The summer months of 2023 have been colourful among the Canadian and U.S. markets to say the least. This week, Wall Street was beat up after Moody’s cut the credit ratings of 10 regional U.S. banks and warned it could also downgrade some of the nation’s biggest lenders. The ratings agency cited stress from higher interest rates, a potential recession next year, and struggling commercial real estate assets. Regional banks are still trying to get over the ill effects from the Silicon Valley Bank (NASDAQ:SIVB) collapse in March.

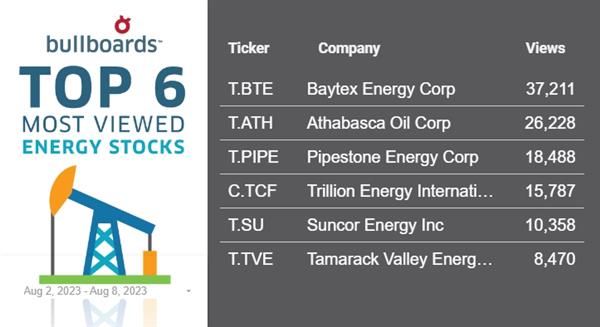

Bay Street has also seen choppy trading this week as Bullboard users brace for a busy week of earnings in Canada and await U.S. inflation data due on Thursday for clues on the market’s immediate course. Energy stocks have been one bright spot for traders, who saw a boost from higher oil prices.

Pipestone Energy (TSX:PIPE, Forum) made recent waves in this space it will be acquired by Strathcona Resources, creating a new public Canadian oil and gas company.

The all-share transaction has been equated to an initial enterprise value of C$11.5 billion.

The two companies will be amalgamated to form a new corporation, which will continue as Strathcona Resources Ltd. Once the transaction is complete, existing Pipestone shareholders will receive 9.05 per cent of the pro forma equity in Strathcona on a fully diluted basis. Existing Strathcona shareholders and employees will own the rest.

Strathcona will become Canada’s fifth largest oil producer, with current production of 185,000 barrels of oil per day (boe / d) (70 per cent oil / condensate, 78 per cent total liquids), across three core areas: Cold Lake Thermal (55,000 bbls / d), Lloydminster Heavy Oil (55,000 bbls / d) and Montney (75,000 boe / d).

Source: Pipestone Energy.

Source: Pipestone Energy.

Dustin Hoffman, no, not the actor, but Pipestone’s COO and interim CEO, called the acquisition a reflection of the successful culmination of growing and delineating its asset base over the past four years.

“This all-share transaction delivers shareholders ongoing exposure to one of the largest, well-diversified, upstream producers in North America, which has the capacity to grow its production meaningfully over the next decade,” Hoffman said in a statement.

PIPE stock has risen 9.5 per cent over the past month.

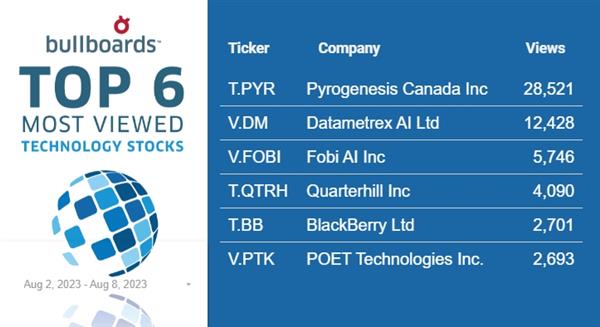

PyroGenesis Canada (TSX:PYR, Forum) made big news this week. Working in partnership with HPQ Silicon Inc. (TSXV:HPQ), its PUREVAP Gen3 Quartz Reduction Reactor project achieved the highest silicon purity level recorded to date, reaching 99.96 per cent. According to data from CRU International Ltd., the demand for silicon is projected to surpass 3.8 million tonnes, valued between US$15 billion and US$20 billion, by 2025.

Meanwhile, PyroGenesis recently secured a C$4.1 million contract with a leading U.S. defence, military and aeronautics company.

The client specializes as an innovation hub – including full-scale testing capabilities essential to U.S. national security – and regularly serves as a prime contractor for the U.S. government.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

“The company’s development of plasma torches for use in high-temperature applications is part of the company’s three-tiered solution ecosystem that aligns with economic drivers that are key to global heavy industry,” P. Peter Pascali, the company’s president and CEO, said in a statement. “Plasma torches as a high and ultra-high temperature application are part of the company’s energy transition and emissions reduction tier, where fuel switching to the company’s electric-powered plasma torches helps heavy industry reduce fossil fuel use and greenhouse gas emissions.

The contract is for a 4.5 MW plasma torch system, with PyroGenesis to receive a 20 per cent upfront payment, plus 15 per cent once initial technical drawings are delivered in one month’s time.

Finally, Tilray Brands (TSX:TLRY, Forum) is preparing to acquire eight beer and beverage brands from Anheuser-Busch (NYSE:BUD).

The cannabis producer announced it will acquire Shock Top, Breckenridge Brewery, Blue Point Brewing Company, 10 Barrel Brewing Company, Redhook Brewery, Widmer Brothers Brewing, Square Mile Cider Company and HiBall Energy.

“Today’s announcement both solidifies our national leadership position and share in the U.S. craft brewing market and marks a major step forward in our diversification strategy,” Irwin D. Simon, CEO of Tilray Brands, said in a statement. “We are excited to work with the teams behind these iconic brands that command great consumer loyalty and have a history of delivering strong award-winning products with tremendous growth opportunities.”

Thanks to the brand acquisitions, Tilray Brands is expected to move up to the fifth-largest craft beer business in the United States, which includes its current brands SweetWater Brewing Company, Montauk Brewing Company, Alpine Beer Company and Green Flash Brewing Company.

Looking ahead, we want to know what you think about the future. It’s a tricky subject, given how erratic the markets in Canada and the United States have been – nearly breaking record streaks one day, deep in the red the next, who knows where we will be tomorrow? I know where I will be next week at least, right here, with the latest on what’s hot on Stockhouse’s Bullboards!

Join the discussion: Find out what everybody’s saying about public companies and hot topics about stocks at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, click here.