Briefly

TCR family: I am on the

Rango Energy call. The Rango projects, chief geologist Vince Ramirez just said on the call, are "short fuse." Mr. Ramirex also said the company is withholding information about a section of the "oil show" at its current Kettleman Middle Dome project in California both for competitive reasons and to analyze the data further.

"Everybody is watching us very, very closely," Vince says. "We're seeing very, very good results." He adds that high-pressure shales in the current drilling are slowing the drilling into the sands. The $5 million or so cost of this first project for the Rango-Hangtown Energy partnership might be revised upward, Mr. Ramirez said.

In the current project, Mr. Ramirez says they are anticipating 49-gravity oil from the target, called the McAdams formation. That is higher gravity than West Texas Intermediate and potentially more valuable, he said.

The call is worth a listen, as is the slide show. There were family trust representatives, analysts and private investors dialed in. Several of them had twangs in their accents. One or two sounded Canadian. At least one was flabbergasted by the projections that Mr. Ramirez was discussing on potential barrels and the quality of the condensates and liquid.

We'll see. Rango shares, even at 37 cents (USA

RAGO bulletin board), are expensive without published and publicly reported data.

I do not own RAGO shares yet I might benefit via my consulting link to

Torrey Hills Capital, which is advising Rango on investor outreach. I would prefer, rather than my relating the details of the call, that folks listen to it themselves. It will be archived almost immediately. As I send this report out, the call is just finishing. (

Noon Pacifico time)

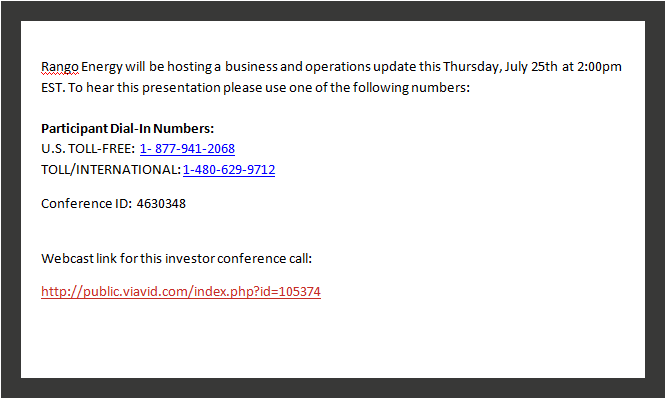

Details of the call-in are here:

Next ...

THIS from David Seconi in Colombia

Next ...

THIS from David Seconi in Colombia:

B2Gold plans to buy assets while valuations are low, VP says.

Proprietary Intelligence

B2Gold (

TSX: T.BTO, NYSE MKT-BTG, NSX-B2G), a Vancouver, British Columbia-based mining exploration and production company operating in Colombia, Nicaragua, Uruguay, the Philippines and Namibia, is actively seeking acquisition targets or joint ventures with approximately CAD 100m in cash on hand, according to Vice President for Colombia Steve Jensen.

Jensen told

Mergermarket the company is evaluating an active list of worldwide opportunities on a weekly basis, signing confidentiality agreements and visiting gold mining projects that could move it closer to its growth profile of 500,000 ounces of gold in annual production. A target acquisition should produce more than 100,000 ounces of gold and have more than 1m ounces in deposits.

Asked whether B2Gold would spend USD 100m in a big purchase or several small purchases, he said the company was not interested in small purchases and that it wanted to make an acquisition that would “add to us significantly.”

In deciding between an acquisition or a JV, Jensen said if the company is cheaper and wants to be taken over, B2Gold would be inclined to make an acquisition. If the target was stronger, B2Gold would be more inclined to earn in through a JV.

“We’re aggressively evaluating projects in Colombia and around the world all the time,” he said. “We always seem to make acquisitions in these bad times because things are cheaper obviously in down times if you have the money to do it.”

Jensen said projects were evaluated internally through the Vancouver office.

B2Gold estimates 385,000 ounces of gold production this year at an operating cash cost of USD 605-635 an ounce. Jensen said once its Namibia mine comes online next year, the company should reach 400,000 ounces in 2014 and 500,000 to 550,000 ounces by 2015.

In the past, B2Gold has used acquisitions to raise production during down times in the market. Jensen noted the company first went public in December 2007 based on its Colombia projects, just before markets dipped, and successfully raised CAD 100m.

“There’s an opportunity for companies like us that have production and have some money,” Jensen said, adding B2Gold is “not scared” to enter more challenging markets. “For us it’s asset first and country second.”

B2Gold is in a JV on the Gramalote project, one of its two projects in Colombia, with Anglo Ashanti, whereB2Gold owns a 49% stake. The company is planning to make a determination regarding prefeasibility and feasibility studies in the fourth quarter of this year. The company operates two other JVs in Nicaragua with Radius Gold and Calibre Mining.

B2Gold’s near-term objectives are to put its Otjikoto mine in Namibia into production, for which it will use a USD 150m credit line from Macquarie Bank. The company will also advance its project at Gramalote in Colombia.

Next ...

Thanks for that, David.

Bellhaven Copper & Gold (

TSX: V.BHV) shares are extremely active. The next assay or assays due for public consumption are moving closer to the center of the magnetic anomaly. As stated, if you did not purchase at 10 to 11 cents Canadian, you should not chase it now. I own 2.3 million shares. Mort Rosner, a member of our

TCR family, tells us from NYC that 70% of the trading the last 2 days were bought by "anonymous." Some 20% was done by Canaccord. He thinks it is. "I am inclined to agree it is one buyer, or two at most, taking a position," he says.

Next ...

Colt Resources shares are receiving positive follow-through after sealing the Hong Kong financing for $5 million, albeit at a lower price than the 45 cents first advertised. The angle here, as has been pointed out to me by friends and TCR family overseas, is Nikolas Perrault's work on acquiring a large (iron ore?) project that moves Colt closer to production. Richard Quesnel will assist in that Quebecois maneuver for the Portugal gold and tungsten developer.

Richard Q. is the new exec. Chairman of Colt and an engineer. He is also

Cliffs Quebec Iron Mining Limited (formerly, Consolidated Thompson Iron Mines Ltd.). Mr. Quesnel also advises

Champion Iron Mines Limited.

Finally ...

Lynden Energy shares (Texas oil developer) are rising smartly.

... ECO ORO saw its Angostura project in Colombia declared of national interest. See:

article. ... The metals numbers appear to be working in our favor, TCR family. We are almost one year into the new

The Calandra Report. At this point, with a solid family of subscribers that number several hundred, we are ready to begin influencing opinion makers. No desire on my part to reach the millions of audience members we had (audited) at MarketWatch. Or the 10,000 paying members of original The Calandra Report. Yet with our faithful network, stretching into many communities, as close as northern California (for me) and as far as Hong Kong, Australia, Lichtenstein, Germany, Colombia and our beloved friends in Canada, we appear poised. Please encourage your private networks to subscribe. I believe we are on the cusp.

This is all for now. Thank you.

THE CALANDRA REPORT: Subscribe