on the deadline to settle the U.S. debt ceiling, many businesses and traders have appeared to hold off on making any big moves until all sides come to literal terms on a deal.

That is obviously not true across the board and several leading-edge businesses have pledged on.

Vancouver-based digital health technology company WELL Health Technologies Corp. (TSX:WELL) has acquired five primary care clinics from MCI Onehealth Technologies.

MCI Onehealth is a healthcare technology company focused on empowering patients and doctors with advanced technologies to increase access, improve quality, and reduce healthcare costs. Its Canadian primary care network includes 280 physicians and specialists, serves more than 1 million patients annually and had nearly 300,000 telehealth visits last year.

Source: WELL Health Technologies Corp.

Source: WELL Health Technologies Corp.

The subsidiary MCI Medical Clinics (Alberta) owns and operates five primary care clinics in Calgary.

Consideration is C$2 million, including $1 million in cash at signing, with the balance subject to customary post-closing adjustments and holdbacks.

The clinics offer a range of primary care services, including family medicine, women’s health, and other specialties, and are expected to collectively contribute approximately $10 million in annual revenue.

The debt-free acquisition adds more than 50 physicians to the WELL Health network, complementing WELL’s 3,000-plus providers in patient services business units across North America. Closing is expected in Q2 2023.

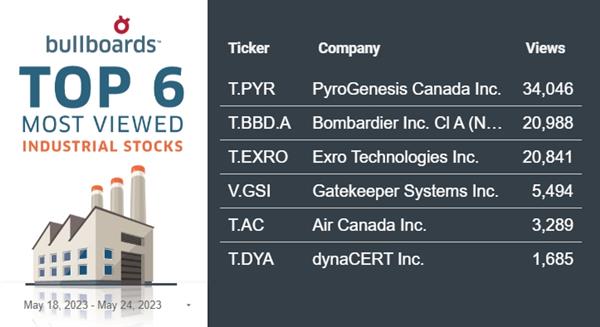

PyroGenesis Canada Inc. (TSXV:PYR) has received a C$2 million payment under its existing $25 million Drosrite contract.

PyroGenesis’ Drosrite system recovers waste from the aluminum smelting process, which can be converted into high-margin products, such as aluminum sulphate and ammonium sulphate.

What the “Buzz”

Our Bullboards have up to 2 Million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

$10.7 million remains to be paid under the contract, which management views as a steppingstone to increasing its presence in the Middle East.

PyroGenesis’ subsidiary Drosrite International was contracted by Radian Oil and Gas Services for seven Drosrite systems. The first three systems are in full commercial operation at the Ma’aden plant in Ras Al-Khair, a joint venture corporation with Alcoa recognized as the largest and most efficient vertically integrated aluminum complex in the world.

Source: PyroGenesis Canada

Source: PyroGenesis Canada

The company has manufactured the remaining four systems, which are ready for deployment subject to a renewed payment schedule.

“We trust that this payment will allay any concerns that some may have had with respect to the collectability of this receivable,” said P. Peter Pascali, CEO and President of PyroGenesis. “The payment announced today was made in accordance with a continuously revised payment schedule geared to better align [with] the pressures on the end-client’s operating cash flows created by increased business opportunities.”

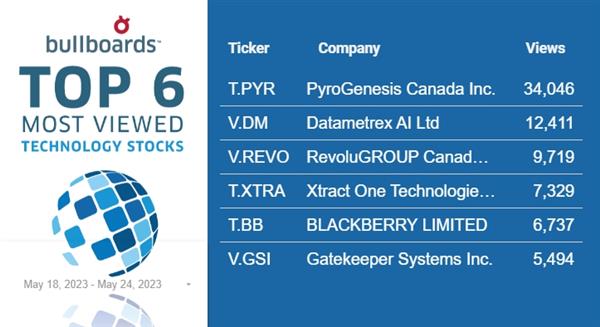

In technology, Datametrex (TSXV:DM) subsidiary DM EVS, an EV charging company, is partnering with Rewatt Power.

Calgary-based Rewatt Power is a climate accounting and monetization platform for individuals, companies, and municipalities of any size. It aggregates and brokers carbon credits, offering government-regulated clean-fuel compliance credits to emit one tonne of carbon emissions. By supplying EVs with electricity, network operators can generate clean-fuel credits by replacing fossil fuels.

The two-year partnership allows DM EVS to accrue the federal Clean Fuel Regulation credit, a Canada-wide government incentive credit, and the Low-Carbon Fuel Standard credit, which is B.C. based.

Source: Datametrex.

Source: Datametrex.

DM EVS will receive a payment for each charge, powered by carbon tax credits, allowing it to build more EV charging stations and charge more EVs while maximizing its earnings.

Even if Washington were to raise the debt ceiling, markets could be roiled, according to analysts. That’s because the Treasury will need to issue a lot of debt to replenish its general account.

2023 continues to be an uncertain rollercoaster for investors, and next week, one way or another, we will see the resolution to the debt ceiling drama. One thing is for sure: some small-cap companies will rise, others will fall, and the keen investors on the Stockhouse Bullboards will be there. For previous editions of Buzz on the Bullboards: click here.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.