Don’t look now, but the U.S. economy is actually getting healthy! And that’s great news for the rail industry.

While economic growth is still well below peak (or even average) levels, there is no denying that key metrics are gradually showing improvement. As the broad economic recovery gradually picks up, railroad companies are poised to benefit.

Higher demand for shipping has led to strong profitability, and Wall Street analysts expect continued growth in earnings. There are several areas of the economy responsible for driving growth in shipping demand.

New Car Purchases - Automakers rely heavily on railroads to ship new cars to the broad network of dealerships. Last month, Ford recorded a 13.1% increase in new car sales. Also, General Motors reported an 8% annual increase; Toyota and Honda saw bumps of 6% and 6.4%, respectively. Currently, the average age of cars on U.S. roads is at a historical high, which means there should be several years of pent-up demand for new cars.

Retail Improvement – American consumers are spending again. For the month of June, the Bloomberg Consumer Comfort Index

hit a 5-year high as rising home values and stronger employment helped to boost confidence. Take a look at the chart below, which tracks average daily spending of U.S. consumers by month. Increased consumer spending means additional demand for rail service, with more products being shipped to distribution centers across the country.

Construction - After years of stagnant activity, construction (residential as well as commercial) is picking up. Builders, who have kept materials inventories low due to low demand, will need to order new material for every new project (or resumption of an existing project) going forward – or more optimistically, these companies could start rebuilding their inventory levels in expectation of stronger demand.

With all of this potential demand hitting railroad stocks, I expect to see rail stocks in the limelight over the next few months. As a growth stock investor, I want to get involved in the industry before institutional traders send the stocks sharply higher.

Three Key Rail Stocks to Consider

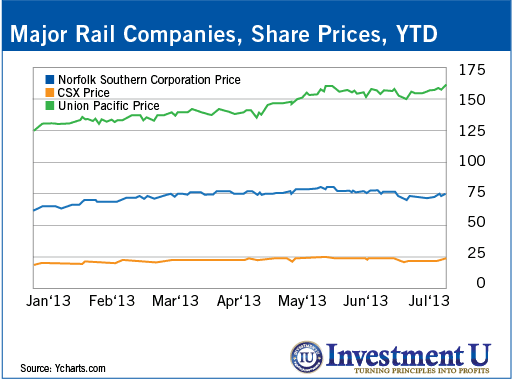

Looking at the various players in the industry, there are three primary rail stocks that I think you should consider for your portfolio:

Union Pacific (

NYSE: UNP), which is included the Oxford Trading Portfolio, is one of the industry’s strongest companies with significant exposure to the auto market. The company has a strong history of revenue and profit growth, more than doubling earnings over the last four years. Analysts expect the company to continue to increase earnings over the next two years, and over the last two months, analysts have actually been increasing their forward expectations.

Union Pacific isn’t a cheap stock (nominally or on a valuation basis). Shares are currently trading just below $160 per share, and analysts expect the company to earn $9.52 this year. But even though investors are paying almost 17 times earnings for the company, I believe the valuation is justified.

Investors should continue to buy the stock as demand for rail shipping picks up, and the company offers a 1.73% dividend yield – enough to keep income investors interested.

CSX Corp. (

NYSE: CSX) has a diversified book of business, transporting intermodal containers, along with steel, automotive, agricultural, and energy shipments. Analysts expect the company to earn $1.78 per share this year, and then increase profits to $2.01 per share in 2014. With the stock trading near $24, CSX represents a very attractive value.

CSX is the first of the major rail companies to report earnings, with the release scheduled for July 15. I will be looking carefully at the company’s earnings report, as the data should shed light on the overall prospects for the entire rail industry. The company recently increased its quarterly dividend to $0.15 per share, resulting in an attractive 2.5% dividend yield.

Norfolk Southern (

NYSE: NSC) is one of the cheaper rail stocks in terms of valuation, and this is because the company has had a lower growth profile than its competitors. However, analysts expect the company to grow earnings by about 14% over the next year (which should help boost the company’s PE ratio over time).

Norfolk currently pays a dividend of $0.50 per share, resulting in a healthy dividend yield of 2.69%. With profitability set to improve next year, I expect the company to increase its dividend payment.

It has been about 18 months since the company has boosted its payout rate, and Norfolk can certainly afford to raise its dividend given the expected growth in earnings. An increase in the dividend payout could be a significant catalyst for the stock, and an announcement could easily be made when the company reports earnings on July 22.

Energy Represents Both a Liability and an Asset

One of the biggest issues for the transportation industry is the price of oil. Higher energy prices naturally compress profits as costs offset increases in revenue. Over the last two weeks, oil prices have increased dramatically, raising concern for shipping companies.

It is hard for me to believe that oil prices will remain above $100 per barrel because of the simple fact that the U.S. is dramatically increasing production levels for oil and natural gas. New technologies allow drilling companies to efficiently reach oil reserves that were previously too expensive to tap. As these new resources come on line, we should continue to see a dramatic increase in the U.S. oil supply. This increase in supply should keep a lid on oil prices and should eventually drive the price per barrel significantly lower.

An increase in oil production could dramatically boost revenue opportunities for the rail industry. At this point, the network of pipelines that connects producers to the main distribution avenues hasn’t been able to keep pace with the new drilling sites that are producing oil and natural gas.

North American oil producers have increasingly turned to rail companies to transport oil, while waiting for pipelines to be built. This new line of business is yet another area of growth for the rail industry, and should more than offset any profit pressures that come from higher oil prices.

Earnings Season on Deck

Next week we will start seeing earnings reports for the most important rail stocks. If any of the companies beat analyst expectations or raise guidance levels, we should see the news reflected across all stocks in the industry.

In particular, I’m watching CSX (the first railroad company to report) for management’s assessment of the broad market, and I’m watching NSC to see whether the dividend payment is increased.

This summer marks an important time for this key industry, and it may be the last chance we have to buy these stocks at current levels.

https://www.investmentu.com/2013/July/three-rail-stocks-to-watch.html